High-speed internet enhances the role of banks in Africa by reducing telecommunication costs and fostering the banks’ adoption of new financial technologies, such as the real-time gross settlement (RTGS) payment system

In recent years, high-speed internet has emerged as a transformative force in Africa, ushering in a new era of progress and opportunity across the continent. This technological advancement has induced a profound political and economic revolution (Manacorda and Tesei 2020), empowering individuals and communities while also redefining the landscape of business and finance (Hjort and Poulsen 2019). The evolution of digital connectivity has become a catalyst for progress in financial markets, with substantial changes in the banking sector (McKinsey and Company 2018).

African banks have responded dynamically to the availability of fast internet. This response has manifested as a strategic shift toward innovative financial technology, commonly referred to as FinTech. This shift is not merely a response to technological advancement but represents an opportunity for banks to reduce financial frictions (Buera et al. 2011) and address information asymmetries (Hertzberg et al. 2010, 2011, Hertzberg et al. 2018).

In D’Andrea and Limodio (2023), we investigate the relationship between high-speed internet, financial technology and banking, and show the pivotal role of fast internet as a driving force that facilitates more liquid interbank markets and promotes increased bank lending.

A natural experiment

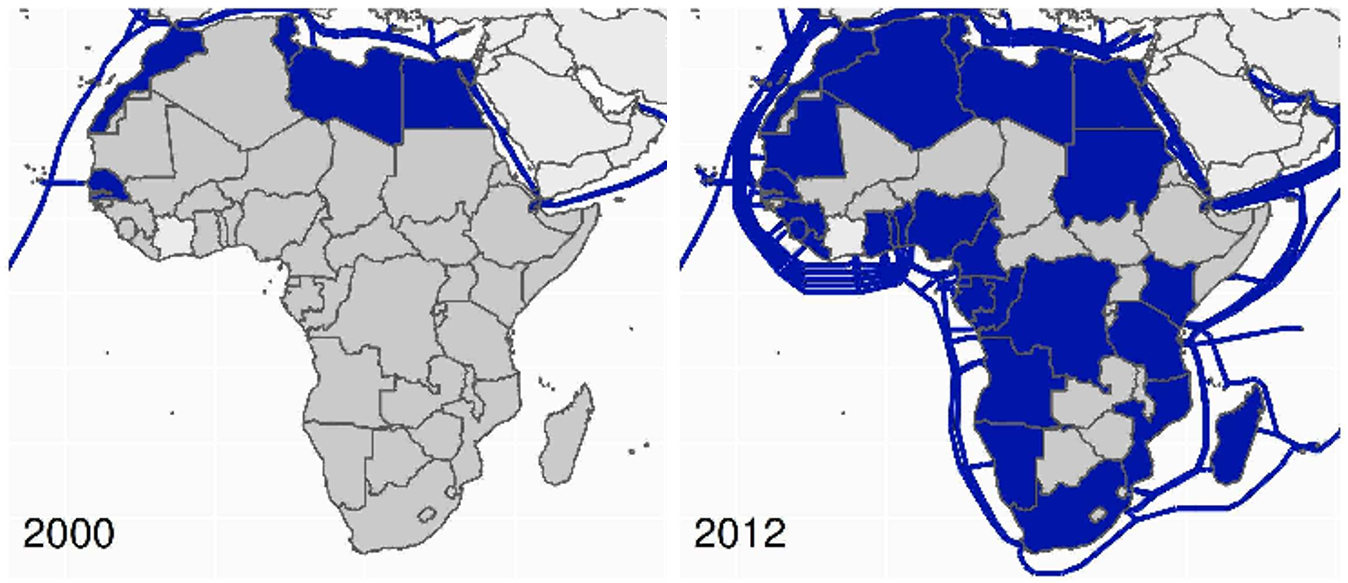

Our research hinges on the staggered arrival of fibre-optic submarine cables in Africa as a natural experiment. This unique setting provides an ideal framework to scrutinise the intricate dynamics triggered by high-speed internet. The staggered deployment of the cables, spanning more than two decades from the mid-1990s onward, allows us to discern causal relationships and isolate the impact of fast internet on banking (see Figure 1).

