China's domestic political needs drive much of its foreign aid to other countries – yet this aid has potentially large economic benefits for recipients

With an estimated USD 843 billion contributed across 165 countries, China has recently become the largest provider of development finance to low- and middle-income countries and now outspends the US by two to one in Africa (Malik et al. 2021). So why does China spend so much on aid1 to other developing countries? And how effective is this aid?

The motives behind China’s foreign aid are highly debated

Critics have accused China of using foreign aid to advance geopolitical goals, secure access to natural resources, and create economic opportunities for its own firms rather than primarily to help the world’s poor (Dreher et al. 2018). Some of China’s development projects have allegedly created debt traps (Tharoor 2022), and increased corruption (Isaksson and Kotsadam 2018), with limited benefits for recipient populations.

Indeed, China exhibits donor characteristics that have been shown elsewhere to undermine foreign aid efficacy. For example, China regularly provides aid to countries with poor institutions such as Angola or Sudan, as unlike Western donors, China prides itself on not interfering with the recipient countries’ politics (State Council 2011). Additionally, much of China’s aid is in the form of bilateral loans, and Chinese state-owned firms (SOEs) are often contracted to implement these infrastructure projects (Gelpern et al. 2022). These firms typically bring their own materials and workers, and could crowd out local businesses and jobs. Moreover, the broad involvement of SOEs fuels suspicions that aid is being wielded as a political tool.

However, there is currently much more speculation than hard evidence on the goals and impacts of Chinese aid. While a recent cross-country study documents positive short-term effects of Chinese aid on economic growth (Dreher et al. 2021), many questions remain on why and how China delivers aid projects, to which countries and when, and how these projects affect economic development in the long term.

One reason for this dearth of evidence lies in the non-transparency surrounding China’s aid programs, as China does not publish disaggregated data on the projects it finances. Another reason is that identifying the causal impact of aid on recipients is difficult because there may be other factors that influence both the amount of aid a country receives, and its subsequent economic development.

Unpacking the black box

In a new study (Mueller 2022), I make progress on this debate by diving deep into the opaque process surrounding China’s aid allocation. I link unofficial project-level aid data from sources such as AidData and the Chinese Loans to Africa Database with administrative firm-level data from China (including firms’ customs and tax records), which covers 1,265 Chinese aid contractors in 2005–2015. This novel dataset allows me to not only unpack the allocation process of Chinese aid contracts to firms, but also develop a novel empirical strategy to credibly estimate the causal impact of China’s aid on recipients.

Domestic political goals drive much of China’s aid

The Chinese leadership’s dominant policy goal is to secure domestic political stability (Shirk 2008). I demonstrate how the Chinese state, consistent with this goal, assigns contracts for foreign aid projects in response to local unrest that may threaten political stability. For example, when Chinese workers go on strike, the central government allocates more aid contracts to firms under its direct control in that area, and employment in these firms increases. Foreign aid projects help to maintain social stability by raising the incomes of Chinese workers, especially in places where it is harder to do so using domestic measures. In the paper (Mueller 2022), I present a plethora of evidence — e.g. a systematic textual analysis of firms’ annual reports — to show that the link between local unrest and aid contract allocation to state-owned firms is causal.

