Timely information brought about by communication infrastructure enables risk-sharing across regions

Wild price fluctuations are a prominent feature of agricultural markets because of their relatively inelastic demand and (short-run) supply and substantial production risk. As a result, governments and international organisations have long sought to tame extreme food prices – especially for staple food items like grains – as an important policy goal. A growing body of empirical work has documented the possible severe consequences of extreme food prices, including social unrest, political turmoil, malnutrition of vulnerable populations and high mortality rates (e.g. Burgess and Donaldson 2010, Arezki and Bruckner 2011, Kudamatsu et al. 2012, Kung and Ma 2014, Bellemare 2015). It suggests that the difficulty of coping with extremely high food prices could create substantial and potentially irreversible welfare losses for poor households and regions. At the same time, another strand of literature shows that a fall in communication times resulting from major improvements in communication infrastructure, such as mobile phones and the telegraph, can facilitate cross-market integration and increase trade volumes (Jensen 2007, Aker 2010, Allen 2014, Steinwender 2018). However, discussions on the impact of reduction of information frictions on price variability are conspicuous by their absence. In our recent study (Gao and Lei 2021), we attempt to address this gap in the literature and examine whether access to timely information reduces grain price variability.

Our study: Exploiting a setting in history

We consider an unusual historical setting – the expansion of the telegraph network in late 19th century China, when railroads were limited – to empirically examine how the reduction of information frictions affects grain price variability. The telegraph network in 19th century China provides an ideal setting for a number of reasons:

- The introduction of the telegraph revolutionised long-distance communication by allowing people to exchange information at once, which represented a substantial reduction in information frictions.

- Disentangling the effects of information frictions from those of transportation costs is very difficult if we are looking at the placement of telegraph poles, as telegraph systems were often built along railroads. The telegraph network in 19th century China was unique because it expanded quickly across the country before many regions were connected by railroads. This time window provides us with an ideal experimental setting in which communication time was markedly reduced for regions that adopted the telegraph, while transportation costs remained relatively fixed. Furthermore, one natural concern when estimating the effect of adopting new technology is that the project's location is usually associated with economic factors. However, these concerns are less important in China, where military and political motives for telegraph placements usually trumped market needs, and the timing of telegraph connection was therefore unforeseen.

- The vast telegraph network in China also provides substantial heterogeneities between regions, which allows us to better understand the impact of a reduction in communication time under different conditions.

Telegraph connection stabilises food prices

We explore the roll-out of the telegraph network between 1870 and 1904. By comparing telegraph-connected regions to those not connected, we find that the telegraph, by allowing the immediate exchange of information, strongly attenuated both the magnitudes and the incidence of extreme prices. According to our preferred specification, telegraph access leads to a reduction in maximum rice prices by about 4% of its mean. It also lowers the average likelihood of the occurrence of rice price spikes from 1.8% to 1.2%.

In Figure 1, we present the differences in maximum rice prices between telegraph-connected regions and regions with no telegraph connection over three years. It shows that the downward shifting of the maximum price occurred immediately after the telegraph arrived and finished within one year. Such a sharp decline in price surges is key as it suggests that our results are not driven by slow-moving confounding factors, such as rising population or improvement in institutions. Importantly, we also show that the effect of the telegraph depends on the scale of the network, meaning that the attenuating effect of the telegraph rises when more regions with relatively lower prices are connected to the network.

Figure 1 The impact of telegraph connection on extreme rice price over time

Notes: The figure shows the differences in maximum prices of high-quality rice between telegraph-connected regions and regions with no telegraph connection over three years: 12 months before, 12 months during, and 12 months after the year the telegraph was adopted. Our reference group is the December preceding the telegraph-adopted year. The circles give the estimated coefficients normalised by the mean of the December prior to the telegraph-adopted year, and the vertical lines indicate the 95% confidence interval.

