It is well-known that risk-sharing networks can smooth shocks, but local production networks can also propagate shocks; policy should consider both

From supply chain disruptions to contagious illnesses, recent experience has underscored that what happens to one individual or firm can have implications for many others. For instance, public health lockdowns in the restaurant sector can harm the livelihoods of florists, fishermen, and bakers. But some interconnections are positive – for instance, funeral expenses may be covered by voluntary contributions from family or community members. The coexistence of multiple types of interconnections may determine whether shocks are smoothed or amplified by local networks.

Why is propagation important?

For household firms, if and how shocks spread determine who is affected by negative shocks. Do the impacts ripple out beyond those directly affected, and is this good or bad? We will refer to these ‘ripple’ effects as propagation: impacts on household businesses who are connected to the directly affected household through local networks, but were not directly affected themselves. Understanding propagation is relevant for designing and evaluating safety net programmes such as insurance for health or unemployment. Propagation in safety nets is good when programmes that provide benefits to the directly covered person also protect those within their networks (Angelucci and De Giorgi 2009). Propagation can also illuminate the constraints that economic actors face. Why is it challenging for a carmaker to shift to a new semiconductor supplier if its original supplier is unable to meet demand? Or, if a local merchant selling fertiliser unexpectedly loses a customer, how long does it take her to find new customers? Is she able to buffer the short-term impacts using gifts, loans, and savings or is she forced to reduce consumption, or sell productive assets?

It is established that various kinds of shocks can reverberate through an economy. Egger et al. (forthcoming) and Suarez-Serrato and Wingender (2016) document multipliers (factors which amplify a direct effect) arising from large inflows of cash into local economies.1 Less is known about whether adverse idiosyncratic shocks – with direct effects limited to a single household – are amplified and generate multiplier effects. Existing evidence on how sectoral disturbances propagate through production networks comes mostly from high-income countries (e.g. Baqaee and Farhi 2020, Carvalho et al. 2021). In low- and middle-income countries (LMICs), the setting is quite different: many firms are small, operated by families, and exposed to shocks like family health and wealth that are generally not faced by large firms. These firms exist in production and labour market networks, but also in risk-sharing networks. While the latter may help households buffer their own shocks, the former may increase one firm’s exposure to other firms’ shocks through adverse propagation.

Health shocks disrupt family businesses

In our study (Kinnan, Samphantharak, Townsend and Vera-Cossio 2022), we analyse how health shocks to entrepreneurs in rural Thailand disrupt family enterprises and, in turn, spread to other households through local transaction networks. We use detailed data across 14 years at a monthly frequency. We first show that health shocks (periods of high health expenditure) meet several important criteria:

- They are exogenous, and not predicted by the household’s level of income, assets, consumption, or other factors.2 This helps give a causal interpretation to our findings.

- They are idiosyncratic, i.e. not predicted by village-level factors. This helps us to analyse how a shock to a single firm propagates through local networks.

- These shocks are large – on average, health spending shocks represent a burden roughly twice the magnitude of average food consumption.

