High-speed internet connectivity in Africa increased FDI into the services sector with the technology, finance, retail and health service subsectors the main beneficiaries

Attracting foreign direct investment (FDI) has been a key growth strategy for many countries in the Global South, due to the perceived effects on technology transfer and job creation (see this VoxDevTalk on FDI). As a result, countries embark on investment promotion drives and offer incentives to attract potential investors to locate in their countries (Harding and Javorcik 2011), yet many countries have been unsuccessful in luring the needed investments to spur their economies. Thus, establishing what matters for cross-border investments decisions is a key concern for policymakers in the global south.

Why does infrastructure matter for investments?

Infrastructure is the spine on which modern economies are run. Energy, transport and logistics (e.g., road, railway, aviation, marine), and digital technologies are critical for the production, distribution and consumption of goods and services. Constrained access therefore affects firm productivity and increases the cost of doing business, which in turn disincentivises investors. This is the case in many African countries, where access to these infrastructures is lacking and even where available, infrastructure is often of poor quality. Admittedly, infrastructure investments are capital intensive, and the dearth of empirical evidence on the returns to these investments often constrains the ability of policymakers in low-income environments to prioritise infrastructure investments.

In our new research (Mensah and Traore 2023), we argue and show that the provision of quality of infrastructure is an important catalyst to attracting FDI. Specifically, we estimate the returns to (quality) infrastructure by showing how the arrival of high-speed internet to Africa spurred FDI to the region. We also examine the role of complementary enablers such as roads and electricity in spurring investments. Access to fast and low-cost internet matters for investments through at least three channels:

- Expansion in internet connectivity increases demand and supply of digital services thereby creating business opportunities for investors. For example, global multinationals such as Uber, Bolt, and Netflix are today present in many African countries due to increased demand for ride-hailing and online entertainment, respectively, powered by access to fast and low-cost internet.

- Increased demand for services also provides a “launching pad” for digital entrepreneurship leading to the creation of technology start-ups. As these start-ups grow, they attract FDI.

- Access to the internet also provided significant support to the Fintech boom in Africa, leading to massive investments in the financial sector (D’Andrea and Limodio 2023).

Estimating the impacts of high-speed internet on FDI

The main challenge researchers grapple with in estimating the returns of infrastructure is the non-random placement of infrastructure. As a result, any observed changes in outcomes cannot exclusively be associated with the provision of infrastructure; instead, it could be driven by underlying trends in economic, social, or political factors. However, in practice, random placement of infrastructure per se is rare and there are likely not enough compelling economic reasons to support it, given the associated high fiscal outlays. Therefore, to provide causal estimates of infrastructure impacts, economists often rely on cases where the placement of infrastructure approximates a random placement (“quasi-random”).

