A simple tax enforcement email aimed at non-filers offers a cost-effective solution for improving tax compliance

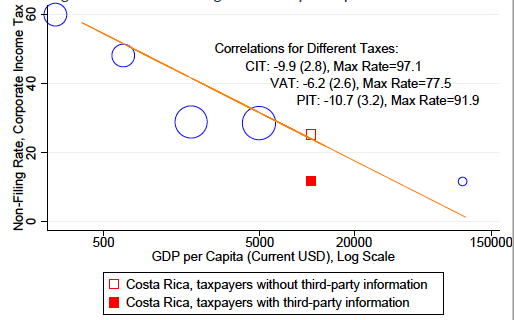

Many firms around the world fail to file their tax declarations, even if they are formally registered. This problem is particularly prevalent in low- and middle-income countries. In many such countries, over half of tax-registered firms do not file their tax declaration, and the maximum non-filing rates reaches over 90% in some countries (Figure 1). Tax non-filing is costly for at least three reasons:

- Non-filing constitutes a loss of government revenue.

- Non-filing can generate horizontal inequities between otherwise similar firms, which can distort resource allocation and lower the tax morale of compliant firms.

- Non-filing deprives the government of information about part of the economy, which hampers policymaking. For instance, it is difficult to design a credit line to support small businesses without knowing how many small businesses exist.

Fortunately, non-filing is a challenge that can be addressed cost-effectively. Indeed, governments have the contact information of non-filing taxpayers (who chose to register at some point but have not filed taxes regularly). With a field experiment in Costa Rica (Brockmeyer et al. 2019), we show that simple enforcement emails can achieve a large and persistent improvement in tax filing rates among firms.

Figure 1 Tax non-filing and GDP per capita across countries

Source: Brockmeyer et al. (2019).

A solution: Simple but credible enforcement emails

Working with the government of Costa Rica, we conducted a tax enforcement experiment targeting non-filers: 50,000 firms that were tax-registered but had not filed their income tax declaration for 2014. Two-thirds of these firms were randomly chosen to be sent an enforcement email and the remaining one-third received no email. The emails contained three features that had proven successful in previous enforcement experiments (Slemrod et al. 2001, Kleven et al. 2011, Pomeranz 2015 and Perez-Truglia and Troiano 2018):

- they mentioned the sanctions that taxpayers could realistically be subject to (shop closure, audit, online publication of names);

- they were informed by behavioural insights (the text was personalised and simplified, and it highlighted a social norm); and

- the emails mentioned the use of third-party information in tax enforcement.

Where does this third-party information come from? The clients, suppliers, and financial service providers of tax-liable firms provide reports to the government, which allow assessing the scale of economic activity of taxpayers. For the 8,000 targeted firms for which the tax authority had third-party information, half of the emails highlighted specific examples of the third-party reports, such as: “We know that you had sales of XXX Costa Rican colones to company YYY, and credit card sales of XXX colones reported by credit card company ZZZ”.

How did the emails affect taxpayer behaviour?

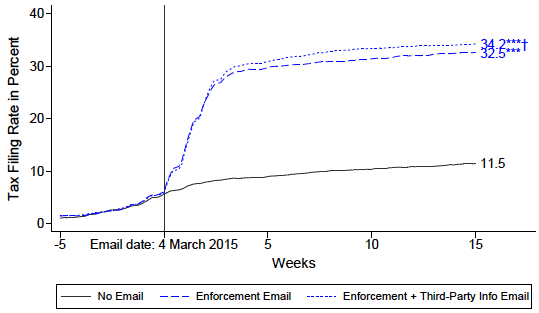

We study the effect of the intervention on income tax filing, which was directly targeted by the intervention, and on several other compliance dimensions. Indeed, while the intervention should improve income tax compliance, it is unclear whether it would crowd out or crowd in compliance on other dimensions. Fortunately, we find no evidence of crowd out behaviour. Our discussion here focuses on the results for those firms for which the tax authorities have third-party information (the paper provides results for firms without such information).

- Tax filing: The income tax filing rate for 2014 increased immediately by 20 percentage points within five weeks (Figure 2). Mentioning specific examples of third-party information increased the filing rate by a further two percentage points.

- Tax payment: Tax payment for the income tax increased by about 8,500 Costa Rican colones ($15) on average among treated firms. We find no statistically significant effect on sales tax payments.