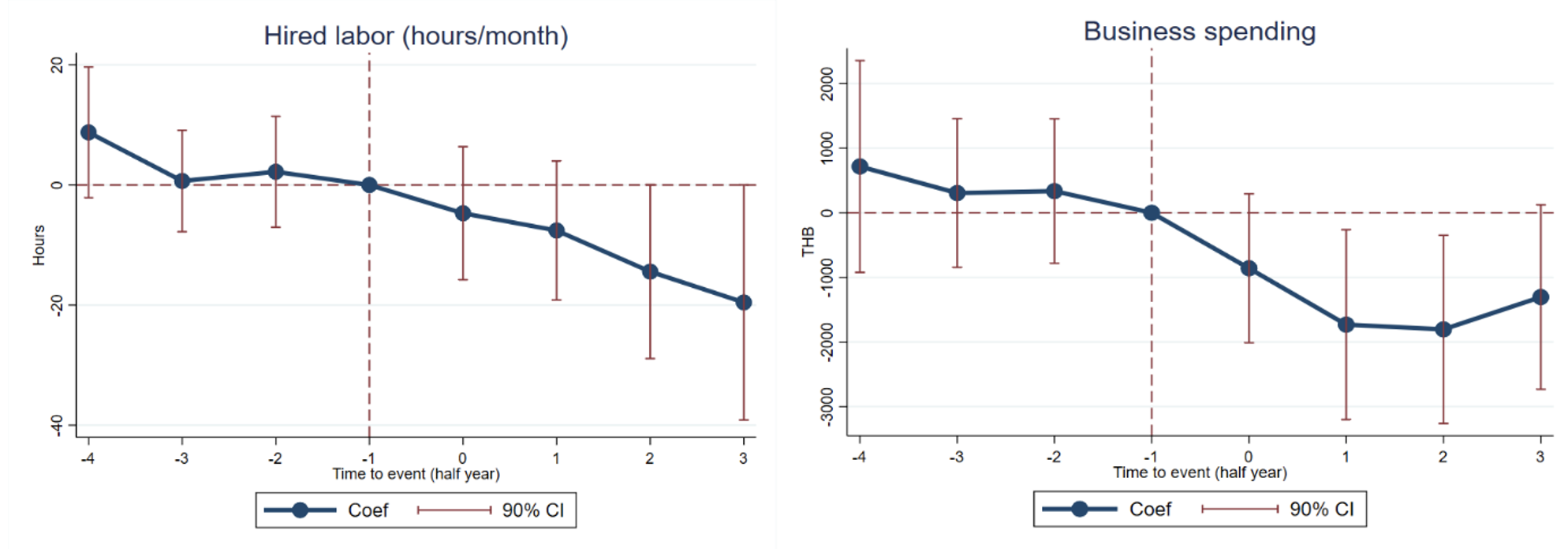

These shocks disrupt family businesses.3 Figure 1 compares changes in business spending and the demand for external labour before and after a shock. Changes are computed between shocked households and other households who have not yet experienced a shock (but will in the future).4 Households accommodate the shock by reducing business spending, reducing input spending by roughly a quarter, and reducing the demand for external labour by 79%.

Figure 1 Direct effects of a shock on family business

Note: Each dot represents differences between treatment and control households in changes in outcomes relative to the period preceding the beginning of the shock (-1). The estimating sample includes two years before and after the shock, divided in half-year bins. All specifications control for household time-variant demographic characteristics, as well as household and month fixed effects. 90% confidence intervals are computed using standard errors clustered at the household level.