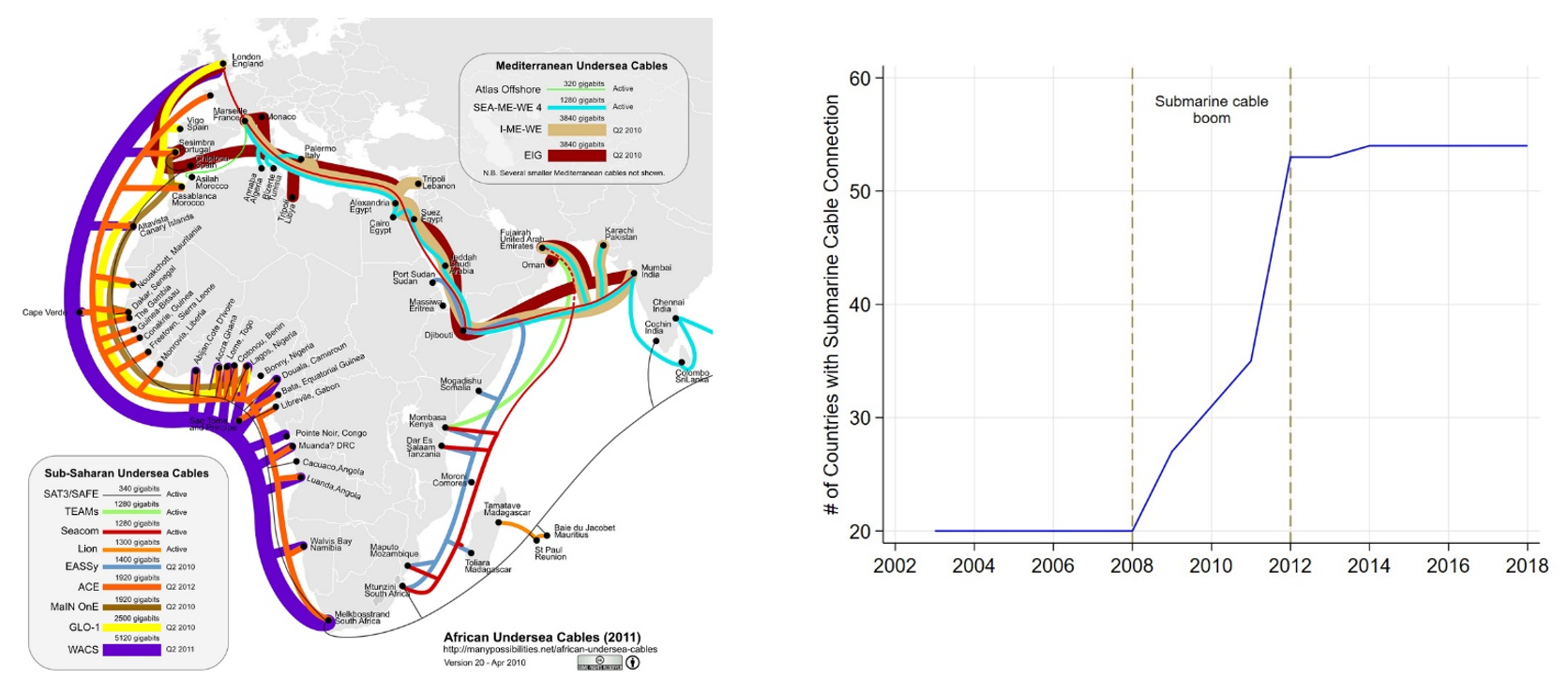

In our research (Mensah and Traore 2023), we leverage the staggered arrival of submarine fiber-optic internet cables (SMC) to Africa to estimate the impact of internet connectivity on FDI. Between 2000 and 2012, Africa witnessed a significant milestone in the internet landscape with the arrival of SMCs from Europe that connected the continent to the global internet landscape (Figure 1). Once the SMCs reached their landing points along the coast, they were connected to the (existing) terrestrial fiber backbone networks which transmitted internet to inland locations. Prior to this, satellite connectivity was the main source of internet in the region. The value-addition of the SMCs over satellite connection is that they were fast and cheaper. This led to increased uptake by households and firms, resulting in increased productivity and employment (Hjort and Poulsen 2019)