Telegraph connection enables risk-sharing across regions

In theory, there are two opposing mechanisms behind the telegraph’s mitigating effect on price surges: telegraph access could mitigate the responsiveness of prices to local shocks, but it also exposes local markets to external shocks. To empirically test the two underlying mechanisms, we utilise extreme weather events (such as floods and droughts) as observable and region-specific productivity shocks to separate local and external productivity shocks. In doing so, we are able to show an interesting pattern in that the extremely high prices induced by local weather shocks can be mitigated by telegraph access, while telegraph connection also made local prices more responsive to shocks that occurred in other telegraph-connected regions. Taking these two results together, the findings indicate that access to timely information, brought about by the telegraph, could enable risk-sharing across connected markets by spreading the impact of a negative event to a wider region.

Telegraph connection’s effect on price volatility

If access to timely information enables risk-sharing across regions, then telegraph access would mitigate price variability in regions with a high extent of risk, while simultaneously amplifying price reactions in previously price-stable regions. We use weather-induced price volatility to proxy for the extent of risk for a market, because price volatility reflects market responses to both the size and frequency of production shocks.

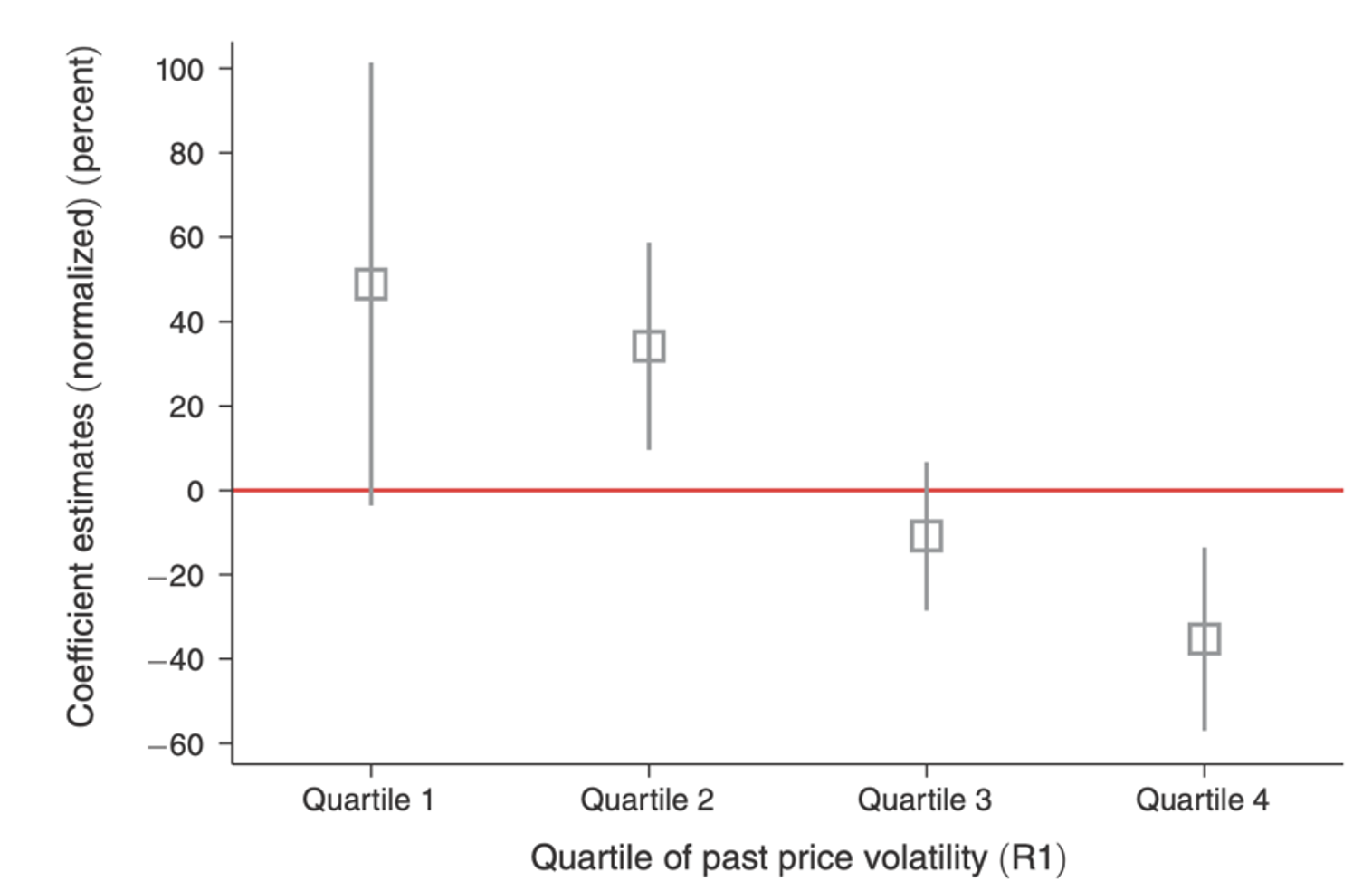

A mean-reverting pattern arises when looking at the effect of telegraph connection on price volatility. In regions with higher historical price volatility, the mitigating effect of the telegraph on local shocks dominated, resulting in a fall in price volatility. In contrast, in regions with lower historical price volatility, the amplifying effect of the telegraph on external shocks dominated, and therefore price volatility increased. To further illustrate this pattern, we divide regions into four groups based on pre-telegraph price volatility, as seen in Figure 2. The results show that the effect of the telegraph falls with an increase in the pre-telegraph volatility, from positive to negative, which indicates a strong mean-reverting effect on price volatility.

Figure 2 The telegraph’s effect on price volatility: Price-stable regions versus volatile regions

Notes: The figure presents the mean-reverting effect of the telegraph on price volatility. It shows the results of high-quality rice. We divide all regions into four quartiles based on pre-telegraph price volatility. Quartile 1 refers to regions with the lowest pre-telegraph price volatility, while quartile 4 contains those with the highest pre-telegraph price volatility. The squares give the estimated coefficients normalised by the mean of the pre-telegraph price volatility for each quartile. The vertical line indicates the 95% confidence interval.

