Lottery incentives in Mexico attracted unbanked households to open bank accounts and caused a persistent increase in the flow of deposits and the stock of savings

Banks worldwide finance their assets using deposits (Hanson et al. 2015), which are a more stable funding source than short-term debt (Ivashina and Scharfstein 2010). However, in developing countries, banks struggle to attract deposits: the fraction of people who are unbanked remains high and people who do have bank accounts do not save much money in them (Demirguc-Kunt et al. 2018, Dupas et al. 2018).

Prize-linked savings (PLS) accounts, which offer lottery tickets for cash prizes (often instead of a fixed interest rate), could help banks attract new customers and increase deposits (Cole et al. 2007, Kearney et al. 2011). PLS products could be particularly attractive to people who like having a small chance at winning a large amount of money, and might lead these people to substitute from gambling to saving in the PLS account (Cole et al. 2021, Cookson 2018). Moreover, PLS accounts could lead to more persistent savings since lotteries tend to be habit-forming (Guryan and Kearney 2010).

In Gertler et al. (2023), we worked with a bank in Mexico to conduct a randomised controlled trial (RCT) of prize-linked savings. We randomly assigned 40 out of 110 bank branches across 19 states to offer PLS over a two-month period. We then measure the effects on account openings, deposits, and savings over the subsequent five years.

People could participate in the lottery incentive by already having an account or opening a new account at one of the treatment branches. The incentive ran over a two-month period (October–November 2010), and every 50 pesos (US$4) of new savings earned people one lottery ticket. The bank awarded one thousand small prizes of 400 pesos (US$31) and two large prizes of 10,000 pesos (US$777) at the end of each lottery month. While the expected return for potential savers was unknown beforehand since it depended on other account holders’ savings responses to the incentive, after the fact it was equivalent to a 1.4% annual interest rate.

Lottery incentive led previously unbanked people to open accounts

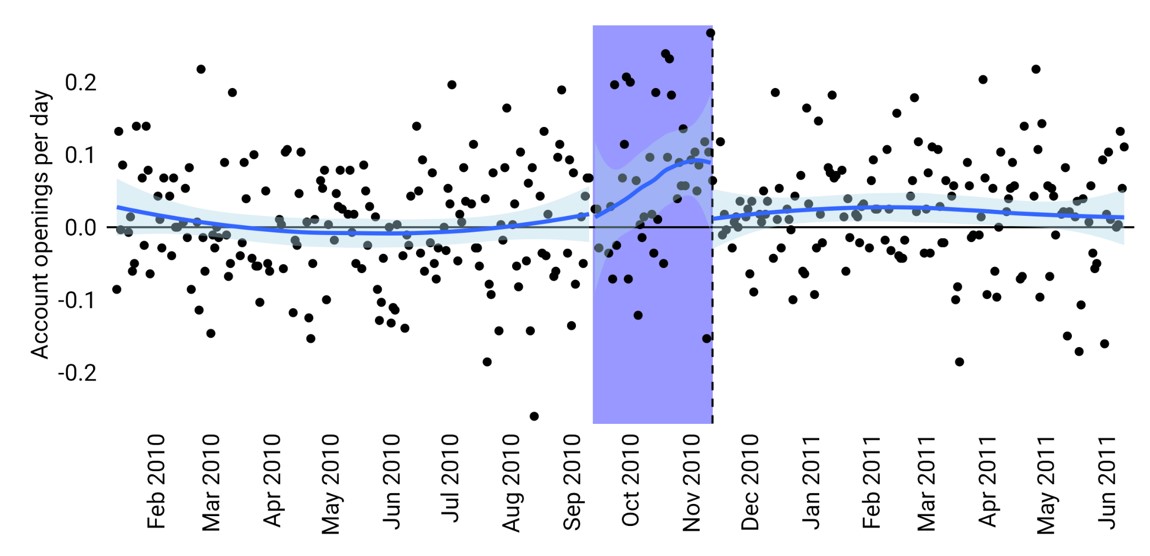

Before the lottery incentive, there were no differences in the number of accounts opened between the treatment and control branches. Offering PLS increased the number of accounts opened by 36% in treatment branches relative to control branches over the two-month lottery incentive period. This effect on the number of accounts opened increased over time during the lottery months (Figure 1). This could be due to people learning about the lotteries over time through word of mouth, or due to the first announcement of lottery prize winners after one month leading to “local buzz” at branches with winners. Right after the incentive ended, the treatment effect fell to zero.