- Accuracy of reported liabilities: Certain types of taxpayers (specifically, unincorporated businesses which are notoriously evasion-prone) displayed an improvement in reporting accuracy, increasing reported sales without increasing reported costs. We show that this is driven specifically by the mentioning of third-party information.

- Filing of third-party reports: Firms that received an email became 2.5 percentage points (4.5 percentage points in the information email group) more likely to file a third-party report about a client or supplier firm. These reports increase the tax authority’s information set for future tax enforcement.

- Deregistration: The emails led to a one percentage point increase in the deregistration rate, concentrated among firms that barely paid any tax in the previous years.

Figure 2 Impact of enforcement emails on tax filing in Costa Rica

Source: Brockmeyer et al. (2019).

An email has an effect even two years later

A concern with tax enforcement interventions based on letters or emails is that the effects may be short-lived. Even worse, a temporary increase in compliance could be followed by a later reduction in compliance, if taxpayers come to think the enforcement message was an empty threat. Other communication experiments with taxpayers have struggled to achieve persistent effects. In Costa Rica, however, taxpayers in the experimental treatment group were still significantly more likely to file income tax declarations in 2015, 2016 and even in 2017 – 2.5 years after the intervention.

How can one simple email achieve such a long-lasting effect? A key reason is that the email was highly credible in the enforcement context in Costa Rica. The tax authority uses a variety of enforcement tools (e.g. shop closures, audits, phone calls about discrepancies on tax returns, invitations for interviews) which jointly achieve a high coverage rate among tax-registered firms. In addition, our experimental intervention was followed by targeted follow-up phone calls to large firms that still had not filed. This follow-up strengthened the credibility of our treatment emails (it did not, however, mechanically drive our medium-term effects, as the follow-up was disproportionately targeted at the control group).

What should tax authorities do differently?

Our intervention had a cost-effectiveness ratio of 1:4 (taking into account only the direct effect on income tax compliance for 2014). Improving compliance among non-filers is thus a more effective way to ‘cast a wider tax net’ than encouraging completely informal firms to register. Indeed, previous work (reviewed in Bruhn and McKenzie 2014 and De Andrade et al. 2014) has shown that incentivising informal firms to formalise is difficult.

We argue that governments should instead focus on firms that are already tax-registered but do not (regularly) file their tax declaration. As non-filers chose to register at some point, they are likely to have a higher benefit from being compliant than completely informal firms. The tax authority also has some third-party information about the economic activities of these firms, which helps strengthen the enforcement message.

However, tax filing can be administratively costly, especially for very small firms with unsophisticated accounting systems. To ensure compliance among these firms, other policy options may need to be considered. These could be simple registration fees, presumptive taxes (as studied in Tourek 2018), or tax withholding regimes, where larger firms or credit card companies withhold tax from smaller firms, as studied in Brockmeyer and Hernandez 2018.

References

Brockmeyer, A and M Hernandez (2018), “Taxation, information and withholding: Evidence from Costa Rica”, World Bank.

Brockmeyer, A, M Hernandez, S Kettle and S Smith (2019), “Casting a wider tax net: Experimental evidence from Costa Rica”, American Economic Journal: Economic Policy, forthcoming.

Bruhn, M and D McKenzie (2014), “Entry regulation and the formalisation of microenterprises in developing countries”, The World Bank Research Observer, 29(2): 186-201.

De Andrade, G, M Bruhn, D McKenzie (2016), “A helping hand or the long arm of the law? Experimental evidence on what governments can do to formalise firms”, The World Bank Economic Review, 30(1): 24-54.

Kleven, H, M Knudsen, C Kreiner, S Pedersen and E Saez (2011), “Unwilling or unable to cheat? Evidence from a tax audit experiment in Denmark”, Econometrica, 79(3): 651-692.

Perez-Truglia, R and U Troiano (2018), “Shaming tax delinquents”, SSRN.

Pomeranz, D (2015), “No taxation without information: Deterrence and self-enforcement in the value added tax”, American Economic Review, 105(8): 2539-2569.

Slemrod, J, M Blumenthal, C Christian (2001), “Taxpayer response to an increased probability of audit: Evidence from a controlled experiment in Minnesota”, Journal of Public Economics, 79(3): 455-483.

Tourek, G (2018), “Targeting in tax behaviour: Evidence from Rwandan firms”, Harvard University.