E-commerce disproportionately benefits consumers in small and remote places, helping to reduce disparities in living standards across locations

Recent studies (Atkin and Donaldson 2015, Handbury and Weinstein 2014, Feenstra et al. 2017) document that consumers in small and remote places face higher prices and fewer varieties, which contribute to large differences in living standards across locations. Trade costs play an important role in shaping these spatial differences. First, because of the fixed costs associated with setting up a physical store and entering a market, small cities are less attractive to firms. This reduces the number of product varieties available in small cities. Second, firms incur higher transport costs when selling to remote cities, making prices higher in these markets. In developing countries, due to limited transportation infrastructure and underdeveloped retail sectors, consumption opportunities in small and remote cities are especially limited.

E-commerce dramatically reduces these trade costs and is particularly beneficial for consumers in small and remote places. There are two major differences between e-commerce and traditional retailing with regard to trade costs. First, e-commerce largely eliminates the need to set up bricks-and-mortar stores, allowing firms to reach consumers in cities that otherwise would not be served. Second, by lowering the cost for consumers to view various products from distant locations, e-commerce reduces the penalty of distance on trade volumes. Thus, while e-commerce benefits consumers everywhere, the benefit is likely to be particularly large for consumers in small and remote places.

E-commerce in China

In recent work, we use the empirical context of China to study the role of e-commerce in reducing spatial consumption inequality. China represents the world’s largest retail e-commerce market, with e-commerce in the country growing at an average annual rate of 35% in the past decade. In 2016, $851 billion was spent online in China, accounting for 15% of the country’s total retail sales, or 37% of worldwide retail e-commerce sales.1 On the other hand, China’s traditional retailing sector is relatively less developed. Modern retail stores are clustered in large cities, leaving much of the country underserved.

Taobao and Tmall, both subsidiaries of the Alibaba group, are two leading online shopping platforms in China. We have prefecture-level aggregate sales data from both platforms in 2014, which account for over 80% of China’s total retail e-commerce sales in that year.

Empirical evidence

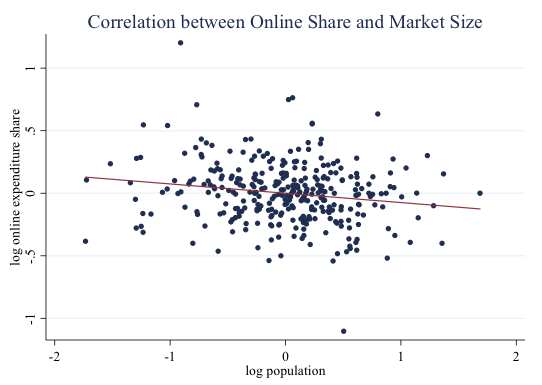

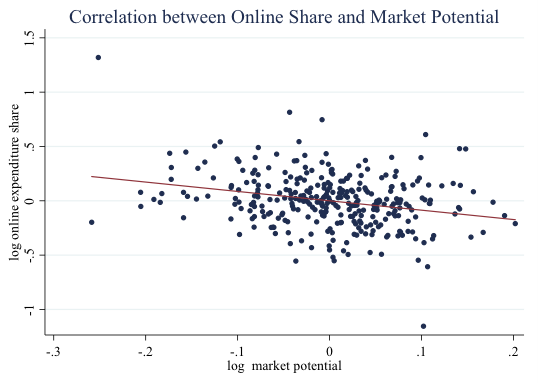

Since consumers in smaller and more remote markets have limited access to varieties in bricks-and-mortar stores, but similar access to online varieties, it follows that they will spend a larger share of their expenditure on online goods. We begin by documenting the empirical relationship between the ‘online expenditure share’ and the size and remoteness of the market (i.e. Chinese prefectures). Population is used to measure market size and market potential is used to measure (the inverse of) remoteness.2

Figure 1 shows that online expenditure share is negatively correlated with both population and market potential (the inverse of market remoteness).

