Improving access to saving tools helps urban Malawian microentrepreneurs save and adjust labour supply decisions

Editor’s note: For a broader synthesis of the themes covered in this article, check out the updated version of our VoxDevLit on Mobile Money.

Most people often have multiple and concurrent savings goals with varying timeframes. For example, an individual may be working towards saving for large indivisible investments such as buying a house, while also setting aside smaller sums of money for more immediate goals such as a vacation, or for precautionary purposes such as health emergencies. In an experiment with microentrepreneurs in Malawi described below, we found that the average individual had 2.4 savings goals.

Saving money is already difficult for most people, so how should they go about saving for multiple simultaneous goals? Behavioural economics suggests that this can be achieved by creating separate labelled accounts. It has been shown that once money has been mentally committed to one purpose, it is cognitively harder to then use that money for any other purpose (Ainslie 2001). Empirical work has established such mental accounting as being effective in increasing savings when individuals have one labelled purpose (Dupas and Robinson 2013), suggesting that this might work for multiple labelled purposes as well.

Physical separation and labelling as a saving strategy

Practically speaking, however, it may be a cognitively challenging task to keep track of distinct sums of money that have been mentally allocated towards different purposes. In Aggarwal et al. (2021), we propose that a physical separation of money allocated to the different mental accounts will enhance the effectiveness of labelling as a saving strategy. A related, policy-relevant question for developing countries with low levels of formal account prevalence, but where mobile money has emerged as a viable alternative to the banking sector, is whether multiple accounts provided via mobile money can help people save towards multiple purposes.

To examine these questions, we run a randomised control trial (RCT) with 761 microentrepreneurs based in the city of Blantyre, Malawi. For our experiment, we randomly provided our treatment subjects with either one or multiple accounts, and we also varied whether these accounts were provided via metal lockboxes (similar to a piggybank with a lock, see picture below) or over mobile money. Microentrepreneurs in the multiple account treatment group received two accounts in the case of mobile money, and either two or three accounts in the case of boxes. Those in the control group did not receive any accounts.

Figure 1: Metal lockboxes

Everybody in the study sample (including the control group) received a simple phone to enable phone interviewing and to separate the impacts of cell phones from the impacts of mobile money accounts. We called a subsample of respondents (from all treatment groups and control) twice every week over the phone to measure the effects of these accounts on their financial lives and wellbeing. We also conducted a couple of surveys that included all respondents, and asked a wider array of questions.

