Dairy farmers have high demand for infrequent payments, which help save. Poor enforcement, however, limits competition in the supply of these payments.

The poor face numerous barriers to saving (Karlan et al. 2015). Some have no access to banks, others are worried of robberies or accidental loss, still others are convinced to spend by their family and friends. Many have self-control problems. To overcome these barriers, the poor often devise apparently inefficient arrangements, like paying deposit collectors or saving in livestock (Rutherford 2000, Collins et al. 2009).

By combining many small payments in one lump sum, infrequent (e.g. monthly) payments from buyers or employers may naturally provide commitment to save for lumpy expenses. Are farmers willing to incur costs to receive infrequent payments? If so, to what extent does the demand for infrequent payments arise from an underlying demand for commitment? And will the market provide these valuable infrequent payments competitively? We explore these questions in a recent working paper (Casaburi and Macchiavello 2018).

Demand for infrequent payments among Kenyan dairy farmers

Our study takes place in Central Kenya. Dairy farmers, who typically own two or three cows, produce and sell milk on a daily basis. They need cash for daily consumption, but they also need to set aside money for lumpy expenses, like cow feed or school fees. If farmers face obstacles to save, they may prefer to receive large amounts of money less frequently rather than smaller amounts on a daily basis. We test these hypothesis with two experiments in which, in private sessions, a large milk buyer offers farmers the choice between different frequencies of payments.

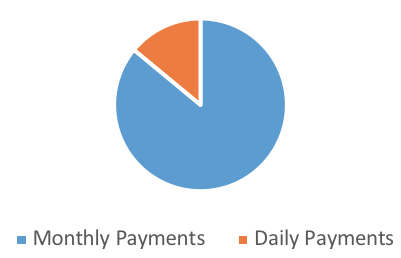

In the first experiment, farmers can choose to be paid monthly or to be paid daily at a 15% higher price per litre. We find that 86% of the farmers choose to receive end-of-month payments, rather than daily payments. In other words, a majority of farmers are willing to incur a negative interest rate on the (delayed) infrequent payments. When asked for the reason of their choice, more than 70% of the farmers mention the need to reach saving goals or the fact that they do not trust themselves handling the money during the month.

Figure 1 Farmers’ demand for monthly payments

Infrequent payments as a commitment device

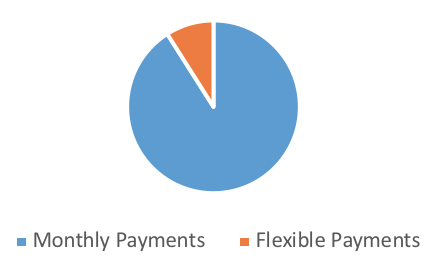

Self-control problems, different transaction costs, safety concerns, or pressure from family/peers may all contribute to a preference for monthly payments. A second experiment isolates demand for commitment. Farmers can privately choose between two options concerning payments for deliveries in the subsequent month:

- a ‘flexibility’ option that, each day, allows them to choose whether to be paid that day or at the end of the month for milk delivered that day; or

- monthly payments.

In this experiment, 91% of farmers turn down the flexibility option and commit to monthly payments at the beginning of the month.

Figure 2 Farmers’ demand for commitment

This preference for commitment over flexibility suggests that self-control concerns are a primary driver of the demand for monthly payments. If transaction costs were the main obstacle, farmers would choose the flexibility to get daily payments whenever they may need them. If pressure from family was the main concern, farmers could always (privately) pick the flexibility option and use it to deal with any emergency that may come up as the month unfolds. However, if self-control concerns are key, farmers would prefer to ‘tie their hands’ against any spending temptation that may arise.

While self-control problems are ubiquitous, there is only limited evidence that people are willing to incur sizable costs for commitment (Laibson 2015, Schilbach 2017). Our results provide one such example. Infrequent payments for frequently supplied goods and services are widespread in many markets. In our setting, farmers have high demand for monthly payments even if they have access to other saving tools (like banks and saving groups). Monthly payments may better provide commitment than these other institutions since:

- payment withholding implies farmers do not access the money till the end of the month; and

- the milk buyer can put pressure on the farmers to ensure deliveries, thus helping them stick to their saving plan.

