Increasing judicial staffing in frontline courts lowers the pending backlog of legal cases and enables capital stuck in litigation to be put to more productive uses, which increases access to working capital for local firms and improves firm productivity

In developing countries, courts are chronically underinvested in despite their importance for contract enforcement and securing property rights (Chemin 2020). This underinvestment generates large backlogs of pending cases, which results in longer times to resolution and constrains factors of production - particularly capital - stuck in litigations from being put to more productive uses. For example, the pending workload per judge in frontline district courts is ten times higher in India relative to judges in similar courts in the US.

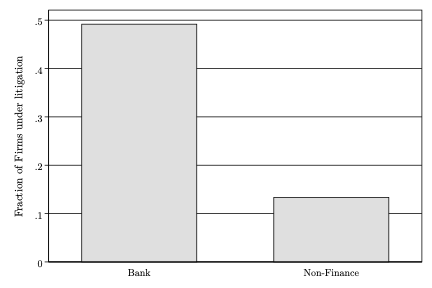

Frontline courts form the backbone of judicial organisations, which are closest to the population and manage the biggest legal caseload. Capacity constraints at this level can thus have important ramifications on effective contract enforcement, resulting in welfare loss (Ponticell and Alencar 2016). This could be thousands of dollars lent by banks to defaulting borrowers that are awaiting decrees from courts to proceed with the next steps in the recovery process, including initiating bankruptcy proceedings. Or this could be parcels of land under litigation, which no one can effectively use until the cases are resolved. As a fact, banks are among the largest class of firms engaged in litigation (see Figure 1). This suggests that courts play a fundamental role in the workflow of the financial and the banking sectors in the debt recovery process, which could be critical in developing countries with acute credit supply constraints (Visaria 2009, von Lilienfeld Toal et al. 2012).

Figure 1: Firms under litigation

Notes: The figure plots the share of litigants in commercial cases across a sample of district courts in India over 2010-2018 in Rao (2023). They are categorised as non-finance firms (i.e., manufacturing and services) or banking firms, according to their statutory industry classification. Remaining ~30% firms (not shown in figure) are non-banking financial sector firms such as insurance firms and shadow banks.

In my research (Rao 2023), I combine the timing of judge staffing changes in a large sample of district courts in India with an event study design to show that when judges are added in net to courts with vacancy, it reduces the extent of case backlog through increased resolution of cases. This generates large and rapid economic returns as local firms experience an increase in productivity and expand operations with increasing wage bills. Importantly, I estimate that the return to adding one more judge to a court with vacancy is over six times when gains are measured in terms of tax revenue and over 30 times in terms of economic gains from more productive firms.

Judicial capacity constraints in frontline courts

Staffing constraints are a key limiting factor in the effective functioning of the judiciary. Judges are central to courts’ output, and without judges, legal cases get backed up. Staff vacancies are particularly problematic in developing countries as they are “sticky”. There are multiple plausible reasons for persisting vacancies, including insufficient and frequently failed recruitment drives and a lack of budgetary support. This problem is particularly severe in India where there is less than one sanctioned judge post per 50,000 population (a ratio which gets worse with persistent vacancy), in contrast with high income economies like the US with a judge serving a population of 10,000 or less.

Typical state-level policies such as age-based retirement, frequent rotation of public officials, and addition of new staff affect judicial staffing in district-level courts. The interplay between the various central policies sometimes generates a net increase in the number of judges, but can also results in a decrease, or at times cancels out without changing the staffing levels. The timing of these changes is uncorrelated with district-level dynamics in socio-economic and political outcomes, nor are they correlated with any past trends in the functioning of the courts themselves, suggesting that these changes are plausibly exogenous shocks to local judicial capacity. Therefore, I use an event study design around the timing of such staffing changes to estimate the causal effect of increasing (or decreasing) the number of judges in frontline courts on the case backlog reduction rate (namely, disposal rate) and subsequently, on the productivity of local formal sector firms.

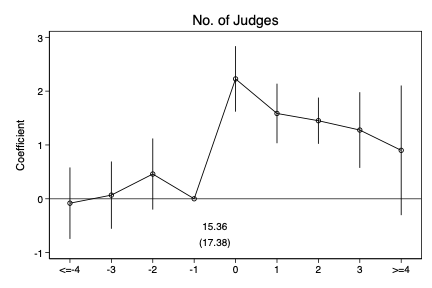

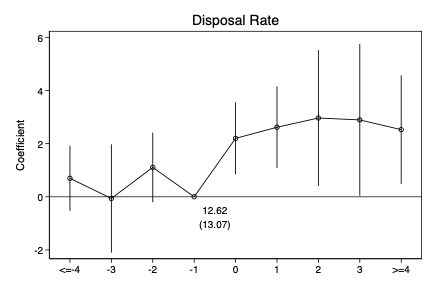

On average, courts gain two additional judges following net positive staffing changes. This increases the case disposal rate by over 2 percentage points over a low baseline disposal rate of under 13% (see Figure 2) - a disposal rate of 13% implies that only 13 out of 100 ongoing cases are resolved within a year. In terms of the number of cases resolved, each additional judge resolves 200 pending cases per year. Negative staffing changes are less lumpy and have a commensurate effect on disposal rate.

