Health insurance for families in Nicaragua had a positive impact on parents and their insured younger children, but not on uninsured older children

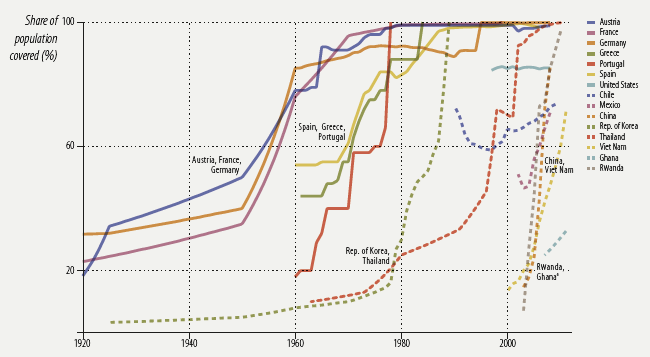

Health insurance can help families prevent catastrophic healthcare expenses (Finkelstein et al. 2012, Gross and Notowidigdo 2011, Mazmuder and Miller 2016), improve healthcare access (Sommers et al. 2013, Sommers et al. 2015), and ultimately improve health (Currie and Gruber 1996, Goodman-Bacon 2016, Sommers et al. 2012). Over several decades, the proportion of the global population with health insurance coverage has dramatically increased, particularly in low- and middle-income countries (Figure 1).

Figure 1 Evolution of health insurance coverage in selected countries

Source: Figure 4.2 in Malik (2014).

The benefits may be particularly large for children, as investments in healthcare accumulate over time (Cunha et al. 2010). Yet there has been limited research into the effects of health insurance for children or families. This is partly due to the difficulty of getting the right data from which to estimate the benefits.

The effect of voluntary health insurance is difficult to evaluate because sicker people disproportionately enrol in insurance (Akerlof 1970, Arrow 1985). As a result, comparing outcomes – such as the number of doctor’s visits or out-of-pocket costs – between people who are insured and those who are not is likely to misrepresent the actual effectiveness of insurance.

One way to resolve this is to offer health insurance to a randomly selected group of people. Since those offered insurance will have the same underlying characteristics as those not offered insurance, researchers can accurately measure the effects of the health insurance without confounding the analysis with additional biases. But there have been a limited number of these randomised trials to study the effects of health insurance, and almost all of them have focused exclusively on understanding the benefits for adults.

Recently we analysed the first randomised study in a developing country that evaluates the effect of parental health insurance on the health of their children (Fitzpatrick and Thornton, forthcoming).

A family matter

Because families have shared budget and time constraints, when only some family members are insured, there may be indirect effects on the rest of the family. Some of these could be positive, some negative. For example:

- When uninsured family members live with insured (and hence, healthier) family members, they may also become healthier.

- Families that save on out-of-pocket expenses for insured household members might have more funds available for family members who are not sick.

- Alternatively, families may choose to decrease expenditure on uninsured members, because their healthcare would be relatively more expensive.

- There may also be economies of scale for travel or time costs that make it more or less costly to take uninsured family members to a doctor.

This led us to ask how families reallocate resources when only some members were insured.

A health insurance experiment

We studied the pilot of a voluntary health insurance program in Nicaragua. Citizens who work in formal employment are automatically enrolled in the Nicaraguan Social Security Institute’s health insurance programme. The programme offers preventative, diagnostic, and curative health services to those enrolled that they can use at covered health providers. In Nicaragua these are known as Empresas Médicas Previsionales. There is also a large population of unemployed, self-employed, or informal-sector workers, however, who are uninsured. They can use free public clinics, but in practice these clinics can be overcrowded, underfunded, and offer lower-quality care. It is common for many in the informal sector to self-medicate at pharmacies. Many must manage without care entirely.

In January 2007, the Nicaraguan government piloted a programme that gave informal sector workers the opportunity to buy government health insurance. Under the programme rules, children under the age of 12 were fully covered for paediatric care, but children over age 12 were not eligible.

To study the effects of this programme, we interviewed uninsured, informal-sector workers in Managua, Nicaragua. The survey asked detailed information about healthcare for the respondent, plus members of the family aged 16 and under. At the end of the survey, respondents opened a sealed envelope that contained an informational brochure about the health insurance product. Half of them were offered six months of free health insurance, which was worth about $100.

Working with the government social security office, we were able to measure whether the study participants signed up for the health insurance programme. One year later, we returned and asked questions about how they used healthcare and how much they spent on it, for themselves and their children.

Our study included more than 1,600 informal workers with children aged 15 or under. In total, we analysed the effects for almost 3,000 children.

First, we looked at health outcomes for children under 12, comparing these children in families that were offered free health insurance with the same aged children in families that were not offered the free insurance. This measured the direct effects of insurance on children who were eligible.

Then, to measure the effects of partial insurance on uninsured children, we compared children between 12 and 15 who were not eligible for the insurance in families that received the offer for free insurance with children of the same age in families that did not.

Health insurance subsidies were important for increasing enrolment

Parents chose to enrol, but only at a heavily subsidised price. With the six-month subsidy, 35% of parents chose to enrol, compared to 2% of the parents who were not offered a subsidy. These rates may seem low, but they are comparable to similar studies of voluntary health insurance programs for low-income populations. In Kenya a study found enrolment rates of only 17-40%, depending on subsidy levels (Chemin 2014); one in Cambodia 47% enrolment (Levine et al. 2016). In the US, offering low-income adults Medicaid health insurance increased enrolment by only 25 percentage points (Finkelstein et al. 2012).

