Shortening intermediation chains does not necessarily lead to gains for consumers

How do goods made in one place reach consumers in another? Research on international trade often makes the simplifying assumption that producers sell directly to consumers all over the world. Most of us, however, are more likely to buy from a business that is reselling a product – whether that is Walmart, a local corner store, or a hawker on the side of the road – than from the business that originally made it. Wholesale and retail trade accounts for a large share of global economic activity all over the world (Lagakos 2016).

In fact, goods may pass through the hands of multiple intermediaries on their way to consumers. A vendor selling shoes in a small town in Nigeria is unlikely to source them directly from the manufacturer in southern China, but rather might buy from a wholesaler, who sources from an importer, and so on. In our research, we show that distribution often involves a whole “chain” of intermediaries who buy and resell goods (Grant and Startz 2022).

How do intermediation chains matter for consumers?

How do chains of sequential resale transactions affect consumers? At each step, costs are incurred and markups may be charged. Understanding intermediation chains is therefore key to understanding prices and product availability in different locations, and how consumers in those places stand to gain from globalisation and trade.

There is a common belief that middlemen use their market power to earn profits without providing much value-added. This has often led to political backlash against middlemen, and to policies that restrict their activities. One example is India’s mandis, a system of regulated agricultural marketplaces that has historically restricted where traders can buy and sell agricultural goods (Chatterjee and Mahajan 2021). The same goal of cutting out middlemen often motivates new business models or technologies meant to help producers and consumers connect more directly, such as platforms that link farmers to major markets (Bergquist, McIntosh and Startz 2021), or retailers to producers (Iacovone and McKenzie 2019).

Is cutting out middlemen likely to help or harm consumers? To answer this question, we first need to know what distribution chains look like in practice, and why.

A wholesale trader in Lagos, Nigeria. Photo credit: Sunday Alamba

Documenting intermediation chains in Nigeria

Wholesale and retail trade accounts for as much as a quarter of employment in Nigeria, mostly in small-scale informal enterprises—some estimates suggest that 98% of spending on consumer packaged goods goes through small traditional outlets (Nielsen 2015). Through a project called the Lagos Trader Survey (LTS), we have followed over a thousand wholesale and retail businesses in Lagos, Nigeria since 2013. These businesses buy and resell goods like apparel and electronics, and typically have only one outlet and one employee. In spite of their small scale, many source globally; about half import directly, on average buying US $60,000 per year in stock to resell.

