Port infrastructure improvements may have higher economic returns than road improvements but have different regional implications

Many governments seek to boost exports and increase integration into the world economy. However, there is no consensus as to which part of the infrastructure network constitutes the main barrier to external and internal integration. Roads (Cosar et al. 2021, Faber 2014, Fan et al. 2021), rail (Donaldson 2018, Fenske et al. 2021) and to a lesser extent ports (Ducruet et al. 2020) have all been studied, but not jointly.

In a new study (Bonadio 2022), I address this issue by asking the following question: which part of the infrastructure network, ports or roads-to-port, is limiting international market access, and what are the regional implications of different types of infrastructure improvements? I provide a model to evaluate returns to road and port improvements in a unified framework. I then use novel firm-level data from India to estimate parameters and perform counterfactual exercises. These simulations show that port improvements have a larger potential for market access expansion than roads in India.

India is an ideal setting to study this question

I study the case of India, a developing nation with a long coastline, numerous ports, and a large road network. In India, less than a third of the national highway network has two lanes per direction. Ports also perform worse than the rest of the world, with an average turnaround time of 2.2 days, compared to a world average of 1.7 (World Bank 2013). India is thus an ideal candidate to study the relative benefits of ports or roads improvements.

Patterns of port use by Indian exporters

I create a novel firm-level dataset of around 11,400 Indian exporters merging information on the exporter’s location, the port of exit, and the country of destination, to document two novel stylized facts about port usage by exporting firms. I focus on containerised trade to focus my comparison on similar ports.

- Firms don’t necessarily use the closest port to their location or to their destination. This implies that firms might be willing to incur additional internal transport cost to reach a better port. This indicates that there is a tradeoff between origin-to-port cost, the cost at the port itself and port-to-destination cost.

- Comparable firms in the same origin district and same sector use different ports to export to the same destination. These patterns suggest that port choices are driven by both common and idiosyncratic factors.

Quantitative model of trade with port choice

I construct a model of international and intranational trade, where exporting firms make a choice on which port to export from. Firms face a three-part cost of serving international markets: the cost of shipping from their home district to the port by road, a transshipment cost at the port and a cost from the port to the foreign destination. In the model, internal trade uses roads. To rationalize the empirical observation that firms in the same district and sector exporting to the same destination use different ports, I subject exporters to idiosyncratic port taste shocks and then show how to solve the model.

Novel methodology to jointly estimate road costs and port quality

To estimate port quality, I use a regression to calculate the share of firms that use a particular port, among firms located in the same district and exporting to the same destination, while controlling for origin-to-port costs and port-to-destination costs. This involves using port fixed effects which are related to their quality: if firms are more likely to use a port after controlling for the origin-to-port and port-to-destination costs, it implies that the port has a lower transshipment cost.

In that regression, parametrising the origin-port cost as a function of distance travelled on normal road vs expressway also allows me to also estimate the differential cost of shipping on the different types of roads. I estimate that the cost of a kilometer on a normal road is around 20% higher than on an expressway.

There is a large heterogeneity in port quality and regional patterns

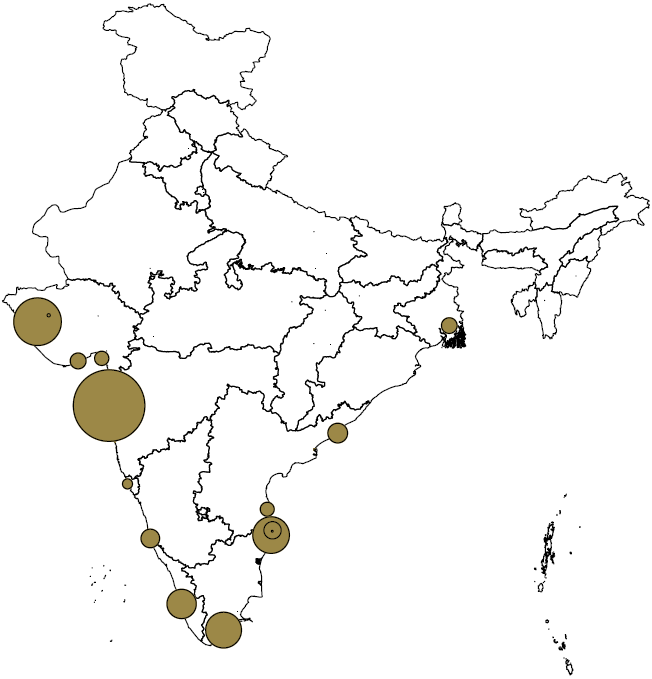

The quality variation across ports is economically large. Improving a port by one standard deviation decreases transshipment trade costs at this port by 15%. Figure 1 displays the ports on a map of India, where each dot represents a port and the dot’s size is proportional to quality (i.e. wider dots represent better ports). It is clear that the geographical distribution of port quality is not balanced.

Figure 1: Estimated port quality of Indian ports

Improving ports has a larger impact than roads on international market access and welfare

I calibrate my model to 636 Indian districts, 56 countries and 16 ports, and conduct three simulations to study the relative importance of roads vs. ports infrastructure improvements. Specifically, I use the model to simulate what would happen:

- if all ports had the same quality as the best port;

- if the origin-to-port costs were as if all roads were expressways;

- if not only origin-to-port costs, but also district-district internal trade costs, were as if all roads were expressways.

The first scenario captures gains from port improvement. The second scenario captures gains from improving the road component of international market access, abstracting away from effects on internal trade. The third scenario captures total gains of road improvement.

In the first scenario, the export share of GDP increases by around 3.1%, from a baseline average of 7.1%. The change in export share is an order of magnitude smaller in scenario 2. This indicates that bringing all ports to the quality frontier has a larger potential for increasing international market access than roads.

