Natural resource discoveries trigger FDI bonanzas and employment booms through a local FDI job multiplier, but also induce political instability

Foreign direct investment (FDI) is a crucial driver of economic development (Sutton 2018). It can bring jobs (McCaig et al. 2022), higher wages (Alfaro-Urenna et al. 2021), technology and knowledge spillovers (Abebe et al. 2022), and can create backward and forward linkages with local firms (Javorcik 2004). Economists have recently tried to identify the multiplier effect of jobs created by FDI, motivated by the idea that "every time a local economy generates a new job by attracting a new business, additional jobs might also be created" (Moretti 2010). For example, Mendola et al. (2022) showed that multinationals’ activity in Africa is correlated with 13% higher off-farm employment at the local level. Nonetheless, the identification of the causal effect of FDI jobs has proved challenging.

An FDI bonanza in Mozambique

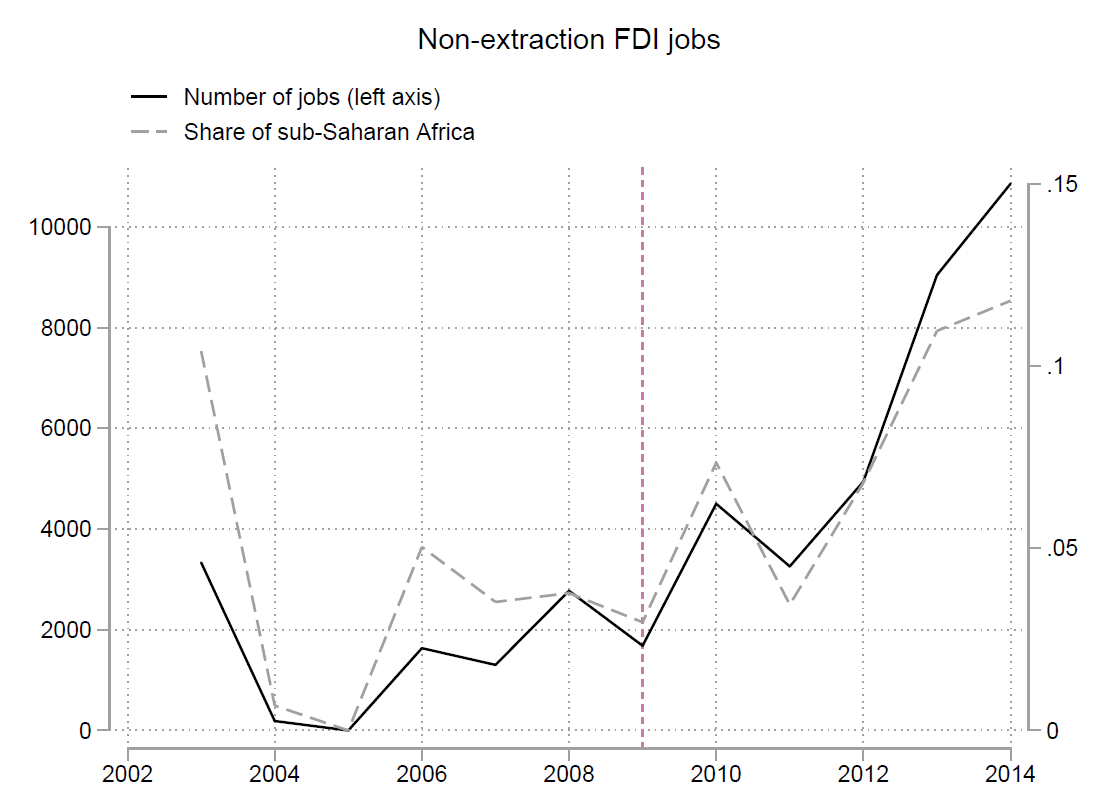

In a recent paper (Toews and Vézina 2022), we use an FDI bonanza in Mozambique to estimate the local job multiplier of new FDI projects. After news of a discovery of giant offshore reserves of natural gas in 2009, worth approximately 50 times annual GDP, Mozambique experienced a surge in FDI inflows. New FDI projects, excluding those in the resource-extraction sector, went from 10 projects in 2009 to 50 projects valued at around US$9 billion in 2014. At the same time, the average number of jobs created by such new projects increased from approximately 2,000 per year to more than 10,000 in 2014, at which time Mozambique accounted for 15% of all new FDI jobs in sub-Saharan Africa (Figure 1). Furthermore, the firms providing FDI were from a diverse set of countries, covered a broad range of industries, including manufacturing, infrastructure, and services, and often benefited areas of the country which previously did not receive any FDI.

Figure 1: Jobs directly created by new non-resource FDI projects

Source: fDiMarkets.

Mozambique’s post-discovery experience is not unique. Across developing countries, we find that FDI flows increase on average by 56%, and become more diversified, in the 2 years following a giant discovery - a discovery of over 500 million barrels of recoverable oil. These large inflows of FDI begin before the extraction of natural resources even begins, jumpstarting business cycles (Arezki et al. 2017). We thus focus on this discovery-driven FDI bonanza in Mozambique to identify the local multiplier effect of FDI.

The FDI multiplier

To estimate the local direct and indirect job-creation effect of this FDI shock, we use data on FDI employment at the firm-level from firm censuses in 2002 and 2014 (CEMPRE). This is then linked to household employment outcomes across districts, periods, and sectors using data from two waves of Household Budget Surveys. This allows us to estimate how many additional jobs are created locally by each new FDI job (focusing on non-resource FDI). For example, employees of the multinational might get high wages and increase the demand for local fruits and vegetables as well as for local restaurants. Moreover, backward and forward linkages with, for example, cleaning and delivery services or consultancies familiar with the local institutional environment, might further increase the demand for local goods and services.

