Policies to reduce information frictions as well as the number of firms on e-commerce platforms can raise allocative efficiency and consumer welfare

E-commerce sales have grown substantially in recent years, reaching $2.9 trillion in 2018 – 12% of total global retail sales (Lipsman 2019). Within e-commerce, cross-border sales have grown two times faster than domestic sales. By extending market access beyond geographical boundaries and lowering traditional export barriers, global e-commerce platforms present a promising avenue for small and medium-sized enterprises (SMEs) in developing countries to enter into export markets. Given these promises and the large market potential, numerous policy initiatives have been adopted worldwide with a specific target to onboard SMEs in developing countries to e-commerce platforms, allowing them to tap into the global market (UNCTAD 2016).

Despite the rapid growth of global e-commerce, there is a lack of empirical evidence on the impact of increased export opportunity on firm growth and market dynamics. Most earlier work on the growth of small- and medium-sized firms has emphasised supply-side interventions (e.g. De Mel et al. 2008, Kugler and Verhoogen 2012, Banerjee 2013, Bloom et al. 2013). More recently, Atkin et al. (2017) examine the impact of export demand shocks on firms and show that firms can respond to export demand by improving quality through learning by doing.

While e-commerce platforms potentially expose prospective exporters to buyers around the world, our new study (Bai et al. 2020) shows that the sheer number of firms operating on these platforms can create substantial congestion in ‘consumer search’. When firms’ intrinsic quality is not perfectly observed, these search frictions can further hinder the resolution of the information problem and hinder market allocation towards better firms. In such an environment, initial demand shocks (or ‘luck’) – as opposed to economic fundamentals such as firm productivity or product quality – can have a persistent impact on firms’ long-run growth and market allocation.

Our study is grounded in the context of AliExpress, a world-leading business-to-consumer cross-border e-commerce platform owned by Alibaba. We focus on the industry of children’s t-shirts and collect data about sellers operating in this industry, including detailed seller-product-level characteristics and transaction-level sales records. We complement the platform data with a set of objective, multi-dimensional measures of quality, ranging from detailed product quality metrics to shipping and service quality indicators, collected based on actual online purchases and direct interactions with the sellers, as well as third-party assessments.

First, we document several stylised facts using this newly assembled data, which imply the existence of sizeable search and information frictions in global online marketplaces.

Stylised facts about online exporters

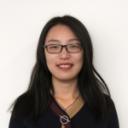

When comparing the sales distribution within ‘identical looking’ product varieties, we find, as shown in Figure 1 below, that even after controlling for horizontal taste differences, the dispersion in sales remains within identical variety groups, as opposed to the trend following a ‘winner-takes-all’ pattern.

Figure 1 Sales performance within identical variety

This finding is indicative of search frictions: in a frictionless market, one would expect that the listing with the highest quality, relative to price, would take over the market. Intuitively, buyers, upon arriving at the platform, face thousands of product offerings but can only sample a limited finite subset of all seller-listings. The relatively low fixed costs of operating in the online marketplace result in an excessive number of firms and product offerings in the online marketplace competing for consumers’ attention.

Next, we ask who gets to grow in the presence of the search problem.