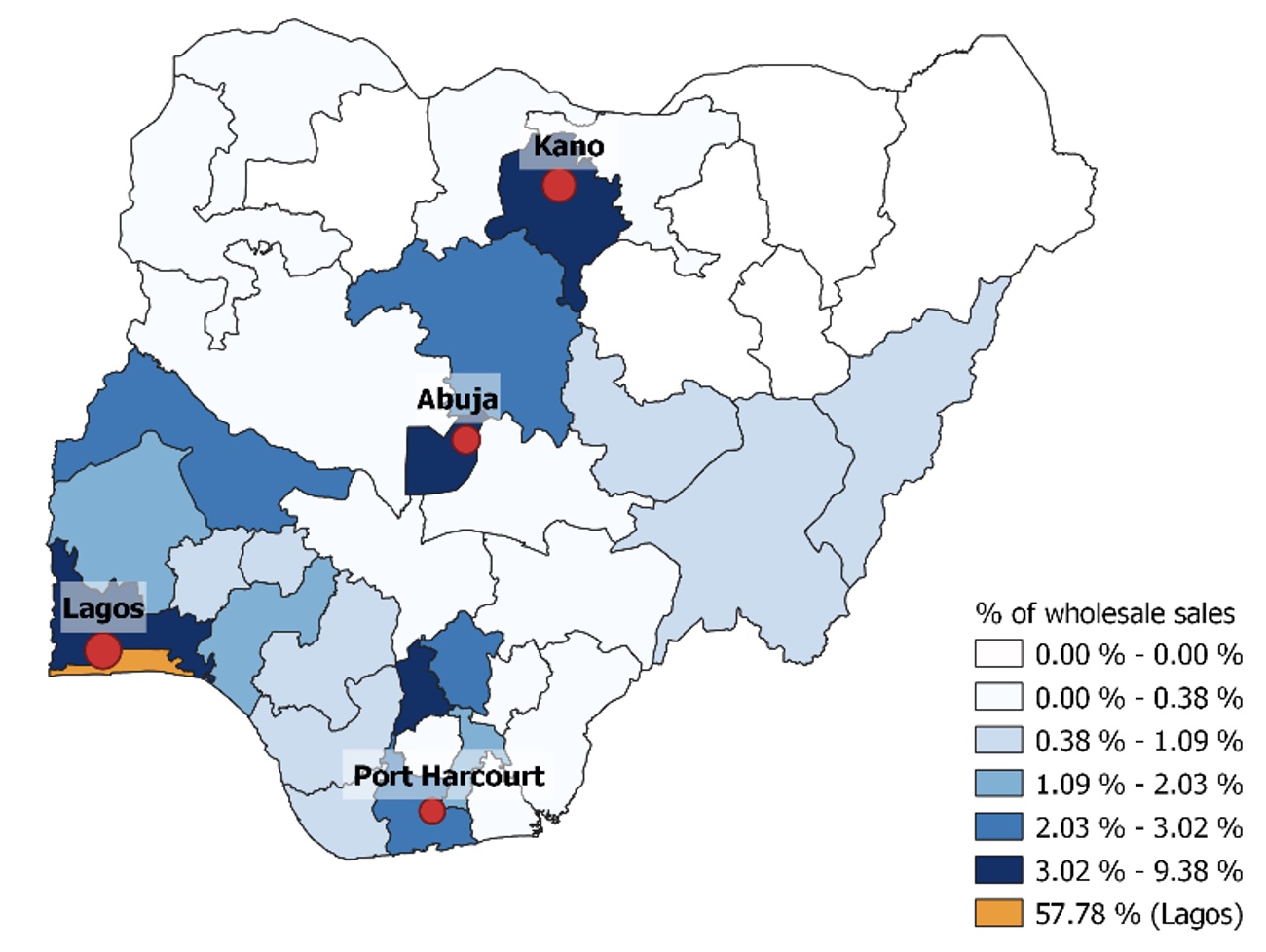

Strikingly, these traders are just one link in the middle of longer chains that carry goods to consumers throughout Nigeria. Almost two-thirds of their international suppliers are wholesalers rather than manufacturers. The majority of their sales are wholesale, meaning that they sell to businesses that in turn resell the goods, rather than to final consumers. Their customers come from all over Nigeria (Figure 1), consistent with Lagos' role as the commercial capital of the country. Thus, Nigerian consumers are served by multi-intermediary chains, with at least two or three independent intermediaries between a foreign producer and a domestic consumer.

Figure 1 Sources of Lagos traders’ domestic sales

Source: Grant and Startz (2022)

We also find that resale transactions vary systematically along this chain, in ways that are likely to be important for consumers.

- Small firms are more likely to buy from wholesalers rather than manufacturers.

- Firms that buy from wholesalers pay higher prices, but face lower “fixed costs” of trade—things like travel costs or fees paid at the port.

- Firms that sell wholesale pay lower prices to their own suppliers, and charge lower markups to their customers, compared to those who sell retail.

Our detailed transaction data point to relationships between firm size, fixed versus variable cost trade-offs, and markups that are related to the structure of the chain itself.

Fixed costs, competition, and variety: How intermediary chains affect price and variety

Why don’t retailers simply cut out the middlemen above them in the chain? The key lies in “economies of scale”. A shopkeeper in a remote town in Nigeria could buy shoes directly from a manufacturer in China at low prices. But to do that, they would have to incur some fixed costs of sourcing – costs that don’t depend on the quantity they want to buy. Many travel to meet with suppliers and inspect goods before purchasing. Shipping is more expensive if you can’t fill a whole shipping container by yourself. There are fees and wait times at the port in Lagos, and so on.

If the shop only sells a small quantity of shoes, it may be worth it to buy at a higher unit price from a domestic wholesaler in Nigeria and avoid these fixed costs. In contrast, a larger shop will find it more worthwhile to pay fixed costs – spread across a larger quantity of shoes – in return for lower prices. This is precisely the relationship we see between firm size, prices, and fixed sourcing costs in the LTS data.

How does this matter for consumers? We show in our research that longer chains involve higher marginal costs for firms, but allow more of them to survive. More firms means more competition, and gives consumers access to a wider range of retailers and products. While higher marginal costs drive prices up, more competition drives them down. Either force may win out, and so, contrary to conventional wisdom, longer chains can sometimes mean lower consumer prices, even when middlemen have market power. Furthermore, consumers may value access to retailers and product variety for their own sake.

Policy implications: Recognising the value and effects of intermediation

It is common for policymakers to assume that cutting out intermediaries will make consumers better off. We find that shorter chains can increase welfare, but will not necessarily do so. The free market does not generally balance the trade-off between lower marginal costs and lower entry of sellers in the same way that consumers do. Therefore, interventions that shorten chains can do good or harm, depending on the situation.

Applying our methods and data to the case of apparel distribution, we find that consumers in small, remote markets in Nigeria are often made worse off by hypothetical new technologies that would allow a small number of retailers to source more directly from producers in China. In these places, the new technology results in consolidation that pushes small retailers out of the market, and the welfare loss associated with fewer sellers outweighs reductions in marginal cost. In contrast, consumers in Lagos, where many retailers already source directly, typically benefit on net.

To understand how a new policy – or improvements to trade logistics or e-commerce – are likely to impact consumers, we must account for how they will change distribution chains. Currently, distribution is a black-box for economists: we have a great deal of data on producers and on consumers, but very little on what goes on between the two. More information on these key links can shed light on why consumers in some places pay so much more for the same goods than others do.

Editors’ note: The research on which this column is based forms part of the PEDL project “Middlemen: Understanding Wholesale and Retail Distribution Chains in Nigeria”.

References

Bergquist, L, C McIntosh, and M Startz (2021), “Search costs, intermediation, and trade: Experimental evidence from Ugandan agricultural markets”

Chatterjee, S and A Mahajan (2021), “Why are Indian farmers protesting the liberalisation of Indian agriculture?”, ARE Update 24(5): 1-4.

Grant, M and M Startz (2022), "Cutting out the middleman: The structure of chains of intermediation", NBER Working Paper No. 30109.

Iacovone, L and D McKenzie (2019), "Shortening supply chains: Experimental evidence from fruit and vegetable vendors in Bogota", Policy Research Working Paper 8977, World Bank.

Lagakos, D (2016), “Explaining cross-country productivity differences in retail trade”, Journal of Political Economy 124(2): 579–620.

Nielsen (2015), Africa: How to navigate the retail distribution labyrinth.