A cheap intervention increased firm registration but failed to impact tax registration, negating potential tax revenue

The informal sector accounts for 30% to 40% of total economic activity in the poorest countries, and a much higher share of employment (La Porta and Shleifer 2014, Gollin 2002). It is particularly pervasive in poorer African countries, such as Malawi, where 93% of firms have not registered with the government. One response could be to wait for development, since development has reduced the size of the informal sector in other countries (e.g. McCaig and Pavcnik 2015). However, many governments want to jump-start this process and encourage firms to register.

Governments have at least four reasons to try and bring firms into the formal system:

- To broaden and increase the tax base

- To enable firms to access the formal economy and help spur firm growth through the potential benefits of being formal (such as access to financial services and government contracts)

- To increase the sense of rule of law by having the default be that everyone is obeying the law

- To have firms provide information about themselves to the state, which can help the government better understand the structure of the economy and better target business programmes.

Formalising firms in poor countries

The standard government response has been to lower the costs of formalising, by making it easier for firms to register. The World Bank’s Doing Business project notes, “Since its inception, Doing Business has captured at least one reform making it easier to start a business in almost 95% of economies.” One of the most popular types of reform has been to set up ‘one-stop shop’ service points, in which a single registration covers registration of both the company name, as well as for tax purposes, and other licenses required. This approach has been implemented in 115 countries, according to the Doing Business report.

However, in practice, the majority of informal firms have remained informal after these reforms (Bruhn and McKenzie 2014), and existing randomised experiments have found low take-up rates to interventions that provide information, assistance, and cost discounts in registering for national taxes. This includes de Mel et al. (2013) who find no impact of information and free registration costs on registration with the tax authority in Sri Lanka; Galiani et al. (2017) who find a small and temporary effect of personalised assistance and a temporary tax holiday on tax registration in Colombia; and Benhassine et al. (2018) who find 9.6% of firms register for a new tax status in Benin.

Separating business and tax registration: An experiment in Malawi

In a recent working paper (Campos et al. 2018) (replication data available here), we conducted an experiment with informal firms in Malawi that aimed to test whether governments can bring firms into at least part of the formal system and thereby achieve at least some of the above goals, and whether firms need additional help to realise the benefits of becoming formal.

Malawi, like much of sub-Saharan Africa, separates the process of business registration from tax registration. This separates the first reason for formalising firms from the other three reasons. But it is then still an open question as to whether formalisation without tax obligations offers meaningful benefits to firms, or whether additional policies are required.

Methodology

Starting with a listing of 100 business centres in the cities of Lilongwe and Blantyre, in early 2012, we conducted a baseline survey of 3,002 informal firms, over-sampling female-owned firms so that 40% of the sample were female-owned. These firms were then separated into the following four groups:

- A control group of 757 firms

- Treatment group 1: Provided free cost business registration. This group of 745 firms was offered assistance in obtaining a business registration certificate at no cost, which is the main form of identification needed for opening a business bank account, registering land, and applying to government assistance programmes.

- Treatment group 2: Provided free cost business registration and free tax registration. This group of 293 firms was offered assistance in obtaining both the business registration certificate and a tax payer identification number, enabling us to measure the additional demand for tax formalisation.

- Treatment group 3: Provided free cost business registration and a bank information session. Here we focus on the idea that firms may face information problems in realising the benefits of registration. To that end, this group of 1,207 firms received assistance in obtaining a business registration certificate, plus received an information session with a private bank, culminating in the chance to open a business bank account.

Results

Registration costs are key

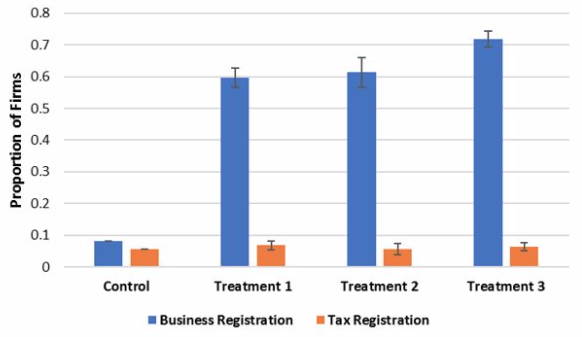

Our results highlight the importance of how governments attempt to bring firms into the formal system for their ability to achieve their different goals from doing so. Even without tax registration, we find the existing transaction costs of registering a business are enough to deter the average firm from registering their business. Yet when we offer our assistance, which brings the costs close to zero, a large majority (75%) of the firms register their businesses (Figure 1).

Tax registration disincentives

This brings most firms into compliance with this law (goal 3) and provides the government with basic data on firms (goal 4). However, on its own, this registration brings no discernible private benefits to the firms (i.e a ‘no’ on goal 2). In contrast, the disincentive to register for taxes outweighs any potential benefits, plus the removal of transaction costs – the take-up of our offer of assistance for tax registration was around 4%, similar to the take-up rates in several other tax formalisation experiments, with no increase in tax revenue (i.e. a ‘no’ on goal 1).