Figure 1: Arrival of submarine Fiber-Optic Internet Cables to Africa

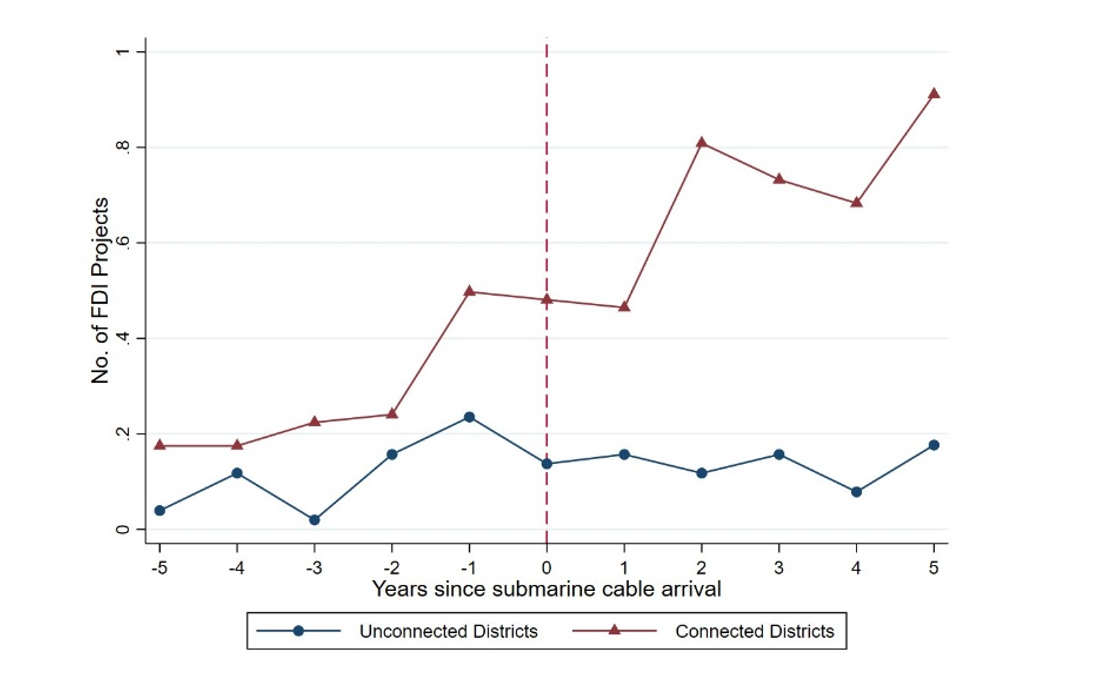

We combine information on the arrival of the SMCs and geodata on the fiber backbone network, with granular project-level data on FDI between 2003 and 2018 in conducting our analysis. Essentially, our research design compares changes in FDI at the subnational level, between subnational districts connected to the backbone networks with unconnected districts before and after the arrival of the high-speed internet (Figure 2).

Figure 2: Trends in FDI projects between connected and unconnected distributes before and after arrival of high-speed internet.

