Lower informality does not necessarily translate to higher total factor productivity or improved welfare

Read more about the informal sector in Gabriel Ulyssea's VoxDevLit.

The informal sector is a prominent feature of most developing economies. It accounts for up to two-thirds of economic activity, with a median size of 35% of GDP (La Porta and Schleifer 2008). The sheer magnitude of informality in these countries is likely to have deep economic implications. On the one hand, it implies widespread tax evasion and allows less productive informal firms to compete with more productive formal firms, leading to misallocation of resources and potentially large total factor productivity (TFP) losses (Hsieh and Klenow 2009). On the other hand, informality can provide de facto flexibility for firms that would be otherwise constrained by burdensome regulations (Meghir et al. 2015). Therefore, understanding how the informal sector affects the economy and assessing the firm-level and aggregate impacts of formalisation policies are crucial to fostering economic development.

A model of the extensive and intensive margins of informality

To better understand the role of informality in developing economies, in Ulyssea (2018) I develop an equilibrium entry model where firms can exploit two margins of informality:

- whether to register and pay entry fees to achieve a formal status (the extensive margin)

- whether firms that are formal in the first sense hire workers “off the books” (the intensive margin).

Accounting for the latter is crucial, as it breaks the direct association between firm and worker informality, which unveils new and more subtle firm-level and aggregate responses to policy changes (as I argue below). Additionally, the intensive margin is very important empirically – in Brazil and Mexico, 40% and 44% of informal employment is located in formal firms, respectively.

In the model, firms decide whether to enter the formal or informal sectors based on a productivity signal and learn their true productivity after entry occurs. Sector membership is defined by the extensive margin, and the (in)formal sector is formed by (un)registered firms. If a firm decides to be formal, it must pay fixed registration costs, revenue, and labour taxes. However, it may avoid the latter by hiring informal workers. Informal firms can avoid all taxes and regulations, but face an expected cost of being caught that is increasing in a firm’s size. This captures the idea that larger firms are more visible to the government and are therefore more likely to be inspected.The same is true for formal firms that hire informal workers. Thus, the two margins of informality introduce a size-dependent distortion in the economy, which is shaped by existing regulations and government’s enforcement technology.

Quantifying the different views of informality

There are three main views in the literature about the role of informal firms in economic development (La Porta and Shleifer 2008). The first view argues that the informal sector is a reservoir of potentially productive entrepreneurs who are kept out of formality by high regulatory costs, most notably entry regulation. This is the De Soto view (De Soto 1989). The second sees informal firms as ‘parasite firms’ which are productive enough to survive in the formal sector but choose to remain informal to earn higher profits from the cost advantages of not complying with taxes and regulations (the parasite view). The third argues that informality is a survival strategy for low-skill individuals who are too unproductive to ever become formal (the survival view).

The model outlined above is able to integrate these seemingly competing frameworks in a unified setting. I show that these views simply reflect firm heterogeneity in the informal sector and are therefore complementary and not competing frameworks for understanding informality. Given that they imply very different perspectives on the role of informality, the relevant question becomes what their relative importance in the data is. To answer this question, I use the estimated model to back out the distribution of informal firm types in the Brazilian data.

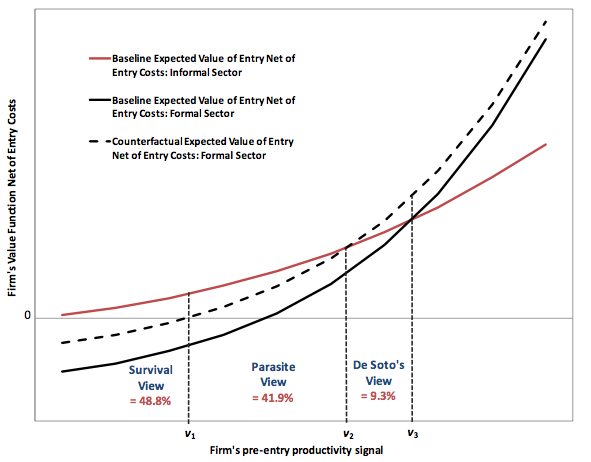

Figure 1 shows that that most informal firms belong to the survival view (48.8%). The second largest group corresponds to the parasite view (41.9%) – informal firms that are productive enough to formalise once entry barriers are removed but choose to remain informal to earn higher profits (red solid line above the solid and dashed dark lines). Finally, the De Soto view – firms that formalise and thrive once entry costs are removed (dark dashed line above the other lines) – corresponds to the minority of informal firms (9.3%). This result can thus rationalise why reducing registration costs around the world have been ineffective in increasing formalisation (e.g. De Mel et al. 2013)

