Anti-corruption regulation against multinational corporations in developed countries can increase the local economic benefits of natural resource extraction for African communities

Rich endowments of natural resources, such as oil and precious minerals, can be a burden for countries with weak political institutions, where corrupt government officials extract rents from the local economy (Robinson, Torvik, and Verdier 2006). This phenomenon has been referred to as the “political resource curse” (Mehlum, Moene, and Torvik 2006, Armand et al. 2020). The extractive sector of Africa is a “hotspot” for concerns about the resource curse and has caught the attention of policymakers and academics.

Anti-corruption interventions in Africa tend to focus on domestic wrongdoings, yet a significant percentage of the high-profile corruption scandals happen among multinational corporations. In response, developed countries, where most large multinational corporations are headquartered, have enacted anti-corruption regulations—the most prominent and widely enforced being the US Foreign Corrupt Practices Act (FCPA). In our paper (Christensen, Maffett, and Rauter 2023), we examine how foreign corruption regulation, in the form of a significant increase in US FCPA enforcement, affects the economic benefits local communities receive from extraction activities in resource-rich areas of Africa. Our study aims to provide evidence of whether and how foreign corruption regulation helps reverse the resource curse.

Methodology

Because we expect the FCPA’s impact to be strongest near extraction sites, we focus on the economic benefits for communities located within a 10- to 50-kilometer radius around an active natural resource extraction facility (henceforth, a “cell”). FCPA enforcement actions mainly affect companies under US jurisdiction that are headquartered in countries that signed the OECD’s legally binding Convention on Combating Bribery of Foreign Public Officials in International Business Transactions (Christensen, Maffett, and Rauter 2022). We are also able to construct a control group of communities less likely to be affected by the FCPA, i.e. extraction facilities with an owner not under US jurisdiction and not headquartered in an OECD country. We estimate the effect of FCPA enforcement by comparing changes in several outcome variables for communities around extraction facilities owned by companies subject to the FCPA (treated communities) to those that are not (control communities) before and after a significant mid-2000s increase in FCPA enforcement.

The primary outcome we focus on is “luminosity”, which is measured by the density of night-time light emissions at levels of spatial stratification from 10- to 50-kilometers around an extraction facility. We use luminosity rather than other economic indicators, like GDP, because it reflects economic activity more broadly, is available at much finer geographic specificity, and allows for estimating changes in activity at the subnational level. The other outcome variables we look at are sub-nationally geocoded data on electricity access, cash-wage employment, and perceived corruption from the Afrobarometer survey.

