A large-scale randomised experiment reveals that temporary health insurance subsidies can improve take-up at no additional cost to the government

To reach the goal of universal health coverage, many developing countries – including Ghana, Kenya, the Philippines, Vietnam, and Indonesia – have introduced contributory health insurance programmes. In contributory systems, the very poor are subsidised by tax revenues but everyone else is required to pay a premium, collected through a payroll tax for formal sector workers and directly from individuals for everyone else. Enforcing the insurance mandate for those who must pay premiums directly is a major challenge for these systems, especially for developing countries where the majority of the population is outside of the tax net.

The difficulty of enforcing the insurance mandate can create two complications for governments trying to achieve universal health coverage: (1) low programme enrolment; and (2) adverse selection, where the least healthy are more likely to enrol, thus raising programme costs (Akerlof 1970, Einav and Finkelstein 2011). Indonesia has experienced both. One year after mandatory, universal health insurance was launched in 2014, the contributory portion of the programme, known as JKN Mandiri, had enrolled only 20% of the targeted population and its claims exceeded premiums by a ratio of 6.45 to 1.

To understand what policy levers can be used to address these challenges, we collaborated with the Indonesian government to design a randomised controlled trial in which we offered randomly selected households large, temporary subsidies and assistance with the registration process.

We find that large, temporary subsidies can work. Offering temporary registration incentives increased the number of households enrolled eightfold, at no higher unit cost per enrolee. Even after the subsidies expired, enrolment stayed significantly higher in the subsidy group, again at no higher unit cost per enrolee.

However, subsidies are not a silver bullet. Even when free insurance for the whole family for a year was coupled with assisted registration, it only resulted in a 30% enrolment rate – substantially higher than the status quo, but still a far cry from the original goal of universal enrolment.

The experiment: Testing temporary subsidies and assisted registration

In 2015, in cooperation with the Indonesian government, we designed an experiment involving almost 6,000 households to assess two interventions that had the potential to increase enrolment and reduce adverse selection:

- We studied large, temporary subsidies by randomising households to receive subsidies of either 50% (‘half subsidy’) or 100% (‘full subsidy’) for the first year of enrolment. To be eligible for the subsidy, households had to enrol within two weeks of being offered it.

- To explore the role played by transaction costs, we randomly offered some households at-home assistance with the online registration system, rather than having to travel to a far-off insurance office to enrol.

We evaluated the interventions using a combination of a short baseline survey and detailed administrative data on enrolment, payments, and claims.

The impact of temporary subsidies and assisted registration on enrolment

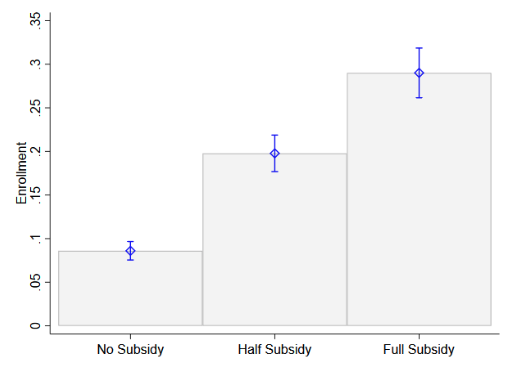

The one-year full subsidies significantly boosted enrolment. As shown in Figure 1, those offered the full subsidy were 20.9 percentage points (almost seven times) more likely to enrol than those in the no-subsidy group while the subsidy offer was valid. The increase was not driven simply by households who would have purchased insurance anyway (‘harvesting’), but rather represented a real net increase in enrolment. The half-subsidies also increased enrolment, although to a lesser extent.

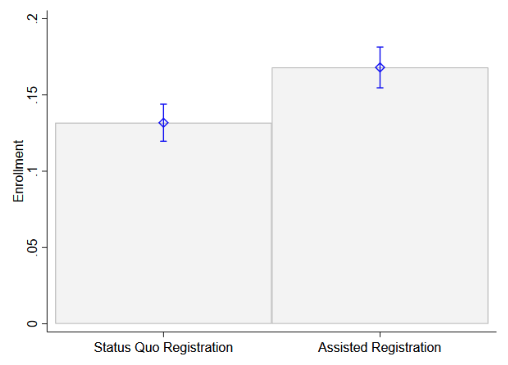

Figure 1 Year 1 enrolment by subsidy and assisted registration treatment

Note: This figure shows mean enrolment for households assigned to different subsidy treatments (graph to the left) and households assigned to different registration treatments (graph to the right), with 95% confidence intervals for the mean.

