A workfare programme increases migration by loosening households’ liquidity and risk constraints

A body of empirical work points towards the large gains in income that can be achieved by migrating internationally (Clemens 2011, McKenzie et al. 2010, Gibson et al. 2018, Clemens et al. 2019, Mobarak et al. 2023). However, while more than 750 million people aspire to migrate to another country (Espivo et al. 2018), only about 5 million people enter OECD countries every year and 272 million people (3.5% of the global population) lived outside of their country of origin in 2019. Furthermore, many people do not move even when there are no formal policy barriers (McKenzie 2023). These observations suggest that important non-regulatory frictions limit international movements of people. In our study (Gazeaud et al. 2023), we use a randomised evaluation to gain new insights on the factors constraining people from migrating in the context of a cash-for-work programme in Comoros.

Migration in Comoros

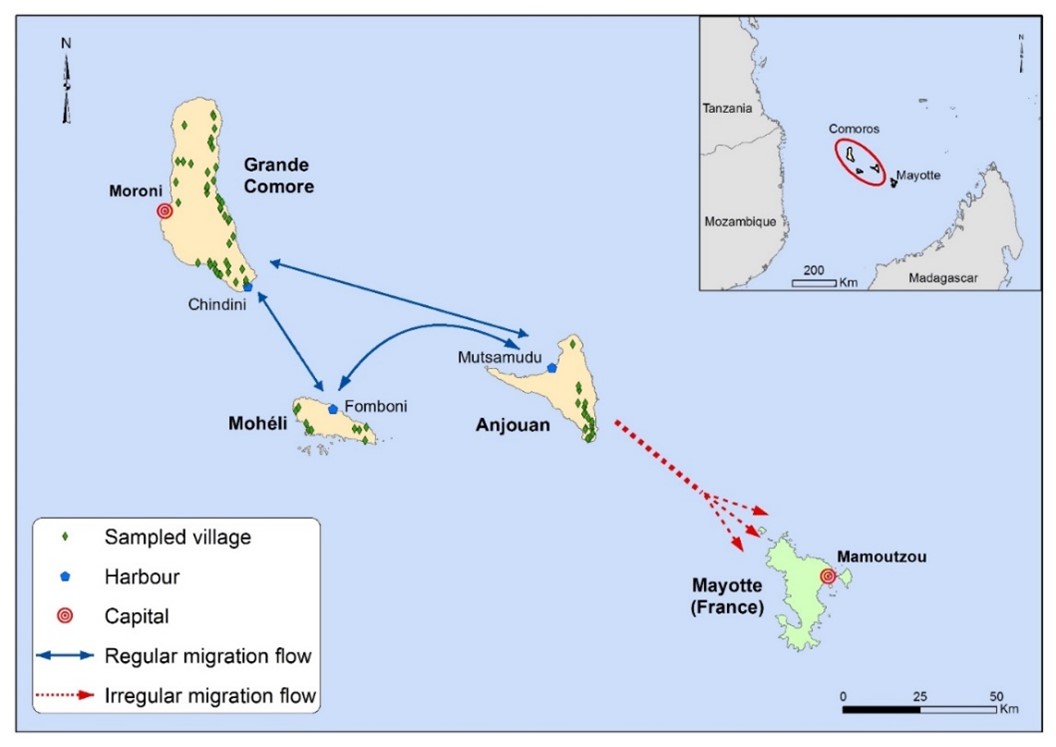

The Comoros is an understudied, yet very relevant, context to examine the drivers of international migration. Comoros is a small archipelago consisting of four islands located in the Indian Ocean, off the coast of East Africa. During colonisation, the islands were placed under the authority of the French colonial governor of Madagascar. However, during the independence referendum in 1974, one island – Mayotte – voted to remain politically a part of France while the other islands – Anjouan, Grande Comore, and Moheli – voted for independence and formed the Union of Comoros. Since the referendum, socioeconomic conditions have been improving steadily in Mayotte, but stagnating in neighbouring Comorian islands. Today, the GDP per capita in Mayotte is more than 10 times that of Comoros, which contributes to high levels of migration from the Union of Comoros to Mayotte. The typical migration route is depicted in Figure 1. Migrants usually converge to the south-east of Anjouan and then use small fishing boats to reach Mayotte. Thousands of Comorians have died on this often-overlooked migration route.

