Resource-rich countries do poorly when they have resource-rich neighbours, why? Possibly due to increased conflict.

Though rich in natural resources, sub-Saharan Africa is home to some of the least prosperous countries in the world. A growing body of evidence suggests that the same natural resources that can catalyse rapid growth can also contribute to a vicious cycle of conflict and underdevelopment (Sachs and Warner 2001). Civil conflict in Africa is all too frequent: in 2018 alone, there have been approximately 200 conflict events a week recorded by the Armed Conflict Location & Event Data Project (ACLED).

Conflict arises in part because resource endowments raise the gains from expropriation and can be used to fund military operations (Dube and Vargas 2013, Caselli et al. 2015, Mitra and Ray 2014). For instance, diamonds in Sierra Leone, Angola, and the Ivory Coast both fuel and fund territorial conflicts. Locations with a great abundance of resources may indeed be witness to severely destructive activities, stalling any gains toward prosperity.

The study: Conflict and regional resources

Our study highlights the idea that the likelihood of conflict (and through conflict, the path of economic development) depends not only on a region’s own resources, but also the resources of its neighbours (Adhvaryu et al. 2018). Conflicts are often the outcome of two antagonistic parties vying for economic gain, and it is important to account for the strength of these parties and the potential gains to winning conflicts – both of which depend on the spatial distribution of resources (Grossman 1991, Esteban et al. 2012).