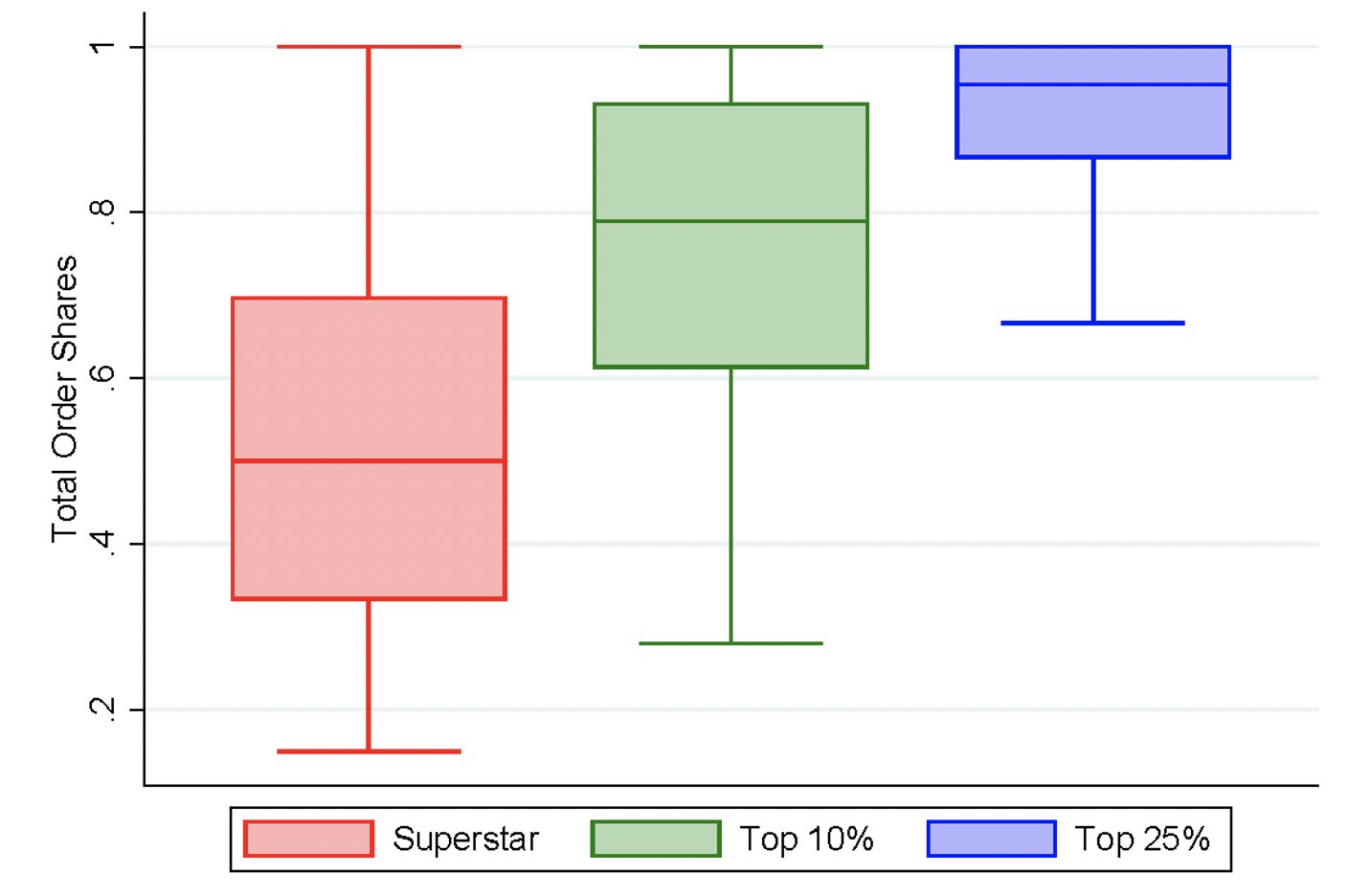

We find that the ‘superstars’, which we define as the largest seller in each product variety, do not necessarily have the highest quality (nor the lowest price). Specifically, we find that quality only weakly predicts sales.

As shown in Figure 2, which plots the distribution of quality difference between the group superstar and the average of the small listings in each group, we observe a substantial fraction below zero: superstars actually have lower quality than the small listings in 45% of the variety groups sampled.

Figure 2 Quality comparison between group superstar and small listings

Intuitively, search friction introduces a random component in firm growth due to the consumer sampling process. Furthermore, when firms’ intrinsic quality is not perfectly observed, such friction can further hinder the revelation of true quality, leading to potential market misallocation.