Figure 1: Migration routes from the Union of Comoros to Mayotte

Cash transfers and the incentives to migrate

The randomised controlled trial offered poor households with up to US$320 in cash in exchange for their participation in public works projects. To measure spillovers, we randomly varied the coverage of the programme inside the different villages (20% versus 40% of eligible population).

The primary objective of the programme was to reduce poverty and vulnerability, as is typical with social safety net programmes. Encouraging or deterring migration was not listed as an objective by the government agency implementing the programme or by the funder (the World Bank). Yet, given the salience of migration in Comoros, the research team decided to track the migration patterns of all household members present at baseline over the study period (about 1.5 years).

Theoretically, we identify four main channels through which cash-based assistance could affect migration.

- Liquidity channel: Cash transfers relax the budget constraint of households and can therefore facilitate the migration of households facing a liquidity constraint (Bazzi 2017).

- Opportunity cost channel: Cash transfers that are conditional on remaining in the origin country – for example to participate in public works – increase the opportunity cost of migrating and can therefore reduce migration (Imbert and Papp 2020).

- Collateral channel: The prospect of future cash transfers can be used by households as a collateral to facilitate access to credit and thereby finance migration (Angelucci 2015).

- Risk-aversion channel: Migration is often a profitable but risky investment. Cash transfers can reduce risk aversion and thereby encourage households to take more risks and invest in the migration of a household member.

Our analysis shows that the cash-for-work programme had a significant positive impact on migration to Mayotte. Eligible households selected for the cash-for-work programme were 38% more likely to have a migrant than those that were not selected (an increase of three percentage points over a base rate of 7.8% in the control group). We see no evidence of significant spillovers.

Which constraints are binding?

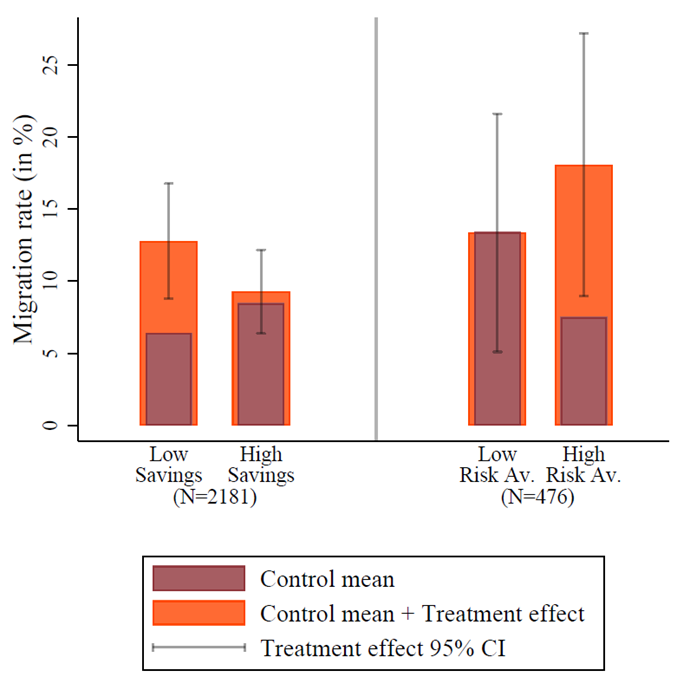

The increase in migration seems to be explained by the alleviation of liquidity and risk constraints (Figure 2). In line with the liquidity channel, the effect of the cash transfers on migration to Mayotte is concentrated within households with low levels of savings at baseline. We also find that the effect of the cash transfers on migration is concentrated within households that are more risk-averse at baseline, which suggests that cash transfers reduce risk aversion and thereby foster risky migrations.