Households in the assisted internet registration group were 3.5 percentage points (41%) more likely to enrol than those assigned to the status quo registration. Importantly, many more people attempted to enrol than were actually able to do so – nearly as many people attempted to enrol in the assisted internet-based registration as in the full-subsidy group. However, households’ efforts were substantially muted by technical and administrative challenges with the government’s online enrolment system, which could not accommodate changes in family structure that were not reflected in the often-inaccurate official data on who is in each family.

The impact of subsidies on coverage

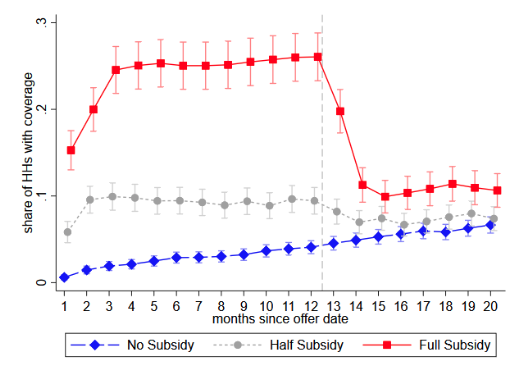

After the initial decision to enrol, households had to decide whether to continue to pay their monthly premiums to remain covered at any given point in time. Figure 2 shows the average coverage of households assigned to each subsidy treatment group, by month since offer. In the no-subsidy group, coverage increased steadily over the time period as more and more households enrolled into the programme, despite many newly enrolled households dropping coverage within a couple of months of enrolment.

The coverage of those offered the full subsidy mechanically remained constant during the first year, when the subsidies were being disbursed. However, even if the full-subsidy group had a high dropout rate after the end of the subsidy (at about month 13-14), coverage levels continued to remain higher than the no-subsidy group at least up to 20 months after the offer date. ‘Experience’ with the health care system might have led households to increase their perceived value of insurance and stay covered after the subsidies expired.

Figure 2 Insurance coverage by subsidy treatment, by month since offer

Note: This figure shows mean insurance coverage by month since the offer for households assigned to different subsidy treatments, with 95% confidence intervals for the mean. Coverage for a household is defined as the premium having been paid in full for all its members that month.

Conclusion: Subsidies increased enrolment and coverage at no extra cost for the government, but were no silver bullet

Despite the fact that more households enrolled under the full-subsidy treatment, the net cost to the government per covered person – the difference between revenues from premiums and payments to providers – was similar with and without the full subsidy. This was true even in the first year, when the subsidy was being disbursed and the full-subsidy group brought in essentially no revenue. This is because the subsidies brought in substantially lower-cost enrolees. Relative to enrolees in the no-subsidy group, those in the full-subsidy treatment reported better health at baseline and had fewer claims during their first year of enrolment.

The cost difference may also, in part, reflect strategic timing decisions by the no-subsidy group. The no-subsidy enrolees submitted more claims than did full-subsidy enrolees in the first three months after enrolment, after which the difference between the two groups attenuated. Such strategic timing of enrolment was less of an option for full-subsidy enrolees because the subsidy offer was time-limited and, once enrolled, they stayed covered for the full first year.

In the second year, once the full-subsidy group began paying premiums, for each covered month full-subsidy households had similar revenues and lower – but non-statistically different – claims to households in the control group. Overall, the bottom line for the government was the same, regardless of treatment. However, for the same total government expenditure, the full-subsidy group had, on net, 58% more people covered. While this is far from universal coverage, it represents meaningfully more people covered with no additional ongoing cost to the government.

Editor’s Note: You can find more evidence on social protection on the IGC at 10 campaign page.

References

Akerlof, G (1970). “The Market for Lemons: Quality Uncertainty and the Market Mechanism”, Quarterly Journal of Economics 84(3): 488–500.

Banerjee, A, A Finkelstein, R Hanna, B Olken, A Ornaghi and S Sumarto (2019). “The Challenges of Universal Health Insurance in Developing Countries: Evidence from a Large-Scale Randomized Experiment in Indonesia”, NBER Working Paper No. 25362.

Einav, L and A Finkelstein (2011). “Selection in Insurance Markets: Theory and Empirics in Pictures”, Journal of Economic Perspectives 25(1): 115–38.