Figure 1 The distribution of informal firm types in the data

Firm-level and aggregate effects of formalisation policies

I consider four policy counterfactuals: (i) equalising the formal and informal sectors’ entry costs, (ii) a 20 percentage point cut in the payroll tax, (iii) increasing the cost of being an informal firm (the extensive margin), and (iv) increasing the cost of formal firms hiring informal workers for both skill levels (the intensive margin). The latter two could be achieved through greater monitoring efforts by the government.

Effects on firms

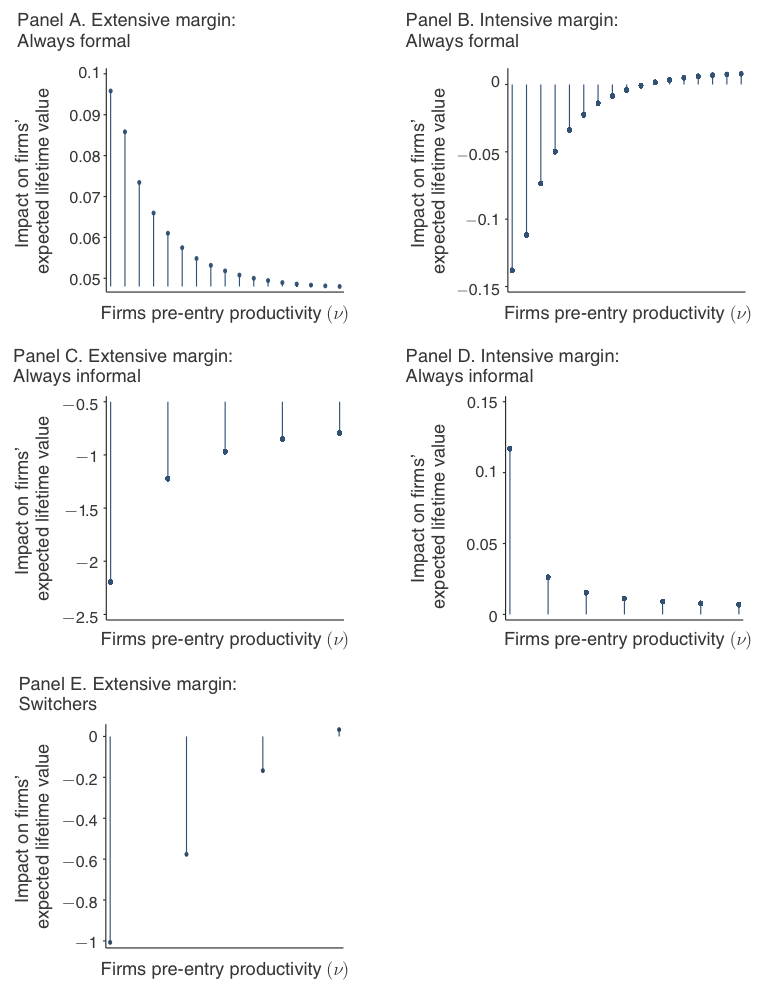

I define a firm’s expected value of entry net of entry costs as the outcome of interest. In order to organise the results, firms are divided into three basic groups: “always formal”, “always informal” and “switchers”, which are informal firms in the baseline scenario that formalise in the counterfactual scenario. Figures 2 and 3 show the following (in my paper I discuss a broader set of results):

Reducing entry costs hurts high productivity formal firms and all informal firms, except for the switchers. These negative effects come from the general equilibrium effects on wages.

- Formal incumbents benefit from higher enforcement on the extensive margin of informality but low-productivity formal firms benefit the most, which indicates that they are the most directly affected by the competition from informal firms.