Figure 1: Lottery incentive led to an increase in the number of accounts opened

We also use data from Mexico’s Central Bank to link individuals’ accounts across different banks in Mexico and find that 96% of account openers at treatment branches during the lottery months were previously unbanked.

Lottery incentive attracted deposits

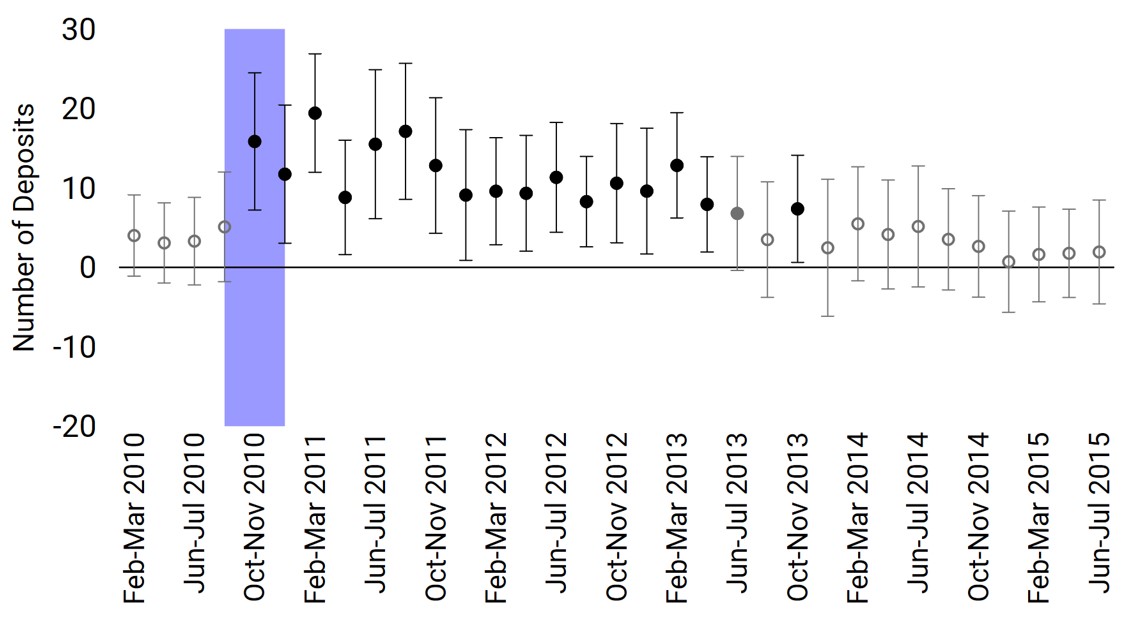

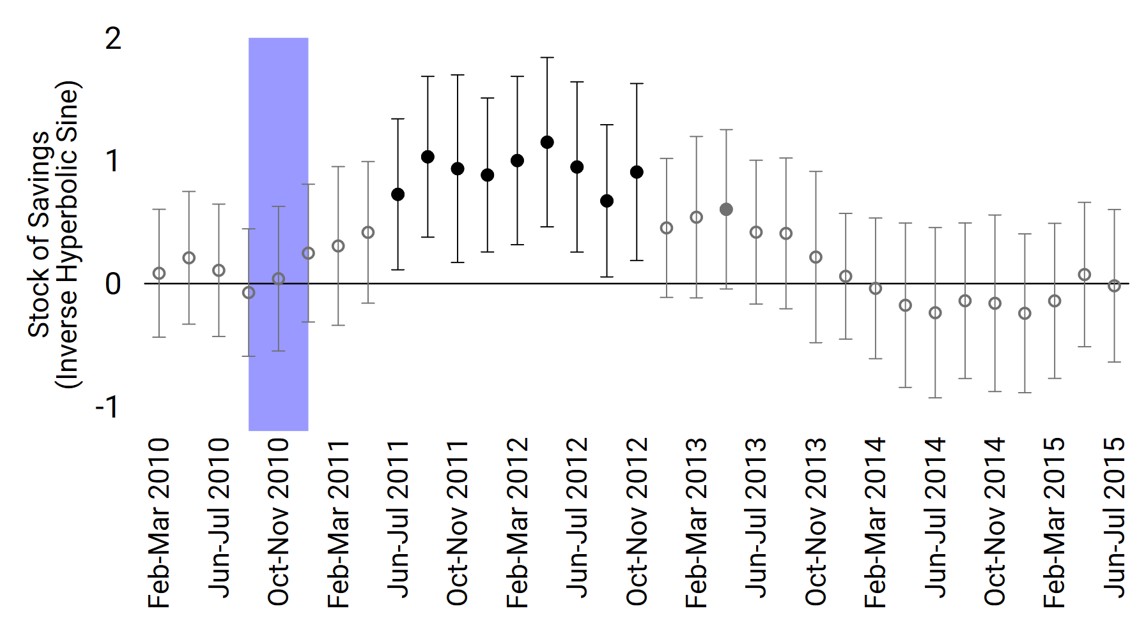

Next, we test the effect of the lottery incentive on the number of deposits made during the lottery incentive period. The lottery incentive increased the number of deposits by 21% in treatment branches relative to control branches during the lottery months, which are shown as the shaded area in the figures below. Moreover, this change persisted long after the lottery incentive ended, and the flow of new deposits remained higher in treated branches for about 3 years after the incentive (Figure 2). This persistent increase in the number of deposits caused the stock of savings in treatment branches to increase steadily over time (Figure 3). Beginning in the lottery period, the stock of savings in treatment branches increased relative to control branches, and the branch-level difference in the stock of savings is statistically significant from about eight months to 2.5 years after the lotteries ended.

Figure 2: Lottery incentive led to a persistent increase in the flow of deposits

Figure 3: Lottery incentive led to a persistent increase in the stock of savings

New accounts drive the increase in the stock of savings

Accounts opened prior to the lottery incentive period and accounts opened during the lottery incentive period were both eligible to win lottery prizes, and thus could both be contributing to the branch-level results above. Decomposing the results for the branch-level stock of savings between these two types of accounts, we find that this increase is entirely driven by accounts opened during the lottery incentive period, as opposed to accounts opened prior to this period. For accounts opened before the incentive, we find no effect on the stock of savings either during or after the lottery incentive. For accounts opened during the lottery incentive period, we see a gap in the stock of savings that grows over time and becomes statistically significant four months after the lottery. This difference persists for at least five years after the lotteries (which is the end of the period for which we have data).

