Rural insurance networks in India incentivise adult males to remain in villages, contributing to the country’s low rural-to-urban migration rates

Rural-urban migration is exceptionally low in India. Changes in the rural and urban population between decennial censuses over the period 1961-2001 indicate that the migration rate for working age adult males (those aged 25-49) ranged from 4% to 5.4%.

An independent measure of migration constructed from the nationally representative India Human Development Survey (IHDS) conducted in 2005 suggests a male rural-urban migration rate of 6.8%; while in the male subsample of the Indian Demographic and Health Survey (DHS), the migration rate is 5.3%. To put these statistics in perspective, the corresponding migration rate from the 1997 Brazil DHS, which also includes a male sample, is over twice as large at 13.9%.

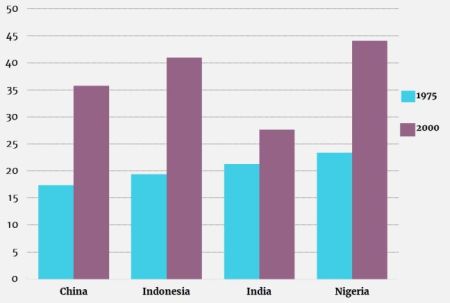

India’s unusually low rural-urban migration is also reflected in its rates of urbanisation. Figure 1 plots the percentage of the adult population for four large developing countries – China, India, Indonesia and Nigeria – who are living in cities, as well as the change in this percentage between 1975 and 2000. Urbanisation in all four countries was low in 1975, but India had fallen far behind the others by 2000.

Figure 1 Change in percentage urbanised, by country, 1975-2000

Source: United Nations Development Programme (UNDP), 2002

Previous studies have documented that rates of urbanisation in India are lower – by one full percentage point – than countries with similar levels of urbanisation. What’s more, the fraction of the population of India that is urban is 15% lower than in countries with comparable GDP per capita.

Perhaps the most relevant comparison is with China, a country that has experienced explosive economic growth over the past three decades accompanied by historically unprecedented rural-urban migration, despite restrictions on residential mobility. The absence of a similar movement in India, where there are no such explicit restrictions, evidently demands an explanation.

Comparative rural-urban wage gaps

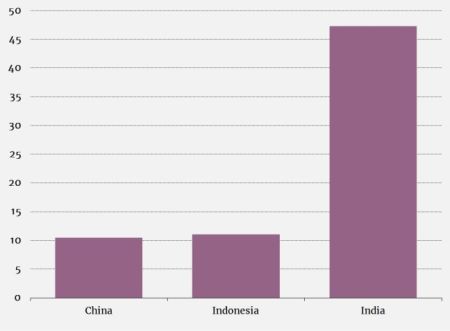

The simplest explanation for India’s low rural-urban mobility might be that rural and urban wages are relatively close, reducing the incentive for workers to migrate. To assess the validity of this explanation, we compare the rural-urban wage gap in India with the wage gap in two other large developing countries – China and Indonesia – in Figure 2.2

Figure 2 Rural-urban wage gap, by country

Sources: Chinese mini-census, 2006; Indonesian Family Life Survey (IFLS), 2007; National Sample Survey (NSS) of India, 2004

We focus on workers with less than primary education to avoid the confounding effects of differences in the returns to education in rural and urban labour markets. Workers with little education will perform similar – menial – tasks in both markets, and so wage gaps for them can be interpreted as an arbitrage opportunity.

As Figure 2 shows, the rural-urban wage gap for India, at over 45%, is actually much higher than the corresponding gap for the other two countries, which is about 10%. One reason why urban wages are higher than rural wages is because the cost of living is higher in urban areas. When we account for these differences in the cost of living, the Indian wage gap declines to 27%.

Although the Chinese and Indonesian data do not allow us to make the same adjustment, the nominal wage gap in these countries serves as an upper bound for the real wage gap because urban prices will always be higher than rural prices. It follows that the real wage gap in India is at least 16 percentage points larger than it is in China and Indonesia. There is evidently some friction that prevents rural Indian workers from taking advantage of more remunerative job opportunities in the city.

The negative impact of rural insurance on mobility

The explanation that we propose in Munshi and Rosenzweig (2016) for India’s low mobility is based on a combination of well-functioning rural insurance networks and the absence of formal insurance, which includes government safety nets and private credit. When an insurance network is active, households that receive a positive income shock provide a transfer (in cash or kind) to one or more households in the network that receive a negative shock. This smooths the consumption of each household over time, making risk-averse households better off.