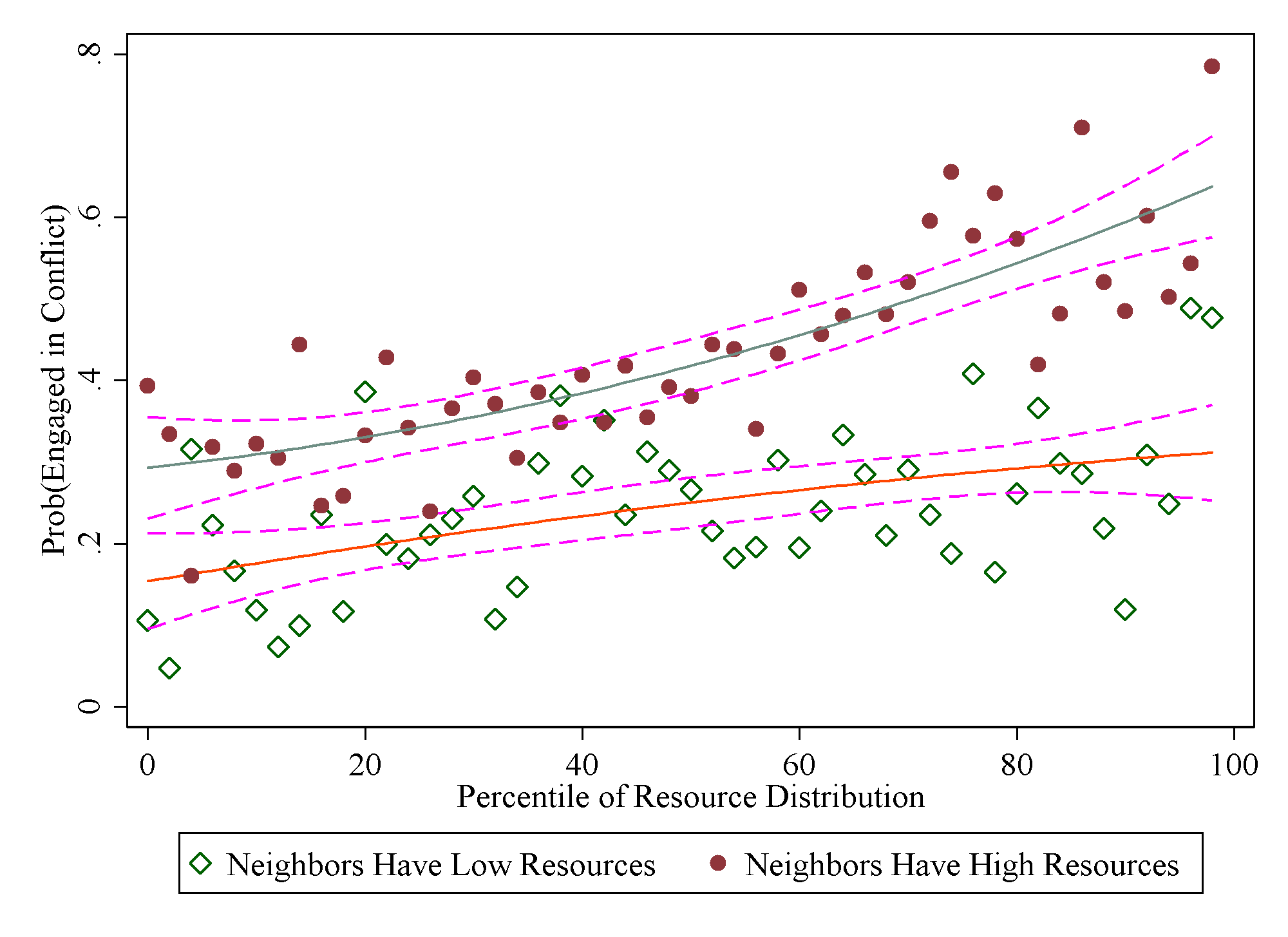

Consider Figure 1, in which each dot represents a 50km by 50km square, together spanning the whole of sub-Saharan Africa. In the top panel, we plot the relationship between the probability of conflict (vertical axis) and the amount of natural resource wealth in a region (horizontal axis). Our measure of wealth captures not just the presence of diamonds, gold, minerals and oil fields, but also the agricultural wealth of a region as proxied by average rainfall between 1998 and 2008.

We split up this relationship by whether neighbouring regions have high or low resources. As the figure shows, while in general more resources are associated with more conflict, this relationship is markedly stronger for regions that have wealthier neighbourswith the means to compete.

