Poorer business owners settle for lower prices when bargaining with buyers

Microenterprises in developing countries face many barriers to profitability and growth. These small business owners may have to deal with constraints and challenges related to credit (Banerjee et al. 2015), capital (de Mel et al. 2008, 2019) labour (de Mel et al. 2019, Hardy and McCasland 2022), lack of business knowledge (Karlan and Valdivia 2011, Drexler et al. 2014, Campos et al. 2017), infrastructure unreliability (Abeberese et al. 2021, Hardy and McCasland 2021b), regulatory burden (de Mel et al. 2013), the lack of business networks (Fafchamps and Quinn 2018, Cai and Szeidl 2018, Brooks et al. 2018), or even lack of demand (Hardy and Kagy 2020, Hardy and McCasland 2021a).

For many of these owners, bargaining over the price of goods and services is an integral part of operations. The final price that is settled by bargaining between the buyer and the seller is a key determinant of business profitability. In our study (Hardy, Kagy, and Song 2022) we investigate how the financial need of the seller affects the pricing of products.

We find that business owners with less money agree to lower sale prices when bargaining with potential buyers. This highlights a potential poverty multiplier that hinders business growth: price-setting behaviour. Those with less money receive lower surplus from each transaction, and may be left with lower profits – and consequently less money – to make future investments in their businesses.

Measuring bargaining behaviour: Two exercises

We study the bargaining behaviour of garment-making firms in Hohoe, Ghana. Like many other small businesses, most of these firms have no paid employees other than the owners themselves. To determine the price of an order, the owner and the potential buyer go back and forth with price offers, until they agree on a final price or one of them decides to walk away.

We designed two types of exercises:

- a real bargaining exercise over the price of a child’s shirt

- a ‘lab in the field’ bargaining game experiment.

We conducted the real bargaining exercise once in January 2018, then again in January 2019 with the same 375 business owners. In both years, an enumerator approached a firm owner as a potential buyer and attempted to order a child’s shirt. All enumerators were trained to bargain naturally, while following a script that specifies how they should respond to each price offered by the owner.

The script was written so that every enumerator would ask the owner to set the first price and the enumerator would respond the same way to the same offer.

- For example, if the first price suggested by the owner was lower than 10GHC (about $2), the enumerator would accept.

- Otherwise, the enumerator would make a counteroffer of 10 GHC.

- If the owner turned down the 10GHC counteroffer, the enumerator and owner would then go back and forth, with the enumerator providing increasingly higher pre-specified counteroffers in the case of disagreement.

- The maximum offer the enumerator was able to make was 30GHC, a high enough figure that the bargaining almost always ended in agreement.

After the bargaining exercise over the price of a child’s shirt, the enumerator asked detailed questions about the owner’s personal, household, and firm information. Importantly, to study how financial need affects bargaining behaviour, we collected information to measure per capita liquidity of the owner’s household.

To corroborate findings from the bargaining exercise over an actual child’s shirt, we administered a ‘lab in the field’ bargaining game in January 2019.

- Immediately prior to this game, to induce random variation in how much financial need a business owner has, owners were given either a high or low amount of cash to keep (with the difference being around a day’s income).

- They were then asked to play the bargaining game, where they bargained with the computer over the divisions of 30GHC.

- They were told that the computer is programmed to “behave like a buyer, bargaining with you over the price of a garment."

- The game started with the owners making the first offer to divide 30GHC between themselves and the computer, and the computer may accept or reject and give a counteroffer.

- The bargaining protocol used by the computer followed that of the real bargaining exercise completed with the enumerators and the business owners.

Owners bargaining with less money get lower prices

In the real bargaining exercise over a child’s shirt, we find a large, positive relationship between the owner’s per capita household liquidity and the final price of the child’s shirt.

Figure 1 demonstrates this relationship across firms. Firms with lower per capita household liquidity settled for lower prices. A one standard deviation decrease in per capita household liquidity is associated with a 5% decrease in final price.

Figure 1

Does this imply that less money leads to a disadvantage in bargaining? Not necessarily. This association between liquidity and final price may be driven by other factors. For example, those who are good negotiators would receive higher prices in the bargaining exercise and have higher levels of liquidity from their successes in the past.