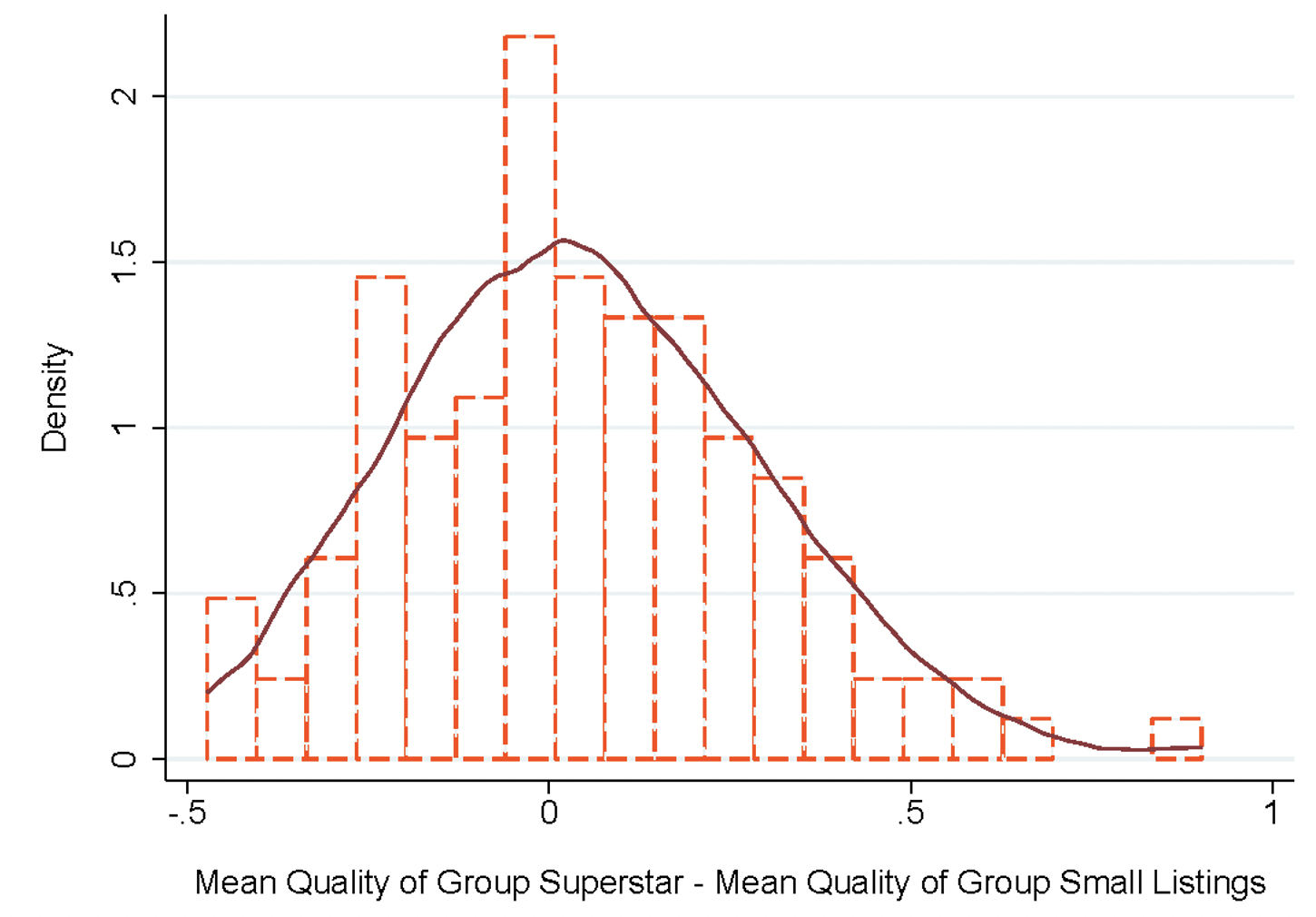

Finally, we dive further into firms’ growth dynamics and examine how superstars emerge. We find that firms with larger past sales, hence higher visibility, have an advantage in overcoming the consumer’s search friction and generating future orders. Specifically, we show that current sales predict the speed of arrival for future sales.

Figure 3 Dynamics of order arrival

Figure 3 plots the number of days it takes to receive the ‘Nth’ order, restricting to listings that accumulated more than ten orders during a six-month period. A striking pattern emerges. On average, it takes 44 days for the first order to arrive. However, when conditioning on having one order, subsequent orders arrive much faster. For example, the second order arrives, on average, five days after the first order, and the third order arrives four days after the second.

This implies that firms with larger past sales (and hence higher visibility) have an advantage in overcoming the consumer’s search friction and generating future orders. However, if information friction prevents a firm’s visibility from being aligned with its fundamentals, such as quality or productivity, the same force could lead to allocative inefficiency. In particular, random demand shocks (or ‘luck’), as opposed to firm fundamentals, can have a persistent impact on firms’ long-run growth. Over time, firm performance diverges; market allocation and consumer welfare depend crucially on the interactions of these demand-side forces.

Experimental evidence on the impact of demand shocks

Our interpretation of the stylised facts centres on a demand-driven mechanism where each additional consumer order makes the selling firm more visible and hence helps the firm to overcome the search frictions faced by subsequent buyers. To further establish the role of this demand mechanism in isolation from unobserved supply-side actions, we conduct an experiment in which we generate exogenous demand shocks and information treatments to a set of small exporters via randomly-placed online purchase orders and reviews.

