Mobile money agents need additional support to transform lives in poor rural areas

Editor’s note: For a broader synthesis of the themes covered in this article, check out the updated version of our VoxDevLit on Mobile Money.

Mobile money has made financial transactions easier by allowing clients to transfer money, buy airtime, and pay bills on their phone without a bank account (Suri et al. 2023). USAID and Citi Foundation (2012) argue that “mobile money can transform the lives of 1.8 billion people who have access to a mobile phone but not a bank” (p. 2). Indeed, several studies find that mobile money has helped households receive more remittances, smooth consumption in the face of shocks, and escape poverty in the long run (Jack et al. 2013, Jack and Suri 2014, Riley 2018, Suri and Jack 2016). However, the agents that intermediate mobile money transactions tend to be concentrated in urban areas (Akinyemi and Mushunje 2020), leaving households in rural areas with limited access to both banks and mobile money.

Mobile money for rural areas

In Wieser et al. (2019), we assess the promise of mobile money for rural households. We collaborated with the International Finance Corporation (IFC) and Airtel Uganda to implement a field experiment in rural Northern Uganda covering an area of approximately 125,000km2. Our setting includes some of the poorest and most remote areas of Uganda. Households in this area are less connected than in previous studies:

- Only 28% of households own a phone, compared to 69% in Kenya (Jack and Suri 2014) and 73% in rural areas throughout Uganda (Munyegera and Matsumoto 2016).

- 15% of households in our sample report receiving remittances compared to 40% in Jack and Suri (2014) and 65% in Munyegera and Matsumoto (2016).

- There is low access to financial services, with a median distance to a bank branch of 25km.

We explore whether rolling out mobile money in these poor and remote areas has the transformative effects found in earlier studies. In a remote and disconnected context, we might expect large economic effects of introducing a financial service that makes it easier for households to receive remittances and allows them to save in mobile money accounts. On the other hand, households in remote areas may not benefit from financial services if they are too poor to save in formal accounts (Dupas et al. 2018).

Study design

To measure the effects of rolling out mobile money agents, we randomly assigned 658 clusters of enumeration areas (EAs) to a treatment or a control group, stratified by a commercial priority rating provided by Airtel. The sample of EAs was drawn with help from the Uganda Bureau of Statistics (UBOS). To minimise potential spillovers of agents to control group EAs, the selected EAs were mapped and grouped into clusters. A 0.5km buffer was drawn around the boundary of each EA and EAs whose buffers overlapped were grouped. Clusters were thus at least 1km apart from each other. None of the clusters in the study had Airtel Money agents at baseline. Less than 2% of clusters had mobile money agents from other providers.

Mobile money agent rollout and data

We worked with the professional services firm that Airtel regularly used to rollout Airtel Money agents. Between January and June 2017, the firm recruited and activated agents in treatment clusters, spending more time in clusters with high priority rating. On average, 35% of treatment clusters received at least one agent (46% in high priority clusters and 24% in low priority clusters).

We use data from a 2018 follow-up survey and 2017 administrative data from Airtel Money to measure the effects of the agent rollout on mobile money usage, savings, remittances, self-employment, and food security. The household survey was designed to be representative of households in the EA and covered about 9% of households (close to 9,000 households).

