Low-cost interventions such as executive education courses can improve firms’ financial practices and decision making, and trigger economic development

Differences in productivity and profitability across firms can be large and persistent (Syverson 2004, Syverson 2011, Foster et al. 2008). Management practices as well as development levels across countries contribute to explaining these differences (e.g. Bloom and Van Reenen 2007, Bloom and Van Reenen 2011, Bloom et al. 2013). Analyses of the role of management practices in explaining firm-level productivity and profitability have mostly focused on operational management practices. However, financial management practices are potentially an important margin that are under the control of firms and yet are not necessarily managed actively. Such policies might be particularly important in contexts where financial frictions are severe, such as in developing economies.

Can formal education be an effective vehicle to improve the financial practices of firms? Existing literature on the impact of financial education and business training offers mixed evidence of its effectiveness, depending on the educational settings and targeted population (McKenzie and Woodruff 2012).

In our recent paper (Custodio et al. 2020), we use a randomised controlled trial (RCT) to estimate the impact of a financial education programme for top executives at medium-sized and large firms in Mozambique. We find that this intervention leads to significant changes in short-term financial policies and investment. We show that upon receiving financial education, managers reduce accounts receivable and inventories, which generates an increase in free cash flows used to finance long-term investments. These changes improve the performance of the treated firms.

Financial practices survey

Before the planned intervention, we interviewed 63 managers of medium and large firms to investigate their financial practices as well as characteristics such as educational background and past professional experience, including financial experience.

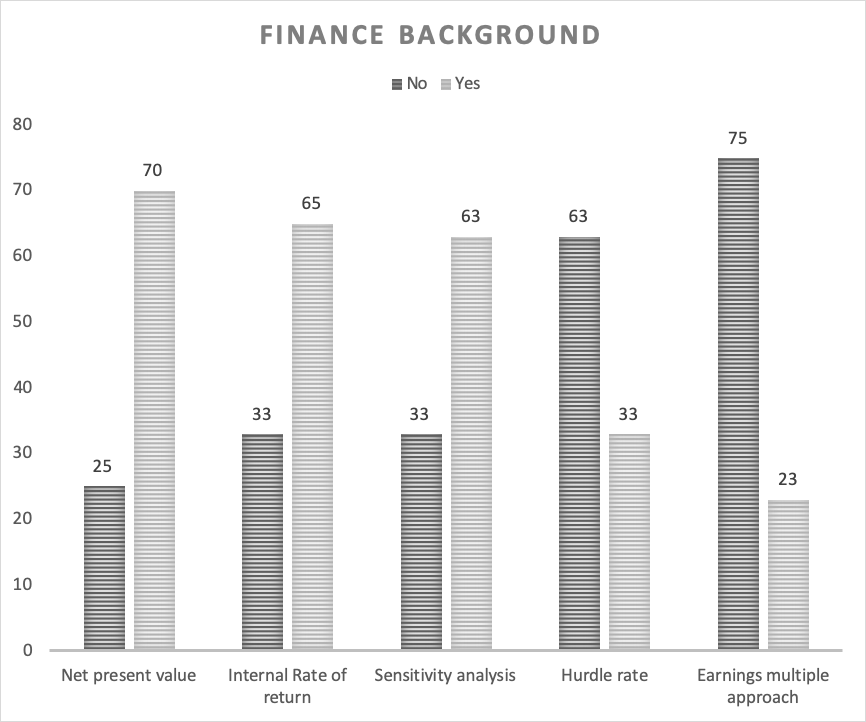

Using this survey data, we first found evidence that CEOs' financial expertise was correlated with firm financial practices. For instance, we found that executives with an educational background in finance are more likely to use more sophisticated valuation techniques such as net present value or sensitivity analysis than respondents with no such background. Those results are consistent with the evidence in previous US studies (Graham and Harvey 2002, Custódio and Metzger 2014).

Figure 1 Finance background knowledge of survey respondents

Notes: The figure displays the usage of different valuation techniques by executives depending on their finance background. An executive is considered to have a finance background if she attended at least one finance course at any higher education degree.

More importantly, this information from the interviews helped us gauge the executives’ interest in participating in a finance course, as well as to identify relevant learning topics.

The impact of finance education

To evaluate the impact of finance education on financial policies, and ultimately on firm performance, we used an RCT and collected several rounds of survey evidence, as well as (external) accounting data.

We offered a free executive education course on corporate finance to C-level managers of medium and large firms in Mozambique. Based on the pre-intervention survey, we designed the course similar to an MBA core module in content and length. The course focused on investment and capital budgeting decisions, as well as financial decisions including working capital management, capital structure, and risk management.

A total of 93 firms participated in the experiment. We followed a staggered design where firms were randomly allocated into two cohorts: a treatment group and a control group. The first cohort – the treatment group – received treatment in May 2017, while the control group participated in the course in November 2018 and April 2019.

