New measures of export and import exposure at the individual level show that international trade increases earnings inequality in Ecuador

Understanding how international trade affects income inequality within a country has long been of great interest to researchers and policymakers alike. While trade has great potential to increase prosperity, its effects on the distribution of income have ignited intense debates, because trade liberalisation – similarly to technological change – can create both winners and losers (for recent surveys of the literature on trade and inequality see e.g. Muendler 2017, Pavcnik 2017, Helpman 2018, and Hummels et al. 2018).

Without the ability to observe a given economy with and without access to global markets, efforts to understand how trade affects inequality inherently draw on a combination of theory and empirics. In our research (Adão et al. 2022), we shed new light on this topic by making contributions on both of these dimensions.

On the theoretical dimension, we build on earlier work (Deardorff and Staiger 1988) that emphasised how the impact of trade on inequality can be closely related to the amount of factor services that are implicitly embodied in a nation’s exports and imports – the so-called factor content of trade approach. Individuals can be affected by changes in trade openness because such changes may impact the demand for the labour or capital services that they provide, thereby boosting or diminishing the market value of their labour or capital. Our research develops new measures of individual-level exposure to exports and imports that capture the extent to which trade shifts the relative demand for factors. Export exposure occurs because foreign consumers and firms demand different products than domestic ones, which in turn changes the demand for domestic individuals’ labour or capital supply. Import exposure occurs because, when imports are available, domestic consumers and firms change the products that they buy domestically, which in turn also has an impact on the demand for domestic individuals’ labour or capital supply. Both of these channels can therefore affect people’s earnings, and how they affect earnings can differ across the income distribution.

We then go on to establish how such exposure measures can be used to quantify the overall incidence of international trade on earnings inequality, through both export and import channels. As a thought experiment, we ask the question: if a country’s exports and imports were to suddenly drop to zero, how would this affect its income distribution?

On the empirical dimension, access to individual-level administrative data linking workers and owners to firms, combined with similar data linking firms to other firms, allows researchers to operationalise our new measures of exposure. Individuals may not only be affected if their firm sells or buys directly in international markets, but also if they are only connected to trade through the supply chain, e.g., by selling to a firm which in turn sells to an exporter. Newly available data sources allow researchers to analyse all of these connections and thereby relax parametric restrictions on preferences and technology that are common in this literature.

Evidence from Ecuador

As an application of these new methods, we turn to granular administrative data from Ecuador – accessed in anonymised form through a research collaboration with the Ecuadorian Tax Authority. We combine firm-to-firm transaction data derived from the value-added tax (VAT), employer-employee-matched salary information from social security records, information on firm owners from firm registries, and firm-level import and export transaction records from customs. Through these linkages, we can analyse how trade shocks propagate from importing and exporting firms to other entities within the economy: from firm-to-firm across the firm network using the VAT data, from firms to employees through employment and salary information from social security data, and finally, from firms to their owners. The combined dataset covers the period of 2009-2015 and contains data on an average of 2.9 million individuals annually, engaged in 1.5 million firms. While such tax-based records, by their very nature, provide a window on the formal economy only, we supplement our analysis with survey-based sources that track a representative sample of informally-engaged workers and entrepreneurs as well.

