Volatility of commodity prices is a key driver of the likelihood of banking crises in low-income countries

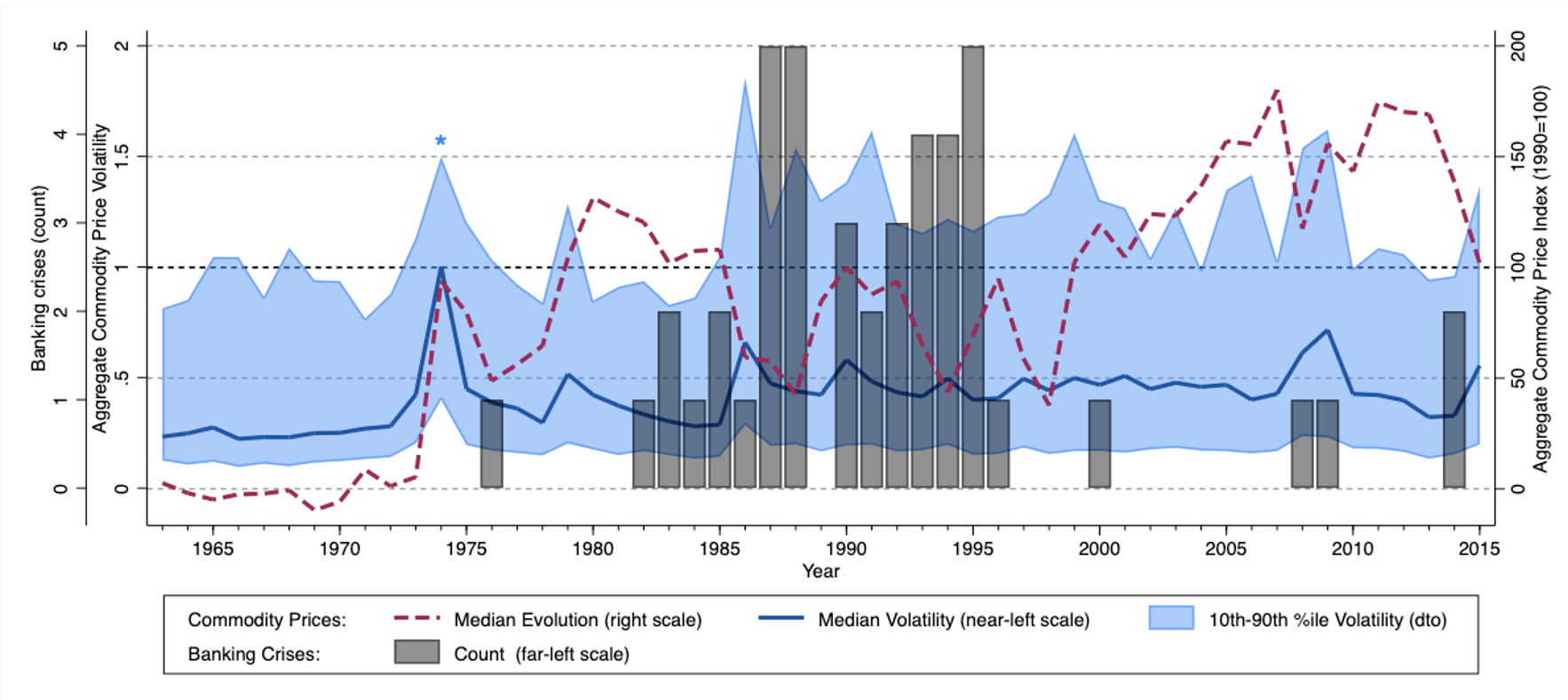

After a period of widespread financial instability in the 1980s and 1990s, mostly concentrated among commodity exporters, only a handful of developing countries have been hit by systemic banking crises over the past two decades. Several factors have contributed to this state of affairs, including an extended period of sustained economic growth, financial deepening, and favourable external conditions, most notably a protracted period of stable and high commodity prices. Figure 1 shows that banking crises in low-income countries are clustered between the late 1980s and the early 1990s, when commodity prices declined and volatility increased, especially at the high end of the distribution. By contrast, crises have been almost absent in the 2000s, in correspondence with the commodity super-cycle. But since ‘graduation’ from banking crises has so far proven elusive (Reinhart et al. 2010), when the commodity super-cycle came to an end in the mid-2010s, bank profitability and asset quality declined in an ever-increasing number of developing countries. The recent increase in government arrears in several Sub-Saharan countries, due to the need to finance Covid-19 relief packages, may worsen the situation and increase the likelihood of triggering a banking crisis (Bosio et al. 2021).