Health insurance helped covered adults and children

Among the insured, utilisation increased, as we would expect. Insured parents were 41 percentage points more likely to attend a covered provider. At the same time, they were 14 percentage points less likely to attend a public health facility (Thornton et al. 2010).

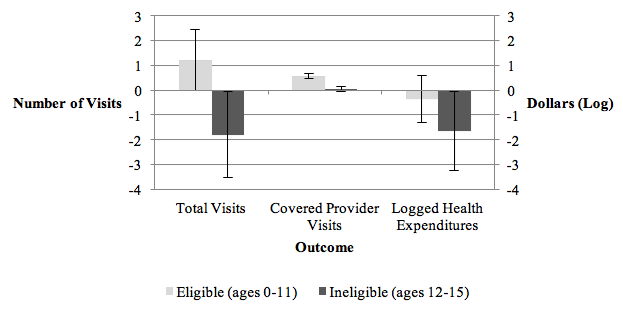

We also saw large effects on eligible children (recall, those aged 12 and under). Those with insured parents were 22.6 percentage points more likely to visit a covered provider, and had 0.56 more visits at covered providers. But unlike the adults, we did not observe substitution away from other providers. Insured children increased overall healthcare utilisation substantially. Compared to similar children in uninsured families, insured children made 1.2 more visits to all healthcare providers combined, a 36% increase. We found no conclusive evidence that insurance had lowered out-of-pocket expenditures for these children (Figure 2).

Figure 2 Impact of household health insurance on children, by eligibility

Source: Fitzpatrick and Thornton, forthcoming.

Uninsured children received less care when other family members were insured

We also found that uninsured children (aged 12 or over) in insured families used substantially less healthcare. Uninsured children in insured families reported 1.8 fewer visits at all providers, mainly driven by fewer visits to non-covered private providers. There was also an 81% decrease in out-of-pocket health expenditures for these children.

Using existing results to inform more effective policies

There are several lessons from this study:

- Enrolment into voluntary health insurance may be low. If it is a priority to increase take-up, policymakers may need to use subsidies. In a recent working paper (Fitzpatrick and Thorton 2017) we outlined the evidence that more convenient enrolment strategies can be cost-effective. We find that allowing respondents to enrol at their place of business is nearly as effective as a six-month subsidy.

- More investments are needed in adequate access to healthcare for children. Children in the study who were insured increased their total healthcare utilization. They did not substitute from uncovered to covered providers. This suggests a potential unmet need for healthcare among uninsured children, and we know that early investments in children’s healthcare pay dividends in the long run.

- When some members are insured the healthcare utilisation of all members may be affected. Family members share resources, and our study indicates that the impact of health insurance programmes may not be limited to those who have coverage. Health insurance may spill over to other family members, although it may increase or decrease the utilisation of uncovered members.

References

Arrow, K (1985), "The economics of agency", in J Pratt and R Zeckhauser (eds), Principals and agents: The structure of business, Harvard Business School Press.

Chemin, M (2014), “Using Informal Risk-Sharing Groups to Extend Formal Health Insurance: Evidence from a Field Experiment”, mimeo.

Cunha, F, J J Heckman and S M Schennach (2010), "Estimating the technology of cognitive and noncognitive skill formation", Econometrica 78(3): 883-931.

Currie, J and J Gruber (1996), “Health Insurance Eligibility, Utilization of Medical Care, and Child Health”, Quarterly Journal of Economics 111: 431–466.

Finkelstein, A, S Taubman, B Wright, M Bernstein, J Gruber, J P Newhouse, H Allen, K Baicker, Oregon Health Study Group (2012), "The Oregon health insurance experiment: evidence from the first year", The Quarterly Journal of Economics 127(3): 1057-1106.

Fitzpatrick, A and R Thornton (forthcoming), “The Effects of Health Insurance Within Families: Experimental Evidence from Nicaragua”, World Bank Economic Review.

Goodman-Bacon, A (2016), “The Long-Run Effects of Childhood Insurance Coverage: Medicaid Implementation, Adult Health, and Labor Market Outcomes”, NBER Working Paper No. w22899.

Gross, T and M J Notowidigdo (2011), "Health insurance and the consumer bankruptcy decision: Evidence from expansions of Medicaid", Journal of Public Economics 95(7): 767-778.

Levine, D, R Polimeni, and I Ramage (2016), “Insuring Health or Insuring Wealth? An Experimental Evaluation of Health Insurance in Rural Cambodia”, Journal of Development Economics 119: 1-15.

Malik, K (2014), Human development report 2014: Sustaining human progress: Reducing vulnerabilities and building resilience, United Nations Development Programme.

Mazumder, B and S Miller (2016), "The effects of the Massachusetts health reform on household financial distress", American Economic Journal: Economic Policy 8(3): 284-313.

Thornton, R, L Hatt, E Field, M Islam, F S Diaz and M A Gonzalez (2010), “Social Security Health Insurance for the Informal Sector in Nicaragua: A Randomized Evaluation”, Health Economics 19 181-206.

Sommers, B D, T Buchmueller, S L Decker, C Carey, and R Kronick (2013), "The Affordable Care Act has led to significant gains in health insurance and access to care for young adults", Health Affairs 32(1): 165-174.

Sommers B D, M Z Gunja, K Finegold and T Musco (2015), "Changes in self-reported insurance coverage, access to care, and health under the Affordable Care Act", Jama 314(4): 366-374.

Sommers, B D, K Baicker, and A M Epstein (2012), "Mortality and access to care among adults after state Medicaid expansions", New England Journal of Medicine 367(11): 1025-1034.