As countries become greater economic friends in terms of the welfare effects of their productivity growth, they become greater political friends in terms of United Nations voting and strategic rivalries.

One of the most dramatic changes in the world economy over the past half century has been China’s emergence as a major force in world trade. A central question in international economics is the implications of such economic growth for the income and welfare of its trade partners. A related question in political economy is the extent to which these large-scale changes in relative economic size involve concomitant heightened political tension and realignments in the international balance of power.1 In Kleinman et al. (2020), we provide new theory and evidence on both of these questions by developing bilateral ‘friends’ and ‘enemies’ measures of countries’ income and welfare exposure to foreign productivity shocks, which can be computed using only observable trade data. We show that these measures are exact for small productivity shocks in the leading class of international trade models characterised by a constant trade elasticity, and almost exact for productivity shocks of the size typically observed in the data. Our approach admits a large number of extensions and generalisations, including multiple sectors, input-output linkages, and economic geography (factor mobility).

Key contributions and economic mechanisms

Our research contributes to the recent revolution in international trade – the development of quantitative trade models following Eaton and Kortum (2002) and Arkolakis et al. (2012). An important advantage of these quantitative models is that they are rich enough to capture first-order features of the data, such as a gravity equation for bilateral trade, and yet remain sufficiently tractable so as to be amenable to counterfactual analysis with a small number of structural parameters. A major challenge is that these models are highly non-linear, which can make it difficult to understand the economic explanations for quantitative findings for particular countries or industries. A key contribution of our bilateral ‘friends and enemies’ measures is that it allows researchers to connect quantitative results to the central underlying economic mechanisms in the model. These include the cross-substitution effect, where an increase in the competitiveness of a foreign country leads consumers in all markets to substitute away from all other nations; a market-size effect, where an increase in income in foreign markets raises demand for all nations’ goods; and a cost-of-living effect, where an increase in the competitiveness of a country’s goods reduces the cost of living in all countries. Therefore, our methods are well-suited to applications where a large number of counterfactuals are required and facilitate comparisons of these counterfactuals across alternative quantitative frameworks, such as our single-sector, multi-sector, and input-output models.

On average, productivity growth has a positive effect on other countries’ welfare

Our main empirical contribution is to use our ‘friends and enemies’ exposure measures to examine the global incidence of productivity growth in each country on income and welfare in over 140 countries across more than forty years between 1970 and 2012. We find a substantial increase in both the mean and dispersion of welfare exposure to foreign productivity shocks over our sample period, consistent with increasing globalisation enhancing countries’ economic dependence on one another. We find that productivity growth in most countries raises their own income and reduces the income of most (but not all) other countries, compared to world GDP. Even when compared to a weighted average of OECD countries, we find that Chinese productivity growth has an increasingly large negative effect on US relative income. Nevertheless, once changes in the cost of living are taken into account, this Chinese productivity growth has an increasingly large positive effect on aggregate US welfare.

Bilateral patterns of welfare exposure to foreign productivity growth

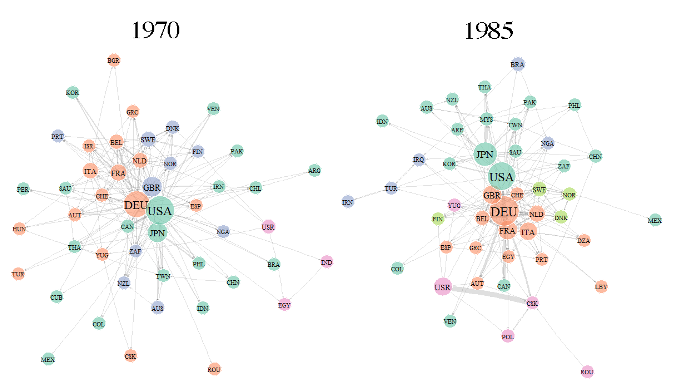

More generally, we find large-scale changes in bilateral patterns of welfare exposure to foreign productivity growth over time. We illustrate these changes in Figure 1 using a network graph, with the nodes being countries and the edges capturing bilateral welfare exposure. For legibility, we display the 50 largest countries in terms of GDP and the 200 edges with the largest absolute values of bilateral welfare exposure. The size of each node captures the importance of each country as a source of productivity shocks (i.e. as a source of welfare exposure for other countries); the arrow for each edge shows the direction of bilateral welfare exposure (from the source of the productivity shock to the exposed country); and the thickness of each edge shows the absolute magnitude of the bilateral welfare exposure. Countries are grouped to maximise modularity, i.e. the amount of within-cluster exposure relative to cross-cluster exposure.

