Encouraging the poor to set higher savings aspirations may backfire if they fall short of these goals, leading to less economic investment

Recent literature has suggested the possibility for poor individuals to be stuck in a behavioural poverty trap, whereby poverty results in reduced aspirations. This in turn limits the actions and investments the poor take and reinforces their poverty (Ray 1998, Appadurai 2004, Ray 2006, Duflo 2012, Dalton et al. 2016). The theory then suggests that inducing the poor to set higher aspirations may be the key to helping them break out of poverty. This ’mindset’ approach is an alternative to traditional financial literacy approaches that focus on teaching budgeting and saving knowledge, and has been the focus of bestselling financial self-help books such as Secrets of the Millionaire Mind (Eker 2005) and Rich Dad, Poor Dad (Kiyosaki 2017). However, Genicot and Ray (2020) note the potential for encouraging higher aspirations to backfire if aspirations are set too high – leading frustrated individuals who fail to reach their goals to reduce economic investments.

Testing this idea in the Philippines

In our study (McKenzie, Mohpal and Yang 2021), we investigate whether the theory of aspiration poverty traps and approach of financial self-help books can help poor entrepreneurs in their financial decision-making. We collaborated with the Peoples’ Alternative Livelihood Foundation of Sorsogon, Inc. (PALFSI), a microfinance institution in the Philippines that offers savings accounts and group-based microfinance loans to a client base of mostly female subsistence entrepreneurs. Typical businesses are raising livestock; small retail businesses selling items such as baked goods, fish, or sodas; tricycle and boat rentals; hair dressing; and reselling scrap metal.

We worked with a sample of over 2,400 of their clients in 190 microfinance groups. These groups were randomly assigned to business as usual (our control group), a financial aspirations treatment, and/or a financial knowledge treatment.

The financial aspirations treatment took place over eight weekly sessions. This training encouraged participants to set ambitious life goals, and telling them that if dreams are too small, one will only see barriers, but a big dream will overcome barriers. They then chose savings targets associated with these goals, and talked about how to identify obstacles to savings and the steps needed to overcome these obstacles and reach their dreams.

We cross-randomised a financial knowledge treatment that provides a much more standard financial education approach that is more typically used in microfinance. This used the eight weekly sessions to teach financial concepts such as assets, liabilities, net worth, and interest rates, and tools such as how to budget.

Since these training sessions took place during regular PALFSI group meetings, take-up of the training was high for both treatments. The median clients attended seven out of the eight assigned sessions.

Results

We measure impacts of the aspirations and knowledge treatments with a survey two years later, alongside administrative microfinance institution data.

The aspirations treatment increased savings goals. The mean saving goal in the control group was about $700, relative to a baseline savings level of $197. This goal was equivalent to 24% of annual income for these entrepreneurs. The aspirations treatment increased this savings goal as a share of annual income by 9.7 percentage points, a 40% increase compared to the control mean. This increase in savings goal was particularly strong for saving for education, where those in the aspirations treatment set a goal that was almost 50% higher than that of the control group. In contrast, the financial knowledge treatment did not have large or statistically significant impacts on savings goals.

