Industrial policy in China aimed to make the country’s shipbuilding industry a world leader. Comprehensive data on shipyards worldwide reveals the huge scale of this policy, which boosted China's domestic investment, entry, and world market share dramatically. However, it created sizable distortions and led to increased industry fragmentation and idleness.

Industrial policy has been widely used in developed and developing countries. Historic examples include the US and Europe after World War II, Japan in the 1950s and 1960s, and South Korea and Taiwan in the 1960s and 1970s. Today, industrial policy is once again at the forefront of economic policy in both the East and the West. As Rodrik (2010) puts it, “The real question about industrial policy is not whether it should be practiced, but how.”

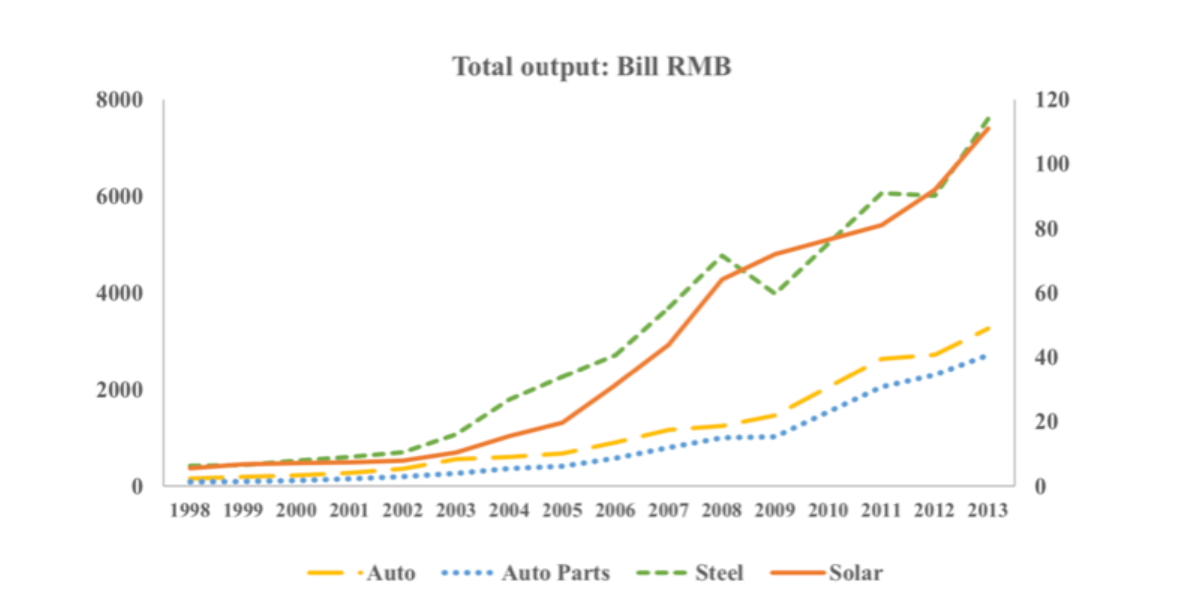

Despite the prevalence of industrial policy in practice and the contentious debate in the literature regarding its efficacy (Baldwin 1969, Krueger 1990), remarkably few empirical studies directly evaluate the costs and benefits of these policies using micro-level data. Our recent research (Barwick, Kalouptsidi and Zahur 2023) addresses this issue, with a focus on China, which has been one of the most prominent proponents of industrial policy in recent years. During the past two decades, Chinese firms have rapidly dominated many global industries, such as steel, autos, and solar panels, in part because of government support (Figure 1). In recent years, the government has explicitly targeted high-tech sectors in an attempt to turn their firms into world leaders (“Made in China 2025”).