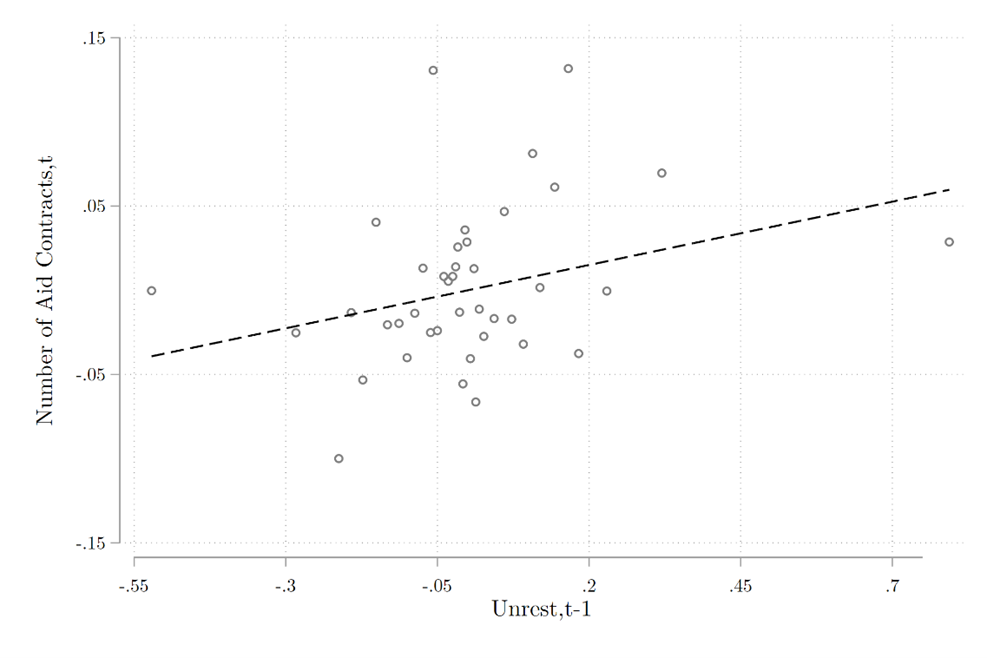

Figure 1: Local Unrest and Aid Contract Allocation to Central SOEs

Notes: The dashed line shows the relationship between the number of Chinese foreign aid contracts allocated to a central state-owned firm in a year and lagged labor unrest intensity in the firm's home prefecture, residualized by firm and year fixed effects. See Mueller (2022).

The allocation of aid contracts to Chinese firms based on China’s domestic political goals also strongly affects which countries receive how much foreign aid from China and when. Because a firm typically works with a specific set of countries, those countries tend to receive more aid when there is more unrest in the firm’s home prefecture.

Identifying the effects of China’s aid

How does politically motivated aid affect the recipients? To address this question, I exploit the variation in aid contract allocation to Chinese firms to generate a novel instrumental variable (IV) for the amount of aid received by a country in a given year. The IV is the interaction of the variation in countries’ links to specific Chinese firms and shocks to local labor unrest in those firms’ home prefectures. The shocks are plausibly exogenous to aid recipients’ future outcomes, yielding an identification strategy that is arguably more credible than existing approaches that rely on macroeconomic variables to generate variation in the amount of aid given to countries.

Large short-term benefits

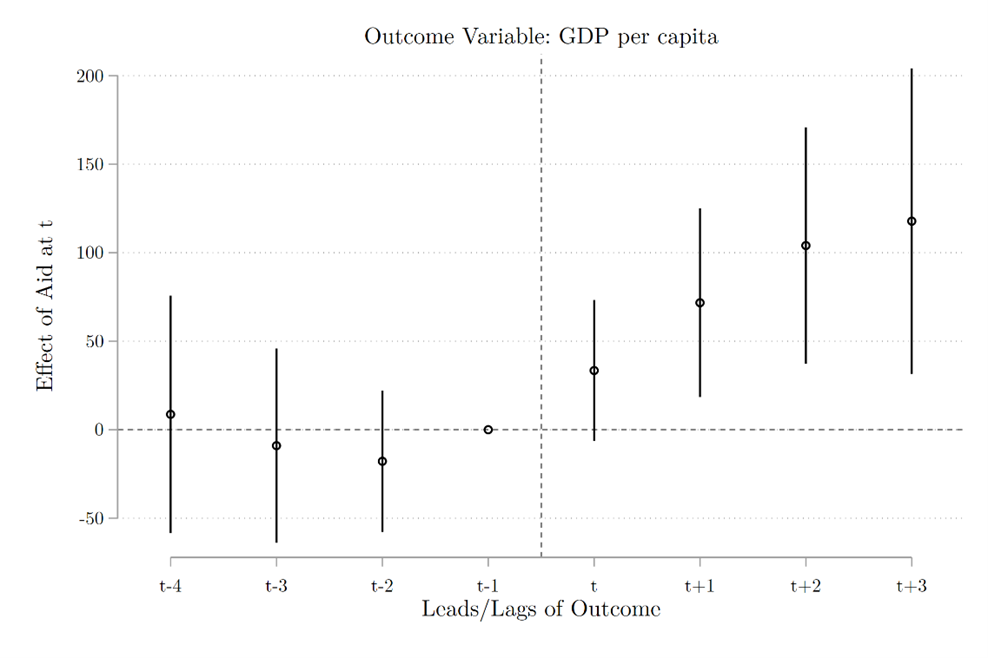

I find large positive effects on the levels and growth rates of aid recipients’ GDP in the short run. On average, three years after the implementation of an additional large-scale infrastructure aid project, GDP per capita has increased by USD 118 (2.5% of the mean) and GDP growth by 0.92 percentage points. The estimates indicate that the economic benefits to Chinese aid projects exceed their costs.

