Economy-wide expansion of credit for SMEs in Brazil induced entry of more capable firms but did not change employment at the municipal level

Despite global efforts by policymakers to lower the barriers to starting a business, there's growing skepticism amongst researchers about the actual benefits of these measures in terms of job creation and economic growth. A study of Portuguese reforms, for example, suggests that a reduction in static entry barriers, such as licensing fees, led to the entry of “marginal firms" with limited growth potential (Branstetter et al. 2014).

In our research (Bazzi et al. 2023), we explore whether improving credit access results in the entry of marginally viable firms, or if it creates more dynamic incentives, alters firm growth trajectories, and attracts entrants with greater capability. We explore this question in the context of a large-scale credit expansion for small and medium enterprises (SMEs) in Brazil.

Evidence from other countries is mixed. Kerr and Nanda (2009, 2010) show that banking deregulation and subsequent credit expansions in the United States induced substantial entry of small, short-lived firms but also increased the size at entry of longer-lived firms. In developing countries, access to microfinance increases growth among incumbent microenterprises but rarely leads to entry of productive, new ones (see Banerjee et al. 2015).

Dynamic versus static entry barriers

To explore how credit access (a dynamic entry barrier) might act differently to static entry barriers, we combine a classic model of entrepreneurial choice (Evans and Jovanovic 1989) with a general equilibrium framework that builds on Melitz (2003). Our model (Bazzi et al. 2023) shows that relaxing credit constraints:

- selects more high-capability entrants than reducing static barriers can achieve

- generates more employment at incumbent firms

These effects occur because financial constraints cause high-ability entrepreneurs with low initial wealth to be shut out of entry or to enter at less than optimal sizes. The combination of additional entry and an expansion of credit-constrained incumbent firms drives up local wages, inducing exit of marginal incumbents. Our results indicate that, relative to reducing static entry barriers, easing credit constraints increases entry of firms with greater long-run growth potential but has an ambiguous effect on local employment.

An economy-wide expansion of credit for SMEs in Brazil

A major policy innovation in Brazil in the early 2000s offers a unique opportunity to identify the causal effects of credit supply expansions on firm entry, growth, and lifecycles. In late 2002, the National Development Bank of Brazil (Banco Nacional de Desenvolvimento Econômico e Social or BNDES) launched a new credit line for formal-sector SMEs, the BNDES Card (Cartão BNDES), to finance investment and inputs on more favourable terms than prevailing credit lines in the market. By 2013, nearly 10% of formal sector firms had accessed the credit.

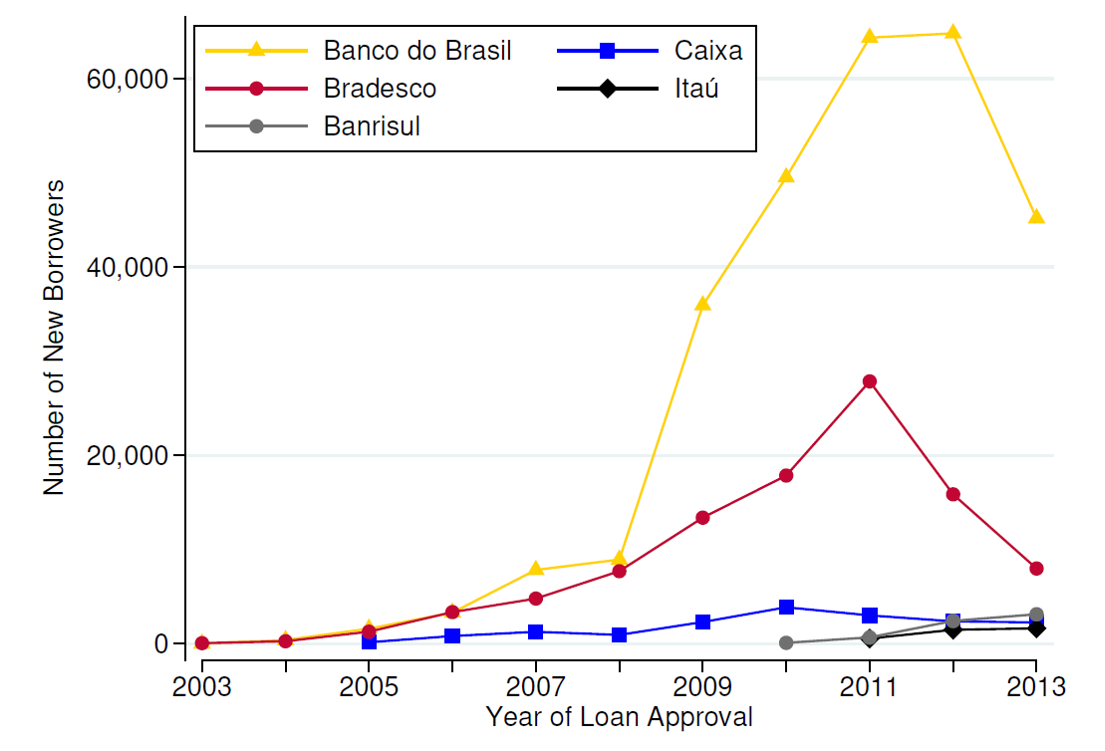

As part of its piloting process, BNDES only allowed certain banks to intermediate Cartão credit beginning in 2003, with other banks becoming eligible in 2005 and in later years. Our empirical strategy relies on prior bank branch locations, pre-Cartão lending relationships with BNDES, and a large national expansion in Cartão funding in 2008. Figure 1 illustrates some of this underlying policy variation.