By tracking these firms over four months, we find that the order treatment leads to a small but significantly positive impact on firms’ subsequent sales. This demonstrates that indeed a key channel for firms to improve their visibility and grow in the online marketplace is by accumulating incremental sales. The effect is, however, mainly concentrated at the top. Only a small fraction of sellers are able to take advantage of the initial demand shock and grow while the vast majority stay small. The size of the average treatment effect suggests that these demand-side frictions cannot be easily overcome by individual sellers’ private efforts.

In the meantime, we do not find any significant treatment effect from the reviews, suggesting that the online reviews are noisy signals of quality and the online reputation mechanism may not function very effectively in the presence of large search friction. Intuitively, reviews only matter when a seller’s listing is discovered by consumers, which is a rare event for small businesses due to their low visibility.

All together, the descriptive and experimental findings are consistent with the presence of large search and information frictions and show that in such an environment demand shocks, as opposed to firm fundamentals, can affect the firm’s future growth.

Structural analyses on the roles of search and information frictions

Motivated by the reduced-form evidence, we build a structural model of the online market, incorporating these realistic frictions. Our model features consumers’ finite sample search to capture search frictions and the online review mechanism to capture information frictions. The model successfully rationalises the experimental findings.

Our structural findings imply that search friction, interacted with information friction, can constitute an important hurdle for the growth of small prospective exporters. Our estimates imply that a consumer can sample only 0.2% of all seller-listings on the e-commerce platform. However, once a seller starts to make sales, the initial success in receiving orders substantially increases a seller’s visibility. Compared with sellers who have made zero sales, striking a first order makes a seller 3.4 times more likely to end up in a subsequent consumer’s search sample. On the other hand, the estimate of the review signal noise indicates substantial information frictions. The posterior uncertainty is only reduced by 7.5% after the first order. This implies that the reputation mechanism takes time to play its role: even if a seller gets sampled and successfully makes a sale, uncertainty regarding quality still remains and only resolves slowly.

Potential policy interventions

Finally, we apply the model to evaluate several policy interventions to promote the growth of promising e-commerce businesses. First, alleviating information frictions by removing the noise of the review signals is shown to significantly shift market share to high-quality sellers and raises consumer surplus by 12.7% due to the improved allocation.

Second, reducing the number of sellers can help mitigate the congestion in consumer search and allow high-quality sellers to be discovered sooner, thereby improving allocative efficiency and consumer welfare. This result points out that just giving firms easy access to foreign markets alone may not be sufficient for generating sustained growth and can in fact exacerbate the search problem, resulting in market misallocation.

Policies should be designed to help firms, especially new businesses, overcome the additional demand-side frictions. In the context of e-commerce, regulating entry, creating a premium market segment, and directing demand to promising newcomers could help facilitate growth and improve the overall market efficiency.

Editors' note: This column first appeared on VoxEU.org.

References

Atkin, D, A K Khandelwal and A Osman (2017), “Exporting and firm performance: Evidence from a randomized experiment”, Quarterly Journal of Economics 132(2): 551-615.

Bai, J, M X Chen, J Liu and D Yi Xu (2020), “Search and Information Frictions on Global E-Commerce Platforms: Evidence from AliExpress”, NBER Working Paper, w28100.

Banerjee, A V (2013), “Microcredit under the microscope: what have we learned in the past two decades, and what do we need to know?”, Annual Review of Economics 5(1): 487-519.

Bloom, N, B Eifert, A Mahajan, D McKenzie and J Roberts (2013), “Does management matter? Evidence from India”, Quarterly Journal of Economics 128(1): 1-51.

De Mel, S, D McKenzie and C Woodruff (2008), “Returns to capital in microenterprises: evidence from a field experiment”, Quarterly Journal of Economics 123(4): 1329-1372.

Kugler, M and E Verhoogen (2012), “Prices, plant size, and product quality”, Review of Economic Studies 79(1): 307-339.

Lipsman, A (2019), “Global Ecommerce 2019: Ecommerce Continues Strong Gains Amid Global Economic Uncertainty”, eMarketer, Saatavissa, viitattu 8.4.

UNCTAD (2016), “Unlocking the Potential of E-Commerce for Developing Countries”.