We find that participation in the executive education course led to significant changes in financial policies and investment decisions. The largest changes are in short-term financial policies related to working capital. Treatment firms reduced working capital compared to control firms, especially by reducing accounts receivable and inventories. The reduction in accounts receivable might be related to the collection of existing payments, potentially late payments, or the negotiation of new contracts with revised terms. From our survey analysis, we document that some firms hired additional personnel to deal with outstanding debts. The reduction in working capital had a positive impact on short-term cash flows, helping firms to overcome potential financial constraints at least partially and in the short run. Overall, these changes improved firm’s financial performance (i.e. returns), which is consistent with efficiency gains.

Importantly, survey data and accounting data obtained through different sources show consistent treatment effects. Treated firms report high intentions to change financial policies after participation in the course, especially related to working capital management. The survey also reveals that a sizeable fraction of firms were not able to adjust their capital structure (33%) or risk management and valuation practices (18% each), mostly because they are subsidiaries of multinational companies and these policies were set elsewhere in the business group.

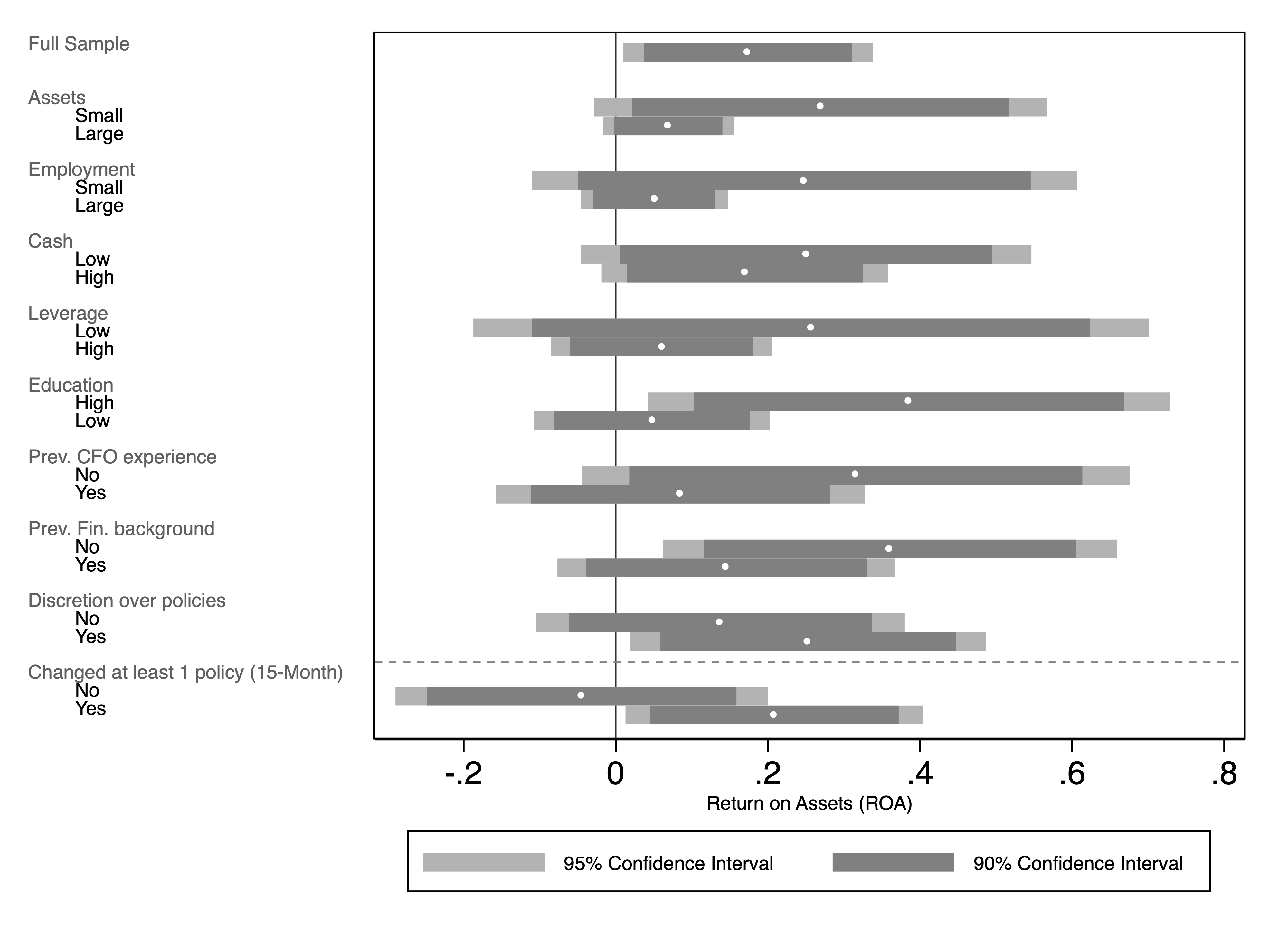

We estimate an average impact on firm cash flows of US$190,000 from changes in working capital. Since we do not find any evidence of an increase in cash holdings or dividends, this suggests that firms spent this influx of cash. Consistent with this evidence, we estimate an increase in capital expenditures of about $210,000 from accounting data. As firms in Mozambique point out difficulties in accessing external financing, this finding is particularly relevant. We also estimate the impact of the intervention on firm value. The estimated effect on return on assets (ROA) of 0.21 is, for most firms, much larger than the estimated cost of a similar course (approximately $10,000 in tuition fees).

