Warrantage is an innovative model of rural finance which improves access to credit and crop storage. In Burkina Faso, warrantage increased farmers’ sales revenues, which they spent on education, health, livestock, and future farm capital.

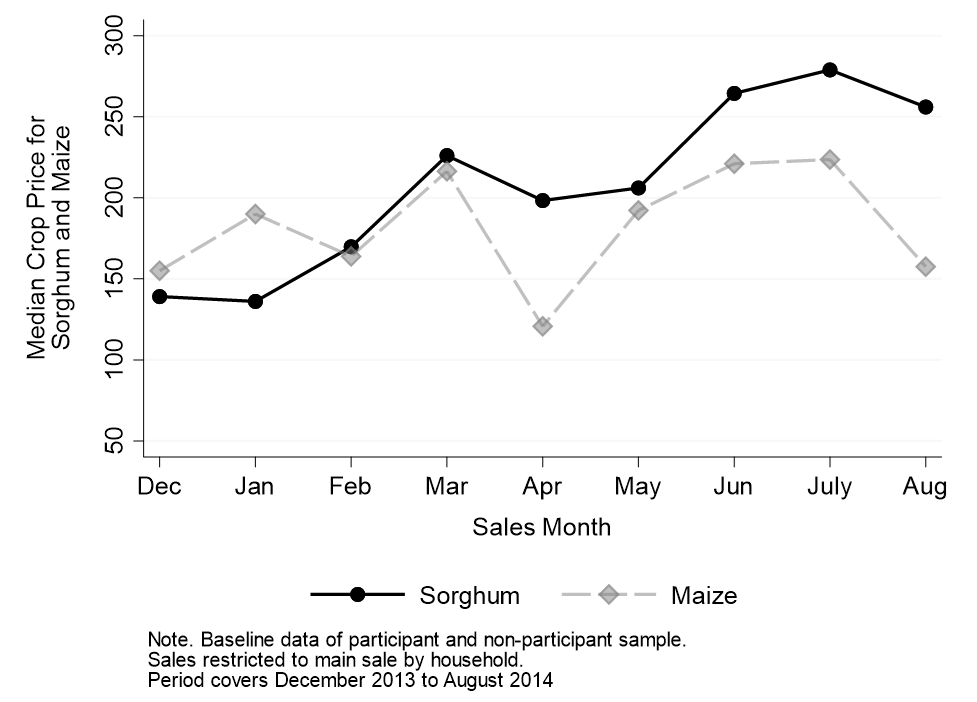

Large seasonal price fluctuations impact many grain markets in developing countries (e.g. Kaminski et al. 2016), and have been documented in Burkina Faso, the context of our research (e.g. Moctar et al. 2015 and Figure 1). This price volatility results in untapped arbitrage opportunities. Researchers have identified several market failures contributing to crop price volatility including credit market imperfections (e.g. Fink et al. 2020), inadequate storage (e.g. Aggarwal et al. 2018), and behavioural constraints that reduce saving and drive sub-optimal investment decisions. Other research has suggest that farmers’ behaviour (selling immediately at harvest) can be rationalised due to risk aversion coupled with the possibility that prices might not rise in the short term following harvest (Cardell and Michelson 2022). Understanding how different forms of rural financing might help farmers address this set of constraints is therefore an important question with large implications for welfare.

Figure 1: Price volatility in study site [Reproduced from Delavallade and Godlonton, 2023]

Warrantage: A localised inventory credit scheme

We examine an innovative model of rural finance, warrantage, as implemented by Cooperative de Prestation de Services Agricoles Coobsa (COPSA-C) in coordination with Coris Bank, with technical assistance provided by Comunità Impegno Servizio Volontariato (CISV).

Warrantage in this setting is a localised inventory credit system with two key elements: 1) access to credit; and 2) access to crop storage. Credit is offered to farmers by a local bank of up to 80% of the value of their crops stored at the time of storage and subject to an annual interest rate of 9.75%. The crops stored serve as collateral. Farmers can choose what crops to store and crops are stored for a fixed period of time, approximately four months. Farmers cannot access their crops in the intervening period. Crops are stored in a neighbouring village warehouse managed by a third-party farmers’ organisation (COPSA-C). COPSA-C also manages relationships with the bank issuing credit and monitors the warehouse storage.

