Rental markets for large machines between small firms allow them to achieve economies of scale, increasing mechanisation and aggregate productivity

Most firms in developing countries employ only a few workers, if any (Hsieh and Olken 2014). A key policy concern is that their small size may prevent firms from adopting technology: technology is often embodied in large machines, and small firms might not have the scale to justify the investment. As a result, firms may be stuck in poverty traps (Banerjee and Duflo 2005).

In a recent study (Bassi et al. 2020), we challenge this view. We show that small firms in urban Uganda engage in active rental markets, and that this allows them to access modern machines that have too large a capacity for any single firm. The importance of rental markets not only limits concerns related to the small scale of firms, but also provides a valuable policy tool to foster technology adoption and productivity in settings plagued by market imperfections.

Measuring production processes in urban Uganda

Together with BRAC Uganda and the Ministry of Trade of Uganda, we surveyed 1,000 firms in three sectors that employ a large share of workers in manufacturing: carpentry, metal fabrication, and grain milling.

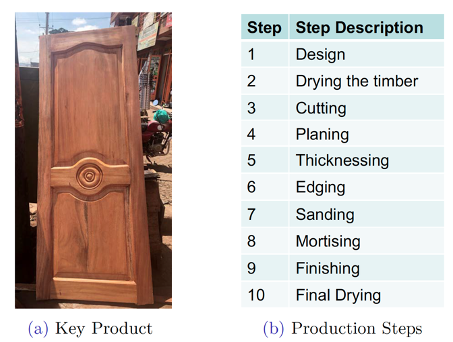

The key innovation of our survey is to collect information on the entire production process for pre-specified products that are common in these sectors. For example, Figure 1 shows our key product for carpentry, a two-panel door and the steps necessary to produce one. For each step, we know the exact combination of labour and capital used, distinguishing between modern machines and manual tools, and whether each machine is owned or rented.

Figure 1 Key product and production steps in carpentry

Notes: The left panel shows an image of a two-panel door produced by one of our firms. The right panel shows the list of all the production steps for a two-panel door.

Small firm production amidst an active rental market for large machines

We use our data to document four sets of facts:

- Informal clusters of small firms: Production takes place in informal clusters of small firms, which produce similar products with similar production steps, but which vary in their mechanisation. While some firms use modern machines, others mostly use manual tools and labour.

- Economies of scale: Machines have a capacity that is too high for the typical firm and are very expensive relative to profits, thus generating sizeable economies of scale. This is particularly the case in carpentry, as the carpentry process uses multiple types of high-capacity machines.

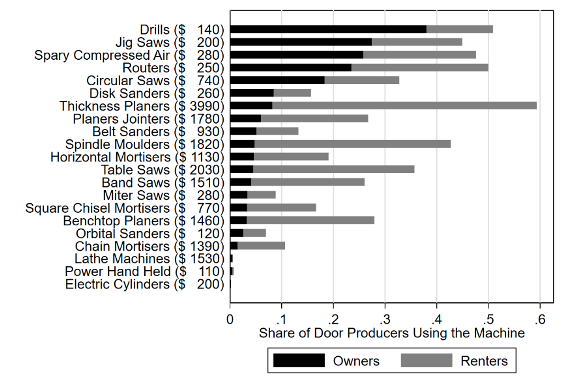

- Machine rental: Most firms access modern machines through an active rental market between small firms. For example, as shown in Figure 2, while less than 10% of firms own a thickness planer – a key machine in the production process for carpentry – 60% use one.

- Transaction costs for machine rental: Our data further shows that the rental market is characterised by transportation and time costs. Machines are operated at the premises of machine owners, and so renters have to carry their intermediate inputs to the machine owner and back, and often have to wait for machine access.

Figure 2 Usage of modern machines in carpentry by ownership versus rental

Notes: This figure decomposes the share of door producers in the carpentry sector that use a machine among those firms that own the machine (black) and those that rent it (grey). Sample: Door producers.

A new perspective on the firm size distribution based on the rental market

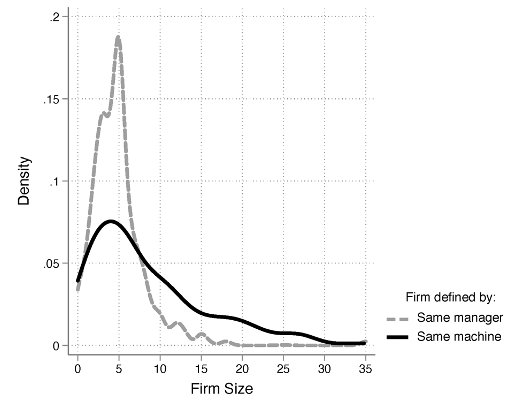

The presence of an active rental market between firms has implications for how we think about the firm size distribution. We usually define the size of a firm as the number of workers employed by the firm owner. However, the presence of the rental market suggests that it might be meaningful to redefine a firm as a group of workers sharing the same machines. Figure 3 shows that, once we do so, medium-sized firms start to appear: the share of firms with more than ten employees grows from 5% to 33%.