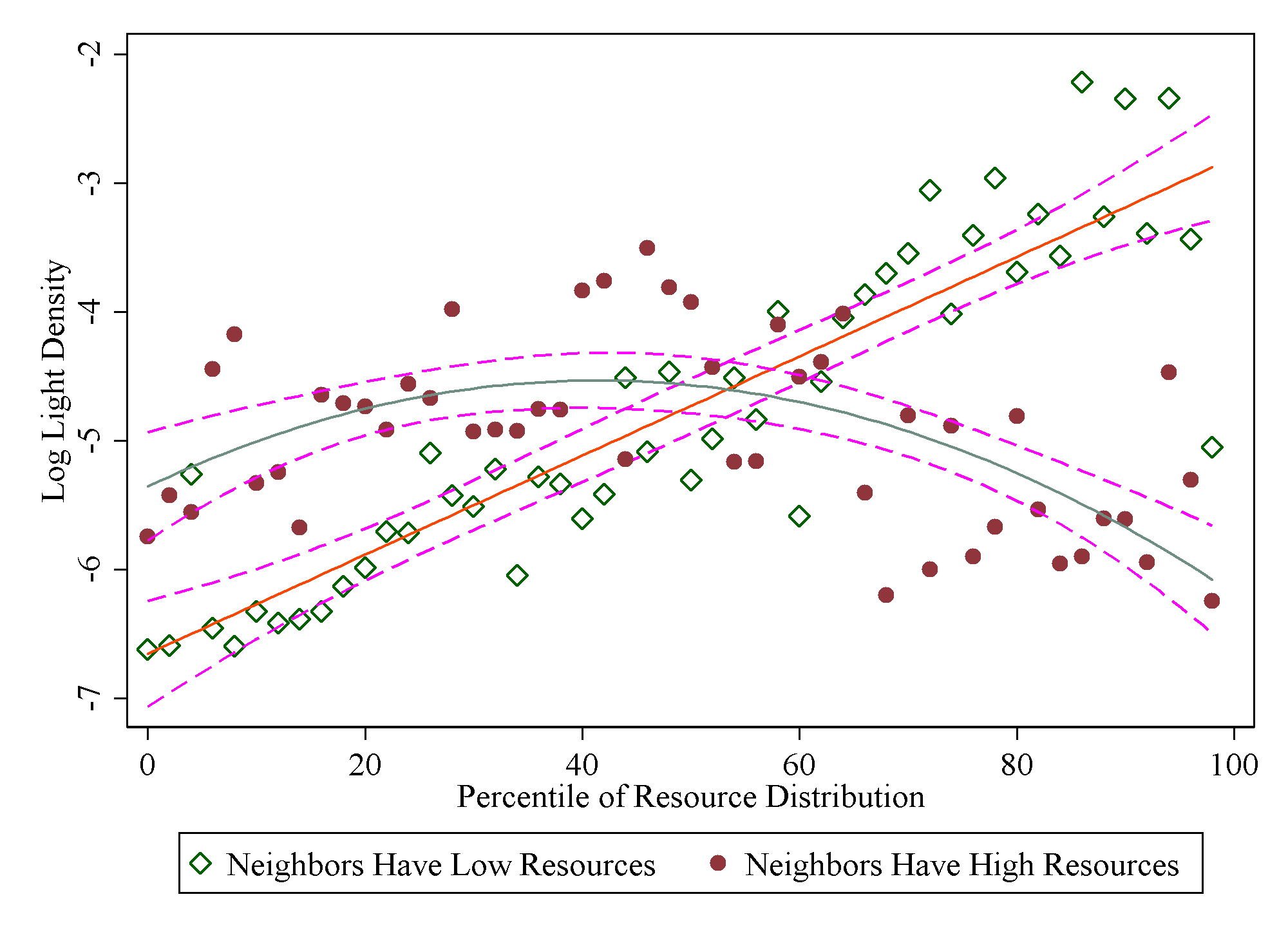

This helps explain the surprising set of relationships depicted in the bottom panel of the figure, plotting the intensity of night-time lights against a region’s resources. Night-time illumination, as captured by satellites, is often used as a proxy for economic prosperity. Here we see that having resource rich neighbours does not imply economic prosperity, measured by light density, as there are high chances of conflict in such areas.

Figure 1 The relationship between regional resources, conflict and light density (a proxy for economic prosperity)

Figure 1 shows that:

- there is a remarkable difference between regions that have resource-rich neighbours and those that do not;

- regions with resource-poor neighbours become more prosperous as their resources increase;

- those that have resource-rich neighbours have a clear inverted U-shaped relationship between resources and prosperity; and

- for those with resource-rich neighbours, a high level of own resources may lead to more conflict, as captured by the top panel of the figure.

Together, the figure makes an important point: the distribution of wealth across potential rivals directly affects where conflict ensues and where growth is stymied by such conflict.

Resources and rivalry

In our paper, we examine the mechanisms underlying the relationship between the spatial distribution of resources across rival parties, conflict, and long-term growth in Africa. We simultaneously incorporate different costs and motives for engaging in conflict, including the gains from expropriating resources, how resources affect the relative strength of rivals, and the loss of economic opportunity when in conflict.

As each mechanism may independently lead to a different set of predictions, it is important to simultaneously incorporate them into a model. We show, in a simple theoretical framework combining several such mechanisms, that:

- when neither group has resources, peace results as there is little to fight over and not much to fund armies;

- when one group has more resources than the other, an uncontested attack may occur in equilibrium; and

- if both are resource rich, then conflict ensues, as there is a lot to gain from expropriating territory and armies are abundantly funded by resources.

We find striking confirmation of these theoretical predictions in the data. We partition sub-Saharan Africa into a 50km by 50km grid and use conflict data from both ACLED and the Peace Research Institute Oslo (PRIO) to test our predictions.

These granular data allow us to capture highly localised civil conflicts lost in cross-country analyses. Accounting for differences across regions, including differences in local agro-climatic characteristics, geographic features, and population densities, we find that own and neighbours’ resources strongly determine the spatial distribution of conflict in exactly the manner predicted by our model.