Figure 1: The arrival of high-speed internet in Africa

Note: This figure shows the gradual arrival of submarine fiber-optic cables in Africa. The left panel refers to cables ready to serve in 2000. The right panel shows the cables ready to serve in 2012, which is the last year in which countries in our sample receive connection. The group of treated African coastal countries is reported in dark blue.

To implement our analysis, we use bank-level data on 629 banks located in 37 coastal countries in Africa, during the period 1997–2018. In addition, we compile a dataset focusing on the adoption of the real-time gross settlement (RTGS) payment system, which is of particular interest due to its capacity to reduce transaction costs on interbank exchanges. Finally, we collect data on 32,761 African firms, with indicators related to firm credit and performance.

We proceed in three main steps. First, we estimate the impact of fast internet availability on bank lending, disentangling the role of supply and demand factors. Second, we investigate the relationship between high-speed internet and firm performance. Finally, we explore a specific mechanism through which the cable’s arrival may lower the marginal cost of bank funding, reduce the need for liquid assets, and increase credit supply: the adoption of the RTGS in the interbank market.

The effect on banking and firms

The empirical strategy is based on a staggered difference-in-difference (DiD) specification, complemented by an event-study around the arrival of high-speed internet. We classify a bank as ‘treated’ when its country of operation connects to a submarine cable.

Our main finding underscores a substantial increase in lending following the adoption of high-speed internet. Treated banks exhibit a relative uptick in loan amounts, amounting to a 36% increase.

To isolate supply effects and ensure that the observed changes are driven by reduced marginal costs of banks and not by a boost in credit demand, we leverage the presence of multi-country banks and define a bank as connected if its headquarter is in a connected country. The estimates confirm a positive and significant effect, suggesting that 62% of the total effect on lending comes from supply-related factors.

We also observe that firms benefit from high-speed internet and exhibit improvements in their financial variables. Specifically, there is a 26 p.p. increase in firms’ access to finance, a 20 p.p. higher likelihood of receiving a loan, and a doubling in loan maturities for firms in countries with access to fast internet and a weak ex-ante interbank market.

Promoting financial technologies

Banks in Africa experience substantial liquidity risk due to imperfect risk-sharing and high volatility of deposits. African banks are severely impaired in their access to international capital markets because of local regulation or, even more importantly, because of low international reputation. Furthermore, African countries are characterised by limited functioning of local liquidity markets, exacerbating deposit shocks. Most central banks are either legally unable or de facto unwilling to provide liquidity on a predictable basis (Choudhary and Limodio 2022).

The RTGS is a special interbank transfer system where the transfer of money and securities occurs on a 'real-time' and 'gross' basis. RTGSs reduce information asymmetries and help banks lower settlement risk. Under certain conditions, RTGSs also tend to promote a more liquid banking system. For these reasons, RTGSs are seen in a favourable light by institutions and practitioners in Africa. The adoption of real-time interbank systems is considered a necessary condition for the development of fast and instant payment networks (Bank for International Settlements 2021) as well as being related to more advanced and efficient interbank markets.

While we acknowledge that there are multiple channels through which fast internet affects the supply of credit by African banks, we concentrate on the role of RTGSs and the resulting change in individual banks' liquidity management. We provide robust evidence on the relevance of this channel and show that reduced transaction costs in the interbank market positively affect credit supply.