The challenge when organising such a network is to prevent households that must make transfers from reneging on their obligations. Social sanctions help to solve this commitment problem and, not surprisingly, mutual insurance arrangements throughout the world are organised around well-established social groups.

In rural India, informal insurance networks are organised along caste lines. The basic marriage rule in India (which recent genetic evidence indicates has been binding for nearly 2,000 years) is that no individual is permitted to marry outside the sub-caste or jati (for expositional convenience, we use the term ‘caste’ interchangeably with ‘sub-caste’). Frequent social interactions and close ties within the caste, which consists of thousands of households clustered in widely dispersed villages, support very connected and exceptionally extensive insurance networks.

Households with members who have migrated to the city will have reduced access to rural caste networks for two reasons:

- First, migrants cannot be as easily punished by the network for reneging on their obligations. What’s more, their family back in the village now has superior outside options (in the event that the household is excluded from the network). It follows that households with migrants cannot credibly commit to honouring their future obligations to the same extent as households without migrants.

- Second, an information problem arises if the migrant’s income cannot be observed. If the household is treated as a collective unit by the network, it always has an incentive to misreport its urban income so that transfers flow in its direction.

If the resulting loss in network insurance from migration exceeds the income gain from migrating to urban areas, then large wage gaps could persist without generating a flow of workers to higher-wage areas. This distortion is paradoxically amplified when the informal insurance networks work exceptionally well because rural households then have more to lose by sending their members to the city.

Strategies to overcome restrictions on mobility

One strategy to circumvent these restrictions on mobility would be for members of the rural community to move to the city as a group. Members of the group could then monitor each other and enforce collective punishments, solving the problems of information and commitment. They could also help each other to find jobs at the destination.

The history of industrialisation and urbanisation in India is indeed characterised by the formation and evolution of caste-based urban networks, sometimes over multiple generations (Munshi and Rosenzweig 2006). But a limitation of this strategy is that a sufficiently large (common) shock is needed to jump-start the new network at the destination, and such opportunities occur relatively infrequently (Munshi 2011). Thus, while members of a relatively small number of castes with (fortuitously) well-established destination networks can move with ease, most potential migrants will lack the social support they need tomove.

A second strategy to reduce the problems of information and enforcement that restrict mobility is to migrate temporarily – and seasonal migration in India has been increasing over time. The principal limitation of the temporary migration strategy is that it will not fill the large number of jobs in which there is firm-specific or task-specific learning and where firms will want to set permanent wage contracts.

Both strategies will be used by rural households and castes to facilitate mobility. But the central hypothesis of our researchis that most men will nevertheless be discouraged by the loss in insurance from migrating permanently and the labour market will not clear, giving rise to the large rural-urban wage gaps and the low rates of male migration.

Testing the links between insurance networks and migration

The simplest test of our hypothesis that the potential loss in network services restricts mobility in India would be to compare migration rates in populations with and without caste-based insurance. But such an exercise is not feasible given the pervasiveness of caste networks. What we do instead is to look within the caste and theoretically identify which households benefit less (more) from caste-based insurance. We then proceed to test whether it is precisely those households that are more (less) likely to have migrantmembers.

One way to describe the insurance network is that it organises transfers between (temporarily) fortunate and less fortunate members. An alternative and equivalent way to characterise mutual insurance is that the income generated by the network in each period is pooled and then distributed on the basis of a pre-specified income-sharing rule.

Most research on mutual insurance is concerned with the degree of ex post ris-sharing – that is, the amount of transfers that households are willing to provide once their incomes have been realised, taking the size of the network and the income-sharing rule as given. But to derive the connection between networks and permanent migration, we need to take a step back and analyse the ex ante (before incomes have been realised) participation decision and the optimal design of the income-sharing rule.

The potential gain of income diversification from migration is typically outweighed by the loss of network insurance back in the village. Households facing greater rural incomes risk would thus be less likely to have migrant members.

In our framework, households can either remain in the village and participate in the insurance network or send one or more of their members to the city, increasing their income but losing the services of the network. The income-sharing rule that is chosen in equilibrium determines which households choose to stay.

A standard assumption in economics is that each additional dollar of consumption provides less and less utility. If this assumption is satisfied, then the total surplus generated by the insurance arrangement can be increased by redistributing income so that relatively poor households consume more than they earn on average. This gain from redistribution must be weighed against the cost to the members of the network from the accompanying decline in its size, since relatively wealthy households will now be more likely to leave and smaller networks are less able to smooth consumption.