Weak and strong institutions

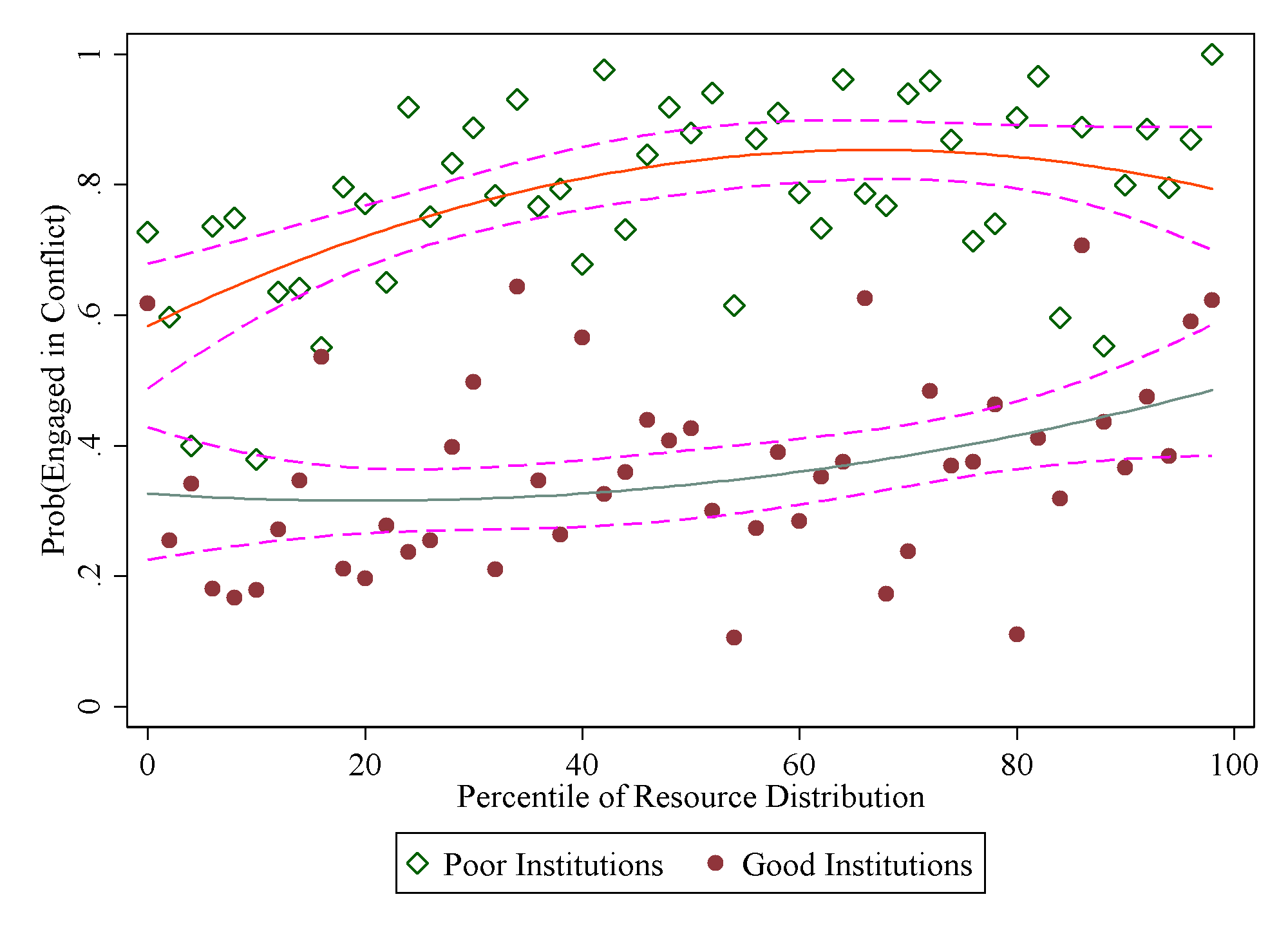

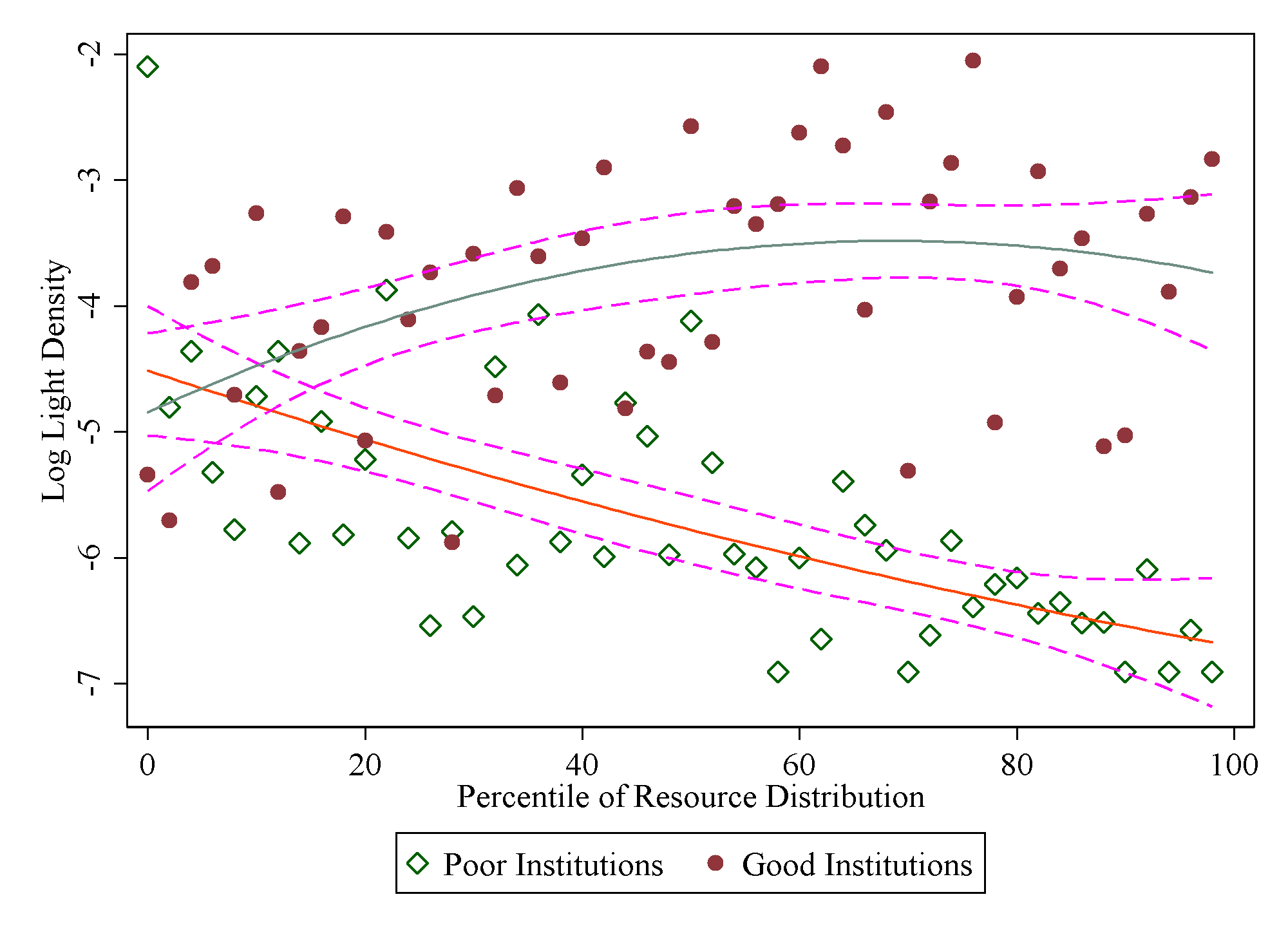

It is also important to know what mitigates the relationship between resources and conflict. Good institutions, like strong property rights, political accountability, and stability can break the link between conflict and resources (Acemoglu and Johnson 2005, Barro 1996, Mehlum et al. 2006). Better institutions raise the costs of conflict and lower the gains from expropriation, which should decrease the explanatory power of a model that predicts conflict solely based on resource distributions. Importantly, we show that the amount of resources required to tip a region into conflict is much higher when institutions are stronger.

To see evidence of this, consider Figure 2, which is similar to our earlier figure, but instead splits the sample up by whether or not institutions are strong in a region. The relationship between resources, conflict, and economic prosperity is starkly different for these two samples:

- Where institutions are strong, conflict is low and more resources are associated with more prosperity.

- Where institutions are weak, conflict is high and more resources are associated with sharp reductions in economic wealth.

Investigating contexts where resources do not lead to more conflict helps us understand the ways to possibly break this deleterious relationship.

Figure 2

Implications

What, in the end, do these results imply for economic development in Africa? The resource-conflict dependence leads to a complex relationship between resources and wealth. We show that resources often lead to a direct increase in wealth; however, as resource-driven conflict increases in certain areas (i.e. those with resource-rich rivals and weak institutions), there are sharp declines in economic prosperity.

