The cost of insurance comes before the benefit. For crop insurance, pay-at-harvest premiums remove this gap, and can increase demand substantially.

Farmers are subject to large risks. Droughts, hail storms, pests, and dud seeds can all lead to failed harvests. So demand for crop insurance must be high, right? Wrong.

For subsistence farmers, who rely on their crops for their livelihoods, the consequences of a failed harvest can be severe. Yet these production risks, while potentially catastrophic for farmers, are a drop in the pond for insurers. What’s more, insuring the risks can give farmers the confidence to buy fertiliser and make other high return investments (Karlan et al. 2014).

This promise has motivated over 20 years of efforts to develop crop insurance markets in the developing world. The big challenge, surprisingly, has been getting farmers to buy insurance.1 Why? Researchers have considered many possible explanations, and insurers have modified their products accordingly:

- Low trust in the insurer – have trusted organisations endorse the product (Cole et al. 2013).

- Poor quality insurance – use new data to improve the design (Clarke 2016, Elabed et al. 2013).

- Too expensive – subsidise the premium (Cole et al. 2013, Karlan et al. 2014).

- Unfamiliarity with insurance – teach farmers about insurance and advertise it (Cai et al. 2015, Karlan et al. 2014).

These impressive efforts have increased demand but it started from a low base rate, and take-up has remained stubbornly low. What’s worse, when farmers do buy insurance, if it doesn’t pay out in the first year they often don’t buy it again (Cole et al. 2014).

The timing of insurance

In a new paper, we ask whether the timing of insurance payments could explain this low demand (Casaburi and Willis 2017). The point of insurance is that you pay when things are good, in order to get paid when things are bad. Crop insurance only gets this half right. It reduces risk: on net you receive money in bad seasons, and pay in good seasons. But it often gets the timing wrong: you typically pay the premium at planting time, when you need the money; and you get paid at harvest time, when you often don’t. Furthermore, as in almost all insurance products, the cost comes before the benefit. This reduces demand for numerous reasons. For example, farmers may not have the cash to pay upfront, they may be present biased, or they may fear that the insurer will disappear.

To illustrate, put yourself in the shoes of a farmer offered crop insurance. If you sign up to the insurance, you will get extra income at the next harvest, if your harvest is bad. Sounds good. But to sign up you have to pay the premium now. You’re already short on cash, and you have to buy inputs for this season's crops, as well as save enough to last you through the hungry season. Perhaps insurance isn’t so attractive after all.

Pay-at-harvest insurance

Now imagine instead you are offered an insurance product where you could sign up now, but pay the premium at harvest. The change in timing means you no longer have to worry about paying today – instead you pay when you receive your income, and you still get paid on net if your income is low. Furthermore, if the insurer disappears before harvest, you don’t pay.

The study

We ran a suite of randomised controlled trials to test such a pay-at-harvest insurance product, in partnership with a sugarcane contract farming company in Kenya. For the insurer, the challenge with delaying the premium is getting farmers to pay it when the time comes. Credit faces a similar problem, which contract farming has solved: the company provides inputs to the farmers on credit, deducting the costs from farmers' revenues at harvest time. We use the same mechanism to enforce premium payment: the company offers the insurance product, and deducts the premium (plus interest) at harvest (which was around 12 months later in our setting).

Experiment 1: Demand for pay-at-harvest insurance is much higher, especially among the poor

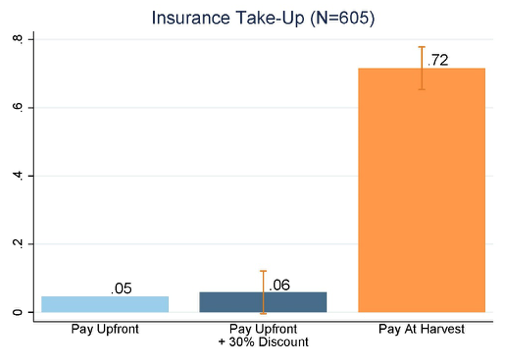

In our main experiment, we offered insurance to 605 farmers and randomised the timing of the premium payment. Take-up of the new, pay-at-harvest insurance was 72%, among the highest take-up rates seen for full-priced agricultural insurance.1 In contrast, take-up of the standard, pay-upfront insurance was 5%, low, but in line with results in other settings. To benchmark the difference, we offered a 30% price discount on the upfront premium to a third group. Take-up was 6%, hardly different from the full price premium.

The results show farmers do have high demand for insurance, but they have a low willingness to pay for it upfront. What’s more, it was the poorest and the most liquidity constrained farmers that increased their demand the most with the change in timing. This is in line with our model, which predicted that they would benefit the most.

Figure 1 Insurance take-up

Note: N = 605.

