Lumpsum cash transfers delivered as business grants can spur microentrepreneurial activities

Somalia has faced a protracted humanitarian crisis due to decades of conflict, political instability, and recurrent droughts. Beyond humanitarian support, small enterprises are a key lifeline and income source, especially for those living in internally displaced person (IDP) camps. Humanitarian agencies in the country often disburse unconditional cash transfers (UCTs) in small monthly instalments. Although UCTs help recipient households to manage immediate food needs, there is an increasing desire among development practitioners to leverage on the UCTs to build resilience by promoting income generation.

Sustainability, impact, and cost-effectiveness of UCTs

Tweaks in the design and delivery of cash transfers (like variations in frequency and size) are useful avenues for improving cost-effectiveness. For example, comparing a transfer of the same amount in monthly versus quarterly disbursements, Bastian et al. (2017) found that although both interventions had a similar impact on asset ownership, the lumpsum transfers had lower administrative costs. Evidence from Sri Lanka (De Mel et al. 2012) and Kenya (Haushofer and Shapiro 2016, 2018, Delius et al. 2020) show that large cash grants have a greater impact on investment in assets, livestock, and non-farm microenterprises. However, the change in impact achieved by transferring additional cash may not necessarily stay the same as the transfer size increases. In fact, a review of evidence by Kondylis and Loeser (2021) found that an increase in transfer size reduces cost-effectiveness both in the short-term and medium-term. Although literature on the impact of cash transfers is rich with studies in stable contexts, there is limited research on the same in humanitarian contexts.

Examining outcomes of different UCT designs

Our recent study (Abdullahi, Ali, Kipchumba, and Sulaiman 2021), looks at the short-term (3–4 months after the transfers, we call it ‘midline’) and long-term (3.5 years after the transfers, or ‘endline’) impact of variations in cash transfers in Somalia. Working with Save the Children International – Somalia, we implemented an individual level randomised controlled trial to measure the marginal effects of lumpsum and larger cash grants relative to a typical UCT. The study includes 800 beneficiary households who were randomly divided into four groups through a public lottery to receive one of four types of transfers: (1) UCT of US$175 in two equal monthly instalments, (2) one-off business grant of $175, (3) medium business grant of $500, and (4) large business grant of $1,000. One beneficiary from each household in groups 2, 3, and 4 (i.e., business grant recipients) also received general business training that lasted for 1–2 hours daily for five days. We measured the impact of the business grants and training by comparing business ownership and income among these three groups vis-à-vis the UCT group.