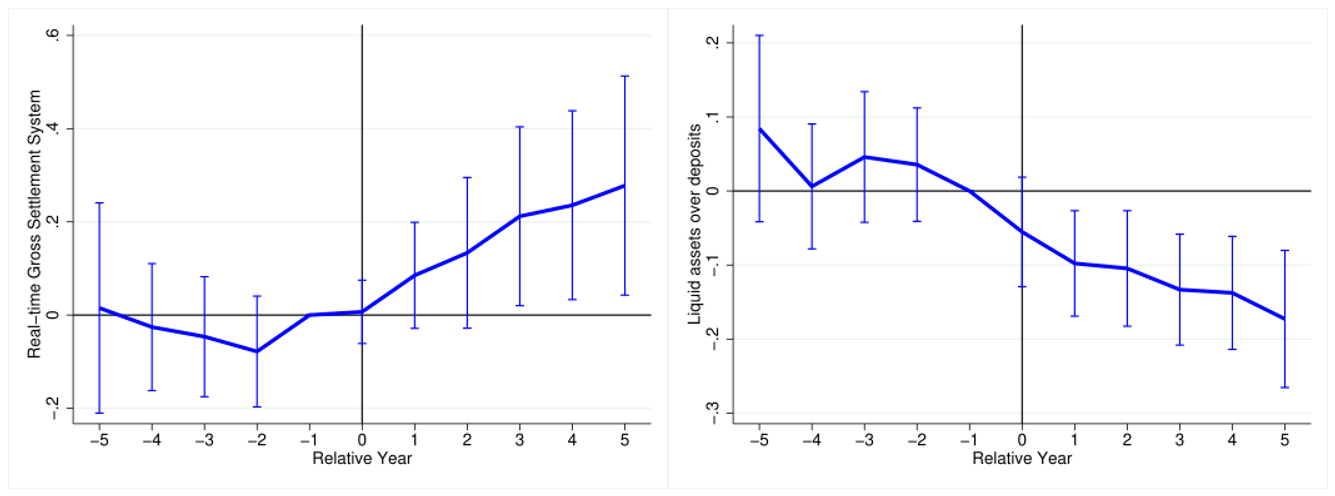

In the specific, we document that as cheaper and more reliable connections become available, the probability of adoption of the RTGS increases on average by 16 p.p. (5.4 p.p.) at the country (bank) level. Simultaneously, local interbank markets grow significantly, with interbank loans and deposits increasing by 30% and 63%, respectively, and the share of liquid assets over deposits and short-term funding decreasing by 14 p.p. (see Figure 2).

Figure 2: High-speed internet, interbank markets and banks’ liquid assets

Note: This figure shows the event study for the period five years before to five years after the arrival of the first submarine cable in a country. The panel on the left refers to the change in the probability of RTGS adoption with respect to the base year (-1). The panel on the right refers to the change in the share of liquid assets over deposits and short-term funding with respect to the base year (-1). The x-axis reports the relative time from the cable's arrival. Standard errors are clustered at the country level, and 95% confidence intervals are also reported.

Conclusion

In summary, our study unravels the multifaceted impact of high-speed internet on the banking sector in Africa. By fostering the adoption of new financial technologies, particularly the RTGS, high-speed internet acts as a transformative force, enhancing banking efficiency and benefiting both banks and local businesses. The findings underscore the pivotal role of digital infrastructure investment in fostering economic growth and financial stability in developing economies.

References

Bank for International Settlements (2021), “Developments in retail fast payments and implications for rtgs systems”.

Buera, F J, J P Kaboski, and Y Shin (2011), “Finance and development: A tale of two sectors”, American Economic Review, 101(5): 1964-2002.

Choudhary, M A, and N Limodio (2022), “Liquidity Risk and Long-Term Finance: Evidence from a Natural Experiment”, Review of Economic Studies, 89(3): 1278-1313.

D’Andrea, A, and N Limodio (2023), “High-Speed Internet, Financial Technology, and Banking”, Management Science, [Online]. Available at: https://doi.org/10.1287/mnsc.2023.4703.

Hertzberg, A, A Liberman, and D Paravisini (2018), “Screening on loan terms: evidence from maturity choice in consumer credit”, Review of Financial Studies, 31(9): 3532-3567.

Hertzberg, A, J M Liberti, and D Paravisini (2010), “Information and incentives inside the firm: Evidence from loan officer rotation”, Journal of Finance, 65(3): 795-828.

Hertzberg, A, J M Liberti, and D Paravisini (2011), “Public information and coordination: evidence from a credit registry expansion”, Journal of Finance, 66(2): 379-412.

Hjort, J, and J Poulsen (2019), “The arrival of fast internet and employment in Africa”, American Economic Review, 109(3): 1032-1079.

Manacorda, M, and A Tesei (2020), “Liberation technology: mobile phones and political mobilization in Africa”, Econometrica, 88(2): 533-567.

McKinsey and Company (2018), “Roaring to life: Growth and innovation in African retail banking”.