Increase in night-time luminosity after FCPA enforcement increase

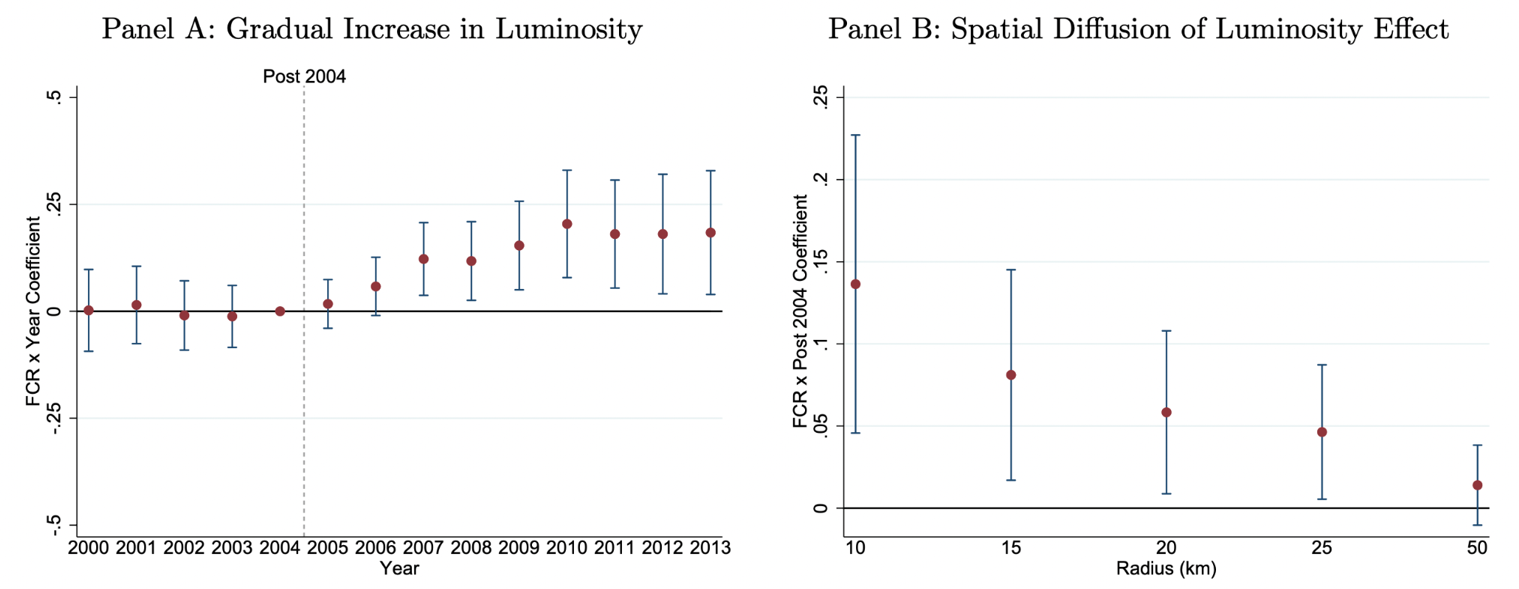

Figure 1 shows two graphs reporting estimates of changes in luminosity for communities affected by the post-2004 increase in FCPA enforcement (i.e. “treated” communities) compared to a control group of communities that were not (based on coefficients from dynamic difference-in-differences regressions). Panel A shows that, before 2005, luminosity changes for the subsequently treated communities were similar to the control group—suggesting that our control group provides a reasonable benchmark. Consistent with foreign corruption regulation increasing the local economic benefits of resource extraction, after 2004, treated communities exhibit a gradually increasing level of luminosity relative to the control group. After 2010, the difference in luminosity between treated and control communities stabilizes at an approximately 20% higher level.

Figure 1: Night-time luminosity

Panel B shows the spatial diffusion of the luminosity effect. If the observed luminosity increase is attributable to changes in the extraction sector, we expect the effect’s magnitude to diminish as the distance between the extraction facility and the local community increases and resource extraction becomes a less central part of economic activity. As shown in the graph, communities within a 10-(25-) kilometer radius of affected extraction facilities experienced an increase in luminosity of 15% (5%). This effect decreases monotonically with a community’s distance from a treated extraction facility, but remains statistically positive for radii up to 25 kilometers.

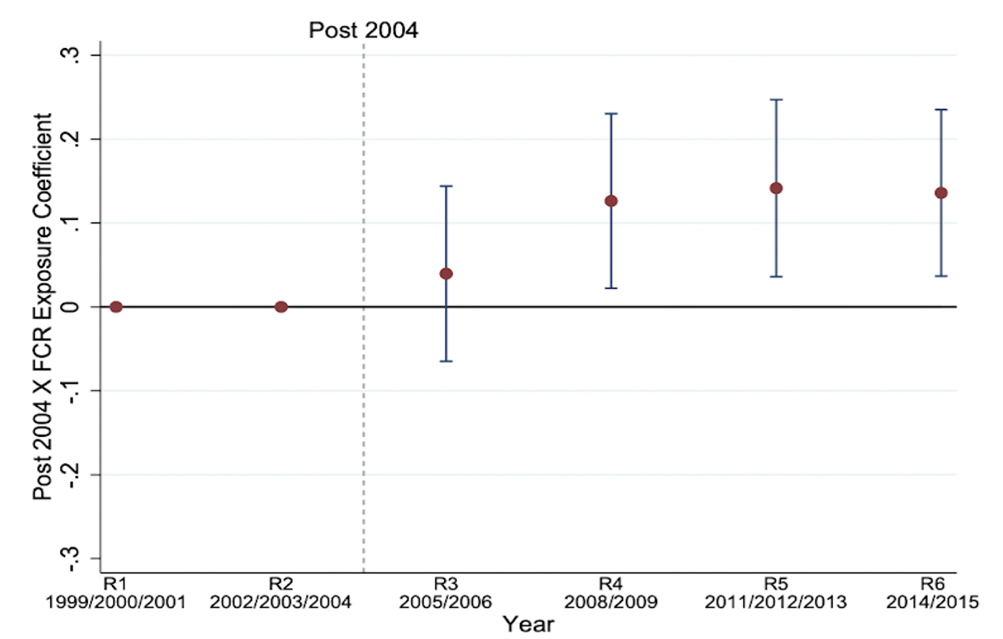

The observed luminosity increase suggests that, after 2004, residents of communities near extraction facilities subject to the FCPA use more electricity. Consistent with this interpretation, Figure 2 reveals that, after 2004, residents of communities near treated extraction facilities reported having greater electricity access (measured using data from the Afrobarometer survey) compared to the control group.