Figure 1: Output of Chinese auto, auto parts, steel, and solar industries, 1998-2013

Shipbuilding in China

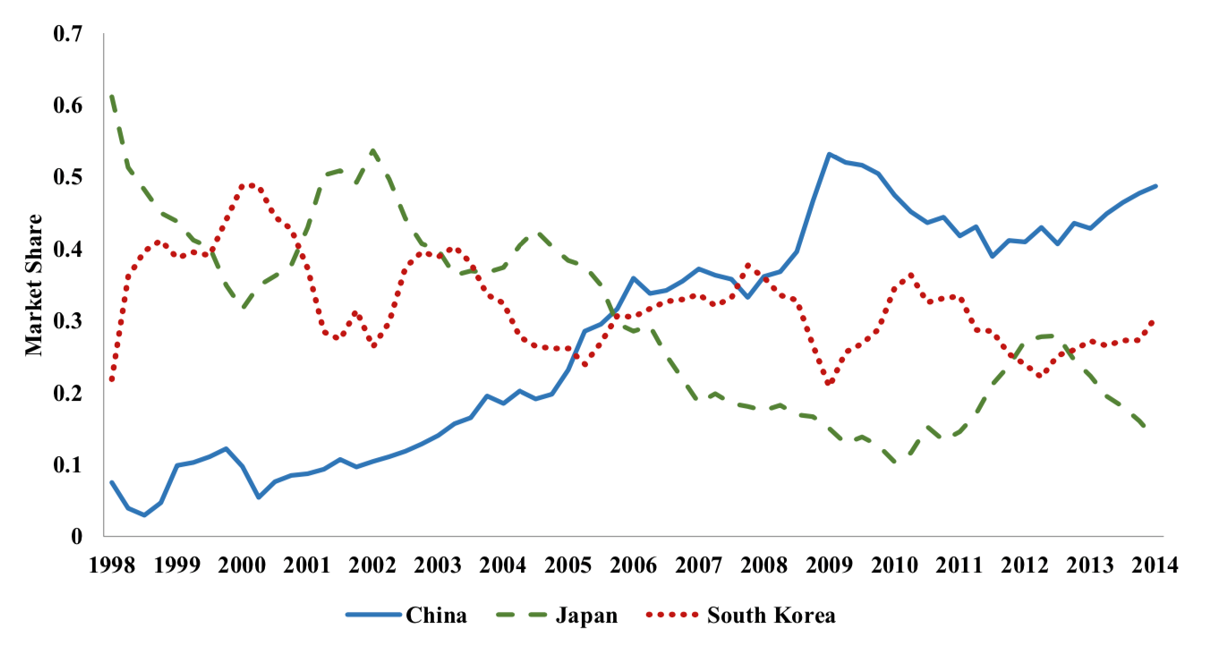

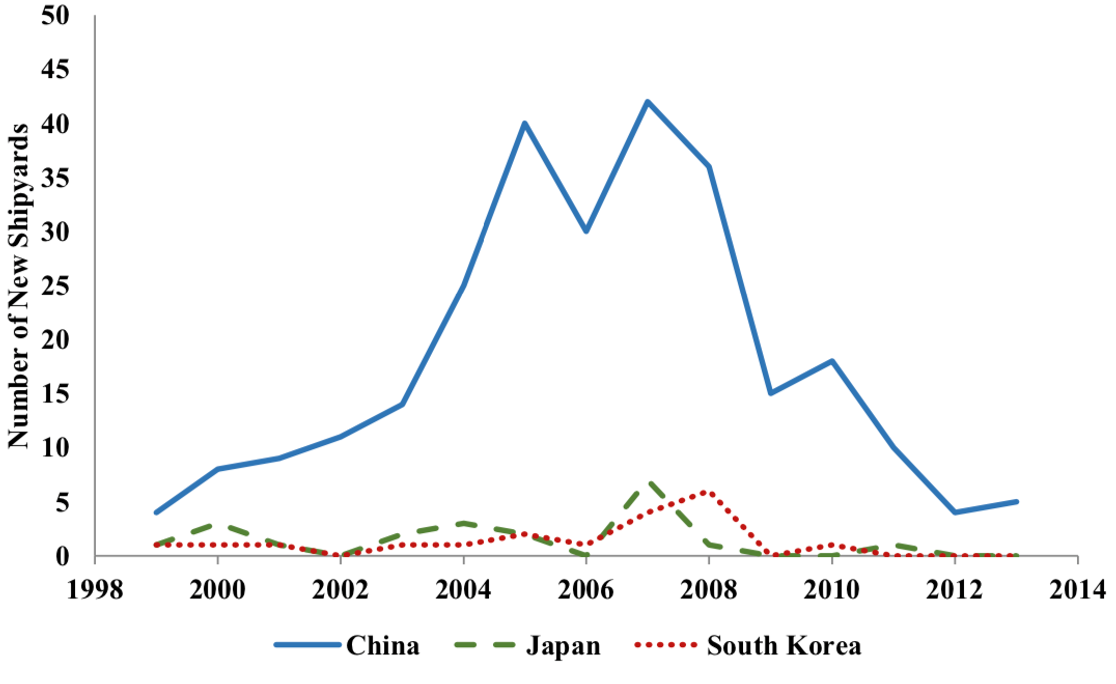

We focus on the shipbuilding industry, an illustrative example of the quick ascent of China’s manufacturing sector into global influence during the 2000s. At the turn of the century, China’s nascent shipbuilding industry accounted for less than 10% of world production. The country’s 11th (2006–2010) and 12th (2011–2015) National Five-Year Plans dubbed shipbuilding a pillar industry in need of special oversight and support. Since then, the government issued an unprecedented number of national policies with the goal of developing this infant industry into the largest worldwide. The policies set specific goals for output and capacity and, as such, involved a mix of subsidies for production (e.g. subsidised material input, export credits, and buyer financing), investment (e.g.,low-interest long-term loans and expedited capital depreciation), and firm entry (e.g. below market-rate land prices). Within a few years, China overtook Japan and South Korea as the leading ship producer in terms of output, as shown in Figures 2 and 3.

Figure 2: Market Shares of China, Japan, and South Korea, 1998–2014

Figure 3: Number of New Shipyards in China, Japan, and South Korea, 1998–2014

Using this historical event as a case study, we examine the welfare consequences of industrial policy, focusing on two questions of general interest. First, how has China’s industrial policy shaped its domestic and the global industry? Second, what is the relative efficacy of different policy instruments, such as production subsidies (e.g. subsidised material input, export credits, and buyer financing), investment subsidies (e.g. low-interest long-term loans and expedited capital depreciation), entry subsidies (e.g. below market-rate land prices), and consolidation policies? We build and estimate a dynamic model of firm production, investment, entry, and exit, under aggregate uncertainty. The model incorporates economies of scale in firm production and accommodates private shocks in investment decisions.

Our analysis delivers four sets of main findings