Using excess capacity in COPSA-C managed warehouses, we randomly assigned access to warrantage among households in villages that previously did not have this option. Households given access to participate are referred to as treated households.

Storage take-up is high, credit take-up is moderate

In our setting, almost all treated households (94%) take up the opportunity to store at least one bag in the external warehouse and primarily choose to store sorghum and maize. Credit take-up is more moderate at 39%. This is similar to the average take-up rate across the six randomised evaluations of microfinance published in a special issue of the American Economic Journal: Applied Economics (Banerjee et al. 2015). However, it is lower than the take-up rate of other interventions focusing on farmers and storage (Fink et al. 2020, Burke et al. 2019), perhaps due to differences in prior exposure to credit and the timing of the offer.

Shifting storage from home storage to warehouses increases sales revenues

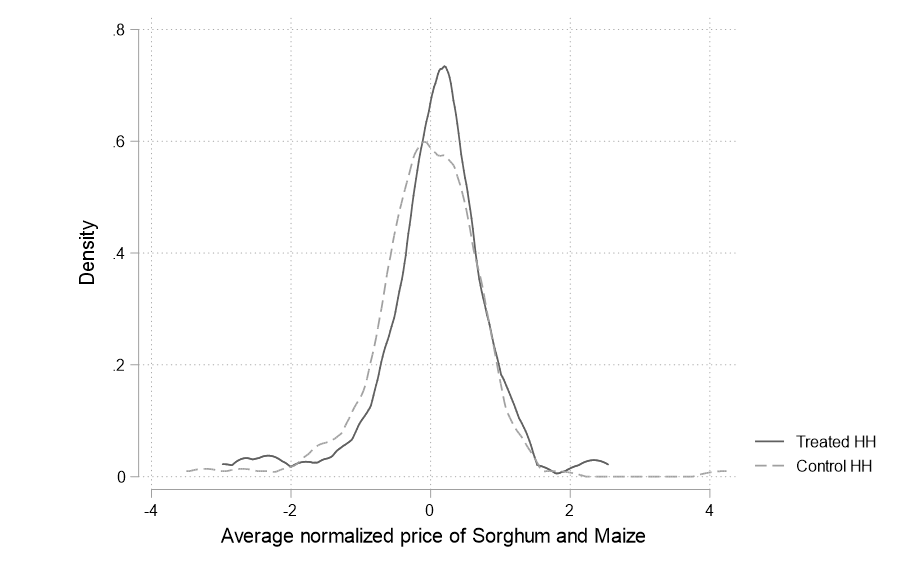

By shifting to selling more of their grain, and selling it later, households benefit from higher crop prices and sales revenues. Two mechanisms are at play. First, households shift away from crop storage in the home to external warehouse storage. The restricted access to crops held in the external warehouses ties farmers' hands, leading farmers to shift the timing of their sales decisions. Households delay the sale of some of their output until later in the season when prices are higher, as demonstrated by the shift in the distribution of prices of treated households compared to control households in Figure 2. Second, they also increase the total share of output that they sell. Ultimately, this translates into a sizeable increase in the Gross Value of Agricultural Output (GVAO) of approximately 9.3%.

Figure 2: Distribution of prices [Delavallade and Godlonton, 2023 Figure reproduction].

Additional revenue is invested in education, health, livestock, and future farm capital