These results convey when and to what extent conflict can stunt development and help explain why many resource abundant countries in sub-Saharan Africa are often poorer than resource-poor regions of the world.

References

Adhvaryu, A, J Fenske, G Khanna and A Nyshadham (2018), “Resources, Conflict, and Economic Development in Africa”, NBER Working Paper No. 24309

Acemoglu, D and S Johnson (2005). “Unbundling Institutions”, Journal of Political Economy 113(5): 949-995.

Barro, R (1996). “Democracy and growth”, Journal of Economic Growth 1(1): 1-27.

Caselli, F and A Tesei (2016). “Resource windfalls, political regimes, and political stability”, Review of Economics and Statistics 98(3): 573-590.

Dube, O and J F Vargas (2013). “Commodity price shocks and civil conflict: Evidence from Colombia”, Review of Economic Studies 80(4): 1384-1421.

Esteban, J, L Mayoral and D Ray (2012). “Ethnicity and conflict: An empirical study”, American Economic Review 102(4): 1310-1342.

Grossman, H I (1991). “A General Equilibrium Model of Insurrections”, American Economic Review 81(4): 912-21.

Mehlum, H, K Moene and R Torvik (2006), “Institutions and the Resource Curse”, Economic Journal 116(508): 1-20.

Mitra, A and D Ray (2014), “Implications of an economic theory of conflict: Hindu-Muslim violence in India”, Journal of Political Economy 122(4): 719-765.

Sachs, J D and A M Warner (2001), “The curse of natural resources”, European Economic Review 45(4): 827-838.