Lumpsum business grants have a sustained entrepreneurial impact

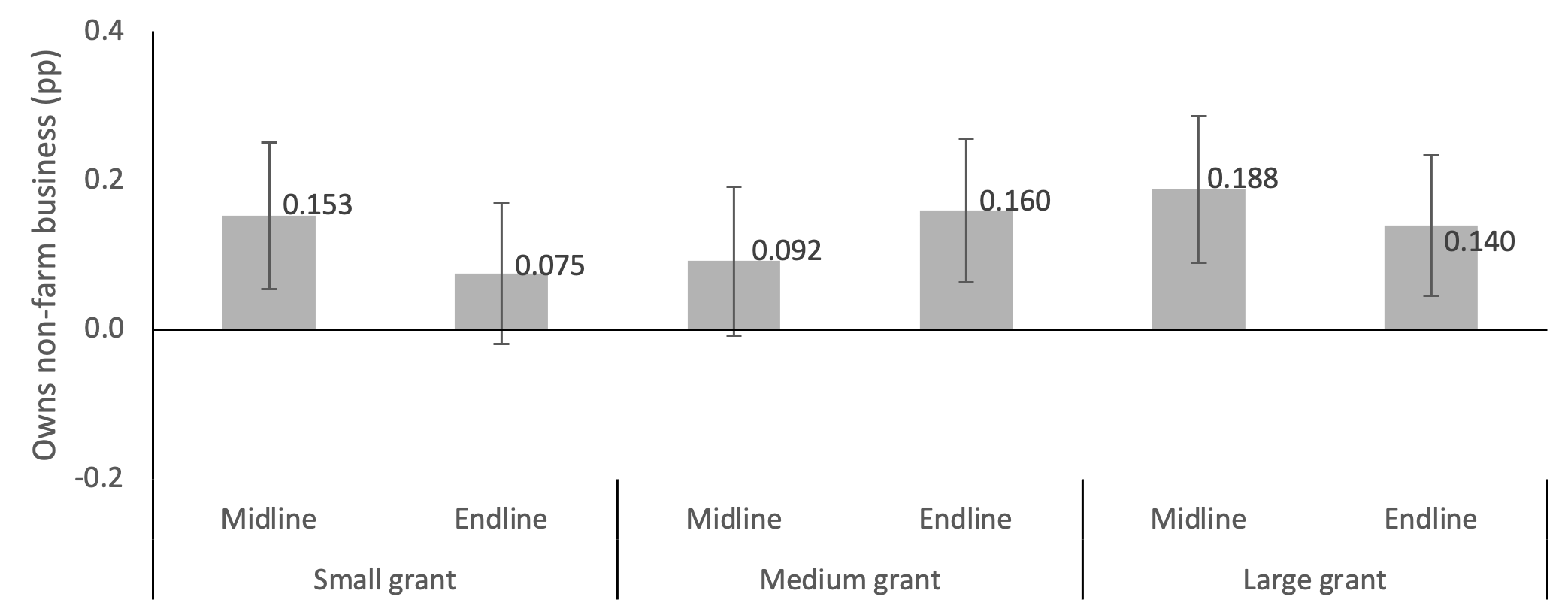

Getting the same amount of money as the UCT group in a one-off grant (instead of two transfers) increased the likelihood of the households being involved in non-farm businesses by 15 percentage points at midline (Figure 1). The small one-off grant, however, did not sustain this positive effect at endline. On the other hand, both medium and large business grants resulted in a sustained impact on business ownership in the long term. However, there is no significant difference in the levels of impact observed for medium versus large business grant recipients. In other words, the additional $500 received by the large grant group did not increase the likelihood of engaging in microenterprises compared to the medium grant group.