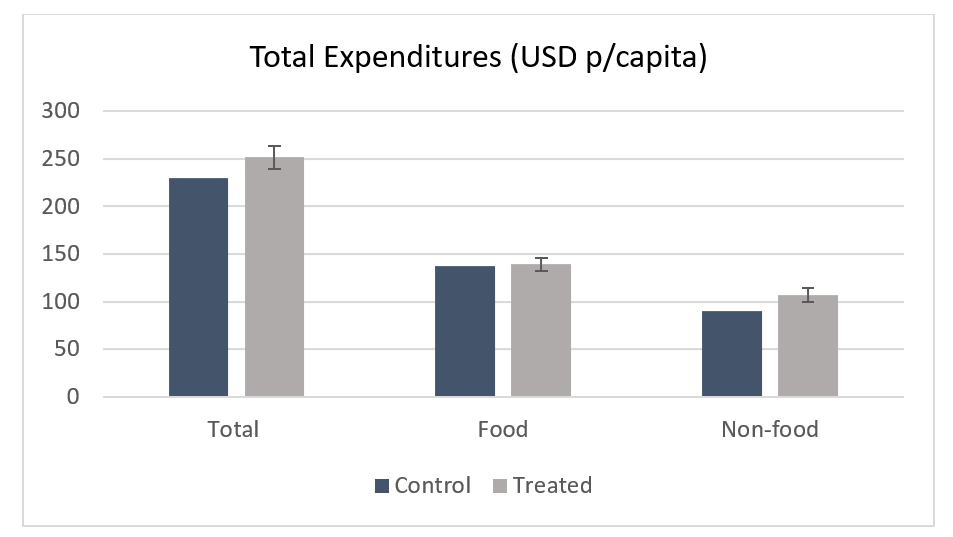

The sizeable increase in revenue from agricultural output begs the question of what households do with the additional income they have available. First, we are able to account for a 9.6% increase in expenditures, which almost exactly matches the proportional increase in GVAO. Second, we find no impact on food expenditures, which may be due to the endline survey being undertaken outside of the lean season. Third, we find an increase in non-food expenditures (see Figure 3.

Figure 3: Impact of warrantage on aggregate expenditures

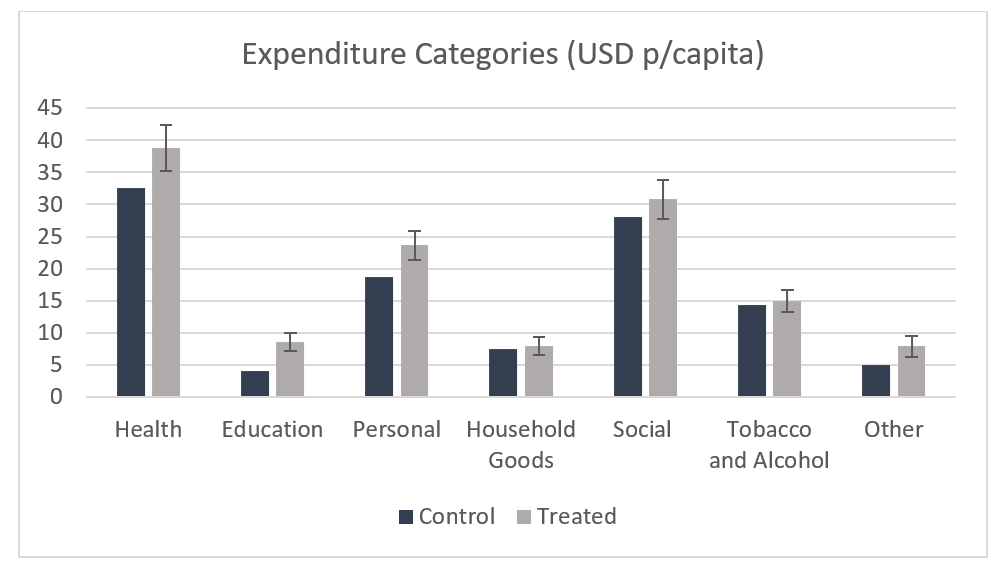

We further disaggregate non-food expenditures and find that households increase expenditures in human capital investments such as health and education.

Figure 4: Impact of warrantage on expenditure categories

Beyond human capital investments, treated households also invest in informal buffer stocks by increasing their livestock assets. Households also increase expenditures in future farm capital by increasing seed purchases.

Using exploratory analysis, we tease out how different types of households are impacted. The mechanisms driving these observed outcomes appear to be different for (likely) credit adopters versus (likely) storage-only adopters. Accessing credit for the (likely) credit adopters enables them to address an immediate financial constraint, increasing net storage in the short term and delaying crop sales. However, among (likely) storage-only adopters, the alternative storage location and restricted access to the crops appear valuable. Net storage among these households did not increase, and measured post-harvest losses are minimal. Thus, for the (likely) storage-only adopters, restricted storage is the mechanism through which these impacts are realised.

Are other village members harmed?