Results

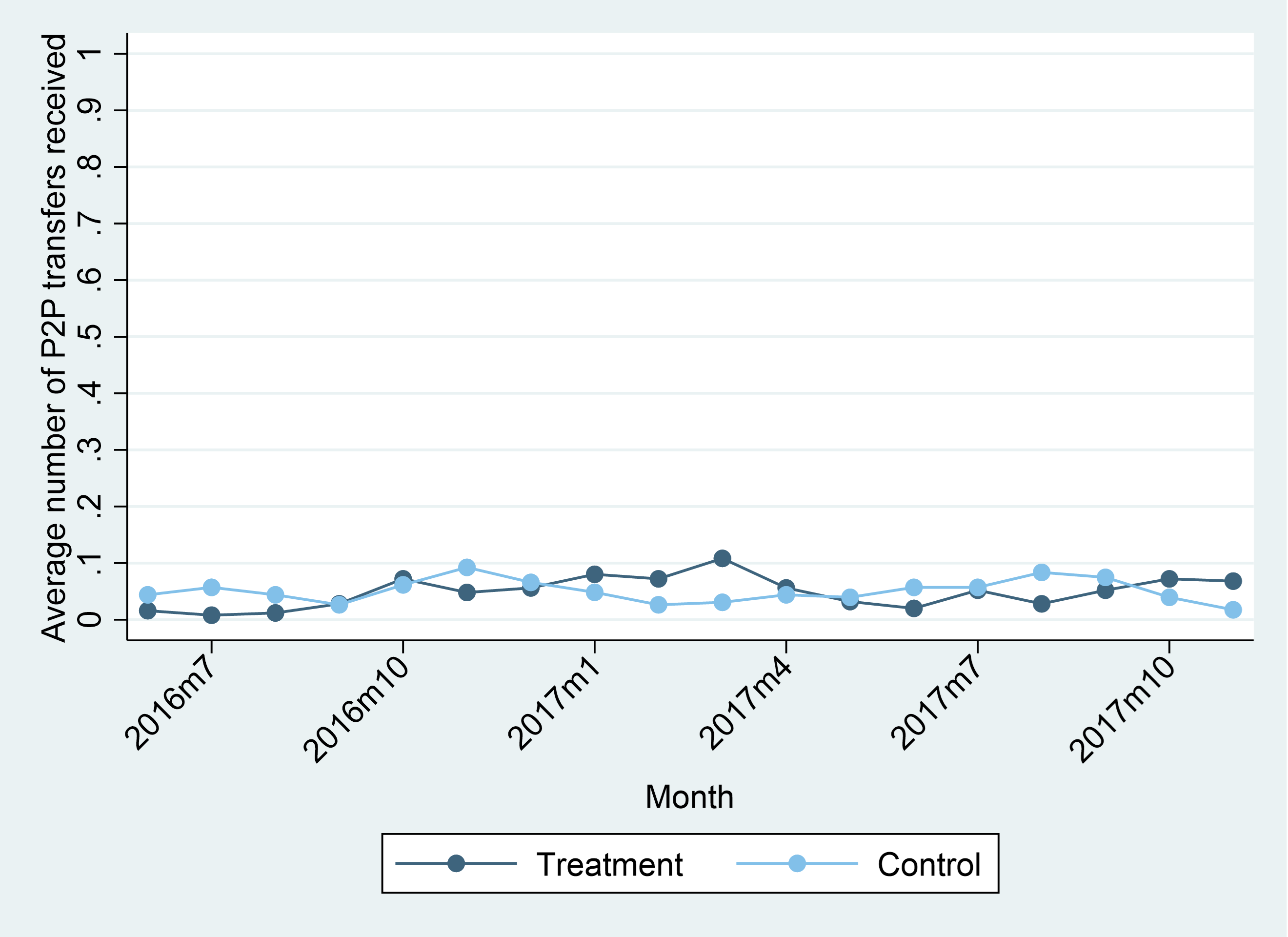

In contrast to the studies of mobile money in more connected settings, our results show that the agent rollout did not increase use of mobile money, savings, or remittance transactions. For example, Figure 1 shows that the average number of peer-to-peer (P2P) transfers received was low throughout the study period, for households in both treatment and control areas. The average household received only 0.05 P2P transfers per month. This number looks low, but it is comparable to data from rural Mozambique, where Batista and Vicente (forthcoming) find that the average household received only between 0.3 and 0.7 transfers per year, depending on the year

Figure 1: Average number of P2P transfers received by month

Source: Administrative transactions data provided by Airtel Money

We find weak evidence that the agent rollout decreased transportation costs by 76% for those receiving remittances, in high priority areas where more agents were rolled out. Consistent with this result, we also find that the agent rollout increased food security in these areas, but neither of these effects are statistically significant when controlling for multiple hypothesis testing. We also find no robust effect on non-farm self-employment.