Conclusion

Our results show new evidence that deficiencies in financial expertise of managers at large firms can be an important constraint on firm performance, particularly in contexts with severe financial frictions. They also suggest that relatively low-cost interventions, such as an 18-hour executive education course on corporate finance and risk management, can improve financial practices and decision making, and could ultimately affect economic development.

Firm performance results suggest that firms’ financial policies changed efficiently in response to treatment. In addition, we also find that CEOs without prior finance experience and firms that face higher financing constrains, such as smaller ones, benefit relatively more from the course.

Figure 2 Returns on assets for firms

Notes: This figure displays the treatment effects of the finance education program for different subsamples. Each bar shows results of a different ANCOVA (the point estimate as well as the 90% and 95% confidence bands). Small/large assets, employment, cash and leverage denote whether a firm is of below/above the median of the respective distribution. High education refers to having obtained a Master’s degree (or higher). Previous CFO experience denotes whether the course participant had prior CFO experience. Previous financial background denotes whether the participant has educational background in finance. Discretion over policies is a dummy variable that is equal to one if the participant has discretion over financial policies. Changed at least 1 policy (15 Month) denotes whether participants reported to have changed at least one policy in the 15-month follow-up survey. All manager-level characteristics refer to the top manager in each company.

Why had firms and managers not already obtained financial education? There are several non-mutually exclusive potential reasons. First, there are no similar courses available locally, which significantly raises the total cost of such programmes (including traveling and opportunity costs). Second, firms might simply not be aware of the benefits of such executive training (e.g. Rivkin 2000). Moreover, Kremer et al. (2019) have argued that this behaviour can be consistent with behavioural biases of managers of firms in developing countries, which include inattention, underestimation of returns, or overestimation of risks involved.

While earlier research on financial education in the context of household finance or finance for small and micro firms in developing countries suggests that generic classroom-based financial education does not work (Zia 2009), our evidence suggests that this type of education is effective for top managers.

There are many reasons that could explain these differences in outcomes. For instance, the content presented to managers (i.e. corporate finance) is very different, as is the pool of recipients. While most research in developing countries has focused on poor, relatively less-educated households and entrepreneurs, the average manager participating in our programme is well educated. This fact might be important since previous research has suggested that cognitive constraints are a key barrier to improving financial knowledge (Carpena et al. 2011). Understanding what type of education is most efficient remains an important avenue for future research – especially whether online courses that can potentially reach a large audience at a very low cost can achieve similar results.

References

Bloom, N, B Eifert, A Mahajan, D McKenzie and J Roberts (2013), “Does management matter? Evidence from India”, The Quarterly Journal of Economics 128(1):1–51.

Bloom, N and J Van Reenen (2007), “Measuring and explaining management practices across firms and countries”, The Quarterly Journal of Economics 122(4):1351–1408.

Bloom, N and J Van Reenen (2011), “Human resource management and productivity”, Handbook of Labor Economics, volume 4, pages 1697–1767, Elsevier.

Carpena, F, S Cole, J Shapiro and B Zia (2011), “Unpacking the causal chain of financial literacy”, World bank Policy Research working paper.

Custódio, C and D Metzger (2014), “Financial expert CEOs: CEO’s work experience and firm’s financial policies”, Journal of Financial Economics 114(1):125–154.

Custódio, C, D Mendes and D Metzger (2020), “The Impact of Financial Education of Managers on Medium and Large Enterprises - A Randomized Controlled Trial in Mozambique”, Working Paper.

Foster, L, J Haltiwanger and C Syverson (2008), “Reallocation, firm turnover, and efficiency: Selection on productivity or profitability?”, American Economic Review 98(1):394– 425.

Graham, J and C Harvey (2002), “How do CFOs make capital budgeting and capital structure decisions?”, Journal of Applied Corporate Finance 15(1):8–23.

Kremer, M, G Rao and F Schilbach (2019), “Behavioral development economics”, Handbook of Behavioral Economics: Applications and Foundations 1, volume 2, pages 345–458, Elsevier.

McKenzie, D and C Woodruff (2012), “What are we learning from business training and entrepreneurship evaluations around the developing world?” World Bank Research Observer 29(1):48–82.

Rivkin, J W (2000), “Imitation of complex strategies”, Management Science 46(6):824–844.

Syverson, C (2004), “Market structure and productivity: A concrete example”, Journal of Political Economy 112(6):1181–1222.

Syverson, C (2011), “What determines productivity?”, Journal of Economic literature 49(2):326–65.

Zia, B (2009), “Valuing financial literacy: Evidence from Indonesia”, World Bank Other Operational Studies.