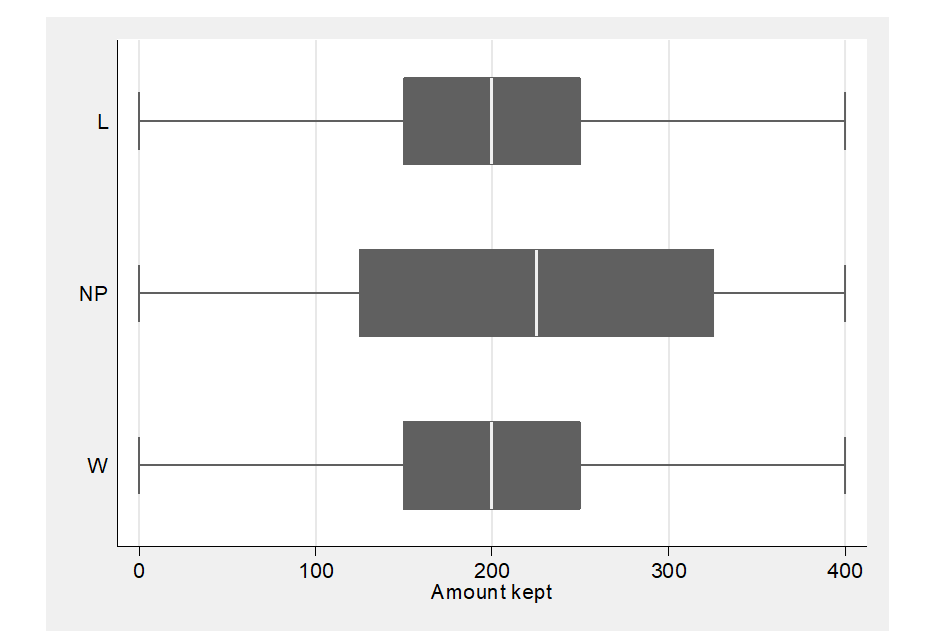

We find that access to warrantage does not meaningfully affect village-level relations or sharing norms within the community. We find little evidence of changes to the share of grains shared with other members of the community. Using a dictator game, we further find no evidence of differences in offers made across treated households (W), control households (L) and households that had no interest in participating in warrantage but were co-resident in the villages of the study.

Figure 5: Dictator game offers [Delavallade and Godlonton, 2023 Figure reproduction]

Given the observed successes, why has warrantage not been taken to scale?

The impressive results we observe in improving smallholder livelihoods in this context suggest there are untapped profitability and welfare gains from scaling warrantage of this type. Warrantage is not new to West Africa and a combination of factors may explain its slow expansion thus far. We find in our research that it is hard to predict, and therefore costly to identify, interested participants. While cost-effectiveness calculations in our context utilising existing infrastructure are favourable, the cost of building new storage infrastructure requires significant initial capital. Finally, comparing across studies, trust with the institutions involved, i.e. financial institutions and third-party storage management partners, is critical for take-up, and thus may require deliberate relationship building across time to enable scale.

References

Aggarwal, S, E Francis, and J Robinson (2018), "Grain Today, Gain Tomorrow: Evidence from a Storage Experiment with Savings Clubs in Kenya", Journal of Development Economics, 134: 1–15.

Banerjee, A V, D Karlan, and J Zinman (2015), "Six randomized evaluations of microcredit: introduction and further steps", American Economic Journal: Applied Economics, 7(1): 1–21.

Burke, M, L F Bergquist, and E Miguel (2019), "Sell Low and Buy High: Arbitrage and Local Price Effects in Kenyan Markets", Quarterly Journal of Economics, 134(2): 785–842.

Cardell, L, and H Michelson (2022), "Price risk and small farmer maize storage in Sub-Saharan Africa: New insights into a long-standing puzzle", American Journal of Agricultural Economics, 105(3): 737-759.

Delavallade, C and S Godlonton (2023), "Locking crops to unlock investment: Experimental evidence on warrantage in Burkina Faso." Journal of Development Economics, 160: 102959.

Fink, G, B K Jack, and F Masiye (2020), "Seasonal liquidity, rural labor markets and agricultural production", American Economic Review, 110(11): 3351–3392.

Kaminski, J, L Christiaensen, and C L Gilbert (2016), "Seasonality in Local Food Markets and Consumption: Evidence from Tanzania", Oxford Economic Papers, 68(3): 736–757.

Moctar, N, E Maitre d’Hôtel, and T Le Cotty (2015), "Maize Price Volatility: Does Market Remoteness Matter?", World Bank Policy Research Working Paper #7202.