High-speed internet connectivity led to increased FDI to Africa

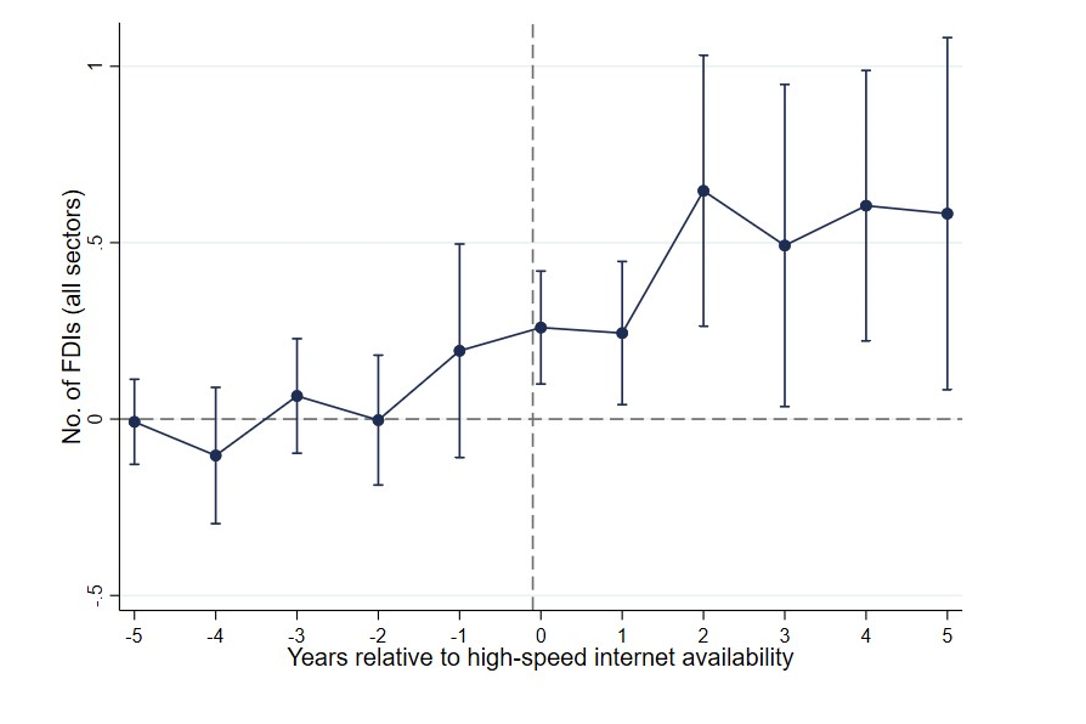

Four key findings emerge from the paper. First, high-speed internet connectivity leads to an increase in the flow of FDI. Specifically, we find that the arrival of high-speed internet via the SMCs to Africa led to a 10% increase in the volume (number) of greenfield FDI projects to the region. The probability and amount (monetary) of FDI also increased following the internet connectivity. This is corroborated by the event-study graph in Figure 3, which shows sustained positive increases in FDI following the high-speed internet connectivity.