Figure 2: Impact of the cash-for-work programme through the liquidity and risk-aversion channels

This result might be explained by the widespread poverty and the lack of formal social safety nets that characterise the Comorian context. In this context, many households could face a “subsistence constraint”, defined by Bryan et al. (2014) as a situation where poverty is so strong that failed investments would lead to unbearable welfare losses. As a result, households are very risk averse and do not make the risky investment in migration even if it can be profitable. With the guaranteed income flow from the cash-for-work programme, households become less risk averse, inducing some to invest in the migration of one household member.

By contrast, the opportunity cost channel seems irrelevant in this study. Beneficiary households were entitled to send the adult of their choice to public works and our results show that workers and migrants were very different. Descriptive statistics show that workers were more likely to be older women while migrants were more likely to be young men. Therefore, the programme did not increase the opportunity cost of the individuals who were the most likely to migrate.

The collateral channel also seems negligible in our study. If the collateral channel were operating, the effect of the cash transfer programme should have appeared soon after households learned that they were selected into the programme. However, we find that the effect of transfers on migration takes time to appear, which is consistent with the liquidity channel.

Study takeaways

Our study shows which constraints tend to be binding when households choose (not) to migrate, and how cash transfer programmes can loosen these constraints.

We refrain from proposing policy recommendations. Indeed, we acknowledge the diversity of policy preferences over migration and the sensitivity of the topic. An intense debate is raging between those portraying migrants as a threat and those arguing that the current migration policies are inhumane, unfair, or inefficient. We recognise that the two sides of the debate will interpret our conclusions differently. Furthermore, effects on welfare are unclear because migration from the Union of Comoros to Mayotte is very risky and many undocumented Comorians in Mayotte are deported to the Union of Comoros every year. Revealed preferences suggest that it is profitable, but some frictions might prevent people from making the optimal decision (e.g. lack of information). Further research to examine the returns to migration in this context is needed.

References

Angelucci, M (2015), “Migration and financial constraints: Evidence from Mexico”, The Review of Economics and Statistics 97(1): 224-228.

Bazzi, S (2017), “Wealth heterogeneity and the income elasticity of migration”, American Economic Journal: Applied Economics 9(2): 219-255.

Bryan, G, S Chowdhury and A M Mobarak (2014), “Underinvestment in a profitable technology: The case of seasonal migration in Bangladesh”, Econometrica 82(5): 1671-1748.

Clemens, M A (2011), “Economics and emigration: Trillion-dollar bills on the sidewalk?”, Journal of Economic Perspectives 25(3): 83-106.

Clemens, M A, C E Montenegro and L Pritchett (2019), “The place premium: Bounding the price equivalent of migration barriers”, The Review of Economics and Statistics 101(2): 201-213.

Esipova, N., Pugliese, A., and Ray, J. (2018). More than 750 million worldwide would migrate if they could. Washington DC:‘Gallup World, 10.

Gazeaud, J, E Mvukiyehe and O Sterck (2023), “Cash transfers and migration: Theory and evidence from a randomized controlled trial”, The Review of Economics and Statistics 105(1): 143-157.

Gibson, J, D McKenzie, H Rohorua and S Stillman (2018), “The long-term impacts of international migration: Evidence from a lottery”, The World Bank Economic Review 32(1): 127-147.

Imbert, C and J Papp (2020), “Short-term migration, rural public works, and urban labor markets: Evidence from India”, Journal of the European Economic Association 18(2): 927-963.

McKenzie, D (2023), “Fears and Tears: Should More People Be Moving within and from Developing Countries, and What Stops this Movement?”, The World Bank Research Observer (forthcoming).

McKenzie, D, S Stillman and J Gibson (2010), “How important is selection? Experimental vs. non-experimental measures of the income gains from migration”, Journal of the European Economic Association 8(4): 913-945.

Mobarak, A M, I Sharif and M Shrestha (2023), “Returns to International Migration: Evidence from a Bangladesh-Malaysia Visa Lottery”, American Economic Journal: Applied Economics (forthcoming).