Experiment 2: Giving farmers cash doesn’t close the gap

One possible explanation is that farmers simply didn’t have the cash to pay the upfront premium. To test this, we gave a subset of farmers cash, before offering them insurance later in the same meeting (similar to Cole et al. 2013). The cash gift was slightly larger than the premium, ensuring that farmers did have money to purchase the insurance if they wished to. It did little to close the gap between pay-upfront and pay-at-harvest insurance, ruling out this explanation – given the choice, farmers preferred to spend the cash on other things.

Experiment 3: Even a one month delay in the premium increases take-up, but not as much

Under present bias (Laibson 1997, Duflo et al. 2011) there is another possible explanation: pay-upfront demand is low because the premium must be paid immediately at sign-up. If so, even a small delay in premium payment could increase demand substantially (related to Thaler and Benartzi 2004). In a third experiment we tested this, by comparing take-up when the premium was due straight away, to take-up when payment was delayed by just one month. This small delay increased take up by 21 percentage points; smaller than the effect of delaying payment until harvest time, but still large and suggestive of present bias. Further, a pay-in-one-month insurance product is without many of the enforcement concerns inherent in a pay-at-harvest product.

Counterparty risk and trust in insurance

Twelve months after our experiment began, due to financial problems, the company had to delay harvesting (in our setting, the company manages harvesting), which drove many farmers (50%) to sell to other buyers. Multiple tests in the paper show that pay-at-harvest insurance did not induce farmers to side-sell. But the episode does highlight another possible channel, counterparty risk. Insurance requires considerable trust from the farmer - trust that the insurer will actually pay out when supposed to. Delaying the premium payment eases this: if the insurer defaults before harvest, at least the farmer saves the premium. While we find little evidence for this channel (and the previous experiments showed other channels matter), it certainly may account for part of our main result.

Implications for policy and further questions

Our findings motivate for further work on the timing of insurance:

- From a policy view, we would want to see the results replicated in other crop insurance settings. Encouragingly, for livestock (pig) insurance, Liu et al. (2016) find that delaying the premium payment triples demand in China.

- Are there other ways to enforce a premium paid at harvest? Comparisons with credit are encouraging - perhaps the enforcement innovations used in microcredit could be applied to microinsurance.

- Do other timings for the premium payment work? At the previous harvest, for example, when farmers still have liquidity.

- The timing of the payout: Times are hardest of all in the hungry season following a bad harvest – perhaps payouts should be made then.

- Are there implications for other types of insurance, especially those with premiums long before payouts, such as life insurance, annuities, and rare-disaster insurance?

Photo credit: It Starts Here/Flickr.

References

Jing, C, A Janry and E Sadoulet (2015), “Social Networks and the Decision to Insure”, American Economic Journal: Applied Economics 7(2): 81-108.

Lorenzo, C and Willis, J (2017), "Time vs. State in Insurance: Experimental Evidence from Contract Farming in Kenya", BREAD Working Paper No. 521.

Clarke, D J (2016), “A Theory of Rational Demand for Index Insurance”, American Economic Journal: Microeconomics 8(1): 283-306.

Shawn, C, X Gine, J Tobacman, P Topalova, R Townsend and J Vickery (2013), “Barriers to Household Risk Management: Evidence from India”, American Economic Journal: Applied Economics 5(1): 104-35.

Shawn, C, D Stein and J Tobacman (2014), “Dynamics of Demand for Index Insurance: Evidence from a Long-Run Field Experiment”, American Economic Review 104(5): 284-90.

Duflo, E, M Kremer and J Robinson (2011), “Nudging Farmers to Use Fertilizer: Theory and Experimental Evidence from Kenya”, American Economic Review 101(6): 2350-90.

Ghada, E, M Bellemare, M R Carter and C Guirkinger (2013), "Managing Basis Risk with Multi-scale Index Insurance”, Agricultural Economics 44: 419–431.

Karlan, D, R Osei, I Osei-Akoto and C Udry (2014), “Agricultural Decisions after Relaxing Credit and Risk Constraints”, The Quarterly Journal of Economics 129(2): 597-652.

Laibson, D (1997), “Golden eggs and hyperbolic discounting”, The Quarterly Journal of Economics 112(2): 443-477.

Yanyan, L, K Chen, R Hill and C Xiao (2016), "Delayed Premium Payment, Insurance Adoption, and Household Investment in Rural China”, IFPRI Discussion Paper 01306.

Rampini, A A and S Viswanathan (2016), "Household Risk Management", NBER Working Paper 22293.

Thaler, R H and S Benartzi (2004), “Save More Tomorrow: Using Behavioral Economics to Increase Employee Saving", Journal of Political Economy 112(S1): S164-S187.

Endnotes

[1] This reflects a broader finding that the poor typically buy less insurance (Rampini and Viswanathan 2016)

[2] The insurance was priced actuarially fairly, meaning that on average, pay-outs equal premiums.