Business disruption ripples out to other households

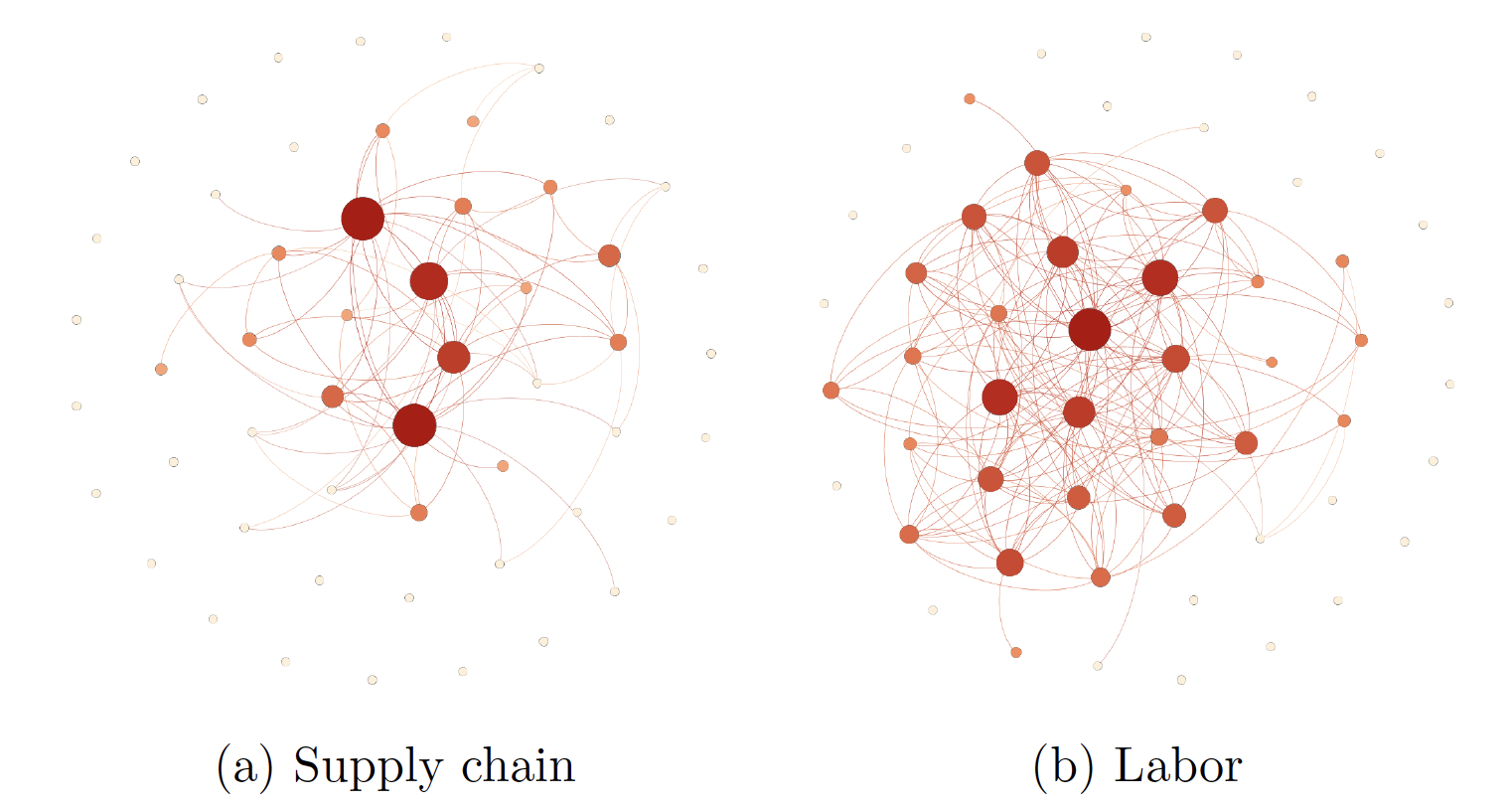

How do these reductions in spending by the shocked households affect their trading partners? Our data allow us to construct supply chain and labour networks, indicating which households trade goods and labour with each other.

Figure 2 Supply chain and labour market networks for a sample village

Note: Each dot in the figure represents a node, and the size of the node increases with an increase in the number of links in the network. Supply chain networks include transactions of raw materials and intermediate goods, and labour networks include relationships through paid and unpaid labour.

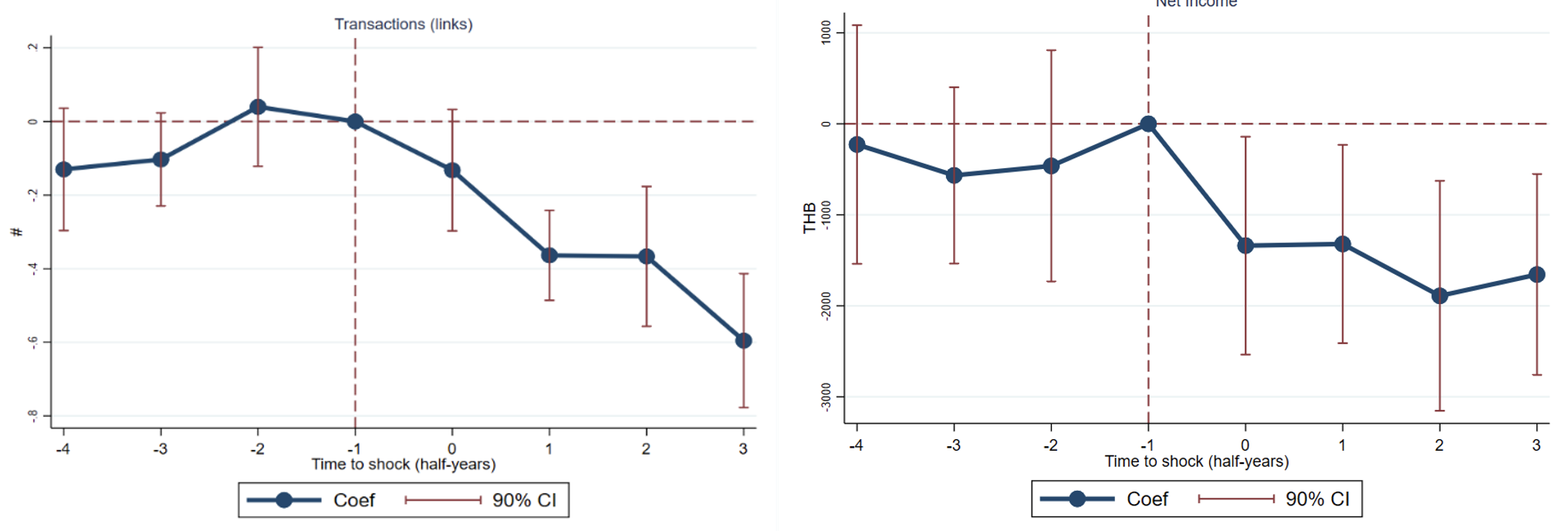

We find that household firms which are closer in the network to the shocked household experience negative effects.5 These ‘indirectly shocked’ households experience declines in the number of local transactions, and experience proportionate declines in total income and consumption. Figure 3 shows the pattern of effects over time following the shock (time periods to the right of the dashed vertical line), indicating that the effects persist for at least two years. The figure also shows that these indirectly shocked households did not experience different trends before the shock, supporting our research design.

The indirect effects are smaller than direct effects on a per-household basis. However, the indirect effects can impact many more households. A simple back-of-the-envelope exercise indicates that shocks to individual households lead to significant multiplier effects – the total indirect effects are roughly 1.5 times as large as the direct effects.