At the beginning of our sample period in 1970, the global network of welfare exposure is dominated by the US, Germany, and other Western industrialised countries (top-left panel). Moving forward to 1985, we see the emergence of Japan and a cluster of newly industrialised countries (NICs) in Asia, and we observe Western Europe increasingly emerging as a separate cluster of interdependent nations. By the time we reach 2000, the separate clusters of countries in Asia and Western Europe become even more apparent, with China beginning to displace Japan at the centre of the Asian cluster. By the end of our sample period in 2012, China replaces the US at the centre of the global network of welfare exposure, with the US more tightly connected to China and other Asian countries than to the Western European cluster.

Figure 1 The bilateral network of welfare exposure for the 50 largest countries by GDP, 1970-2012

Sectoral comparative advantage and production networks

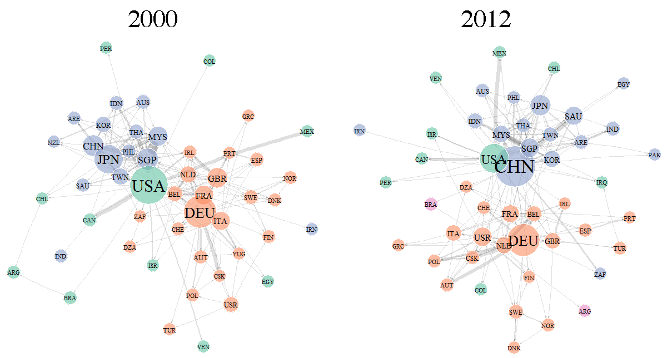

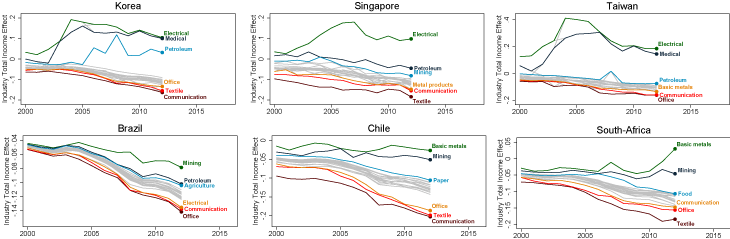

We compare our ‘friends and enemies’ exposure measures in our baseline model with a single sector to those in models with multiple sectors and input-output linkages. Although there is a strong correlation between the predictions of all three models, we find that introducing both sectoral comparative advantage and production networks has quantitatively relevant effects on bilateral income and welfare exposure for individual pairs of exporters and importers. Additionally, both the multiple-sector and input-output models yield additional disaggregated sector-level predictions, in which even foreign productivity growth that is common across sectors can have heterogeneous effects across individual industries in trading partners, depending on the extent to which countries compete with one another in sectoral output markets vis-à-vis sourcing intermediate inputs from one another. Comparing these sector-level predictions for the impact of Chinese productivity growth, we find some marked differences across countries. For nearby South-East Asian countries, the sectors that benefit most include the electrical, medical, and office sectors, consistent with input-output linkages between related sectors through global value chains in Factory Asia (see the top panels of Figure 2). However, for the resource-rich emerging economies, the sectors that benefit most include the mining, agricultural, and basic metals sectors, consistent with a form of ‘Dutch disease’ in which the growth of resource-intensive sectors propelled by Chinese demand competes away factors of production from less resource-intensive sectors (see the bottom panels of Figure 2).

Figure 2 Industry sales exposure to Chinese productivity growth

Shared economic interests predict political alignment

We use our ‘friends and enemies’ exposure measures to provide new evidence on a political economy debate about the extent to which increased economic rivalry between nations necessarily involves heightened political tension. A number of scholars have drawn parallels between the current China-US tensions and earlier historical episodes, such as the confrontation between Germany and Great Britain around the turn of the 20th century, and the rise of Athens that instilled fear in Sparta that itself made war more likely (the ‘Thucydides Trap’). On the one hand, there are good reasons to be sceptical about this essentially mercantilist view of the world, because a key insight from trade theory is that trade between countries is not zero-sum. On the other hand, it remains possible that the extent to which countries have shared economic interests is predictive of their political alignment. Consistent with this view, we find that as countries become less economically friendly in terms of the welfare effects on one another of their respective productivity growths, they also become less politically aligned in terms of their foreign policy stances, as measured by United Nations voting patterns and strategic rivalries.

References

Arkolakis, C, A Costinot and A Rodriguez-Clare (2012), “New Trade Models, Same Old Gains”, American Economic Review 102: 94-130.

Brunnermeier, M, R Doshi and H James (2018), “Beijing’s Bismarckian Ghosts: How Great Powers Compete Economically”, The Washington Quarterly 41: 161-176.

Eaton, J and S Kortum (2002), “Technology, Geography, and Trade”, Econometrica 70: 1741-1779.

Liu, E, B Kleinman and S Redding (2020), “International Friends and Enemies,” NBER Discussion Paper, 27587.

Endnotes

1 See for example Brunnermeier et al. (2018) and “China-US rivalry and threats to globalisation recall ominous past”, Martin Wolf, Financial Times, 26 May 2020.