Information is power: a low-cost transparency programme reduced vendor misconduct and increased market efficiency in Ghana’s mobile money market.

The landscape of mobile money and misconduct

Mobile money has transformed financial services in developing countries by offering accessible banking solutions. However, vendor misconduct, such as overcharging, significantly undermines consumer trust and market efficiency. Misconduct in financial services is ubiquitous in developing countries. In addition to Ghana, where this study was conducted, similar issues of overcharging and fraud have been documented in Kenya, Uganda, and Nigeria (Blackmon et al. 2021). These issues highlight the need for robust interventions to improve market dynamics and trust in digital financial services.

From a theoretical perspective, vendor misconduct can be viewed through the lens of information asymmetry (where consumers know less than vendors) and reputation concerns. Vendors often exploit consumers' imperfect information about official tariffs, leading to misperceived beliefs and fraudulent practices. This misconduct imposes significant costs on consumers and undermines the potential benefits of financial inclusion. In this project, we address these challenges by testing a scalable information programme that enhances transparency and accountability in the mobile money markets in Ghana.

Context and measurement: Mobile money in Ghana

In Ghana, the M-Money market is dominated by MTN M-Money, Vodafone VodaCash, AirtelTigo Money, and GCB Ltd.'s G-Money. Despite its wide reach, this market suffers from significant vendor misconduct. To measure overcharging, we conducted an audit study where trained auditors performed actual M-Money transactions and compared the charges to official tariffs. This objective measure provided clear evidence of misconduct, with 22% of transactions being overcharged.

One potential source of misconduct could be the significant information asymmetry, where vendors possess superior knowledge of official tariffs compared to consumers. To quantify this, we tested both vendors and consumers on their knowledge of transaction tariffs. Vendors were correct 80% of the time, while consumers were only correct 42% of the time. This discrepancy creates opportunities for vendor misconduct.

This misconduct, combined with poor consumer knowledge about official transaction tariffs, resulted in 62% of consumers reporting a lack of trust in vendor points. Moreover,

consumers’ beliefs about misconduct are upwardly biased, with 59% believing they have been overcharged, significantly higher than the objective overcharging measure of 22%.

The experiment: Interventions and methodology

To tackle these issues, we implemented three distinct anti-misconduct information programmes across 130 local markets in Ghana:

- Price Transparency (PT): This intervention provided consumers with information and training about official transaction charges, aimed at reducing instances of overcharging.

- Monitoring and Reporting (MR): This programme offered consumers a toll-free number to report suspected misconduct, increasing the perceived risk of punishment for vendors.

- Combined PT+MR: This intervention integrated both price transparency and monitoring/reporting mechanisms to maximise the impact on vendor behaviour.

In all treatment arms, the treatment status and content are common knowledge among vendors and consumers: we inform vendors about the intervention and provide the same information given to the consumers, making our interventions two-sided.

Findings: Impact on misconduct and market activity

The interventions yielded significant improvements across several metrics:

