CCT programmes in developing countries may generate disincentives to registered employment, but the efficiency consequences can be relatively small

The incentive effects of social assistance programmes on labour market outcomes have been at the centre of the economic policy debate. In developing countries with high levels of labour informality and poor enforcement of tax and labour regulations, social assistance may introduce disincentives not only in the overall labour supply but in registered (formal) employment. This has important implications.

First, access to social insurance for workers and their families is typically tied to formal jobs (Levy and Schady 2013). Second, unregistered employment means lower reporting of earnings and thus lower payroll and income tax revenue. Third, a larger informal sector may restrict productivity growth and economic development (Porta and Shleifer 2014).

In Latin America, the recent expansion of conditional cash transfer (CCT) programmes has prompted discussions of their effects on labour formality. Empirical evidence on this specific issue, however, is limited and the impact of CCT programmes on overall employment seems to be small or null (Alzua et al. 2012, Banerjee et al. 2015). Moreover, with few exceptions (Gerard and Gonzaga 2020), these discussions are limited to labour market outcomes in isolation and fail to quantify their efficiency costs. In a recent study (Bergolo and Cruces 2021), we explore how Family Allowances (henceforth, AFAM), a CCT programme in Uruguay, affected formal employment. We also document the anatomy of such response and evaluate the efficiency-cost implications of our results.

The CCT´s impact on formal employment

The AFAM is a means-tested CCT programme implemented in 2008 that targeted poor households with children or pregnant women in the bottom 20% of the income distribution. The programme’s monetary transfers were conditional on health checks (both for pregnant women and children) and school attendance for children in beneficiary households. Eligibility for AFAM depended on two criteria which the household must pass:

- An income test: Total verifiable income – i.e. earnings from registered work mostly— has to be below an income threshold.

- A proxy means test: A poverty score based on a household’s pre-programme characteristics must be above a predetermined threshold.

After enrolment, the income test is applied to participant households every two months, and it is strictly enforced by the administration. On average, about 57% of AFAM disqualifications were attributable to households’ verifiable income exceeding the income test threshold.1

The AFAM income eligibility threshold generates a large disincentive to work formally. For instance, for eligible single mothers with one child, it would imply an additional implicit tax rate on registered employment of 12.2%. This implicit loss is due to the loss of the programme’s cash transfer if her earnings from formal employment exceeded the income threshold.3

To evaluate the AFAM’s effects on labour market outcomes, we leverage the sharp discontinuity in the likelihood of participation at the poverty score cut-off point introduced by the programme’s eligibility rules. We use this identification strategy with longitudinal administrative data.2 Specifically, our research design compares labour market outcomes for adults in applicant households just above (forming the treatment group) and just below (forming the comparison group) the programme’s poverty score eligibility threshold, controlling for potentially confounding pre-application differences around the threshold.