We show that under reasonable conditions, the income-sharing rule will nevertheless be set so that there is some amount of redistribution in equilibrium. This implies that relatively wealthy households within their caste benefit less from the network and so will be more likely to have migrant members, everything else equal, providing the first prediction of our theory.

Although permanent male migration is exceptionally low in India, women have always moved to a different village when they marry. This marital migration expands the scope of the caste network and diversifies its income. By an analogous argument, migration by a male household member diversifies thehousehold’s income and so is typically assumed to lower the income risk that the household faces.

The implicit assumption in our framework is that in the Indian context, the loss in network insurance when an adult male from the household migrates dominates this gain from income diversification. It follows that households that face higher rural income risk and which, therefore, benefit more from the network, everything else equal, will be less likely to have male migrant members. This second prediction is especially useful in distinguishing our theory from alternative explanations for large rural-urban wage gaps and low migration in India.

One alternative explanation for the lack of mobility is that individuals cannot enter the urban labour market without the support of a (caste) network at the destination. Alternative explanations are also available for redistribution within the caste and the increased exit from the network by relatively wealthy households. But none of these explanations implies that households facing greater rural income risk should be less likely to have migrant members. Indeed, if insurance networks were absent, we would expect the opposite pattern, with these households sending members to the city to diversify their income.

Weighing up migration: Loss of network insurance versus income diversification

We begin the assessment of our theory by showing that there is substantial redistribution of income within castes, using data from the Indian ICRISAT (International Crops Research Institute for the Semi-Arid Tropics) panel surveys and from the most recent (2006) round of the Rural Economic Development Survey (REDS), a nationally representative survey of rural Indian households that has been administered by the National Council of Applied Economic Research (NCAER) at multiple points in time over the past four decades. Following up on this new result, we show (using data from a census of villages covered in the 2006 REDS) that relatively wealthy households within their caste are significantly more likely to report that one or more adult male members have permanently left the village.

Highlighting the role that rural income-risk plays in the migration decision, we also find that households with a higher coefficient of variation in their (rural) income – those that benefit more from the rural insurance network — are less likely to have migrant members. Additional results directly support the key assumption of our model, which is that migration should be associated with a loss in networkservices.

Having found evidence consistent with the theory, we proceed to estimate the structural parameters of the model. Migration and the income-sharing rule are determined jointly in the model. Our estimates of the income-sharing rule indicate that there is substantial redistribution within the caste, consistent with the descriptive evidence and the tests of the theory.

The potentially positive impact of formal insurance on migration

Counterfactual simulations that quantify the effect of formal insurance on migration (leaving the rural insurance network in place) indicate that a 50% improvement in risk-sharing for households with migrant members (which is still some way from full risk-sharing) would more than double the migration rate – from 4% to 9%. In contrast, nearly halving the rural-urban wage gap – from 18% to 10% – without any change in formal insurance would reduce migration by just one percentage point.

Additional counterfactual simulations examine the effect of policies that provide private credit to wealthy households or government safety nets to poor households in order to encourage migration. The first of these policies generates particularly striking results. Access to private credit frees up the wealthy households that were previously constrained by the loss in network insurance from moving, increasing their level of migration dramatically.

But relatively poor households in their caste, which do not benefit directly from this policy, are left worse off in two ways:

- First, the size and scope of the insurance network is reduced by the exit of the wealthy households, making it function less effectively and increasing the consumption variance of the households that remain.

- Second, the level of redistribution (determined by the income-sharing rule) will decline as a way of getting some wealthy households to stay in the network, reducing the consumption level of the poor households.

A well-intentioned policy that succeeded in its objective of increasing migration could thus have unintended distributional consequences, highlighting the need to take account of underlying network linkages when designing policies in developing countries.

Editors' note: This column was published on Ideas for India on 4 July 2016. An earlier version appeared on Microeconomic Insights.

References

Munshi, K and M Rosenzweig (2016), “Networks and Misallocation: Insurance, Migration, and the Rural-Urban Wage Gap”, American Economic Review 106(1): 46-98.

Munshi, K (2011), “Strength in Numbers: Networks as a Solution to Occupational Traps”, Review of Economic Studies 78(3): 1069–1101.

Munshi,K and M Rosenzweig (2006), “Traditional Institutions Meet the Modern World: Caste, Gender, and Schooling Choice in a Globalizing Economy”, American Economic Review 96 (4):1225–52.