Figure 2: Staffing changes and courts

Notes: The figure demonstrates the net positive staffing events on the number of judges and judicial capacity metric - disposal rate.

Impact on the banking sector and indirect effects on local firms

Many of the cases resolved are those involving debt recovery by banks. This enables banks to recover lent capital stuck in litigation once they have a court decree. At the district level, I note an increase in total lending by banks to local industrial borrowers by over 10%, which reaches close to 20% among private sector banks.

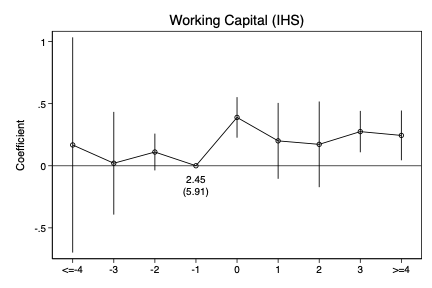

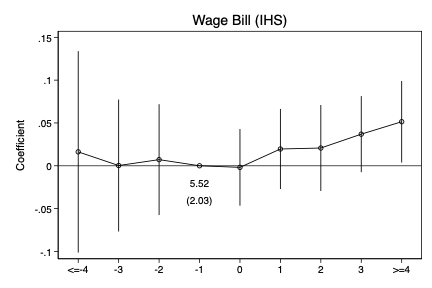

It is important to note that the effects of frontline courts are local in nature because of the legal code of procedure. Banks lend through their local branches to individuals and businesses located within their jurisdiction (Nguyen 2019) and any disputes arising from lending contracts are adjudicated in the corresponding district court. Therefore, I examine the indirect consequences of improvements in judicial capacity on local firms, which may experience an increase in their borrowing levels to finance their investments and working capital, corresponding to the increase in overall lending to industrial borrowers I found at the district-level. Indeed, working capital increases by over 30% and sustains over the long run among local formal sector firms (see Figure 3). Subsequently, such firms expand their operations with a 5% increase in their long run wage bill and over 40% increase in their profitability.

Figure 3: Judicial staffing and local firms

Notes: The figure demonstrates the net positive staffing events on local firms’ working capital and expansion of operations for productivity gains.

This story of improved capital circulation is also consistent with any standard lending model that ties lender incentives to borrower wealth (as collateral) and the quality of the contract enforcement environment. In addition to increases in overall lending and firm productivity on average, I also document increased lending to smaller, less frequent borrowers (as measured by their ex-ante leverage), who also experience productivity gains.

Implications for economic policy

My research shows that improving the functioning of frontline courts improves local credit markets and makes them more efficient. However, this could plausibly be driven by liquidity implications at the local level through the recovery of frozen capital stuck in litigation rather than a general increase in credit supply in the larger economy. Furthermore, it is likely that substantial changes to the functioning and efficiency of judicial organisation could have macroeconomic implications, which remains an open question for future research.

This study has important implications for policy. A plausible reason for chronic underinvestment in the judiciary could be a misalignment in the incentives of the executive, who may incorrectly believe that the returns from augmenting judicial capacity would only accrue over a longer timescale and not within an electoral cycle. I show that the returns to adding an additional judge to a court experiencing vacancy is large (6x or 30x depending on measuring the return in terms of tax dollars or social welfare gains) and rapid, occurring within an electoral timescale.

This research highlights the importance of judiciary as a key tool for economic development, calling for additional research on this topic to assess the policy implications of various aspects of the judicial organisation and workflow.

Editor’s note: This research appeared on STEG’s Working Paper series here.

References

Chemin, M (2020), “Judicial Efficiency and Firm Productivity: Evidence from a World Database of Judicial Reforms.” The Review of Economics and Statistics, 102(1): 49–64.

Lilienfeld-Toal, U V, D Mookherjee, and S Visaria (2012), “THE DISTRIBUTIVE IMPACT OF REFORMS IN CREDIT ENFORCEMENT: EVIDENCE FROM INDIAN DEBT RECOVERY TRIBUNALS.” Econometrica, 80(2): 497–558.

Nguyen, H-L Q (2019), “Are Credit Markets Still Local? Evidence from Bank Branch Closings.” American Economic Journal: Applied Economics, 11(1): 1–32.

Ponticelli, J, and L S Alencar (2016), “Court Enforcement, Bank Loans, and Firm Investment: Evidence from a Bankruptcy Reform in Brazil.” The Quarterly Journal of Economics, 131(3): 1365–1413. https://doi.org/10.1093/qje/qjw015.

Rao, M (2023), “Front-Line Courts As State Capacity: Evidence from India.” Working Paper available here: https://manaswinirao.com/files/rao_courts.pdf

Visaria, S (2009), “Legal Reform and Loan Repayment: The Microeconomic Impact of Debt Recovery Tribunals in India.” American Economic Journal: Applied Economics, 1(3): 59–81.