Ultimately, we find the FDI job multiplier in Mozambique to be 5.4. For every job directly created in non-resource FDI, approximately four additional jobs are created, split evenly between the formal and informal sectors. It is worth noting that our estimates are larger on average than those found using US data. Setzler and Tintelnot (2021), using data across US commuting zones, estimate the local FDI multiplier to be 1.5. Similarly, Moretti (2010) suggests that for every job in the tradable sector of the US, 1.6 jobs are created in the non-tradable sector, adding up to a job multiplier of 2.6. Yet Moretti also estimates that the local job multiplier of new high-tech firm jobs to be as high as 4.9. Our estimate provides initial evidence that job multipliers may be larger in developing countries, which tend to have excess capacity coupled with the fact that the wages paid by multinationals tend to entail higher local spending capacity.

Our multiplier estimate suggests that the 25,000 jobs created directly by non-resource FDI projects between 2009 and 2014 translated into a total of 125,000 jobs, about 1.5% of Mozambique’s labour force. Thus, one could argue that large FDI inflows provided Mozambique with an opportunity to grow out of poverty.

The natural resource curse in action

However, an abundance of natural resources has been shown to be associated with the spread of corruption (Vicente 2010, Martinez 2022) and conflict (Berman et al. 2018); the well-known natural resource curse. Unfortunately, Mozambique has proved to be an exemplar case of the curse in action, with problems hitting the country several years before the extraction of natural gas even began.

The country experienced a debt crisis in 2016 when news came out of undisclosed and illegal loans worth an incredible 12% of GDP. This led to a default on international debt payments and severely curtailed foreign aid. A recent report (Cortez et al. 2021) documented that this scandal pushed almost two million into poverty. It also triggered a corruption trial in which Mozambique's former finance minister was found guilty of abuse of power and bribery. The ex-president's son is currently on trial. Additionally, the country has been hit by violent attacks and displacement in the north near the offshore gas fields since 2017, with more than 700,000 people displaced and over 3,000 killed. According to a recent report by the International Crisis Group (2023), most militants who joined the insurrection have been motivated by their “perceived socio-economic exclusion amid major mineral and hydrocarbon discoveries in the region”.

Ultimately, we may even say that Mozambique suffered a “Presource Curse” (Cust and Mihalyi 2017) with just the prospect of resource wealth unleashing malign political forces. This a major counter-balance to positive employment effects FDI inflows can bring.

Conclusion

We use an FDI bonanza in Mozambique, caused by a giant gas discovery as a natural experiment, to identify and estimate the local FDI job multiplier. We find that for each new FDI job in the non-resource sector, four extra jobs are created locally, two of which are in the formal sector. Natural resource discoveries may thus provide a window of opportunity for developing countries struggling to attract FDI and create jobs. At the same time, the case of Mozambique unfortunately shows that the well-documented malign political forces unleashed by natural resource discoveries are also alive and well.

References

Abebe, G, M McMillan and M Serafinelli (2022), “How domestic firms in poor countries learn from foreign firms: Evidence from Ethiopia”, VoxDev.

Alfaro Urena, A, I Manelici and J P Vasquez (2021), "The Effects of Multinationals on Workers: Evidence from Costa Rican Microdata", CEPS Working Papers 285.

Arezki, R, V A Ramey and L Sheng (2017), “News Shocks in Open Economies: Evidence from Giant Oil Discoveries", The Quarterly Journal of Economics 132(1): 103-155.

Berman, N, M Couttenier, D Rohner and M Thoenig (2018), “Countering the mining curse”, VoxDev.

Cortez, E, A Orre, B Fael, B Nhamirre, C Banze, I Mapisse, K Harnack, and T Reite (2021) "Costs and consequences of the hidden debt scandal of Mozambique." Centro de Integridade Publica. Available here.

Cust, J F and D Mihalyi (2017), “Evidence for a presource curse? oil discoveries, elevated expectations, and growth disappointments," Policy Research Working Paper Series 8140, The World Bank.

International Crisis Group (2023), Mozambique, Available here.

Javorcik, B S (2004), “Does Foreign Direct Investment Increase the Productivity of Domestic Firms? In Search of Spillovers Through Backward Linkages", American Economic Review 94: 605-627.

Martinez, L (2022), “Natural Resource Rents, Local Taxes, and Government Performance: Evidence from Colombia”, Available at http://dx.doi.org/10.2139/ssrn.3273001.

McCaig, B, N Pavcnik and W Foong Wong (2022), "FDI Inflows and Domestic Firms: Adjustments to New Export Opportunities," NBER Working Papers 30729.

Mendola, M , G Prarolo and T Sonno (2022), "Curse or Blessing? Multinational Corporations and Labor Supply in Africa," CEPR Discussion Papers 16964.

Moretti, E (2010), “Local Multipliers", American Economic Review 100: 373-377.

Setzler , B and F Tintelnot (2021), "The Effects of Foreign Multinationals on Workers and Firms in the United States", The Quarterly Journal of Economics 136(3): 1943-1991.

Sutton, J (2018), “Harnessing FDI in Africa”, VoxDev.

Toews , G and P L Vezina (2022), "Resource Discoveries, FDI Bonanzas, and Local Multipliers: Evidence from Mozambique", The Review of Economics and Statistics 104(5): 1046-1058.

Vicente, P C (2010), "Does oil corrupt? Evidence from a natural experiment in West Africa", Journal of Development Economics 92(1): 28-38.