Figure 3: Effects of high-speed internet connectivity on FDI receipts

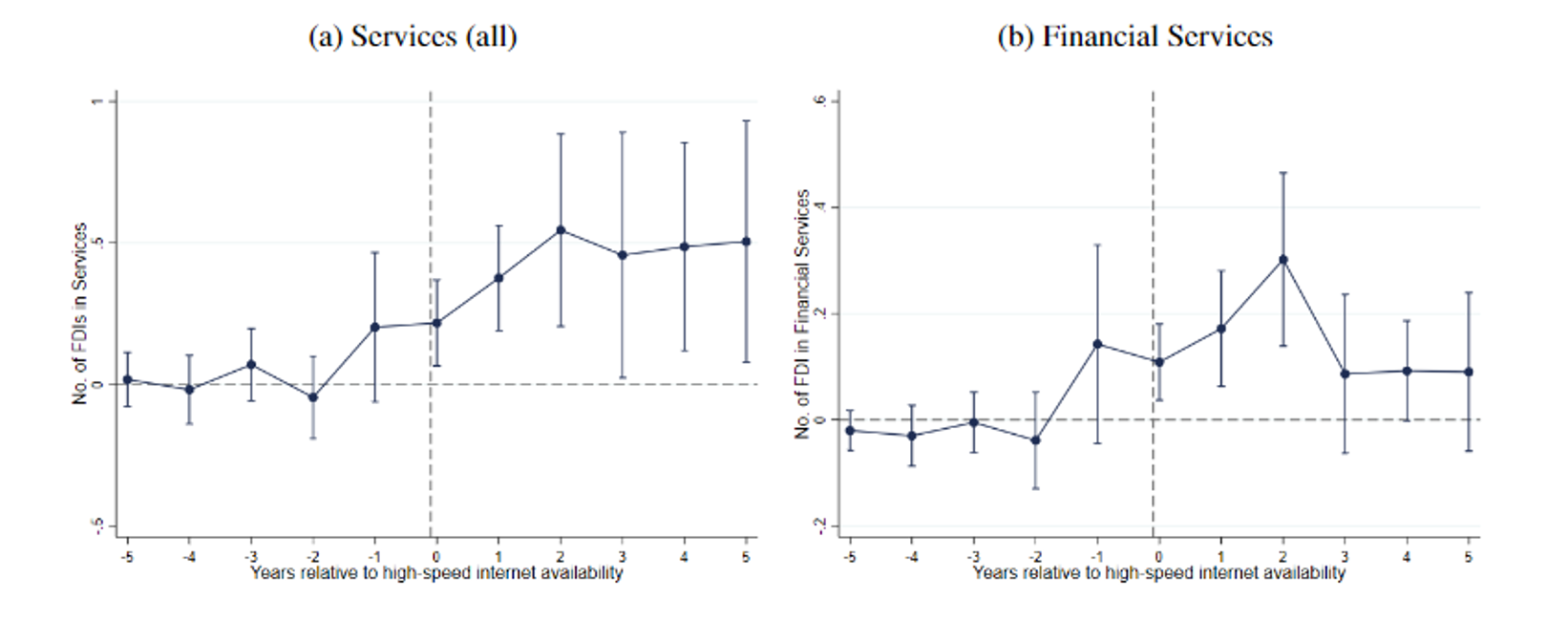

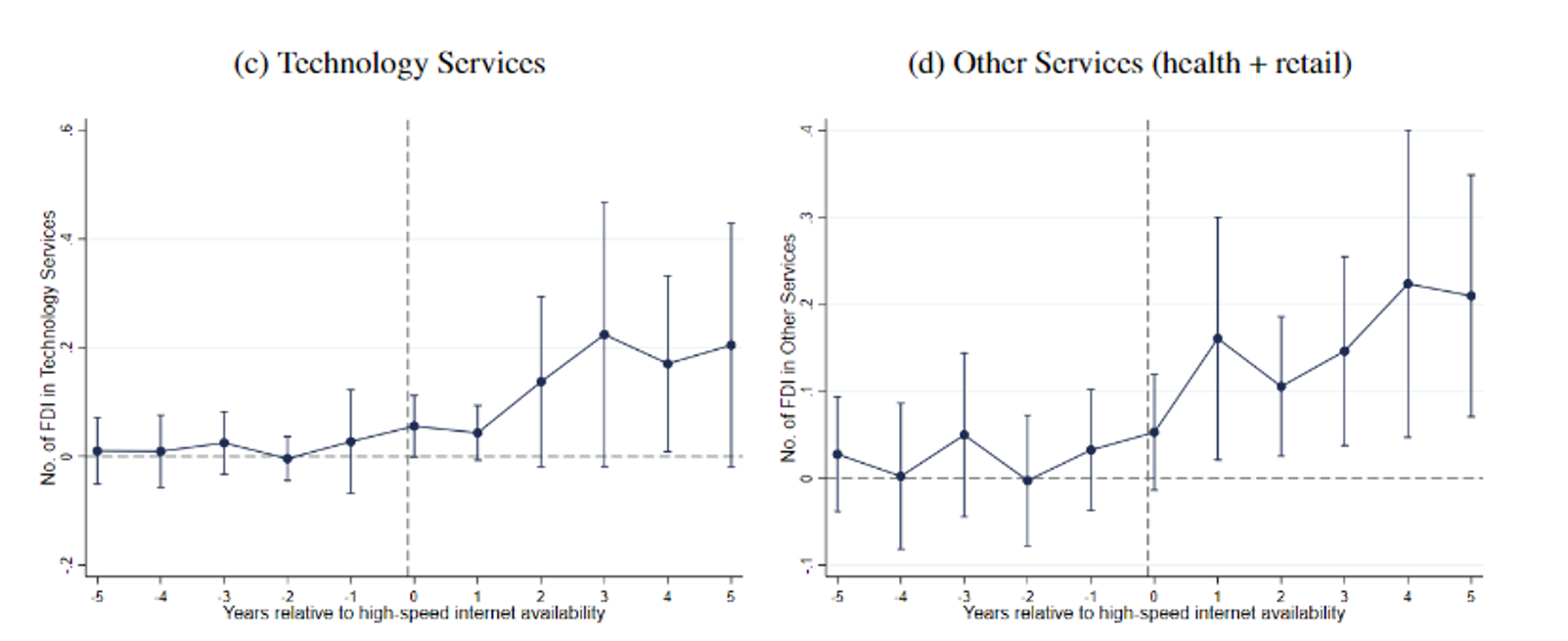

Second, the effects on FDI are largely concentrated in the services sector, with finance, technology, retail and health services subsectors as the main beneficiaries (see Figure 4). The probability of receiving FDI in services increases by 5.7 percentage points, while the number and size of FDI receipts also increase by 9.6 and 23% respectively, following high-speed internet connectivity. We do not find any evidence of increased FDI in manufacturing or in the energy and construction (real estate) subsectors. This suggests that expansion in the digital infrastructure increases demand and supply of digital services thereby leading to increased inflow of investments in internet-dependent sectors such as services.

Figure 4: High-speed internet connectivity and FDI in services

Our third finding relates to the extent to which complementary infrastructure such as roads and electricity connectivity influence the effect of internet connectivity on attracting FDI. Our results indicate that road and electricity connectivity amplify the effects of internet connectivity on FDI, thus highlighting the role of complementarities in the impact of infrastructure. This finding has significant bearings on policy design in the region: to maximise the returns to infrastructure, countries must recognise the complementarities in infrastructure provision and provide them as a bundle rather than in isolation. For instance, in the absence of reliable (and affordable) electricity, uptake and utilisation of digital services will be constrained even with the best of digital infrastructure.

Fourth, we provide evidence on (a) improvement in the quality of governance; and (b) market expansion as plausible channels underlying the results. Access to the internet has been shown in the literature to influence confidence in government (Guriev et al. 2020), corruption (Gonzalez 2021), and political mobilisation (Manacorda and Tesei 2020) via increased access to information thereby enabling citizens to demand greater accountability from their governments. For instance, access to social media, powered by the internet enhances scrutiny and reporting, thereby inducing governments