Figure 2: Electricity access

Increase in local economic benefits beyond electricity

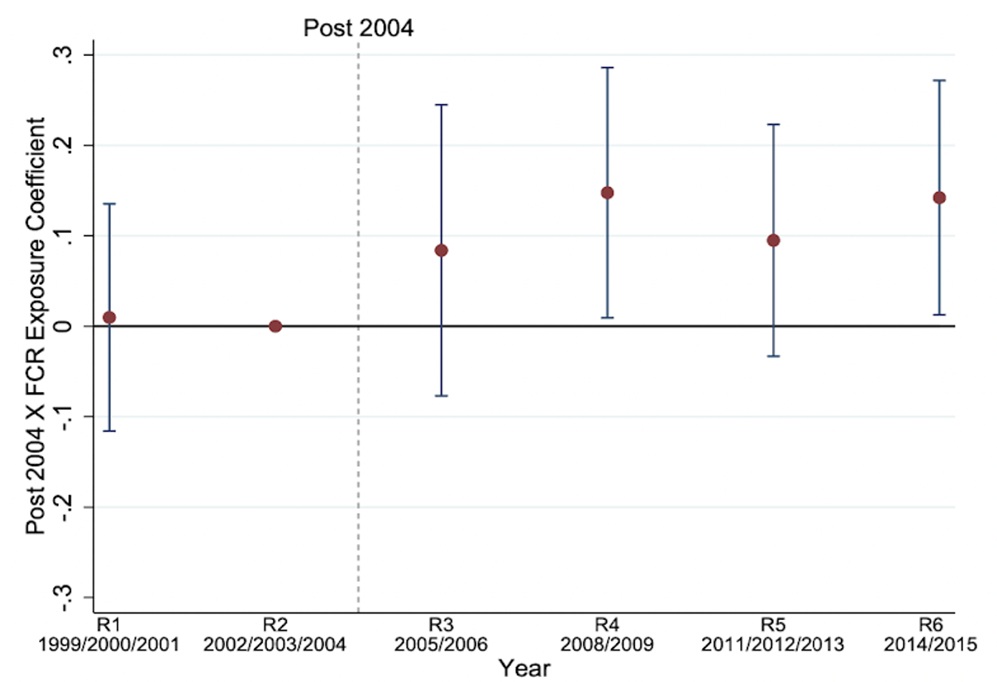

To assess whether the observed increase in luminosity and electricity access is accompanied by other economic benefits, we use an alternative measure of economic activity, cash-wage employment. Cash-Wage Employment is an indicator equal to one if a respondent answers yes to the Afrobarometer survey question “Do you have a job that pays a cash wage?” Figure 3 shows that, after 2004, respondents in communities affected by the FCPA report a significant increase in cash-wage employment, relative to the control group.

Figure 3: Cash-wage employment

The resource curse reversed?

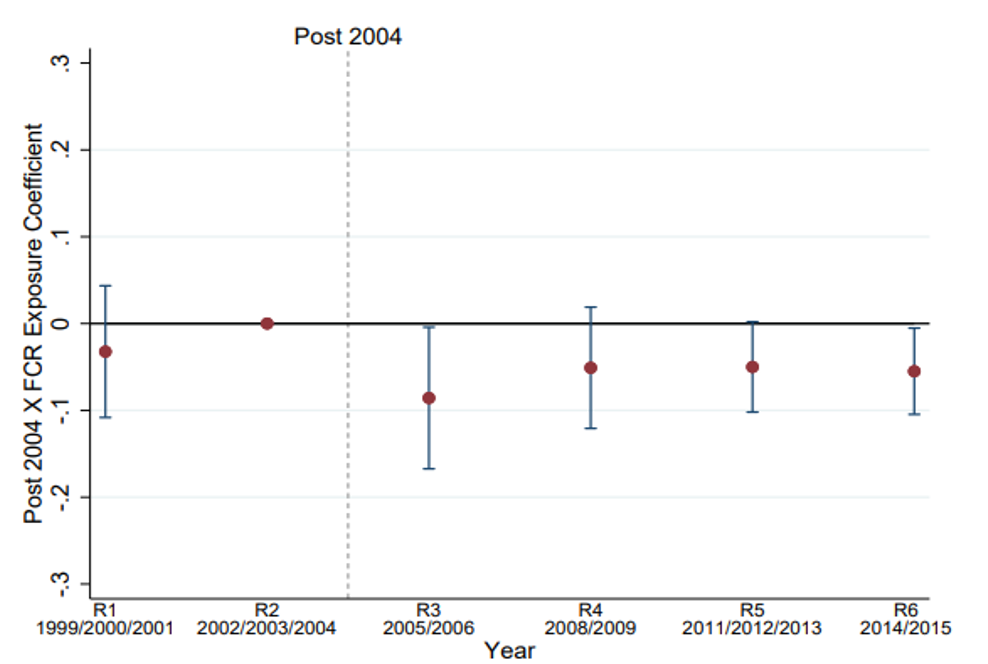

To shed light on whether the increase in economic activity we document is accompanied by a broad decline in the corruption that contributes to the political resource curse, we examine two additional outcomes 1) changes in perceived corruption and 2) a novel measure of the benefits that local communities receive from resource extraction based on the correlation between global mineral prices and local luminosity. We measure perceived corruption based on answers to the Afrobarometer survey question “How many of the following people do you think are involved in corruption: Government officials?” Figure 4 shows that, after 2004, residents around extraction sites subject to the FCPA perceive the government as less corrupt relative to the control group, indicating a likely reduction in corruption resulting from foreign corruption regulation.

