The quality of tax administration effects productivity, particularly that of small firms, therefore lowering tax compliance costs can support growth

Walking past the sheds at a technology incubator in Palo Alto, one sees under one roof, an abundance of brainpower and talent, in their twenties and thirties, turning their patented innovations into successful products. This company provides resources and mentorship to startups to build the next hits in robotics and artificial intelligence. Said one nanotech geek we met there: “When we build our team to market our product, just as important as our engineering design and sales professionals, is a good accounting and tax team. Tax compliance is so complex, that if you don’t get it right the first time, you’re on a slippery slope of problematic audits.”

Tax compliance: Costs, firm productivity, and administration

Tax compliance costs can be particularly onerous for startups and small and medium-sized enterprises (SMEs). The costs can contribute significantly to the tax burden that firms face in addition to direct financial tax liability. The reasons are simple; they include substantial fixed components that can be especially large for small businesses, which lack experience built up over time to deal with tax issues. Filing a tax return also costs the same regardless of the tax remitted. In addition, larger firms benefit from economies of scale and specialisation within them.

It is well known that investments to improve the quality of tax administration may raise revenue collection and are, hence, worthwhile from a fiscal perspective. The way taxes are administered also matters for firm productivity because it is a major determinant of tax compliance costs. Another important – although less well-known – benefit of such improvements is the sizeable productivity dividend for small and young firms. To the extent that a high compliance burden diverts resources from productive activities (e.g. investment in physical capital or productivity-enhancing innovation) and increases costs without creating additional output, firm productivity can decline.

A new measure of the quality of tax administration

Measurement issues have mostly prevented a rigorous empirical cross-country analysis on the link between tax administration and productivity. Existing measures of tax compliance costs reflect both the quality of tax administration and the complexity of tax policy, which are often difficult to disentangle. In addition, the quality of tax administration is multidimensional in nature, displaying, inter alia, the quality of taxpayer services, ease of access to information on tax liabilities, and the modalities for submitting returns, among other issues.

Our new working paper compiles a novel measure, the Tax Administration Quality Index (TAQI), which addresses these issues (Dabla-Norris et al. 2017). The construction of the index on the strength of tax administration is similar to indices of public investment efficiency (Dabla-Norris et al. 2011).

Consistent with internationally-recognised frameworks to assess the efficacy of tax administrations, the index aggregates information from 33 individual indicators that are grouped into four broad categories:

- Supporting taxpayer information refers to advice and assistance available to facilitate business access to information on how to comply with taxes and can play a crucial role in bridging knowledge gaps and lowering compliance costs.

- Filing and payment can impose significant costs on taxpayers in terms of time spent on filling the return forms and making payments, the cost of keeping additional tax-related records, and hiring accountants or lawyers. We measure the ease of filing tax returns and making payments by assessing the availability of e-services among other factors.

- Post-filing processes run the gamut from claiming a Value Added Tax (VAT) refund, undergoing a tax audit or appealing a tax assessment, which can impose large costs on businesses. Our index measures the efficacy of the VAT refund system, the use of modern tax compliance management strategies and the adequacy of available tax dispute resolution mechanisms.

Accountability and transparency are central pillars of good governance in tax administration, especially as corruption (or unethical conduct) within the tax administration remains a significant concern in many countries. The index measures the degree to which both accountability and transparency are institutionalised within tax administrations.

The index draws upon the Tax Administration Diagnostic Assessment Tool (TADAT), which provides evidence-based and scored assessments that cover most tax administration functions, processes, and institutions, independently of tax policy. To minimise discretion in scoring for each individual indicator, the TADAT framework uses a set of standardised criteria.

Tax administration and the firm productivity gap

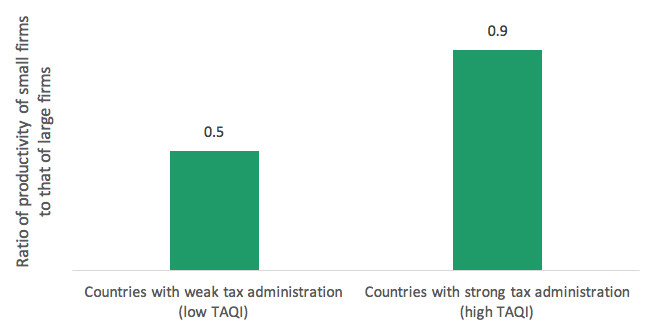

To assess the role of tax administration, this country-level index is related to firm-level data from the World Bank Enterprise Surveys for 21 emerging market and developing countries. We find a significantly positive association between the quality of tax administration and the productivity of small and young firms, which is consistent with the widely-accepted evidence that tax compliance costs tend to be disproportionately higher for SMEs and startups. Figure 1 suggests that in countries with good tax administration (i.e. a relatively high TAQI score), the productivity differential between small and large firms is much smaller compared to countries with weak tax administration.

Figure 1 The quality of tax administration and productivity differences between small and large firms

Notes: Countries with a low TAQI have an index score of equal or smaller than the median; countries with a high TAQI have an index score of higher than the median. The chart displays the median ratio of average country-level labour productivity of small firms to that of large firms for each country grouping.

Source: World Enterprise Surveys, TADAT database, and own compilation.

A key policy implication is that an important way of supporting small and young firms is to improve those aspects of tax administration that lower tax compliance costs. The TAQI, together with the criteria it is derived from, can offer guidance on how such improvements could be implemented.

References

Dabla-Norris, M E, Misch, F, Cleary, D and Khwaja, M (2017), "Tax Administration and Firm Performance: New Data and Evidence for Emerging Market and Developing Economies", IMF Working Paper WP/17/95.

Dabla-Norris, M E, Brumby, J, Kyobe, A, Mills, Z and Papageorgiou, C (2011), “Investing in Public Investment: An Index of Public Investment Efficiency”, Journal of Economic Growth 17(3): 235–266.