Effects of trade across income percentiles

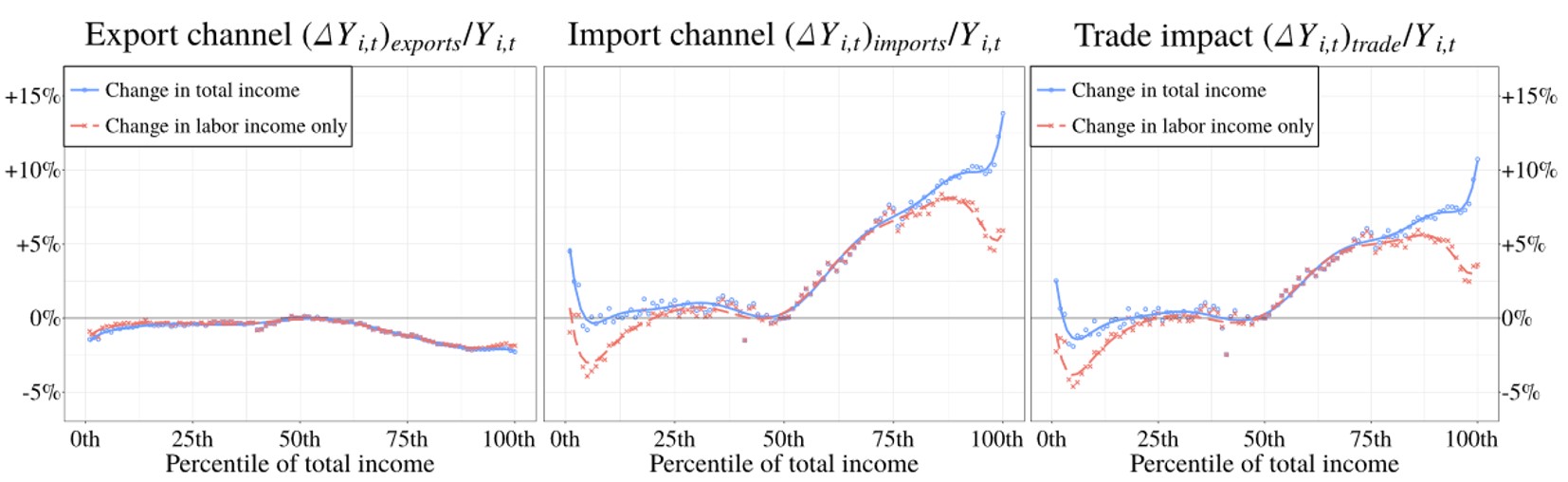

Our analysis for the case of Ecuador reveals that the import and export channels affect the earnings distribution in different ways. Figure 1 below shows them separately (first two panels) and jointly (right-hand panel).

Figure 1: Trade and earnings inequality

Notes: Blue circles report the total (including both labour and capital) estimated income change for each individual, averaged within each percentile and normalised to zero at the median percentile. It shows the difference between 2012 and a hypothetical equilibrium with no international trade. Positive numbers, therefore, reflect larger gains from trade than for individuals at the median. Red crosses do the same but for labour income only. Lines indicate fitted 10th-order polynomials. Trade impact is the sum of the export and import channels. All changes are expressed as percentages.

The export channel leads to a reduction in income inequality, with gains from trade being somewhat smaller for those in the higher income deciles than below the median. The import channel, on the other hand, leads to much larger gains for those with higher incomes. For labour income, the gains are highest around the 85th percentile. Including capital income as well, the gains continue increasing monotonically beyond that, all the way to the very top of the distribution. Combining both the import and export channels, we see that the import channel dominates, leading to the finding that international trade creates an overall increase in earnings inequality in this context. Quantitatively, this phenomenon is modest for below-median incomes, but much larger for comparisons between median and top incomes (such as the 1% highest earners), and with top-income effects being shaped by capital earnings particularly strongly.

Stepping back, it is important to emphasise that this analysis focuses on the distribution of income – that is, on relative earnings – and does not speak to impacts on absolute levels. Therefore, while our findings show higher income inequality as a result of trade liberalisation, this does not imply that it causes higher levels of poverty.

Beyond Ecuador

Given the similarity between the pattern of trade of Ecuador and those of many developing countries which also export commodities in exchange for manufacturing goods, we expect similar biases of export and import exposures to hold more generally. With the growing availability of administrative data sets such as ours – in countries such as Belgium, Brazil, Chile, Costa Rica, the Dominican Republic, and Turkey – efforts to combine VAT data with matched employer-employee records provide increasingly rich opportunities to explore further which individuals are exposed to international trade around the world, through both direct and indirect forms of both exports or imports.

References

Adao, R, P Carrillo, A Costinot, D Donaldson, and D Pomeranz (2022), “Imports, exports, and earnings inequality: Measures of exposure and estimates of incidence.” The Quarterly Journal of Economics, 137(3): 1553-1614.

Deardorff, A V and R W Staiger (1988), "An interpretation of the factor content of trade." Journal of International Economics 24(1-2): 93-107.

Helpman, E (2018), Globalization and inequality. Harvard University Press.

Hummels, D, J R Munch, and C Xiang (2018), “Offshoring and labor markets.” Journal of Economic Literature, 56(3): 981-1028.

Muendler, M A (2017), “Trade, technology, and prosperity: An account of evidence from a labor-market perspective.” WTO Staff Working Paper No. ERSD-2017-15.

Pavcnik, N (2017), “The Impact of Trade on Inequality in Developing Countries,” in The Jackson Hole Economic Policy Symposium Proceedings: Fostering A Dynamic Global Economy, Federal Reserve Bank of Kansas City.