to be more transparent and accountable. This leads to overall improvement in governance, with positive spillovers to the business community (investors), as it reduces uncertainty and cost of doing business. Similarly, the boom in e-commerce in Africa allows firms the opportunity to expand their markets beyond the confines of the traditional “brick-and-mortar” market at relatively low cost. This results in enhanced productivity, revenue, and profitability, leading to increased investments.

Implications for policy

Our study documents significant returns to the provision of infrastructure in Africa using the rollout of fast internet across the continent as a case study. Our findings underscore the need for the region to increase infrastructure investments as it exerts positive economic spillovers. However, the quest to expand infrastructure must not be done at the expense of quality, since provision of low-quality infrastructure entails significant economic cost (Mensah 2024). Finally, the study also demonstrates the co-benefits of bundling infrastructure arising from the complementarities in infrastructure use.

References

D’Andrea, A, and N Limodio (2023), “High-Speed Internet, Financial Technology and Banking in Africa,” Management Science.

Harding, T, and B S Javorcik (2011), “Roll Out the Red Carpet and They Will Come: Investment Promotion and FDI Inflows,” Economic Journal, 121(557): 1445–76.

Hjort, J, and J Poulsen (2019), “The Arrival of Fast Internet and Employment in Africa,” American Economic Review, 109(3): 1032–79.

Guriev, S, N Melnikov, and E Zhuravskaya (2021), “3G Internet and Confidence in Government,” Quarterly Journal of Economics, 136(4): 2533–2613.

Gonzalez, R M (2021), “Cell Phone Access and Election Fraud: Evidence from a Spatial Regression Discontinuity Design in Afghanistan,” American Economic Journal: Applied Economics, 13(2): 1–51.

Manacorda, M, and A Tesei (2020), “Liberation Technology: Mobile Phones and Political Mobilization in Africa,” Econometrica, 88(2): 533–67.

Mensah, J T, and N Traore (2023), "Infrastructure Quality and FDI Inflows: Evidence from the Arrival of High-Speed Internet in Africa," The World Bank Economic Review.

Mensah, J T (2024), "Jobs! Electricity Shortages and Unemployment in Africa," Journal of Development Economics, 167: 103231.