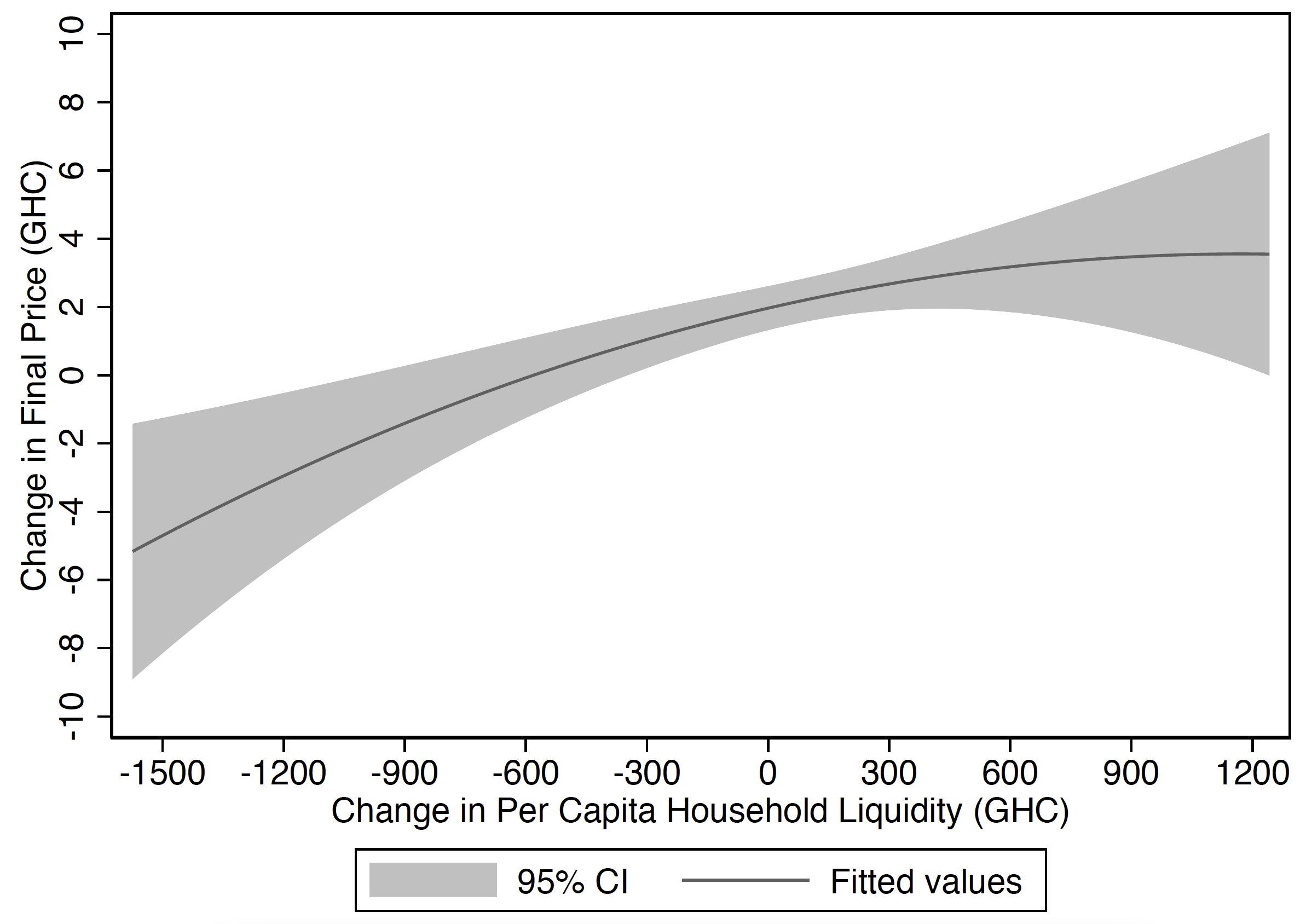

With two years of data, we look at whether the relationship between liquidity and final price holds within a firm over time. Figure 2 demonstrates that changes in per capita household liquidity and changes in final price are positively associated. This means that the relationship between liquidity and price is not driven by anything about the owner, owner household, and firm characteristics that are fixed over time (such as ability to negotiate) or measured in both years (such as quality of the shirt produced).