Figure 1 Effect of cash transfer on non-farm business ownership

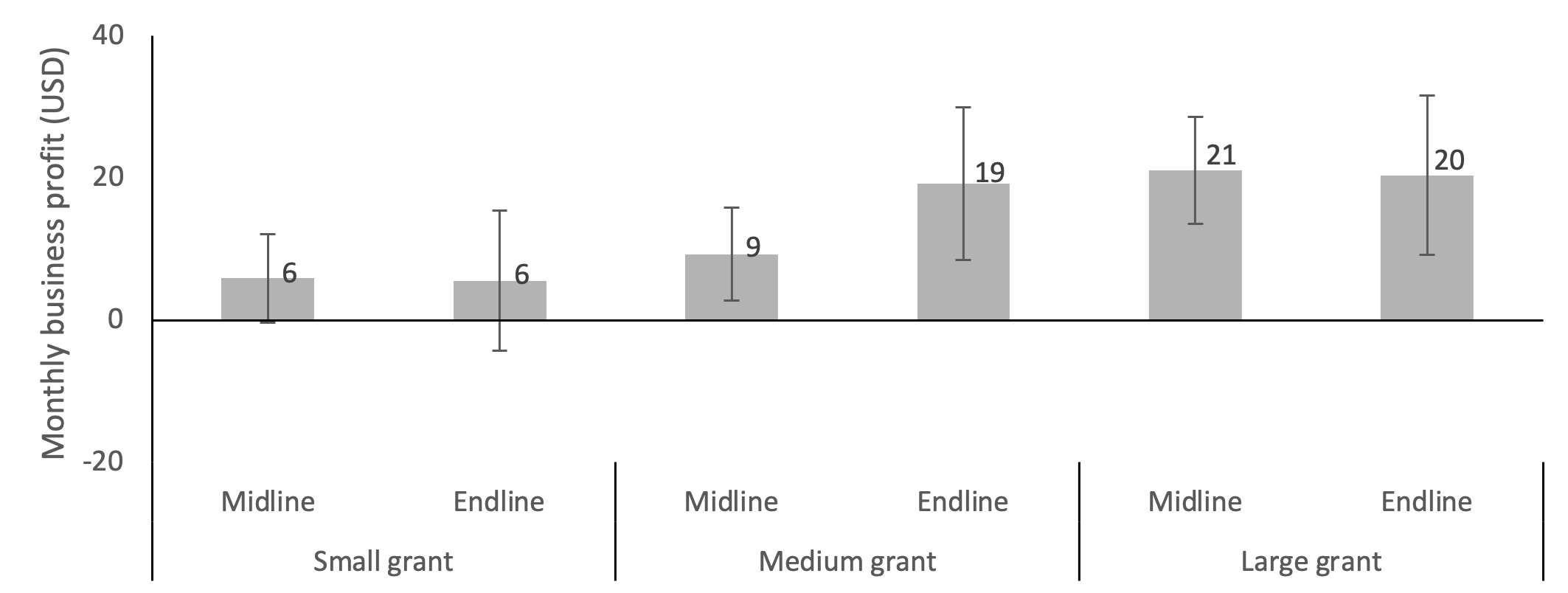

These patterns of impact on business ownership are also reflected in the impact on income (Figure 2). When compared to the UCT group, all three business grant groups had higher income from non-farm enterprises at the midline. The long-term impact is only observed for medium and large business grants. Although large grant recipients experienced higher impact on their monthly business profit at midline compared to medium grant recipients at midline ($19 versus $9), the medium grant group caught up by the endline. Since we did not find any difference among the four groups in their income from other sources, we used the profit earned from their microbusinesses to measure cost-effectiveness. We estimate that the additional cost for medium grant has a benefit-cost ratio of 1.16 compared to 0.94 for the large grant if we count only the observed impact until endline.

Figure 2 Effect of cash transfer on non-farm business profit

Note: A business grant of $500 or $1,000 had an effect of about $20 from micro-enterprise per month more than 3 years later.

Policy implications

The extent to which humanitarian support can be utilised to enhance household resilience is an important policy consideration in prolonged humanitarian contexts like Somalia. Our study reveals that it is possible to improve the cost-effectiveness of UCTs by making small changes such as labelling the transfers as business grants and providing business training. Given the prominent role of cash transfer in humanitarian programming – for example, 17% of total humanitarian programming in Somalia in 2017 was cash transfer worth $214 million – it is conceivable to apply such small changes in the transfer design that can facilitate resilience building. Although our research does not measure the impact at scale, which may differ if many households in the same community receive business grants compared to the scale of our pilot, there is clearly potential gains to be achieved by increasing focus on resilience in humanitarian assistance. As many agencies are exploring different ways of leveraging on cash transfers for enhancing social impact, which are often described as ‘cash plus’ approaches, they can consider business grant as one of the tools. Such incremental changes in the programme design are a practical way to adopt evidence-based programming.

References

Abdullahi, A, M K. Ali, E Kipchumba and M Sulaiman (2021), “Supporting Micro-enterprise in Humanitarian Programming: Evidence of Cash Transfer in Somalia”, working paper.

Bastian, G, M Goldstein, and S Papineni (2017), “Are Cash Transfers Better Chunky or Smooth? Evidence from an Impact Evaluation of a Cash Transfer Program in Northern Nigeria”, Gender Innovation Lab Policy Brief No. 21. World Bank.

De Mel, S, D McKenzie, and C Woodruff (2012), “One-time transfers of cash or capital have long-lasting effects on microenterprises in Sri Lanka”, Science 335(6071): 962–966.

Delius, A, O Sterck, J Alix-Garcia, A Betts, S Dercon, D Mckenzie, N Omata, G Ulyssea, and C Woodruff (2020), “Cash Transfers and Micro-Enterprise Performance: Theory and Quasi-Experimental Evidence from Kenya”, working paper.

Haushofer, J and J Shapiro (2016), “The short-term impact of unconditional cash transfers to the poor: Experimental evidence from Kenya”, Quarterly Journal of Economics 131(4): 1973–2042.

Haushofer, J. and J. Shapiro (2018), “The Long-Term Impact of Unconditional Cash Transfers: Experimental Evidence from Kenya”, working paper.

Kondylis, F. and J. Loeser (2021), “Intervention size and persistence”, World Bank Policy Research Working Paper No. 9769.