Evidence from South Africa shows that both marketing and financial entrepreneurship training can help small businesses boost profits

Business training programmes are popular policy tools to foster growth among small entrepreneurs. Past research draws a strong connection between better business practices and productivity and efficiency gains (e.g. Bloom et al. 2013, McKenzie and Woodruff 2017). Yet the causal evidence of business training as an instrument for improving business practices shows weak and inconsistent results, and the mechanisms by which such trainings improve outcomes are poorly understood (e.g. Fairlie et al. 2015, McKenzie and Woodruff 2017).

Analysing a business training programme in South Africa

In Anderson et al. (2018), we address these shortcomings by studying a comprehensive business training programme in Cape Town, South Africa, that spanned ten weeks of client engagement. We distinguish between two separate types of business trainings – finance and marketing – in order to identify mechanisms of impact. We differentiate between a ‘growth’ focus in the marketing training, which emphasises sales and revenue expansion, and an ‘efficiency’ focus in the finance training which emphasises cost savings.

Our research design allows us to test the following four hypotheses:

- Business owners with higher ‘marketing’ managerial capital will increase firm profits by implementing more growth-focused policies.

- Business owners with higher ‘financial’ managerial capital will increase firm profits by implementing more efficiency-focused policies.

- Business owners with higher ‘marketing’ managerial capital will increase firm profits to a greater extent when these owners also have narrow prior exposure to different business contexts.

- Business owners with higher ‘financial’ managerial capital will increase firm profits to a greater extent when these owners are also operating more established firms.

Hypotheses one and two relate to primary pathways of impact concerning the content of each training programme, while hypotheses three and four refer to heterogeneous effects. Specifically, we predict that entrepreneurs who have not previously been exposed to different business environments may benefit more from marketing training as it offers them content that was previously unknown through experience. Similarly, we predict that larger, more established businesses may benefit more from finance training as these are the businesses with the operational size and scale that can identify and benefit more from cost savings.

Our study utilises a sample of 852 small businesses in the Cape Town area of South Africa through a randomised controlled trial. The study design comprises two treatment arms, with 266 businesses randomly assigned to finance training and 270 businesses to marketing training. A third group of 316 businesses, the control arm, did not receive any training but was surveyed in the same manner as the treatment groups at baseline and follow-ups. The study measured outcomes at two intervals after the trainings, at six months (midline) and again at 12 months (endline).

Training helps increase profits

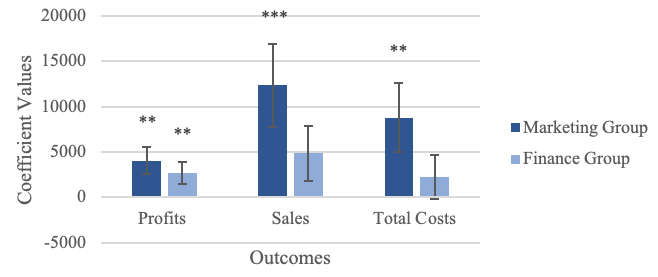

The results show that businesses in both training programmes increased their profits significantly when compared to the control group at endline, as shown in Figure 1. By contrast to previous literature, the magnitude of these effects is quite large, with profit improvements in the range of 41-61% over the control group. These effects are substantively important as well – the increase in monthly profits in either training group is within the salary range of a full-time employee in a regular job with a large South African corporate, such as KFC or Shoprite.

Figure 1 Business outcomes

Pathways of impact

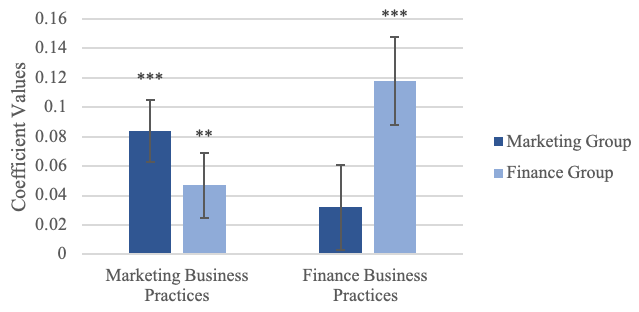

Despite these parallel improvements due to marketing and finance training, the mechanisms or pathways of impact are markedly different. As Figure 1 further illustrates, the marketing training shifted firm owners’ focus onto business growth as seen in the significant increases in sales and costs. These firms also expanded by hiring more employees. Further, Figure 2 shows that businesses assigned to marketing training were more likely to implement practices connected to top-line business growth (e.g. market research, marketing tactics, and sales tactics).

By contrast, finance training tended to shift a firm owner’s focus towards greater efficiency in the business through more finance/accounting activities that economised on costs to boost profits. Specifically, Figure 1 shows that the profit gains for these businesses did not correspond to an increase in sales or costs, rather our results show a significant improvement in their output-input ratio (a marker for efficiency). These firms were also significantly more likely to conduct practices focused on enhancing business efficiency (e.g. financial tracking, financial analysing, and financial planning), as shown in Figure 2.

Figure 2 Business practices aggregate scores

Furthermore, the study results show that our hypotheses on heterogeneous treatment effects hold – marketing training was significantly more effective for businesses with lower prior business exposure, whereas finance training was significantly more effective for larger, more established businesses.

Policy implications

The growth and prosperity of small businesses is vital for economic wellbeing and for generating jobs for a young and rapidly growing labour force in emerging market economies. Our findings show that managerial capital, delivered comprehensively and addressing the appropriate constraints, can help in these causes. Specifically, different types of businesses may benefit from different types of skills training, which can help shape and target future programmes.

Editors’ note: This article is based on this PEDL research.

References

Anderson, S, R Chandy and B Zia (2018), “Pathways to profits: The impact of marketing vs. finance skills on business performance”, Management Science 64(12).

Bloom, N, B Eifert, M Aprajit, D McKenzie and J Roberts (2013), “Does Management Matter? Evidence from India”, Quarterly Journal of Economics 128(1): 1-51.

Fairlie, R W, D Karlan and J Zinman (2015), “Behind the gate experiment: Evidence on effects of and rationales for subsidized entrepreneurship training”, American Economic Journal: Economic Policy.

McKenzie, D and C Woodruff (2017), “Business Practices in Small Firms in Developing Countries”, Management Science 63(9): 2967-2981.