Concluding remarks

Lottery incentives attract unbanked households to open bank accounts and save in these accounts. Moreover, even a short-term lottery incentive (two months in the case of our experiment) can cause a persistent increase in the flow of deposits and the stock of savings.

References

Cole, S, B Iverson, and P Tufano (2022), “Can gambling increase savings? Empirical evidence on prize-linked savings accounts.” Management Science 68(5): 3282-3308.

Cole, S, P Tufano, D Schneider, and D Collins (2008), “First National Bank's golden opportunity.” Harvard Business School Case Study 208-072.

Cookson, J A (2018), “When saving is gambling.” Journal of Financial Economics 129(1): 24-45.

Demirguc-Kunt, A, L Klapper, D Singer, S Ansar and J Hess (2018), “The Global Findex Database 2017: Measuring financial inclusion and the fintech revolution.” The World Bank.

Dupas, P, D Karlan, J Robinson, and D Ubfal (2018), “Banking the unbanked? Evidence from three countries.” American Economic Journal: Applied Economics 10(2): 257-297.

Gertler, P, S Higgins, A Scott, and E Seira (2023), “Using Lotteries to Attract Deposits.” National Bureau of Economic Research Working Paper 31529.

Guryan, J and M S Kearney (2010), “Is lottery gambling addictive?” American Economic Journal: Economic Policy 2(3): 90-110.

Hanson, S G, A Shleifer, J C Stein and R W Vishny (2015) “Banks as patient fixed-income investors.” Journal of Financial Economics 117(3): 449-469.

Ivashina, V, and D Scharfstein (2010), “Loan syndication and credit cycles.” American Economic Review 100(2): 57-61.

Kearney, M S, P Tufano, J Guryan, and E Hurst (2012), Making Savers Winners: An Overview of Prize-Linked Saving Products, in Olivia S. Mitchell and Annamaria Lusardi (eds), Financial Literacy: Implications for Retirement Security and the Financial Marketplace.