Figure 1 Banking crises and aggregate commodity prices, 1963–2015

Notes: N = 60 economies for the 1963–2015 period. Banking crisis frequency is highlighted with grey bars (far-left scale). We add the median for Aggregate Commodity Price evolution (index, 1990 = 100; right scale) in red, and the median Aggregate Commodity Price Volatility (within-country volatility derived from commodity price growth via GARCH as described in the text; near-left scale) in dark blue, as well as the 10th to 90th percentile range for this variable (light blue shading, near-left scale). For ease of illustration, we curtail the 90th percentile volatility in 1974 (effect of the first oil crisis) to half of what it really was.

Commodity prices and financial sector stability

In a recent paper (Eberhardt and Presbitero 2021), we focus on the role of commodity prices in driving financial sector distress in low-income countries, where commodity prices are one of the most important factors driving economic aggregates (Schmitt-Grohe and Uribe 2015). Since the 1960s, global shocks to commodity prices account for about one quarter of output fluctuations in low-income countries (Fernandez et al. 2017). The macro literature also shows that the volatility of commodity prices – more than their growth – matters for output fluctuations (Blattman et al. 2007, Williamson 2012). Consistent with this argument, Figure 2 shows that two thirds of banking crises, spread across low-income countries at different income levels, happened when commodity price volatility was higher than its short-run average.

Figure 2 Banking crises and aggregate commodity price volatility

Notes: In this plot we relate banking crises to Aggregate Commodity Price (ACP) Volatility on the y-axis and log per capita GDP on the x-axis. 67% of all banking crises in our sample occur after volatility is high relative to its moving average: these are the scatter plot markers in orange; 33% occur when this volatility is relatively low: these are the markers in blue. Since the y-axis is in logs, a value of 0.5 equates to around 65% higher relative volatility.

Commodity price fluctuations could also have real effects through a financial channel, as they affect banks’ balance sheets and financial stability (Cespedes and Velasco 2012, Agarwal et al. 2017). Caprio and Klingebiel (1996a, 1996b) extensively document a number of banking crises in the 1980s and early 1990s and show that volatile terms of trade are associated with systemic crises, especially in countries with a concentrated export base. For instance, the 1988 crisis in Benin was triggered by declining and volatile terms of trade, which impinged on the financial situation of several state-owned enterprises (SOEs) and, as a result, led to liquidity and solvency problems for banks exposed to SOEs. Commodity price shocks also played a key role in Bolivia (1986), Cote d’Ivoire (1988), Kenya (1985), and Senegal (1988), among others, as well as in banking crises in the early 20th century.

Terms of trade fluctuations could lead to financial instability and crises through different channels. First, large variations in prices increase asymmetric information and make it more difficult to select good from bad borrowers. Second, a sharp drop in prices translates into reduced revenues for exporting firms, which find it more difficult to service their debt obligations, with potential negative effects on bank asset quality. Similarly, the drop in commodity prices can put pressure on the public sector, which could start running arrears to supplier and contractors, triggering second round effects on banks’ balance sheets (Bosio et al. 2021). In addition, a reduction in government revenues could incentivise the issuance of public debt and result in an increase of banks’ exposure to sovereign risk through government interference and moral suasion (Ongena et al. 2016). Finally, to the extent that a negative shock induces a surge in deposit withdrawals (also from the government to finance budget deficits), declining commodity prices could impact bank funding and liquidity.

Drivers of banking crises

Consistent with this literature, our baseline results indicate that the volatility of commodity prices is a key driver of the likelihood of banking crises in low-income countries: A one standard deviation increase in the volatility of country-specific commodity prices is associated with a 2.5 percentage point increase in the probability of a crisis – a substantial effect given the unconditional crisis propensity is around 1.8%.

By contrast, private credit growth and net capital inflows, the leading indicators for banking crises in advanced and emerging economies (Taylor and Schularick 2009, Reinhart and Rogoff 2013, Jorda et al. 2015), are not robust predictors of banking crises in low-income countries. We rationalise these results pointing to different structural characteristics of low-income countries, where the relatively limited size of the financial sector and an ongoing process of financial deepening are likely to minimise the incidence of boom-and-bust episodes. Moreover, low-income countries have traditionally relied on official financing, which is generally directed to government and less likely to be intermediated by the banking system. However, this does not imply that private credit and capital inflows can be ignored moving forward, as frontier economies with access to international capital markets and with more developed financial markets could also run into the boom-and-bust episodes leading to banking crises.