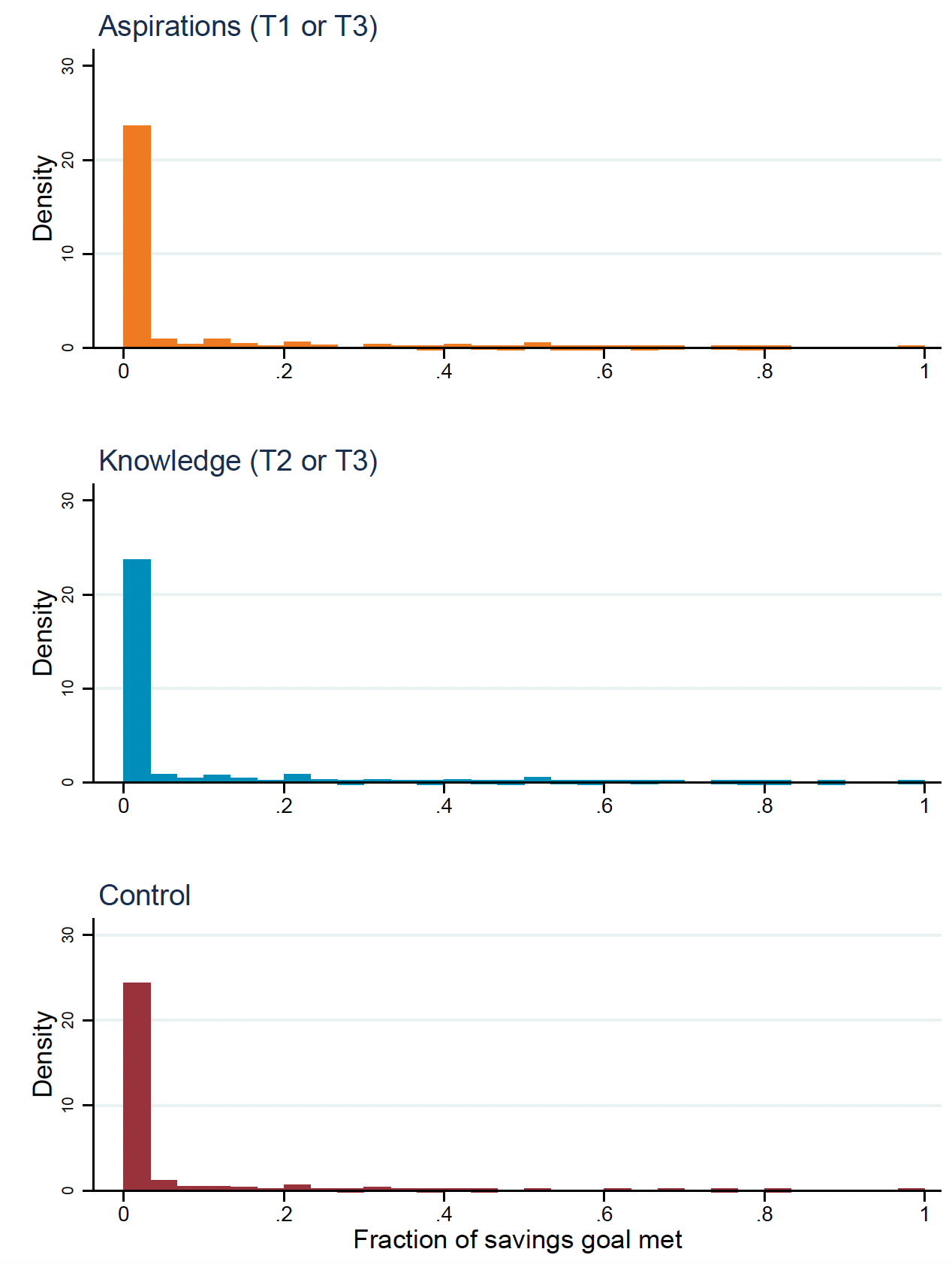

However, individuals only achieved small fractions of their savings goals, and savings did not increase. Figure 1 shows histograms of the share of the savings goal met by treatment, with these clients on average having only met 5% of their savings goal two years after the interventions. Using administrative data, we can show that this does not come from them saving a lot and then withdrawing these savings. Instead, there is no significant impact of either treatment on the amount saved.

Figure 1 Distribution of savings goals met, by treatment

Notes: The figure plots histograms of fraction of savings goal met (savings divided by savings goal), among individuals with non-zero savings goals, by treatment group (where T1 – financial aspirations treatment, T2 – financial knowledge treatment, and T3 - both). Data are from endline survey.

Instead, the aspirations treatment leads to less borrowing and a reduction in business investment. Using both survey and administrative measures of borrowing, we find that individuals in the aspirations treatment take fewer loans from PALFSI, and have 15% less debt. This reduction in debt comes with a 37% reduction in business investment. This is consistent with the theoretical possibility suggested by Genicot and Ray (2000) that if aspirations are set too high, they may lead to frustration and reduced economic investments.

Examining plausible mechanisms

Using administrative data, we show these measured impacts in the survey are not from treated individuals meeting their goals quickly and then no longer needing to save or borrow. While the training emphasised that a key way to boost savings was through reducing unnecessary expenditures, an examination of household spending patterns found that clients are spending almost all they earn. They do not cut back on temptation good spending, despite saying that they regret some of the spending they do, highlighting that consumption habits can be sticky and hard to break.

Instead, we find evidence for an additional reason why individuals may have reduced their economic investments: the aspirations treatment reduced their internal locus of control. Locus of control measures how strongly people believe they have control over situations and experiences that affect their lives (Rotter 1954). By setting ambitious goals that they fell far from meeting, the aspirations treatment may have inadvertently led people to believe they have less control over their situation than they initially thought.

Implications for policy and future research

Our results suggest reasons to be cautious about attempts to spur the poor to break out of poverty through setting higher aspirations. Our results show that such an approach may even backfire if these aspirations are set so high as to be unachievable. Moreover, there is a risk that focusing on low aspirations may not address other causes of low incomes. This relates to critics of traditional financial education programmes (e.g. Ogden 2019) who argue that the main reasons for low savings are not lack of financial knowledge and budgeting acumen, but rather the more structural issues of low and uncertain income and high living costs.

Nevertheless, this is just one study. Given the emerging literature on the role of aspirations for economic behaviour (Genicot and Ray 2020), future research should also investigate whether encouraging individuals to set more modest, but attainable, aspirations may be more effective and reduce the risk of frustration and discouragement.

References

Appadurai A (2004), “The Capacity to Aspire: Culture and The Terms of Recognition”, In V. Rao & M. Walton (Eds.), Culture and Public Action (pp. 59-84). Stanford University Press.

Dalton P, S Ghosal, & A Mani (2016), “Poverty and Aspirations Failure”, The Economic Journal, 126(590), 165-188.

Duflo E (2012), “Human values and the design of the fight against poverty”, Tanner Lectures.

Eker T H (2005), Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth. Harper Business.

Genicot G & D Ray (2020), “Aspirations and Economic Behavior”, Annual Review of Economics, 12, 715-746.

Kiyosaki R T (2017), Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!, Plata Publishing.

McKenzie D, A Mohpal and D Yang (2021), “Aspirations and financial decisions: Experimental evidence from the Philippines”, BREAD Working Paper no. 596.

Ogden T (2019), “More states are forcing students to study personal finance. It’s a waste of time”, Washington Post, 23 April.

Ray D (1998), Development Economics. Princeton University Press: Princeton, NJ.

Ray D (2006), "Aspirations, Poverty, and Economic Change", in A Banerjee, R Benabou and D Mookherjee (eds), What Have We Learned About Poverty?, Oxford University Press

Rotter, J B (1954), Social Learning and Clinical Psychology. Prentice-Hall.