First, like many other policies that China’s central government has unleashed in recent decades, the scale of the industrial policy in the shipbuilding industry is massive relative to the size of the sector. Our estimates suggest that the aggregate policy support from 2006 to 2013 is equivalent to RMB 624 billion (in constant 200 RMB), with entry subsidies around RMB 431 billion, followed by production subsidies of RMB 156 billion and investment subsidies of RMB 37 billion. The policy boosted China’s domestic investment and entry by 140 and 120%, respectively, and increased its world market share by 40%, almost three-quarters of which occurred via “business stealing” (i.e. reduced production) from rival countries. However, the policy created sizable distortions and generated merely RMB 153 billion (USD $23.6 billion) of net profits to domestic producers and RMB 290 billion (USD $44.7 billion) of worldwide consumer surplus.

Second, the policy instruments varied greatly in their effectiveness. Production and investment subsidies can be justified on the grounds of revenue considerations, but entry subsidies are wasteful and lead to increased industry fragmentation and idleness. Entry subsidies attract small and inefficient firms; in contrast, production and investment subsidies favour large, efficient firms that benefit from economies of scale. Production subsidies achieve output targets more effectively, while investment subsidies are less distortionary over the long run.

Third, we find the efficacy of industrial policy is significantly affected by the presence of boom and bust cycles, as well as by heterogeneity in firm efficiency, both essential features of the shipbuilding industry (see Kalouptsidi 2014 and Greenwood and Hanson 2015). A counter-cyclical policy would have out-performed the pro-cyclical policy that was adopted by a large margin. Indeed, their effectiveness at raising long-run industry profit differs nearly twofold, due to both a composition effect (more high-cost firms operate in a boom than a bust) and capacity constraints that render increases in production more costly during the boom. In addition, shortening the horizon over which the policy is implemented could further boost returns, as temporary interventions mitigate the entry of inefficient firms and reinforce increasing returns to scale in ship production.

