The adoption of sales registration machines in Ethiopia substantially increased tax revenue, but by less than expected due to taxpayer responses

Raising more revenue is a top priority for lower-income countries, whose revenue-to-GDP ratios are on average 20 percentage points below those of higher-income countries. Increasing tax revenue is critical for financing essential infrastructure and public services, and enabling countries to make progress towards achieving the Sustainable Development Goals.

Information and communication technologies (ICTs) offer tremendous potential for improving the efficiency and transparency of tax administration, for example through digitised records and online declaration filing. ICTs can also provide administrators with new tools to monitor taxpayer behaviour and detect non-compliance. But in practice, how effective have these new tools been for increasing tax compliance, given the constraints in contexts where administrative capacity is weak and informality widespread?

Evidence about ICTs in tax administration is promising but limited

Evidence from Tajikistan shows that e-filing substantially improves compliance and tax payments for firms that were previously evading, while also substantially reducing compliance costs and corruption (Okunogbe and Pouliquien 2022). Similar evidence is mounting from other countries: in Liberia, technology improved property tax collection (Okunogbe 2021), while two evaluations of e-invoicing in Peru and China reveal relatively large revenue increases (Fan et al. 2020, Bellon et al. 2019). These studies provide invaluable insights into the role of technology and digitised data in tax administration in lower-income countries. However, they are part of a limited yet growing literature which still leaves many questions unanswered. Two of these unanswered questions are:

- Does the compliance effect spill over across all tax types or does it remain confined to the tax type most directly affected by the technological innovation? Lopez-Luzuriaga and Scartascini (2019) argue that evaluating such compliance spillovers across taxes is crucial for a complete evaluation of any policy intervention.

- Do taxpayers respond to technological innovation by adjusting less verifiable margins to minimise the extra taxes they must pay? Two recent studies from higher-income countries suggest this might happen in practice (Carrillo et al. 2017, Slemrod et al. 2017).

Studying the introduction of sales registration machines (SRMs) in Ethiopia

Our paper (Mascagni et al. 2021) addresses these questions by evaluating the introduction of sales registration machines (SRMs) in Ethiopia. In a context of low and declining tax revenue, SRMs were introduced in 2007 with the aim to improve taxpayer compliance, particularly in relation to the Value Added Tax (VAT). The key innovation introduced by SRMs was the ability to digitally record data from each transaction and transmit it to the tax administration in real time.

In addition to making such detailed data available, the machines represent a visible way to detect evasion because failure to use them is a criminal offence in Ethiopia. This represented a huge improvement in the tax administration’s detection capacity, which was accompanied by a push to increase enforcement actions and their visibility amongst the public, for example through court cases and media coverage.

We evaluated the impact of SRMs using a difference-in-difference framework that exploits the machines’ rollout, paying particular attention to the selection of a sample of comparable firms.

Sales registration machines increased tax revenue, but firms’ responses partly offset this effect

We found that the adoption of SRMs by Ethiopian firms led to a large and significant increase in their reported sales. Our estimates suggest an increase in reported sales of over 100% for VAT and 30% for profit taxes.

However, firms responded by increasing their reported costs to minimise the increase in their tax liability. This adjustment in reported costs was proportionally more than the increase in sales: at least 190 % for VAT input and 88% for expense deductions claimed in the profit tax declaration. This over-adjustment of expenses partly offset the positive revenue effect of the SRM rollout.

Despite this behavioural adjustment, the net impact on tax revenue is still positive and large, though less than proportional compared to the increase in reported sales. We found that tax revenue increased by at least 48% for VAT and 12% for profit tax as a result of firms’ SRM adoption.