Figure 1 Correlations between online expenditure share, population (market size), and market potential (inverse of market rmoteness)

According to our preferred specification, the online share for a city in the 1st population quintile (i.e. a city with a relatively low population) is about 1.9 percentage points higher than that for a city in the 5th quintile (i.e. a city with a relatively high population). The online share for a city in the 1st quintile of market potential (i.e. a remote city) is 7.4 percentage points higher than that for a city in the 5th quintile (i.e. a well-connected city). These negative correlations are robust to controlling for a rich set of demand shifts. In particular, the correlations remain strong for each consumption category. Thus, differences in consumption structure do not seem to explain these empirical patterns.

Drawing on the revealed preference insight, Arkolakis et al. (2012) show that the share of expenditures on foreign goods is a sufficient statistic of welfare gains from trade. Following the same intuition, we show that our results imply that residents in smaller and more remote cities enjoy larger gains from e-commerce.

Quantifying gains from e-commerce

To quantify the welfare impacts of e-commerce and to investigate the underlying channels, we develop a multi-region general equilibrium model which allows for both traditional retailing and e-commerce. We calibrate model parameters to match salient features of the Chinese economy. Our calibrated model features large spatial differences in access to varieties of goods, cost of living, and real wages. We perform a policy experiment and solve for a counterfactual equilibrium in which e-commerce is prohibitively costly.

Results

We find that the share of online intercity trade in expenditure is around 9% in an average city. However, growing e-commerce crowds out offline trade. As a result, e-commerce leads to only a 1.1% increase in total intercity trade. We find that the intercity trade brought about by e-commerce generates substantial welfare gains, measured as changes in real wages.

For an average city, the welfare gains from e-commerce are about 1.6%. Residents in smaller and more remote cities gain more than those in bigger and better-connected cities – the average welfare gains are 2% for cities in the lowest population quintile and 1.1% for those in the highest quintile; they are 2.1% for cities in the lowest market potential quintile and 1.2% for those in the highest quintile. Thus, e-commerce significantly reduces spatial consumption inequality in China.

Channels of welfare gains

We further study the channels of the welfare gains. We decompose the changes in real wage into two components: nominal wage and price level. We find that both components are larger for smaller and more remote cities, and that these two channels contribute about equally to the differential welfare gains from e-commerce across cities of different sizes. Decomposing the channels underlying the change in nominal wages, we find that the increase in labour demand from new entrants, which are induced by e-commerce, are especially important for the higher wage growth in smaller cities.

We also decompose the change in the price index into three primary channels: price, variety, and the ‘new entrant’ effect. The price channel captures the decrease in prices in varieties originally available in a city, but that become less expensive because of e-commerce. The variety channel captures the increasing access to varieties originally not sold in a city through the offline channel. The ‘new entrant’ effect captures the decrease in price index from new entrants. We find that the variety effect tends to be the most significant source of the price decrease except for the largest cities, in which the price effect is more important.

Policy implications

A top policy priority for many developing countries is to reduce disparity in living standards across locations. Our research points to the importance of reducing differences in the prices and variety of goods, in addition to reducing nominal income differences. Our research suggests that consumers in small and remote locations stand to benefit the most from e-commerce. Thus e-commerce, as a new trade technology, can substantially reduce inequalities in consumer welfare across space.

E-commerce provides developing countries with a unique opportunity to leapfrog the ‘big box’ retailing mode that has been dominant in the developed world since the 1950s. To ensure that developing countries are able to reap the benefits from e-commerce, policymakers should strive to provide modern transportation infrastructure, competitive courier services, and easy access to the internet.

References

Arkolakis, C, A Costinot and A Rodríguez-Clare (2012), “New trade models, same old gains?” American Economic Review 102(1): 94–130.

Atkin, D and D Donaldson (2015), “Who's getting globalized? The size and implications of intra-national trade costs”, NBER Working paper No w21439.

Feenstra, R C, M Xu and A Antoniades (2017), “What is the price of tea in China? Towards the relative cost of living in Chinese and US cities”, NBER Working paper No w23161.

Handbury, J and D E Weinstein (2014), "Goods prices and availability in cities", The Review of Economic Studies 82(1): 258-296.

Endnotes

[1] eMarketer Chart.

[2] Market potential is measured as the sum of the inverse of distance to all other prefectures using other prefectures’ market size as weight.