When SOEs are privatised their employees’ wages, particularly for the less educated, fall dramatically, which also has negative spillover effects on workers at other private sector firms.

A discussion of the key takeaways from this research is available as a podcast here.

In many countries, privatisation of state-owned enterprises (SOEs) remains a popular policy tool for debt-burdened governments to quickly raise large amounts of revenue. Often, however, workers at state-owned enterprises oppose privatisation, fearing it will lead to layoffs and lower wages. Despite these fears, there is limited empirical evidence on how privatisation impacts workers. Most of the academic literature on privatisation focuses on the impact of privatisation on firm profits and efficiency (Megginson and Netter 2001, Porta and Silanes 1999). However, the source of these gains is not always clear, and one possibility is that firms increase profits through lower wages and employment. Therefore, while privatisation may benefit firm owners, it could lead to decreases in worker welfare.

A useful case to consider

To understand the privatisation process and how it might affect workers it is helpful to discuss the case of Telebrás, a large Brazilian telecommunications company that was privatised in 1998. Before privatisation, employees of Telebrás organised multiple protests and filed lawsuits seeking to block the privatisation sale, fearing it would result in lower wages and employment. Later, they sought to include stipulations regarding employment and compensation into the purchase (Guimarães 2007). In the end, these stipulations were not included when Telebrás was sold in 1998. After privatisation, unions in the telecommunications industry report losing bargaining power with the new owners, leading to layoffs and worse compensation packages.

In a recent article (Arnold 2022), I aim to provide evidence on the impacts of privatisation on workers by studying Brazil’s 1990s privatisation program which raised roughly $87 billion in revenue, making it one of the world’s largest privatisation programs (Telebrás was one of many firms privatised in this time period in Brazil). Brazil makes an ideal case study for privatisation given both current policy debates surrounding privatisation as well as the rich administrative data available to study past privatisation periods.

In my study, I use matched employer-employee data from Brazil which contains earnings and demographic information for the entire formal sector of Brazil. To estimate the impact of privatisation on workers, I compare earnings for workers in SOEs that are privatised to otherwise similar workers both before and after privatisation. Given the rich administrative data, I am able to construct a valid control group for the privatised workers by matching each privatised worker to a worker of similar age employed in the same occupation and industry.

How are workers at privatised SOEs affected?

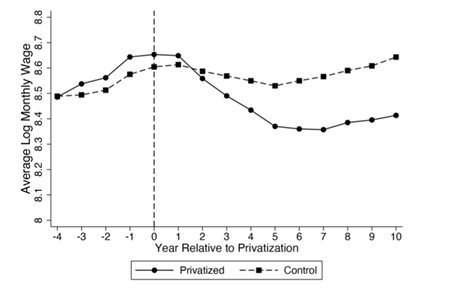

Figure 1 plots the average log monthly wage (in real terms) for workers in the privatised SOEs alongside workers in the matched control group. As can be seen in Figure 1, in the years prior to privatisation, earnings are similar for both the privatised and control workers. However, after privatisation, earnings for the privatised workers fall dramatically. Ten years after privatisation, the privatised workers earn roughly 26 percent less than the control workers.

Figure 1: On average, workers in privatised SOEs lose significant earnings following privatisation

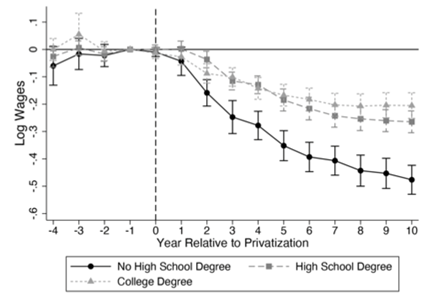

This shows that on average, workers in privatised SOEs lose significant earnings following privatisation. However, it is unclear how this loss is distributed across workers. It could be that politically connected managers are able to inflate their wages in SOEs relative to private-sector firms. To explore this possibility, Figure 2 plots the impact of privatisation on log monthly earnings for three different groups: workers without a high-school degree, worker with a high-school degree, and workers with a college degree. As can be seen in the Figure, earnings losses are by far the largest for workers without a high-school degree (roughly twice as large), suggesting the losses are not solely due to large rents for politically connected managers. While privatisation led to persistent earnings losses for all groups, the losses are greatest for the least economically advantaged group.

Figure 2: Earnings losses are by far the largest for workers without a high-school degree

These direct impacts of privatisation are large and economically meaningful. However, they will underestimate the total impact of privatisation on workers in the presence of spillovers to the private-sector labor market. Theoretically, these spillovers might arise for several reasons. For example, one reason is that SOEs hire many workers and pay high wages, which could lead to higher wages at private-sector firms who need to compete for workers against these SOEs.

Do these effects spill over?

To test for spillovers, I construct a measure of exposure to privatisation which traces how the impacts of privatisation propagate to private-sector firms connected to privatised SOEs by labor mobility. For example, before privatisation, a large fraction of electrical technicians were employed in SOEs. Therefore, electrical technician jobs at private-sector firms were highly exposed to privatisation. I find that exposure to privatisation is associated with a significant decline in wages. To put the magnitude of the spillovers in perspective number in perspective, I compute a simple summary calculation which suggests that privatisation decreased the aggregate wage in the formal sector of the Brazilian labor market by about 3 percent. Roughly one-third of this effect attributable to the direct effect on privatised workers. That is, only considering the impact of privatisation on workers employed at the privatised SOEs, the aggregate wage in Brazil would have declined by about 1 percent following privatisation. The spillovers magnify this direct effect, leading to a 3 percent overall decline in wages. Therefore, in this context, incorporating spillovers is crucial for understanding the total impact of privatisation on workers.

Interpreting these results

These results show that privatisation can have large, negative impacts on workers. However, even with these large negative impacts, privatisation may still be welfare improving overall. Increases in efficiency will contribute to economic growth and could outweigh the negative impacts on exposed workers. On the other hand, if privatisation increases profits primarily through reduced wages and employment, then the perceived “efficiency benefits” of privatisation may be due to decreased worker welfare rather than increased output and lower prices for consumers.

Editor's note: This is an updated version of a previous VoxEU Column.

References

Arnold, D (2022), “The Impact of Privatization of State-Owned Enterprises on Workers”, American Economic Journal: Applied Economics 14(4): 343-380.

Guimarães, S MK (2007), “Brazil’s Telecom Unions Confront the Future: Privatization, Technological Change, and Globalization”, International Labor and Working-Class History 72(1):42-62.

Megginson, W L and J M Netter (2001), “From State to Market: A Survey of Empirical Studies on Privatization”, Journal of Economics Literature, 39(2):321-389

Porta, R La and F L de Silanes (1999) “The Benefits of Privatization: Evidence from Mexico”, The Quarterly Journal of Economics, 114(3):1193-1242.