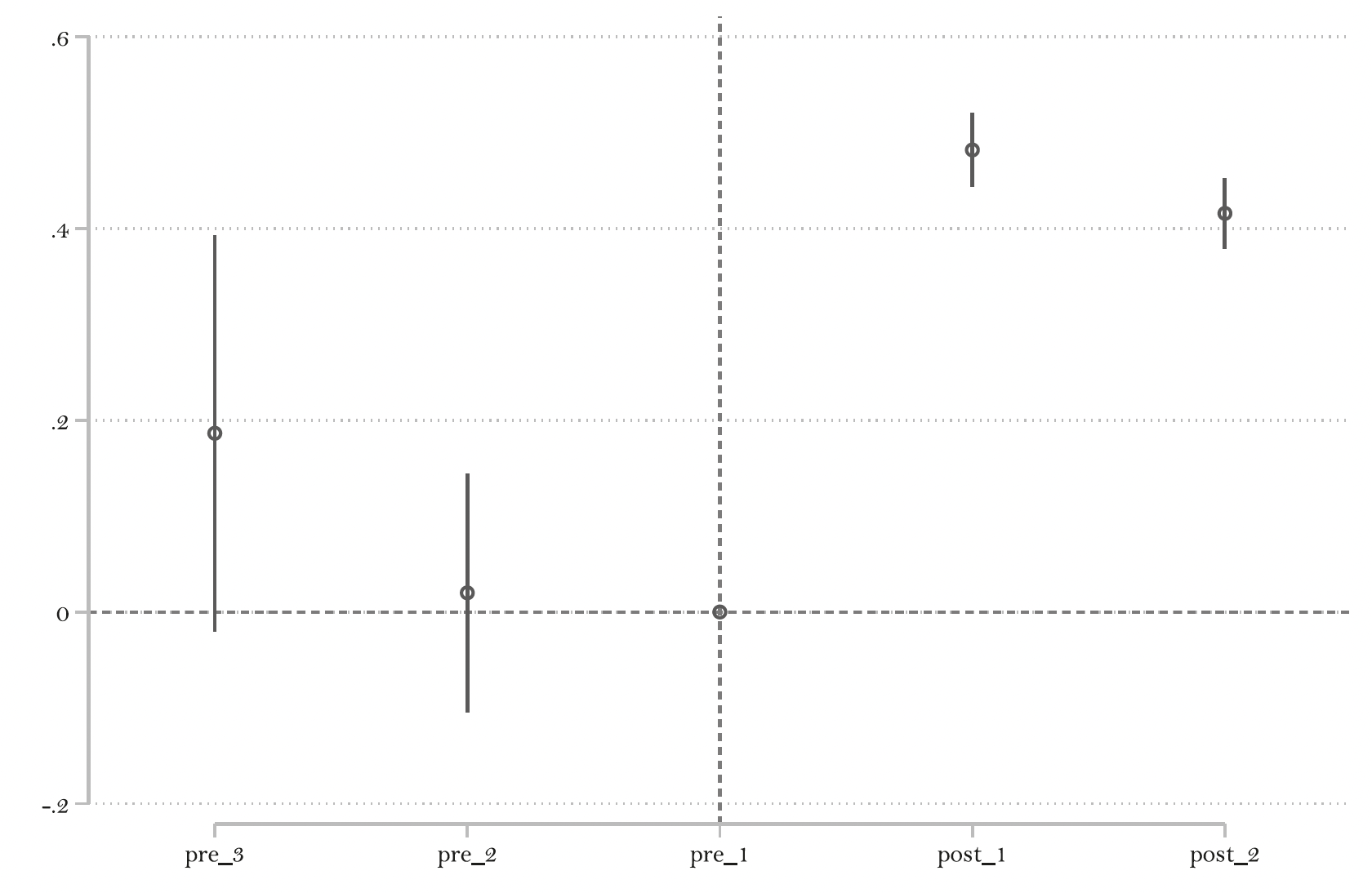

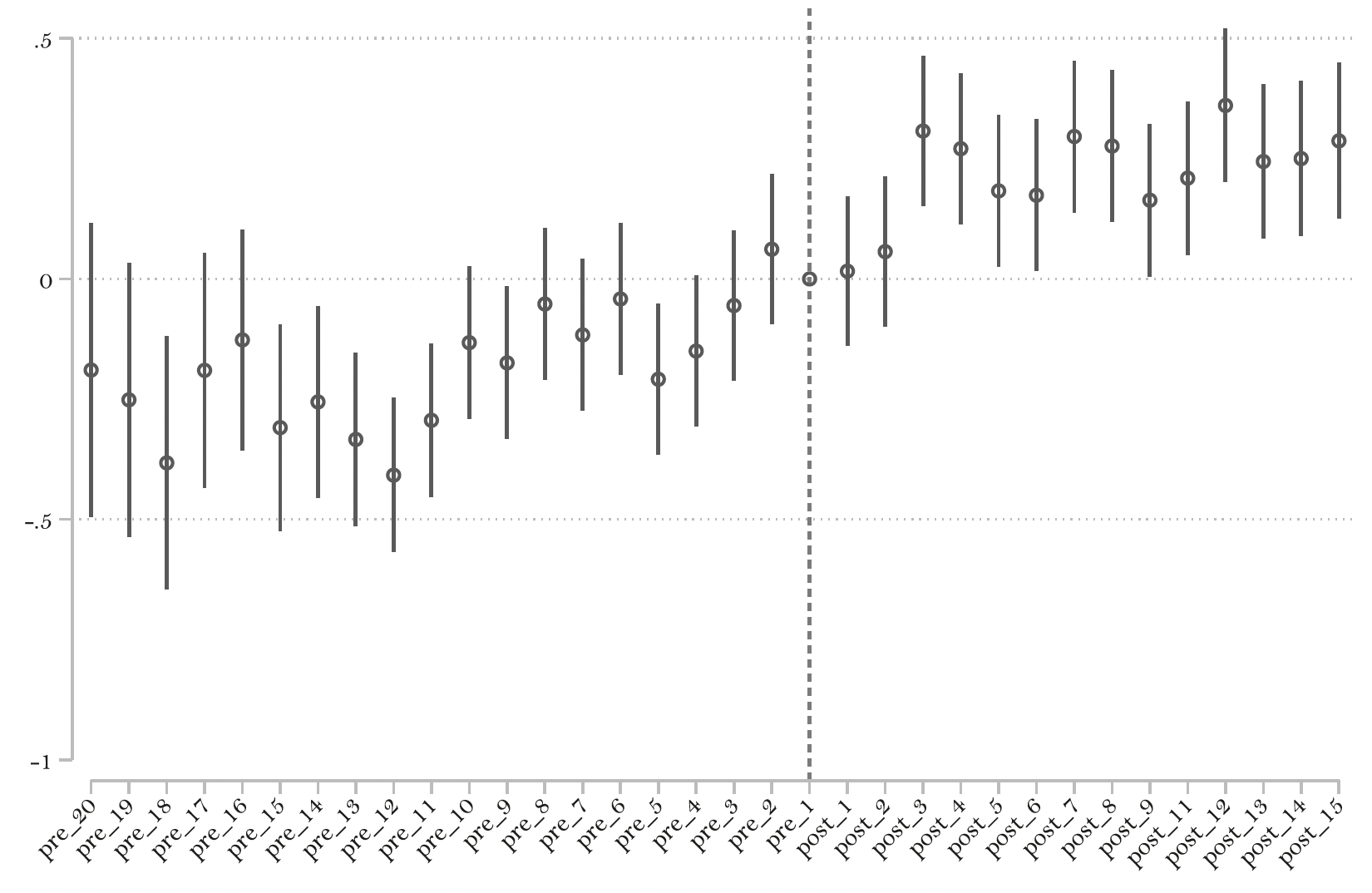

Figure 1 depicts the dynamic response of net VAT to SRM adoption using annual and monthly VAT data (respectively in panels a and b). These results imply a combined revenue gain of US$2.75 million in 2012 alone. While these impacts are large, they align with both the literature on compliance interventions in low-income countries, and with the Ethiopian context.