Figure 3 Firm size distribution in carpentry

Notes: The figure shows the firm size distribution in our data according to two alternative definitions: (i) A firm is a manager and his/her workers (dotted grey line); (ii) a firm is a set of workers using the same machines (black line). Sample: Door producers. See Bassi et al. (2020) for further details on how we computed (ii).

Modelling firm production in the presence of machine rentals

Is it meaningful to define a firm as a machine? It depends on the size of transaction costs in the rental market, as transaction costs are what creates a boundary between firms, keeping them distinct. To measure transaction costs and to understand the equilibrium effects of the rental market, we estimate a model.

Rental market transaction costs

We develop a model in which managers face two key choices; (i) whether to mechanise their production process (i.e. use modern machines), and (ii) whether to purchase or rent machines. The rental and output markets are in equilibrium. The rental market is competitive but subject to a rental market ‘wedge’, which represents transaction costs.

We estimate the model with our data for the carpentry sector and find the rental market wedge to be equal to 40 cents for every dollar spent on renting machines. An accounting exercise shows that we can explain most of the wedge with direct transportation and time costs from our survey.

So, are transaction costs small or large? To answer this question, we use the model to show that our benchmark economy reaps more than half of the potential gains from moving from an equilibrium with no rental markets, to one with frictionless rental markets. In this sense, frictions in the rental market are relatively limited, and defining a firm as a set of workers sharing the same machines is meaningful, as the boundaries between firms are tenuous.

Aggregate gains from the rental market

The model also shows that the rental market generates large aggregate gains, increasing mechanisation by 130% and aggregate productivity by 8% relative to a counterfactual where firms must purchase a machine to use it.

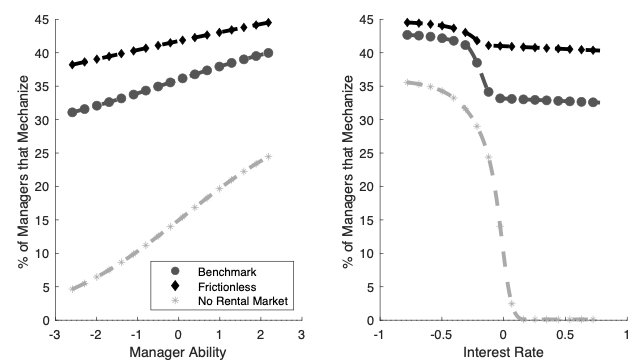

Where are these large gains coming from? Figure 4 highlights the two benefits of the rental market; (i) it allows firms to overcome the capital indivisibility by letting them share machines, thus helping low productivity firms to mechanise, and (ii) it unbundles capital ownership and utilisation, thus allowing firms with a high cost of capital to mechanise.

Figure 4 Mechanisation choice and the rental market

Notes: The figure shows mechanisation choices as a function of manager productivity (left) and manager cost of capital (right). The three lines show three different economies: the estimated one, one with no rental market, and one with zero transaction costs.

The importance of rental markets in developing cities

The rental market plays an important role in the carpentry sector in urban Uganda. Beyond our context, where should we expect rental markets to be relevant? We expect them to matter where firms are geographically concentrated and where the size of machines is large relative to the size of individual firms. In our context, this was the case in carpentry.

We also show that the rental market generates gains by attenuating the costs of other market imperfections, such as financial frictions. Therefore, we expect rental markets to matter most in developing countries plagued by market imperfections.

Policy implications: How to help small firms access technology

We learn two broad lessons for policy:

- To understand technology adoption in developing countries, it is important to shift the focus away from the size of individual firms, and towards the size and functioning of informal firm clusters. Firm-to-firm interactions in the market for capital increase the effective firm size and are an essential driver of technology adoption.

- The presence of rental markets has important implications for policy targeting. Policymakers wishing to foster the mechanisation of small firms might want to subsidise credit for larger firms, which are better able to sustain capital investment, and have the benefits trickle down to the rest of the cluster through the rental market.

Editors' note: This column is based on this PEDL project.

References

Banerjee, A and E Duflo (2005), "Growth Theory through the Lens of Development Economics", in Handbook of Economic Growth, Vol. 1A, Amsterdam: Elsevier, 2005, pp. 473–552.

Bassi, V, R Muoio, T Porzio, R Sen and E, Tugume (2020), "Achieving Scale Collectively", CEPR Discussion Paper No. DP15134

Hsieh, C-T and B Olken (2014), “The Missing “Missing Middle”, Journal of Economic Perspectives 28(3): 89-108.