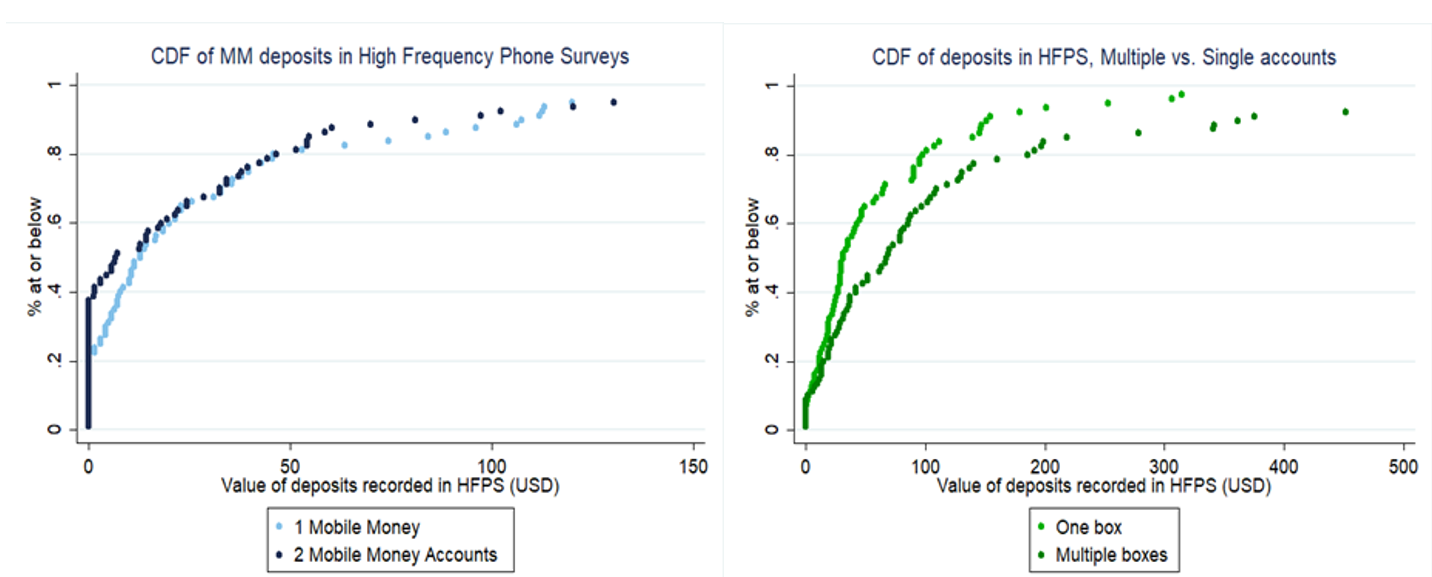

Multiple physical accounts increase aggregate deposits

First, we find strong empirical support that both types of accounts, boxes and mobile money, were useful to the study participants suggesting a general lack of availability of financial tools. The average monthly deposits were US$27 and $9 for box and mobile money holders respectively, which is between 12-36% of business income. Second, we find that simply providing a second account increased the aggregate amount deposited in lockboxes by 40%. However, we do not find this effect for multiple mobile money accounts. In fact, our evidence suggests that the second mobile money account was hardly ever used, potentially because using the second account required users to navigate to another SIM card in their dual SIM phones, which the respondents may have found technically challenging.

Our mobile money results underscore the need to design financial products with an eye towards usability and access. While at baseline the closest mobile money agent was about 11 minutes away, anecdotal evidence suggests that those networks were not very reliable (at least during the study time period in 2017-19). Agents also often did not have adequate cash for customer’s withdrawal requests, thus reducing liquidity and likely discouraging usage.

Figure 2: Cumulative distribution frequency of deposits for mobile money and box account holders

In an examination of impacts on various other saving tools, we see robust evidence of reduced usage of less secure methods such as keeping cash unlocked at home. However, we see mixed evidence on total deposits. There was no detectable increase in mobile money or single lockbox groups, however, we do see an increase in deposits for the multiple lockbox group.

Separate accounts result in increased time and money invested in agriculture

While the provision of accounts increased deposits into more secure saving places, an important question is whether it led to a subsequent improvement in business practices such as choices of where and how to work, business success, and credit. We find that the provision of savings accounts caused business owners to reallocate their labour supply hours from their main business towards farming. While farming is a relatively rare activity and only 6% of the sample engaged in farming, we see that the hours dedicated to farming increased by about 160% for account holders relative to the control group. This increase is accompanied by an increase in investments on the farm, on inputs as well as in buying and renting more land. This suggests that the labour reallocation may have been driven by an increase in the marginal returns to labour in farming.

It is also possible that households were working in the main business, not because it offered higher returns, but because it provided a more regular cash flow relative to farming. By allowing households to save money, the accounts may have alleviated this liquidity constraint. In addition, compared to the control group, we find that there was a 40-60% increase in credit given to customers, which is likely due to increased liquidity and a way of expanding their business in a highly competitive environment. We do not however find compelling impacts on business revenues, profits, or credit taken.

Access to savings tools increases education expenditure

Looking closely at expenditures we find some support that access to savings accounts allowed individuals to increase spending on children's school education by 63% and 31% for boxes and mobile money accounts, respectively. On the contrary, we do not find evidence that saving accounts helped business owners with risk coping strategies such as dealing with illnesses.

In summary, we find that multiple savings accounts helped microentrepreneurs in Malawi deposit more, and that savings accounts in general had a significant impact on their lives. Specifically, they helped them reallocate money towards more secure saving places, pursue earning opportunities with higher (but slower) potential returns such as farming, and accumulate funds for investing in children’s education. Financial service providers should therefore consider ways to physically partition savings accounts to enable people to save more effectively towards their multiple goals.

References

Aggarwal, S, V Brailovskaya, and J Robinson (2021), “Saving for Multiple Financial Needs: Evidence from Lockboxes and Mobile Money in Malawi”, The Review of Economics and Statistics: 1-45.

Ainslie, G (2001), Breakdown of Will, Cambridge: Cambridge University Press.

Dupas, P and J Robinson (2013), “Why Don’t the Poor Save More? Evidence from Health Savings Experiments”, American Economic Review 103(4): 1138-1171.