Figure 2

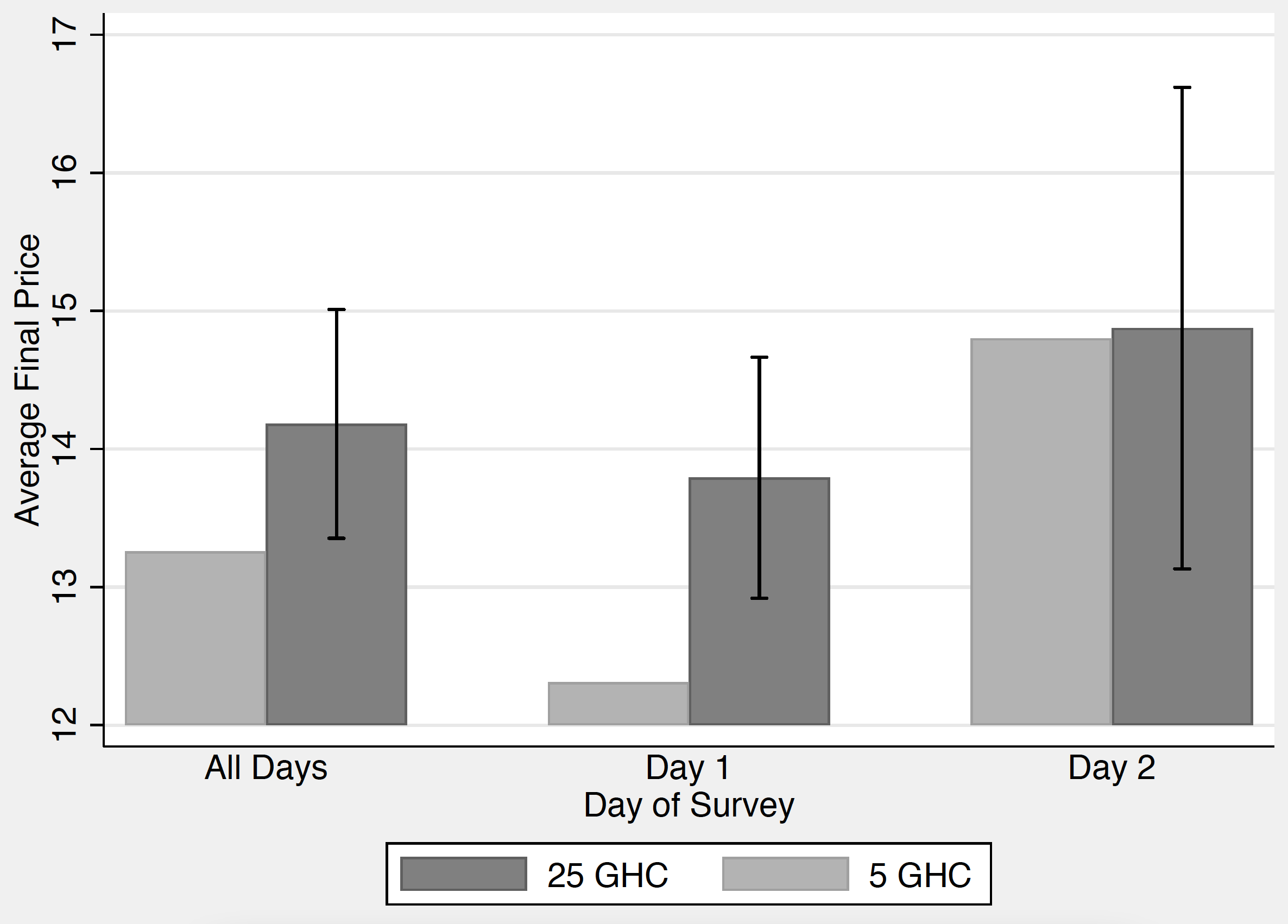

Finally, these findings are corroborated by results in the ‘lab in the field’ bargaining game conducted in 2019. Figure 3 plots the average winnings (‘final price’) from the bargaining game separately for those who randomly received 25GHC and 5GHC. Receiving a higher amount of cash causes a 7% increase in winnings.