Fourth, we examine the consolidation policy the government adopted in the aftermath of the financial crisis, whereby it implemented a moratorium on entry and issued a “White List” of firms selected to receive government support. Several industries adopted this strategy to curb excess capacity and create large conglomerates that can compete globally. Consistent with the evidence discussed above, we find that targeting low-cost firms creates fewer distortions; that said, the White List chosen by the government favored state-owned enterprises and did not include the most efficient firms.

Takeaways for industrial policy

Our results highlight potential mechanisms underlying industrial policies’ diverging outcomes across countries. For instance, in East Asian countries, where industrial policy was considered successful, the policy support was often conditioned on performance. In contrast, in Latin America, where industrial policy was viewed as ineffective, there were no mechanisms to weed out nonperforming beneficiaries. Our analysis illustrates that similar mechanisms are at work in China’s modern-day industrial policy in the shipbuilding industry. The policy’s return was low in earlier years when output expansion was primarily fueled by the entry of inefficient firms but increased considerably over time as the government used performance-based criteria (the whitelist) to channel subsidies.

Finally, we examine the possible rationales for adopting industrial policy. Our analysis suggests that strategic trade benefits are small, as the shipbuilding industry is fragmented and the extent of market power is limited. There is also no evidence of industrywide learning by doing, another common rationale for industrial policy. We also find limited evidence that the shipbuilding industry generates significant spillovers to other domestic sectors (e.g., steel production, ship owning, or the labor market).

On the other hand, the substantial increase in the global fleet ensuing from China’s increase in ship production did lower freight costs and increased China’s imports and exports. Our (back-of-the-envelope) calculations indicate that the policy lowered freight rates by 6% and boosted China’s trade volume by 5%, or $144 billion annually. It is also worth noting that non-economic arguments—such as national security, military considerations, and the desire to be number one worldwide (Grossman 1990)—could be important for the design of this policy. For instance, there is some evidence that military ship production might have benefited from China’s industrial policy: military ship production is concentrated at state-owned yards with commercial ship production and increased severalfold during the same period, though this is only suggestive given limited data coverage. Political motivations aside, our analysis provides cost estimates and sheds light on the relative efficacy of implementing different policies that governments can use to guide future policies.

Editor's note: An earlier version of this article appeared on VoxEU.

References

Baldwin, R E (1969), "The Case against Infant-Industry Tariff Protection", Journal of Political Economy, 77(3): 295–305, https://www.jstor.org/stable/1828905

Barwick, P J, M Kalouptsidi, and N Zahur (2024), "Industrial Policy Implementation: Empirical Evidence from China's Shipbuilding Industry", NBER working paper 26075, July, Conditional Acceptance at Review of Economic Studies, https://drive.google.com/file/d/16c1bCrO56wvWpn73OdXI6JwujDmZYuq8/view

Greenwood, R and S G Hanson (2015), "Waves in Ship Prices and Investment", Quarterly Journal of Economics, 130(1): 55–109, https://academic.oup.com/qje/article/130/1/55/2337948

Grossman, M G (1990), "Promoting New Industrial Activities: A Survey of Recent Arguments and Evidence", OECD Economic Studies, 14(Spring), https://search.oecd.org/eco/growth/34306065.pdf

Kalouptsidi, M (2014), "Time to Build and Fluctuations in Bulk Shipping", American Economic Review, 104(2): 564–608, https://www.jstor.org/stable/42920708

Krueger, A O (1990), "Government Failures in Development", Journal of Economic Perspectives, 4(3): 9–23, https://www.aeaweb.org/articles?id=10.1257/jep.4.3.9

Rodrik, D (2010), "The Return of Industrial Policy", Project Syndicate, 12 April, https://www.project-syndicate.org/commentary/the-return-of-industrial-policy?barrier=accesspaylog

Yap, C-W and P Mozur (2013), "China Aims to Create Electronics Giants", Wall Street Journal, Jan. 22 2013, https://www.wsj.com/articles/SB10001424127887324624404578257351843112188