Figure 1: Expansion of Cartão BNDES Lending

Our strategy effectively compares municipalities with more versus less exposure to banks eligible to intermediate Cartão BNDES before versus after the expansion of Cartão lending to intermediating banks. For municipalities with weakly developed financial markets, the Cartão line constitutes an enormous expansion, reaching as high as 15—20% of total lending locally.

Our data

We estimate the impacts of Cartão-induced credit expansions on local firm dynamics using comprehensive new data on firms and finance. First, we construct firm- and municipality-level outcomes from the Brazilian matched employer-employee database Relação Anual de Informações Sociais (RAIS) from the Brazilian Ministry of Labor. This data spans 1987-2016, covers firms with as few as one employee, and allows us to construct reliable measures of firm entry and exit as well as employment growth. Second, we observe precise detail on financial transactions using the Credit Information System (Sistema de Informações de Crédito or SCR) database maintained by the Central Bank of Brazil. The SCR includes all loan operations with a value of at least R$ 5,000 (roughly US$ 2,500) from 2003-2011 and R$ 1,000 from 2012 to 2016. This data links the financial institution that originates or intermediates a public or private-sector loan to individual borrowing firms in the RAIS data. We supplement the SCR with data from BNDES on the universe of approved indirect lending operations from 2003 to 2013, which allows us to observe smaller Cartão BNDES loans.

We find that the Cartão BNDES credit expansion induced eligible local bank branches to substantially increase lending in other credit products as well. It also prompted the banks to reach new firms with whom they had no prior relationship. Branches with prior experience intermediating other BNDES products before the Cartão were responsible for driving the increased borrowing opportunities beyond the immediate targeted credit line. While assessing the direct effects of Cartão lending on firm dynamics, we also estimate overall effects inclusive of the credit amplifiers stemming from targeted SME lending.

Results

We find that the Cartão-induced credit expansion had significant effects on firm turnover and entrant capability. A 10% increase in local credit supply led to a 7% increase in entry of new firms. Moreover, this entry effect seemed to be driven by entirely new firms rather than transitions out of informality (e.g., to gain access to bank credit only available to registered firms). At the same time, we find nearly identical effects on firm exit. These effects on entry and exit offset each other as entrants and closures are of similar size, and imply no change in overall formal-sector employment at the municipality level. The results are consistent with deeper credit markets fostering greater opportunity but also greater competition, the combination of which is associated with limited changes in the size of the formal sector at impact.

Nevertheless, the local credit supply increase does induce entry of higher capability firms, compared to entrants prior to the credit expansion. New firms are more likely to survive at least two years. A 10% expansion of local credit leads these two-year survivors to enter at 2% larger scale and grow 0.4 percentage points faster.

We show further that these turnover and capability effects are concentrated in municipalities with weaker credit markets prior to the introduction of Cartão BNDES. In fact, in municipalities with above median credit per capita at baseline, local credit expansions have no significant effects on firm entry, exit or capability. Finally, we find that increased local credit supply leads to greater employment growth among young but not old firms. Older firms, in business for more than ten years, arguably have a stronger internal financing capacity as well as wider access to external credit.

Conclusions

Together, our results point to an important role for credit access in shaping firm dynamics in financially immature markets. In places with limited financial development, a greater number of high-capability entrepreneurs will be on a margin where the promise of sustained credit lines may suffice to induce entry of firms with high productivity and growth potential. These entrants drive out less productive competitors, leaving overall employment unchanged in the short run. Understanding the longer-run performance of these higher-capability entrants is an important task for future research. In Brazil today, the initial Cartão BNDES programme we study is considered successful enough for BNDES to pilot an expansion of the programme using a digital card.

References

Banerjee, A, D Karlan and J Zinman (2015), “Six Randomized Evaluations of Microcredit: Introduction and Further Steps?” American Economic Journal: Applied Economics 7(1): 1–21.

Bazzi, S, M Muendler, R Oliveira and J Rauch (2023), “Credit Supply Shocks and Firm Dynamics: Evidence from Brazil,” National Bureau of Economic Research Working Paper No. 31721.

Branstetter, L, F Lima, L Taylor and A. Venâncio (2014), “Do Entry Regulations Deter Entrepreneurship and Job Creation? Evidence from Recent Reforms in Portugal,” The Economic Journal 124: 805–832.

Evans, D and B Jovanovic (1989), “An Estimated Model of Entrepreneurial Choice under Liquidity Constraints,” Journal of Political Economy 97: 808–827.

Kerr, W and R Nanda (2009), “Democratizing Entry: Banking Deregulations, Financing Constraints, and Entrepreneurship,” Journal of Financial Economics 94: 124–149.

Kerr, W and R Nanda (2010), “Banking deregulations, financing constraints, and firm entry size,” Journal of the European Economic Association 8(2-3): 582–593.

Melitz, M (2003), “The impact of trade on intra-industry reallocations and aggregate industry productivity,” Econometrica 71(6): 1695–1725.