Together, these results imply that business owners having less money leads to a disadvantage in bargaining.

Figure 3

Understanding the relationship between financial need and pricing

One possible explanation for this strong relationship between financial need and pricing is that having less money makes an owner less comfortable with risk. In the pricing decision, owners face a trade-off: asking for a higher price for the same product pays off if the buyer agrees, but the owners also face a higher chance of the customer walking away (i.e. of not selling the product at all). This study suggests that having less money makes business owners feel less comfortable with risk, and therefore they will settle for lower prices to make a sale.

Our study documents that small business owners in Ghana with lower liquidity than their counterparts settle for lower prices in bargaining. That is, poorer owners may be bargaining their way into a lower surplus. An important avenue for future work is to understand whether lower surplus from each transaction translates to lower profits, lower future investments, and a poverty cycle. If so, this would imply that an exogenously-determined fixed price imposed by market or government regulations (such as a fixed taxi fare) has distributional consequences and benefits the largely self-employed poor.

Editors’ note: This article is based on this PEDL research.

References

Abeberese, A B, C G Ackah, and P O Asuming (2021), “Productivity losses and firm responses to electricity shortages: Evidence from Ghana”, The World Bank Economic Review 35(1):1-8.

Banerjee, A, D Karlan, and J Zinman (2015), “Six randomised evaluations of microcredit: Introduction and further steps”, American Economic Journal: Applied Economics 7(1):1–21.

Brooks, W, K Donovan, and T R Johnson (2018), “Mentors or teachers? Microenterprise training in Kenya”, American Economic Journal: Applied Economics 10(4):196–221.

Campos, F et al. (2017), “Teaching personal initiative beats traditional training in boosting small business in West Africa”, Science 357:1287–90.

Cai, J and A Szeidl (2018), “Interfirm relationships and business performance”, Quarterly Journal of Economics 133(3):1229–82.

de Mel, S, D McKenzie, and C Woodruff (2008), “Returns to capital in microenterprises: Evidence from a field experiment”, Quarterly Journal of Economics 123(4): 1329–72.

de Mel, S, D McKenzie, and C Woodruff (2013), “The demand for, and consequences of, formalisation among informal firms in Sri Lanka”, American Economic Journal: Applied Economics 5(2):122–50.

de Mel, S, D McKenzie, and C Woodruff (2019), “Labour drops: Experimental evidence on the return to additional labour in microenterprises”, American Economic Journal: Applied Economics 11(1):202–35.

Drexler, A, G Fischer, and A Schoar (2014), “Keeping it simple: Financial literacy and rules of thumb”, American Economic Journal: Applied Economics 6(2):1–31.

Fafchamps, M and S Quinn (2018), “Networks and manufacturing firms in Africa: Results from a randomised field experiment”, World Bank Economic Review 32(3):656–75.

Hardy, M and G Kagy (2020), “It’s getting crowded in here: Experimental evidence of demand constraints in the gender profit gap”, Economic Journal 130(631):2272–90.

Hardy, M, G Kagy, and L Song (2022), "Gotta have money to make money? Bargaining behaviour and financial need of microentrepreneurs", American Economic Review: Insights 4(1):1-17.

Hardy, M and J McCasland (2021a), “It takes two: Experimental evidence on the determinants of technology diffusion”, Journal of Development Economics 149:102600.

Hardy, M and J McCasland (2021b), “Lights off, lights on: The effects of electricity shortages on small firms”, World Bank Economic Review 35(1):19–33.

Hardy, M and J McCasland (2022), “Are small firms labour constrained? Experimental evidence from Ghana”, American Economic Journal: Applied Economics. Karlan, D and M Valdivia (2011), “Teaching entrepreneurship: Impact of business training on microfinance clients and institutions”, Review of Economics and Statistics 93(2):510–27.