- Increasing enforcement on the intensive margin of informality hurts low-productivity formal firms, as these firms hire a large fraction of their labour force without a formal contract.

Figure 2 Profiles of firm-level effects: Reducing regulatory costs

Figure 3 Profiles of firm-level effects: Increasing the costs of informality

Economy-wide effects

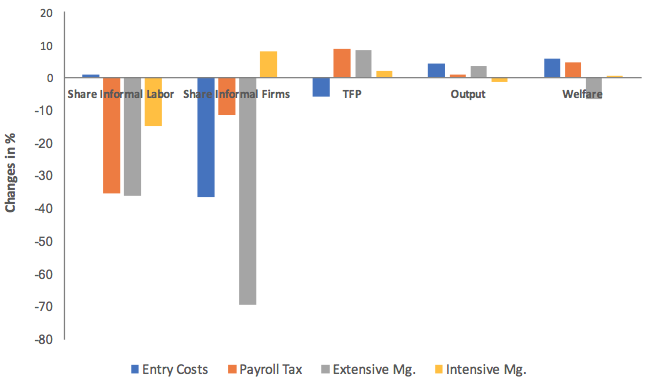

As Figure 4 shows, reducing the formal sector’s entry cost substantially reduces firm informality, but the effect on labour informality is null. This is due to the intensive margin, as the newly formalised firms are low-productivity and hire a large share of informal workers. Similarly, increasing enforcement on the intensive margin reduces labour informality but increases informality among firms. This occurs because effective labour costs are now higher for small formal firms, which increases their incentives to become informal.

Figure 4 Aggregate effects (%)

Reducing entry costs eliminates wasteful barriers to entry, increasing the mass of firms, total output, and wages. However, the intervention has a negative effect on aggregate TFP via composition effects, as it increases the presence of low-productivity firms in the formal sector. In contrast, increasing enforcement on the extensive margin generates a positive composition effect, as it eliminates many low-productivity informal firms, which increases TFP. The net effect is a 3% increase in total output.

In terms of welfare effects, reducing entry costs leads to the largest gain (5.5%), followed by the payroll tax policy (4.4%). In contrast, higher enforcement on the extensive margin leads to a loss of 6.7%, which is a consequence of enforcing costly and inefficient regulations on all firms. These results thus show that lower informality can be, but is not necessarily, associated with higher TFP or welfare.

Concluding remarks

The results above indicate that only a minority of informal firms are potentially productive and formalise once the formal sector’s entry costs are removed. Most informal firms either choose informality to exploit the cost advantages of non-compliance (even though they are productive enough to survive in the formal sector) or are too unproductive to ever become formal. Thus, one should not expect substantial formalisation effects from policies that aim at reducing registration costs.

The policy simulations show that there are winners and losers in all scenarios and that there is substantial heterogeneity in policy effects both between and within groups of firms (switchers, always formal and always informal). At the aggregate level, I find that increasing enforcement is highly effective in reducing informality but it reduces welfare in the economy. Reducing formal sector’s entry costs is not as effective in reducing informality but generates welfare gains and leads to greater output and wages. Overall, the results show that informality reductions can be, but are not necessarily, associated with higher GDP, TFP, or welfare.

References

De Mel, S, D McKenzie and C Woodruff (2013), “The demand for, and consequences of, formalisation among informal firms in Sri Lanka”, American Economic Journal: Applied Economics 5 (2): 122–50.

De Soto, H (1989), The other path: The economic answer to terrorism, New York: Harper & Row.

Hsieh, C and P Klenow (2009), “Misallocation and manufacturing TFP in China and India”, Quarterly Journal of Economics 124 (4): 1403–48.

La Porta, R and A Shleifer (2008), “The unofficial economy and economic development”, Brooking Papers on Economic Activity (Fall): 275–352.

Meghir, C, R Narita, and JM Robin (2015), “Wages and informality in developing countries.” American Economic Review 105 (4): 1509–46.

Ulyssea, G (2018), “Firms, informality, and development: Theory and evidence from Brazil.” American Economic Review 108 (8): 2015-2047.