Information frictions and transportation costs

We also explore whether the fall in information frictions brought about by telegraph connection depends on transportation cost. We find it is only when transportation costs, proxied by navigable river density, are sufficiently low that the gains from the price arbitrage could make up for the transportation costs, and the effect of telegraph access would be realised. In short, the effect of the telegraph on attenuating extreme price falls with transportations costs.

Implications

These findings could open up further discussions on the welfare implications of both price stabilisation and communications infrastructure investment. The overall gains from the fall in information frictions are well-studied by a burgeoning body of work (e.g. Allen 2014, Steinwender 2018), but the unequal gains amongst regions with different characteristics remain unclear. To fully understand this question, further studies with detailed data on income and trade volume are needed.

References

Aker, J C (2010), “Information from Markets Near and Far: Mobile Phones and Agricultural Markets in Niger”, American Economic Journal: Applied Economics 2(3): 46–59.

Allen, T (2014), “Information Frictions in Trade”, Econometrica 82(6): 2041–83.

Arezki, R and M Brückner (2011), “Food Prices and Political Instability”, IMFWorking Paper WP/11/62.

Bellemare, M F (2015), “Rising Food Prices, Food Price Volatility, and Social Unrest”, American Journal of Agricultural Economics 97(1): 1–21.

Burgess, R and D Donaldson (2010), “Can openness mitigate the effects of weather shocks? Evidence from India’s famine era”, American Economic Review 100(2): 449–53.

Gao, P and Y Lei (2021), "Communication infrastructure and stabilizing food prices: Evidence from the Telegraph Network in China", American Economic Journal: Applied Economics 13(3): 65-101.

Jensen, R (2007), “The Digital Provide: Information (Technology), Market Performance, and Welfare in the South Indian Fisheries Sector”, Quarterly Journal of Economics 122(3): 879–924.

Kudamatsu, M, T Persson and D Strömberg (2012), “Weather and infant mortality in Africa”.

Kung, J K and C Ma (2014), “Can cultural norms reduce conflicts? Confucianism and peasant rebellions in Qing China”, Journal of Development Economics 111: 132–49.

Steinwender, C (2018), “Real effects of information frictions: when the states and the kingdom became united”, American Economic Review 108(3): 657–96.