Turning to welfare, Indian real wages increase by about 1% when ports are improved. This is an order of magnitude higher than when roads-to-ports are improved (0.1%). In the third scenario, when internal trade costs are also reduced as a result of road improvement, the average welfare gain of road improvement increases to around 0.6% but remains lower than the impact of port improvement. Hence, even taking into account the road improvements’ impact on internal trade, port improvement still produces higher aggregate welfare gains.

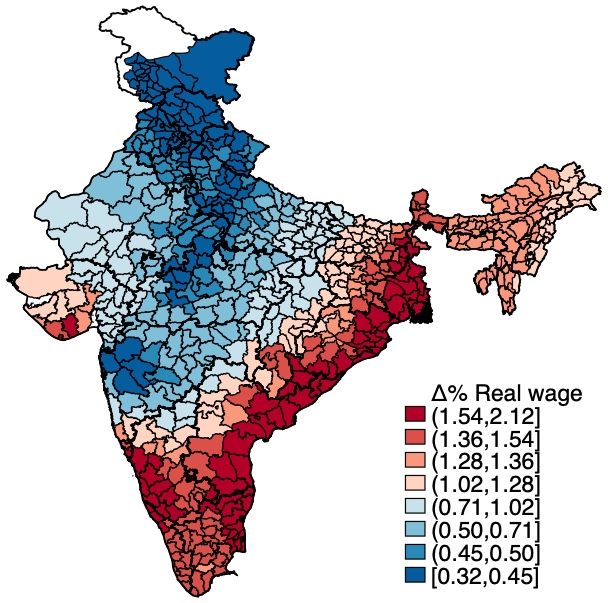

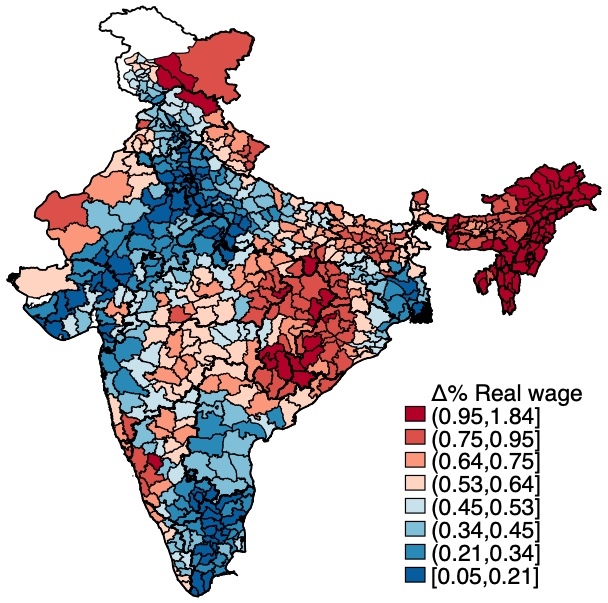

Regional distributional consequences are different

The two types of infrastructure improvement have different regional implications. Figure 2 displays the district-level wage changes under scenarios 1 and 3: when all ports improve to the best level, and when all roads are changed to expressways. Port improvements lower export costs the most and tend to favour coastal regions because they are more export-oriented. On the other hand, road improvements favour domestically oriented regions, which are predominantly inland regions not connected to the expressway network.

Figure 2: District-level results with port improvements (Panel A) vs road improvements (Panel B)

What about cost-benefit?

It could be that while improving ports has larger welfare benefits, this policy also has larger costs. In the paper, I provide back of the envelope estimates of the cost of the simulated scenarios to show that they are of similar magnitude. Simulations using marginal improvements in ports or roads rather than the broad counterfactuals presented above also show that port improvements have larger returns on investments.

Policy implications

Overall, the simulations imply that potential port improvements would be an order of magnitude more important than road improvements in terms of international market access and welfare in India. However, since the distributional impacts are different, policymakers might find a combination useful to balance the effect of infrastructure improvements across regions. Furthermore, the regional heterogeneity in port quality could also motivate targeted port improvements to benefit specific regions. Of course, these conclusions are only valid for the current Indian infrastructure environment, but this framework could be applied to other settings as well.

References

Asturias, J, M García-Santana, R Ramos (2019) “Competition and the Welfare Gains from Transportation Infrastructure: Evidence from the Golden Quadrilateral of India”, Journal of the European Economic Association, 17(6): 1881–1940.

Bonadio, B (2022), “Ports vs Roads: Infrastructure, Market Access and Regional Outcomes”, Working Paper, NYUAD

Kerem, C, B Demir, D Ghose, N Young (2022), “Road Capacity, Domestic Trade and Regional Outcomes.” Journal of Economic Geography, 22(5): 901-929

Ducruet, C, R Juhász, D K Nagy, C Steinwender (2020), “All Aboard: The Effects of Port Development.”, Working Paper 28148, National Bureau of Economic Research

Donaldson, D (2018), “Railroads of the Raj: Estimating the Impact of Transportation Infrastructure.” American Economic Review, 108(4-5): 899–934.

Faber, B (2014), “Trade Integration, Market Size, and Industralization: Evidence from China’s National Trunk Highway System.”, Review of Economic Studies, 81(3): 1046-1070

Fan, J, Y Lu, W Luo (2021), “Valuing Domestic Transport Infrastructure: A View from the Route Choice of Exporters”. mimeo.

Fenske J, N Kala and J Wei (2021), “Railways and cities in India”, CAGE Working Paper No. 559, VoxDev column.

World Bank (2013), “Reforming the Indian Ports Sector”, Washington DC, 2013.