Figure 1 Dynamic responses for VAT declarations of machine adoption

a) Annual data

b) Monthly data

Note: The figures report coefficients on dummies capturing periods before and after adoption, estimated in a diff-in-diff setting. The excluded category is the last period before adoption.

SRM adoption helped increase the accuracy of taxpayer records

In Ethiopia, there are large and widespread discrepancies in taxpayers’ self-reports. In 42% of all declarations available for the period 2010-2016, there is a discrepancy between the sales that taxpayers report in their income tax and VAT declarations over the same period. This represents on average 36% of the largest value of reported sales. Importantly, these could easily be detected by simple cross-checks, since all data are digitised. However, the Ethiopian tax administration does not seem to make full use of data that is already available to it, largely due to severe capacity constraints. We investigated whether the adoption of SRMs improved the accuracy of taxpayer records and found that when firms adopt SRMs, discrepancies in reporting decrease significantly.

SRMs improved taxpayer compliance

To test the mechanism by which SRMs increase tax revenue, we exploited an exogenous variation in the perceived probability of detection generated by a nudge letter, which was implemented in the context of a separate randomised controlled trial (RCT) (Shimeles et al. 2017). We show that the revenue increase is largely due to increases in compliance rather than real changes in business activity.

The RCT also provides an opportunity to indirectly test the effectiveness of SRMs, which is particularly important in our case because the policy rollout was not randomised. We show that those who had already adopted the machine before the RCT implementation did not respond to an increase in the perceived probability of audit. Non-adopters, however, showed a large and significant response. This result confirms higher compliance amongst SRM users.

Technology can be transformative for tax administration, but it is no silver bullet

Our results show that technological innovation, and particularly SRMs, can be highly effective in increasing tax compliance and revenue. The effects we documented in Ethiopia are substantial, and result in sustained increases in tax revenue. However, technology alone is no silver bullet in a context of limited state capacity. Realising its full potential requires substantial investments to boost the revenue administration’s capacity to use the available data and ICT systems. Taxpayers respond strategically to increases in enforcement by shifting evasion to less enforced margins, like deductible expenses. Tackling tax evasion thus requires a combination of technological innovation and measures to boost capacity, traditional enforcement, and taxpayers’ motivations to comply voluntarily.

References

Bellon, M, J Chang, E Dabla-Norris, S Khalid, F Lima, E Rojas and P Villena (2019), “Digitalization to Improve Tax Compliance: Evidence from VAT e-Invoicing in Peru”, IMF Working paper 231.

Carrillo, P, D Pomeranz and M Singhal (2017), “Dodging the taxman: firm misreporting and limits to tax enforcement”, American Economic Journal: Applied Economics 9(2): 144–164.

Fan, H, Y Liu, N Qian and J Wen (2020), “Computerising VAT invoices in China”, NBER Working Paper 24414.

Lopez-Luzuriaga, A and C Scartascini (2019), “Tax compliance, spillovers, evasion, property tax, sales tax, randomized field experiment, behavioral economics”, Journal of Economoc Behavior and Organisation 164: 518–534.

Slemrod, J, B Collins, J Hoopes, D Reck and M Sebastiani (2017), “Does credit-card information reporting improve small-business tax compliance?”, Journal of Public Economics 149: 1–19.

Mascagni, G, A T Mengistu and F B Woldeyes (2021), “Can ICTs increase tax compliance? Evidence on taxpayer responses to technological innovation in Ethiopia”, Journal of Economic Behavior & Organization 189: 172-193.

Okunogbe, O (2021), “Becoming Legible to the State. The Role of Detection and Enforcement Capacity in Tax Compliance”, World Bank Policy Research Working Paper 9852.

Okunogbe, O and Pouliquien, V (2022), “Technology, Taxation, and Corruption: Evidence from the Introduction of Electronic Tax Filing”, American Economic Journal : Economic Policy 14(1): 341-372.