Overall, our findings suggest that, in poor and remote areas with low mobile phone penetration and low remittances, rolling out mobile money agents has limited effects on the average household. Households who already used mobile money may have benefitted from the rollout since they were able to use closer agents, thereby saving on transportation costs. However, household who were not already using mobile money did not start doing so due to the agent rollout. In the follow-up survey, the most stated reasons for not using mobile money were that (i) respondents don’t have enough money (44% of households) and (ii) they had no need to use mobile money since they don’t conduct financial transactions (27%).

Lessons from our and related studies

Our study is closely related to two other randomised experiments with poor rural households. First, Lee et al. (2021) measures the effects of training and technical assistance for using mobile money on poor rural households with migrants in Bangladesh. The training and technical assistance increased mobile money use and remittances, leading to more rural consumption and less poverty. These results are consistent with our finding that the agent rollout benefitted household receiving remittances via lower transportation costs. However, when we look at the effect of rolling out agents on the average household, we find these broader effects to be limited.

Second, Batista and Vicente (forthcoming) study rural areas in Mozambique that did not have mobile money agents at baseline. Randomly selected treatment areas received three combined interventions (i) rollout of a mobile money agent, (ii) a community theatre and a meeting demonstrating mobile money services, and (iii) support and incentive payments for opening mobile money accounts. This combined intervention increased mobile money use, savings, migration, remittances, and expenditures. Together with our results, these findings suggest that rolling out mobile money agents in and of itself is not sufficient to promote uptake of mobile money by households. Complementary interventions are needed to increase mobile money usage and its economic effects in rural areas.

References

Akinyemi, B E and A Mushunje (2020), “Determinants of mobile money technology adoption in rural areas of Africa” Cogent Social Sciences 6(1).

Batista, C and P C Vicente (Forthcoming), “Is Mobile Money Changing Rural Africa? Evidence from a Field Experiment” The Review of Economics and Statistics.

Dupas, P, D Karlan, J Robinson and D Ubfal (2018), “Banking the Unbanked? Evidence from three countries”, American Economic Journal: Applied Economics 10 (2): 257-297.

Jack, W, A Ray and T Suri (2013), “Money Management by Households and Firms in Kenya”, American Economic Review: Papers and Proceedings 103(3): 1-8.

Jack, W and T Suri (2014), “Risk Sharing and Transactions costs: Evidence from Kenya’s Mobile Money Revolution”, American Economic Review 104(1): 183-223.

Lee, J, J Morduch, S Ravindran, A Shonchoy and H Zaman (2021), “Poverty and Migration in the Digital Age: Experimental Evidence on Mobile Banking in Bangladesh”, American Economic Journal: Applied Economics 13(1): 38-71.

Munyegera, G K and T Matsumoto (2016), “Mobile Money, Remittances, and Households Welfare: Panel Evidence from Rural Uganda”, World Development 79: 127-137.

Riley, E (2018), “Mobile Money and Risk Sharing Against Village Shocks”, Journal of Development Economics 135: 43-58.

Suri, T, J Aker, C Batista, M Callen, T Ghani, W Jack, L Klapper, E Riley, S Schaner and S Sukhtankar (2023) “Mobile Money”, VoxDevLit 2(2).

Suri, T and W Jack (2016), “The Long-Run Poverty and Gender Impacts of Mobile Money”, Science 354(6317): 1288-1292.

USAID and Citi Foundation (2012), “10 Ways to Accelerate Mobile Money: USAID-Citi Mobile Money Accelerator Alliance.” Available at: https://www.findevgateway.org/paper/2012/01/10-ways-accelerate-mobile-money-usaid-citi-mobile-money-accelerator-alliance.

Wieser, C, M Bruhn, J Kinzinger, C Ruckteschler and S Heitmann (2019), “The Impact of Mobile Money on Poor Rural Households: Experimental Evidence from Uganda”, World Bank Policy Research Working Paper 8913.