Buyers’ supply of infrequent payments under poor contract enforcement

Farmers have a large demand for infrequent payments. What about the supply of infrequent payments? The amount of competition on this margin determines the implicit price farmers pay for this commitment tool and, in turn, their welfare. In the study setting, farmers sell milk daily to a large buyer (a cooperative, our partner in the previous experiments) or to small itinerant traders. A puzzling aspect of our context is that, despite the existence of many buyers competing to buy milk, only the large buyer pays monthly. Why don’t small traders offer infrequent payments as well? Monthly payments require the farmer to trust that the buyer will pay the due amount at the end of the month. Small traders may not be credible: they move from village to village and do not have fixed premises or a ‘brand’. Could lack of credibility of the small players explain why only the large buyer offers infrequent payments?

An additional experiment tests this hypothesis. We pair farmers and small traders from the same village. Farmers can choose whether to sell milk to these small traders for end-of-month or daily payments. The experimenter then purchases the milk from the traders. In a random subset of transactions, the experimenter guarantees the end-of-month payment by deducting the amount owed to the farmer from the trader payment and paying it to the farmer at the end of the month. In other transactions, at the end of the month, traders decide whether to pay the farmers or to default (the daily payments are always guaranteed).

When we exogenously make monthly payments credible by guaranteeing them, farmers’ willingness to sell to small traders for monthly payments (vs. daily payments) raises from 14% to 90%. Therefore, farmers are not willing to sell to small traders for monthly payments when, as is the case in the real world, such payments are not guaranteed. As a result, there is limited competition among buyers in the provision of infrequent payments to farmers. In additional experimental designs, we show that:

- farmers are primarily concerned about the traders willingly defaulting on payments, as opposed to the trader lacking the ability to hold money until the end of the month; and

- at prevailing market prices, traders would indeed like to pay farmers at the end of the month.

Figure 3 Percentage of farmers choosing to sell for monthly payments

Policy implications and further questions

Our research sheds light on producers’ demand for, and buyers’ supply of, infrequent payments. Several policy implications follow from our results.

- The strong demand for infrequent payments suggests that these are a natural form of saving commitment. Promoting infrequent payments in domains such as labour contracts, cash transfers, and agricultural value chains may be an effective way to foster investment. More work is needed to understand how to optimally structure payments to both help fund lumpy expenses and ensure consumption smoothing for daily consumption, which may require higher frequency payments.

- Improving contract enforcement may increase competition among buyers in the supply of infrequent payments. Credibility problems are less relevant if producers can enforce contracts through courts or other institutions. Through this logic, better enforcement may have an impact similar to improving the terms of saving products (i.e. increasing interest rates).

- In a broader historical perspective, the establishment of the factory system led to a shift toward (semi-)monthly payments (Engerman and Goldin 1991). Kaur et al. (2010), building on Clark (1994), showed that the monitoring associated with the factory system helps workers deal with self-control in effort provision. We suggest that the ability of larger, more credible employers to offer regular monthly payments may also help address self-control issues in spending habits.

References

Casaburi, L and R Macchiavello (2018), “Firm and market response to saving constraints: Evidence from the Kenyan dairy industry”, Working paper.

Clark, G (1994), “Factory discipline”, The Journal of Economic History, 54(1): 128-163.

Collins, D, J Morduch, S Rutherford, and O Ruthven (2009), Portfolios of the poor: How the world's poor live on $2 a day, Princeton University Press.

Engerman, S and C Goldin (1991), “Seasonality in nineteenth century labor markets”, NBER Working Papers Series on Historical Factors in Long Run Growth.

Kaur, S, M Kremer and S Mullainathan (2010), “Self-control and the development of work arrangements”, American Economic Review 100(2): 624-28.

Laibson, D (2015), “Why don't present-biased agents make commitments?”, American Economic Review 105(5): 267-72.

Rutherford, S (2000), The poor and their money, New Delhi: Oxford University Press.

Schilbach, F (2017), “Alcohol and self-control: A field experiment in India”, Unpublished manuscript.