How automatic payments can help individuals save more and better protect themselves against consumer risks

Read “Learning to navigate a new financial technology: Evidence from payroll accounts” by Emily Breza, Martin Kanz, and Leora F. Klapper here.

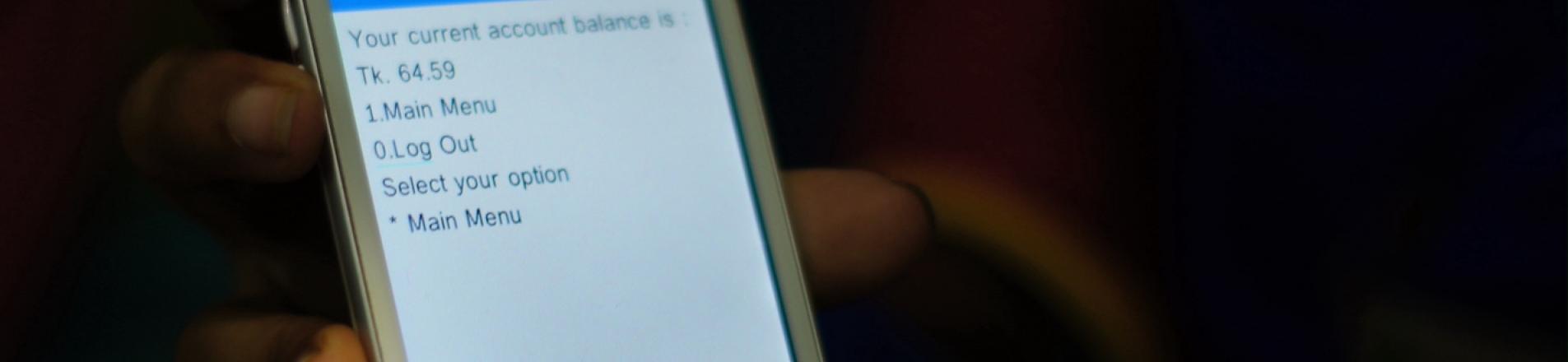

Financial technologies and mobile banking provide essential connections to the financial system for unbanked individuals. However, for many rural and poor communities, new accounts often go unused, and new users are susceptible to fraud and exploitation by financial middle-men. In this VoxDevTalk, Leora Klapper discusses the global landscape of financial inclusion. She also shares insights from her recent study with Emily Breza and Martin Kanz that investigated the adoption of payroll accounts by Bangladeshi factory workers to better understand how people use their accounts and how they can protect themselves from exploitation.

They find that setting up a payroll account alone is insufficient for encouraging regular use, and that setting up automatic deposits for salaried workers leads to greater usage and higher savings. Moreover, increased usage not only brings greater familiarity with financial technologies, it can also enable workers to better protect themselves against consumer financial risks. Finding that individuals can learn naturally while they navigate financial technologies leaves positive policy implications for scaling access to automatic payments through formal accounts.

Editors’ note: To know more about digital payroll accounts, read our VoxDevLit on Mobile Money.