Figure 4: Local corruption perceptions

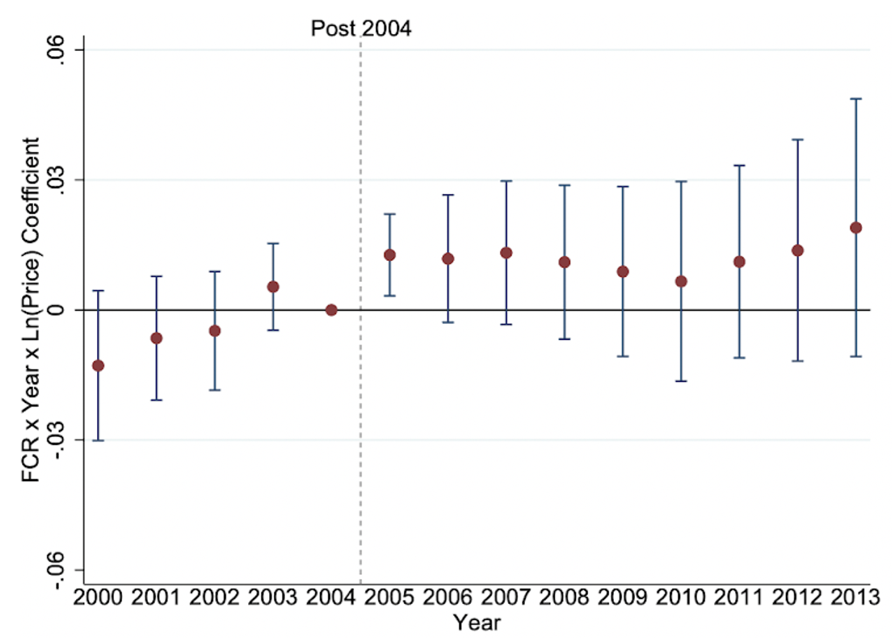

Finally, we examine changes in the association between global commodity prices (for the locally extracted commodity) and luminosity. We argue that a higher correlation between commodity price changes and luminosity can be interpreted as an indication that the local community receives a greater share of the rents from resource extraction. Consistent with increased enforcement of foreign corruption regulation reducing local corruption and reversing the political resource curse, Figure 5 shows a gradual (albeit imprecisely estimated) increase in the association between commodity prices and luminosity after 2004.

Figure 5: Pass-through from commodity prices to night-time luminosity

Policy implications

An important policy implication of our findings is that increased enforcement of foreign corruption regulation, such as the US FCPA, against multinational corporations can increase the local economic benefits of natural resource extraction in African communities around oil and mineral extraction facilities—possibly because a larger share of the resource rents are captured locally rather than being siphoned off through bribery and corruption. Our study also highlights the long reach of the FCPA and illustrates how anti-corruption regulation originating in developed countries can have a positive impact on the economic conditions in developing countries.

A further implication of these results is that, by mitigating the factors that contribute to the political resource curse, foreign corruption regulation can be an effective policy instrument for changing corporate behavior. This implication is particularly relevant for developing countries that might not have the resources, institutions, or political will to address misconduct by multinational corporations themselves.

References

Armand, A, A Coutts, P C Vicente, and I Vilela (2020), “Does Information Break the Political Resource Curse? Experimental Evidence from Mozambique.” American Economic Review, 110(11): 3431-53.

Christensen, H, M G Maffett and T Rauter (2022), “Policeman for the World: The Impact of Extraterritorial FCPA Enforcement on Foreign Investment and Internal Controls.” The Accounting Review, 97(5): 189-219.

Christensen, H, M G Maffett and T Rauter (2023), “Reversing the Resource Curse: Foreign Corruption Regulation and the Local Economic Benefits of Resource Extraction.” American Economic Journal: Applied Economics (Forthcoming).

Mehlum, H, K Moene and R Torvik (2006), “Institutions and the Resource Curse.” Economic Journal, 116: 1-20.

Robinson, J A, R Torvik and T Verdier (2006), “Political Foundations of the Resource Curse.” Journal of Development Economics, 79(2): 447-468.