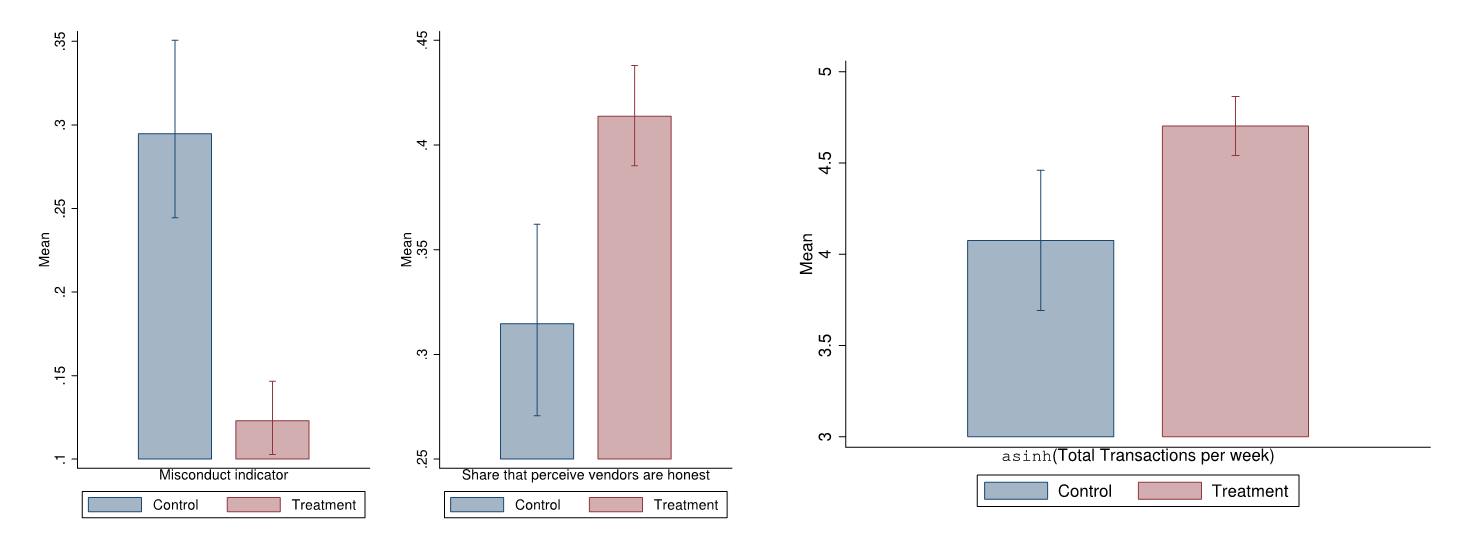

- Reduction in Misconduct: The incidence of overcharging decreased by 21 percentage points, translating to a 72% reduction. The severity of misconduct also dropped significantly, with the average overcharge amount falling by 78% (see left panel of Figure 1).

- Improved Consumer Trust: Enhanced transparency and monitoring efforts increased consumer trust in vendors. The proportion of consumers who believed in the honesty of vendors rose by 30%, reflecting a substantial shift in consumer perceptions (see left panel of Figure 1).

- Increased Market Activity: With improved trust and reduced transaction costs, consumer usage of M-Money services surged by 10-45% (see right panel of Figure 1). Additionally, the likelihood of consumers saving on M-Money platforms increased by 12.1%.

- Vendor Revenue Growth: As misconduct decreased, vendors saw a 52% increase in total sales revenue, indicating that fair practices could enhance business performance and market efficiency.

- Spillover Effects: Even non-treated vendors in treated localities exhibited reduced misconduct, suggesting that the positive effects of the interventions extended beyond the directly targeted vendors. This highlights the potential for widespread market improvements through such interventions.

Visual Evidence

Figure 1: Treatments reduced misconduct and improved perception of vendors’ honesty (left) and increased service usage among consumers (right).

Discussion: Pareto improvement and the prisoner's dilemma

The reduction in misconduct and the corresponding increase in market activity can be understood through the framework of the prisoner's dilemma (a la Macchiavello and Morjaria 2015). In this context, vendors face a situation where individual incentives to overcharge lead to a collectively worse outcome. By implementing transparency and monitoring systems, we effectively shifted the market from a high-misconduct equilibrium to a low-misconduct equilibrium. This shift represents a Pareto improvement, where both consumers and vendors benefit from increased trust and market activity. Consumers experience lower transaction costs and increased trust, while vendors benefit from higher sales volumes and revenues.

Conclusion: Broader implications for policy and practice

Our study highlights the effectiveness of low-cost, two-sided information programmes in addressing market misconduct. By providing consumers with critical information and the means to report vendor malpractices, these interventions significantly enhance market efficiency, consumer trust, and business revenues. The interventions proved highly cost-effective and scalable, with a cost-benefit ratio of 1:5 for service usage among consumers and 1:21 for vendor revenue. The findings from Ghana's M-Money market offer valuable insights for policymakers and stakeholders aiming to improve market integrity in developing economies. Empowering consumers and holding vendors accountable through transparent practices and effective monitoring can create a more trustworthy and efficient market environment, crucial for fostering broader financial inclusion.

References

Annan, F (forthcoming) "Misconduct and Reputation under Imperfect Information." Journal of Political Economy, https://www.researchgate.net/publication/345110909_Misconduct_and_Reputation_under_Imperfect_Information

Macchiavello, R, and A Morjaria (2015), "The Value of Relationships: Evidence from a Supply Shock to Kenyan Rose Exports." American Economic Review, 105(9): 2911-2945.

Blackmon, M, R Mazer, and A Warren (2021), "IPA Consumer Protection Research Initiative: RFP Overview.”