Figure 3 The indirect effects of health shocks

Note: The figure presents flexible difference-in-difference estimates of the indirect effects of idiosyncratic shocks on local businesses. Each dot captures differences in changes in outcomes with respect to the half-year preceding the shock (-1) between more- and less-exposed households. Regressions include household-, event-, month-, village- and year- fixed effects, and household size, household average age and education, and number of adult men and women in each household. Standard errors are two-way clustered at the household and shock level.

Network structure and propagation

Do some network structures lead to larger indirect effects? Do shocks to households with certain network positions lead to greater propagation? These questions are important, but typically difficult to evaluate. With network data on 16 distinct village networks, we find that shocks to more connected (higher degree) households propagate to a greater extent, and likewise, shocks in networks that are more connected (higher degree density) also have greater ripple effects.

This suggests that propagation not only reflects the existence of linkages in input markets, but also establishes the existence of market failures. As Baqaee and Farhi (2020) note, with frictionless markets, the aggregate effect of an idiosyncratic shock should not depend on the structure of the economy, and should only depend on a firm’s ratio of total output to aggregate value added (Hulten 1978). If the extent of propagation depends on the network position of the shocked firm or the overall structure of the network¬ – as we find – this indicates deeper market failures in the economy.

Insurance and negative propagation in village networks

One such market failure relates to insurance markets and the fact that firms and households are part of multiple non-perfectly overlapping networks. Gifts and loans play a key role in ex-ante risk-sharing,6 while supply chain and labour market networks are key in adverse propagation ex post. In our setting, not all households are equally connected in these types of networks; some households are relatively well-insured while others are exposed with little recourse to insurance networks. We find that when a shocked household is part of an active risk-sharing network, it can smooth over the shock through gifts. Consequently, the indirect effects of the shock are smaller, with less adverse propagation. Prior research has shown that local insurance networks can play a role in smoothing risk; our work sheds light on another, opposing role of other networks – propagating risk through labour and supply chains. These roles are related, as there is more propagation when insurance is incomplete.

Policy implications

Informal insurance networks help spread the burden of a shock optimally, but their scope is limited to those with kin or tight social relationships. Thus, interventions that reduce the direct effects of health shocks and other risks may be more beneficial than previously appreciated. Health insurance, better access to credit, and other safety nets may protect a directly shocked household from the need to reduce business investment, and thus, help not only that household but also, its local trading partners.

Finally, underpinning our findings is the fact that indirectly shocked households struggle to find new trading partners when existing partners are hit by shocks. Policy and technology changes such as skill certification or matching platforms that reduce this rigidity may enhance resilience to the indirect effects of shocks.

References

Angelucci, M and G De Giorgi (2009), "Indirect Effects of an Aid Program: How Do Cash Transfers Affect Ineligibles' Consumption?", American Economic Review 99(1): 486-508.

Baqaee, D.R. and E Farhi (2019), “The Macroeconomic Impact of Microeconomic Shocks: Beyond Hulten's Theorem”, Econometrica 87: 1155-1203.

Breza, E, A Chandrasekhar, B Golub, and A Paravatheni (2019), “Networks in Economic Development”, in M Elliott, A Teytelboym and Y Zenou (eds), Networks and Economic Policy, Oxford Review of Economic Policy.

Carvalho, V M, M Nirei, YU Saito and A Tahbaz-Salehi (2021), “Supply Chain Disruptions: Evidence from the Great East Japan Earthquake”, The Quarterly Journal of Economics 136(2): 1255–1321.

Egger, D, J Haushofer, E Miguel, P Niehaus and M W Walker (2019), “General equilibrium effects of cash transfers: experimental evidence from Kenya”, NBER Working Paper 26600.

Hulten, C R (1978), “Growth Accounting with Intermediate Inputs”, The Review of Economic Studies 45(3): 511–518.

Kinnan, C, R Townsend, K Samphantharak and D A V Cossio (2022), “Insurance and propagation in village networks”, NBER Working Paper 28089

Suárez Serrato, J C, and P Wingender (2016), “Estimating local fiscal multipliers”, NBER Working Paper 22425.

Endnotes

1 They examine cash transfers in Kenya and federal spending programs in the US respectively.

2 We omit spending shocks associated with pregnancy/childbirth as these are likely predictable by the household in advance.

3 All households in our sample have one or more businesses, which may be in agriculture (such as raising crops, dairy, or fish), or non-agriculture (such as a grocery store or tailoring business).

4 In our paper we discuss how we construct a control group to infer the counterfactual outcomes of the household which experiences the shock (see Section 3.1 and Appendix A.2).

5 See Section 3.2 of our paper for details about the econometric specification.

6 See, for example, Breza et al. (2019) for an overview.