Similar results hold in a sample of 40 ‘peripheral’ countries – commodity-dependent price-takers – between 1848 and 1938, providing evidence of an additional financial channel through which commodity price volatility has played an important role and is driving the divergence in income levels between the world’s ‘core’ and the ‘periphery’ (Blattman et al. 2007).

Channels of transmission

The effect of commodity price volatility on the probability of banking crises is concentrated in countries with a dominant primary sector of production and in those with a fixed exchange rate regime or a hard peg. In addition, we provide evidence for a fiscal channel of transmission of commodity prices to financial stability: Higher commodity price volatility is associated with lower fiscal revenues, which could affect banks’ balance sheets through weaker financials of public companies. Consistent with a fall in revenues, we observe a significant increase in external public debt alongside a reduction in debt maturity, suggesting that commodity price volatility increases uncertainty and hinders the capacity of long-term sovereign borrowing, potentially increasing the banks' exposure to sovereign risk through the holding of short-term government debt.

Looking ahead

Vulnerability to commodity prices is a pressing issue for many developing countries. In this respect, the sharp decline in commodity prices and their increased volatility after 2014 have already translated into worsening bank balance sheets and episodes of distress. In this environment, the Covid-19 pandemic crisis could put further pressure on the financial systems of developing countries through worsening fiscal conditions and heightened uncertainty and volatility in financial and commodity markets.

Editors' note: This column first appeared on VoxEU.

References

Agarwal, I, R Duttagupta and A F Presbitero (2020), “Commodity Prices and Bank Lending”, Economic Inquiry 58(2):953–979.

Blattman, C, J Hwang and J G Williamson (2007), “Winners and losers in the commodity lottery: The impact of terms of trade growth and volatility in the Periphery 1870–1939”, Journal of Development Economics 82(1):156–179.

Bosio, E, R Ramalho and C M Reinhart (2021), “The invisible burden: How arrears could unleash a banking crisis”, VoxEU.org, 22 March.

Caprio, G and D Klingebiel (1996a), “Bank Insolvencies: Cross-Country Experience”, Policy Research Working Paper 1620, The World Bank, Washington DC.

Caprio, G J and D Klingebiel (1996b), “Bank Insolvency: Bad Luck, Bad Policy, or Bad Banking”, In M Bruno and B Pleskovic (eds.), Annual World Bank Conference on Development Economics, The World Bank, Washington DC.

Cespedes, L F and A Velasco (2012), “Macroeconomic Performance During Commodity Price Booms and Busts”, IMF Economic Review 60(4):570–599.

Eberhardt, M and A F Presbitero (2021), “Commodity prices and banking crises”, Journal of International Economics, in press.

Fernandez, A, S Schmitt-Grohe and M Uribe (2017), “World shocks, world prices, and business cycles: An empirical investigation”, Journal of International Economics 108(1): S2-S14.

Fernandez-Villaverde, J, P Guerron-Quintana, J F Rubio-Ramirez and M Uribe (2011), “Risk Matters: The Real Effects of Volatility Shocks”, American Economic Review 101(6): 2530–2561.

Jordà, O, M Schularick and A M Taylor (2015), “Leveraged bubbles”, VoxEU.org, 01 September.

Ongena, S, A Popov and N van Horen (2016), “Moral suasion and bond buying in the Eurozone Crisis”, VoxEU.org, 17 March.

Reinhart, C M and K S Rogoff (2013), “Banking crises: An equal opportunity menace”, Journal of Banking & Finance 37(11): 4557–4573.

Reinhart, C M, K S Rogoff and R Qian (2010), “Do countries ‘graduate’ from crises? Some historical perspective”, VoxEU.org, 31 August.

Schmitt-Grohe, S and M Uribe (2015), “How important are terms-of-trade shocks?”, VoxEU.org, 20 July.

Taylor, A M and M Schularick (2009), “Credit booms go wrong”, VoxEU.org, 08 December.

Williamson, J G (2012), “Commodity Prices over Two Centuries: Trends, Volatility, and Impact”, Annual Review of Resource Economics 4(1):185–206.