Figure 1 All three treatments increased business registration but not tax registration

Follow up survey

Profitability and access to finance

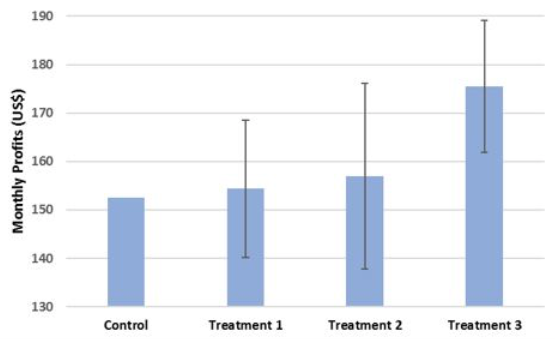

We use four follow-up survey waves that enable us to track outcomes for three years after the intervention. Survey attrition rates were 10% or lower in each wave. Neither treatment 1 nor treatment 2 lead to any measurable improvement in firm profitability (Figure 2), and relatively little change in access to finance.

Bank accounts

Only an additional 1% to 2% of these firms set up business bank accounts. The supposed access to finance benefit of getting a business registration certificate was therefore far from automatic. In contrast, when we added the bank information session in treatment 3 to the free cost business registration, we get a 39 percentage point increase in business bank account usage. This in turn helped the firms grow (goal 2), with sales growing 20% and profits 15% or US$27 per month (Figure 2).

Figure 2 Only the combination of business registration assistance and a bank information session increased profits

Note: Treatment 3 has a significantly different impact than treatment 1 (p=0.002) and than treatment 2 (p=0.053).

A cheap and profitable intervention… but no increase in tax revenue

The bank information session and business registration assistance was a cheap intervention to administer, averaging $27 per firm registered – which we see firms gaining in per month profits. This is a large increase on investment, and a substantially cheaper way of assisting firms than many other government business support programmes, such as training programmes or business grants.

Moreover, our results show that it works well for female-owned businesses as well as male-owned, in contrast to the more limited impacts of some business grant and training programmes for women.

However, such an intervention does require separation of the business registration from tax registration (unlike the one-stop shops), and the government does not gain at all in tax revenue over the first three years post-intervention. Efforts to increase the tax base may therefore require other interventions.

Implications: Interventions that ‘pay for themselves’, but don’t pay the government

Here we have an example of a policy that leads to sharp improvements in firm profits, which greatly exceed the cost to the government of providing the policy. However, faced with a tight budget, the government moved to increase the cost of business registration towards the end of our intervention, and, in order to strengthen and widen the tax base, is seeking to integrate business and tax registration more.

This raises a challenge for thinking about cost-effectiveness when the costs are to the state, and the benefits are to private firms. Our results show these benefits are only realised when firms are given a helping hand to both register in the first place, and then to take advantage of these benefits at banks. They therefore suggest the presence of several frictions, including transaction costs and information problems, which prevent firms from undertaking this profitable investment themselves.

A key question for future research is to think about how to better enable firms to pay themselves for interventions that have high expected returns – and/or to help governments consider other ways of raising the funds needed to pay for such firm support.

Editors’ note: This blog is an adaptation of an article originally published on the World Bank Development Impact Blog, "A cheap intervention that helped partially formalize firms and increased profits – just don’t ask about taxes" and is based on this PEDL project.

References

Benhassine, N, D McKenzie, V Pouliquen and M Santini (2018), “Can Enhancing the Benefits of Formalization Induce Informal Firms to Become Formal? Experimental Evidence from Benin”, Journal of Public Economics 157: 1-14.

Bruhn, M and D McKenzie (2014), “Entry Regulation and Formalization of Microenterprises in Developing Countries”, World Bank Research Observer 29(2): 186-201

Campos, F, M Goldstein and D McKenzie (2018), “Firms into the Formal System? Experimental Evidence from Malawi”, World Bank Policy Research Working Paper WPS8601.

De Mel, S, D McKenzie and C Woodruff (2013), “The demand for, and consequences of formalization among informal firms in Sri Lanka”, American Economic Journal: Applied Economics 5(2): 122-50

Galiani, S, M Meléndez and C Navajas Ahumada (2017), “On the effect of the costs of operating formally: New experimental evidence”, Labour Economics 45: 143-57.

Gollin, D (2002), “Getting Income Shares Right”, Journal of Political Economy 110(2): 458-474,

IMF (2011), Revenue Mobilization in Developing Countries, Washington: International Monetary Fund.

La Porta, R and A Shleifer (2014). “The Unofficial Economy in Africa”, in African Successes: Government and Institutions, NBER Research Chapters.

McCaig, B and N Pavcnik (2015), “Informal Employment in a Growing and Globalizing Low Income Country”, American Economic Review Papers and Proceedings 105(5): 545-50.