Figure 2: IV estimates of the effect of Chinese aid on recipient GDP

Notes: Each dot shows the IV coefficient estimate of the effect of an additional Chinese aid project on different lead and lag time periods for recipient country GDP per capita. The vertical bars indicate 90% confidence intervals. See Mueller (2022) for details.

One may be worried that the economic gains are captured by political elites or that the aid projects crowd out local employment. After all, China’s aid comes without the institutional safeguards typically imposed by Western donors and Chinese firms import their own materials and workers. However, I find that household consumption increases by 2.5% and unemployment falls by 0.43 percentage points three years after commitment of a project.

These results, while contradicting critics’ lore, make sense. The countries with poor institutions are often those that are most in need of infrastructure and thus have the largest economic returns to such aid. Chinese firms have the capacity to build large-scale infrastructure projects such as highways, power plants, and ports without relying on local supply chains and are thus less vulnerable to local corruption. Moreover, the benefits of the infrastructure can spill over to the recipient population even if the infrastructure was built with other goals in mind. For example, a new railroad connecting an oil field to a port also provides connectivity and jobs for the people living along it.

Policy implications

These findings suggest that aid allocated according to the political needs of the donor country and without policy conditions attached need not have the deleterious effects on recipient populations found in other contexts. Moreover, China’s aid is likely driven not just by geopolitics but also by domestic agendas.

It would be premature to conclude that China should be viewed as a role model for other donors. The economic benefits are unlikely to be equally distributed and may come at costs such as increases in corruption, conflict, and environmental destruction. Moreover, the short-term gains to households are not necessarily sustainable; I find no positive effects of Chinese infrastructure aid on employment and household consumption growth in the longer run (six years after aid project commitment).

Nevertheless, despite its flaws, and the fact that it is partly politically motivated, it would be a mistake to dismiss the Chinese aid model entirely. The growing evidence of a rare case of development finance having positive economic impacts on recipients deserves a closer look by policymakers and development economists alike.

References

Dreher, A, A Fuchs, B Parks, A M Strange, and M J Tierney (2018), “Apples and dragon fruits: The determinants of aid and other forms of state financing from China to Africa.” International Studies Quarterly, 62(1): 182-194.

Dreher, A, A Fuchs, B Parks, A Strange, and M J Tierney (2021), “Aid, China, and growth: Evidence from a new global development finance dataset.” American Economic Journal: Economic Policy, 13(2): 135-74.

Gelpern, A, S Horn, S Morris, B Parks, and C Trebesch (2022), “How China Lends: A Rare Look into 100 Debt Contracts with Foreign Governments.” Economic Policy, eiac054.

Isaksson, A S and A Kotsadam, (2018), “Chinese aid and local corruption.” Journal of Public Economics, 159: 146-159.

Malik, A, B Parks, B Russell, J J Lin, K Walsh, K Solomon, S Zhang, T Elston, and S Goodman (2021), “Banking on the Belt and Road: Insights from a new global dataset of 13,427 Chinese development projects.” Williamsburg, VA: AidData at William & Mary, pp.23-36.

Mueller, J (2022), “China’s Foreign Aid: Political Determinants and Economic Effects.” NUS Working Paper.

Shirk, S L (2008), China: fragile superpower. Oxford University Press, USA.

State Council (2011), White Paper on China's Foreign Aid. Information Office of the State Council The People’s Republic of China. Retrieved January 2, 2022.

Tharoor, I (2022), “China has a hand in Sri Lanka’s economic calamity.” The Washington Post. Retrieved January 2, 2022.

Footnotes

1For ease the term “foreign aid” is used to include all bilateral official finance between Chinese government entities and government entities of other low- and middle-income countries.

Acknowledgments

I thank EeCheng Ong for editorial suggestions and Nancy Qian for invaluable advice.