The anatomy of the registered employment response

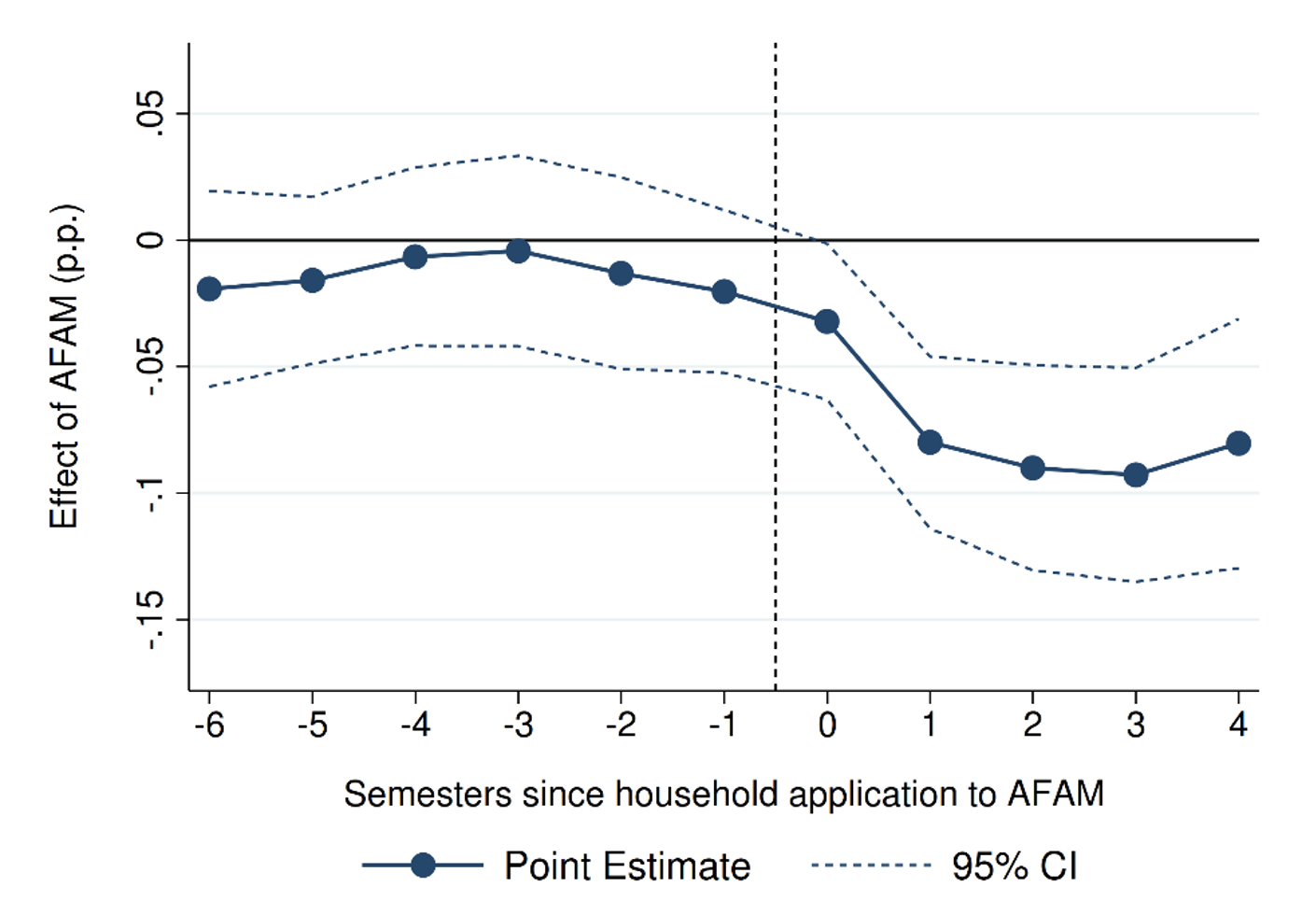

We find that AFAM reduces formal labour force participation by about six percentage points (a 13% drop) among all beneficiaries, and by 8.7 percentage points (a 19% drop) for single mothers, who make up about 43% of total beneficiaries. This translates into an elasticity of formal sector participation with respect to the net-of-tax rate of about 0.78 for the full sample and about 1.3 for single mothers.4 As shown in Figure 1, this effect persists for the two-year period following application to the programme.

Figure 1 Effect of AFAM eligibility on registered employment over time

Notes: Each point (solid circle) in the plot represents the estimate of the RD effect of eligibility on registered employment for a specific semester from one to six semesters before application to AFAM, and up to four semesters after applying to the programme. The estimates correspond to a local linear regression, estimated separately on either side of the eligibility cutoff. Regressions include covariates as controls. The dotted lines plot a 95% confidence interval based on standard errors clustered at the household level.

What about the potential heterogeneity of results in our population of study? Labour market attachment varies substantially across beneficiaries, some of whom may not be at the margin of formality. AFAM, like many other CCTs in the developing world, has a ‘one-size-fits-all' approach that fails to accommodate these features, with potentially negative consequences.

First, there is a question of whether workers respond heterogeneously to AFAM in terms of their attachment to the formal sector. We find that the reduction in registered employment is stronger among individuals who have a medium propensity to be formally employed – i.e. those who are closer to the registered or not registered employment margin of choice – and is even stronger for single mothers in this group. In contrast, the impact on those who have a low or high propensity to be formally employed is substantially lower than the average effect, probably because these individuals would not be employed formally or informally irrespective of their participation in AFAM.

Second, we decompose the formal employment response into informality and non-employment margins using data from a follow-up survey that sampled households on both sides of the discontinuity. We find suggestive evidence that the decline in formal employment is divided about equally between individuals moving into inactivity and those moving into informal employment.

Efficiency cost and policy implications

To evaluate the implications of our results in terms of efficiency costs we use the responses we estimate to recover the marginal value of public funds (MVPF) for AFAM single mothers, following Hendren’s (2016) methodology.5

Despite pervasive labour informality in the context of the programme, AFAM’s MVPF of 0.61 implies an efficiency cost within the range of cash transfer programmes targeted to families in the US, though lower than the MVPF of similar programmes that induce labour supply disincentives (Hendren and Sprung-Keyser 2020).

Policymakers might minimise similar programmes’ disincentives in the labour market and improve the equity-efficiency trade-off of policies of this type. First, policymakers should consider ways to smooth out the cash notch implied by programme eligibility rules that increase the implicit tax rates or perceived tax wedges on formal earnings. For instance, the income test in the AFAM case could be modified by introducing a more continuous schedule with phase-in and phase-out regions that withdraw the benefit gradually, and with lower implicit tax rates, rather than generating a total loss of the benefit at the income threshold as in the current design. Alternatively, authorities could test the effects of allowing beneficiaries to continue in the programme while generating earnings from registered employment above the threshold for a transitory period. This temporary disregard of earnings could ease the transition to formal employment and mitigate the possibility that beneficiaries prefer lower but more stable income from the programme to higher but riskier earnings from registered employment.

While some of these implications are specific to AFAM, the general message that CCT and welfare programme eligibility rules should avoid sharp discontinuities and high implicit tax rates applies to other contexts.

References

Alzua, M L, G Cruces, and L Ripani (2012), “Welfare programs and labor supply in developing countries: experimental evidence from Latin America”, Journal of Population Economics 26(4): 1255–1284.

Banerjee, A, H Rema, K Gabriel and O Benjamin (2015), “Debunking the stereotype of the lazy welfare recipient: evidence from cash transfer programs worldwide”, World Bank Research Observer 32(2): 155–184.

Bergolo, M and G Cruces (2021), “The anatomy of behavioral responses to social assistance when informal employment is high”, Journal of Public Economics 193.

Bertrand, M, M Mogstad and J Mountjoy (2020), “Improving Educational Pathways to Social Mobility: Evidence from Norway’s Reform 94”, Journal of Labor Economics, forthcoming.

Gerard, F and G Gonzaga (2020), “Informal labor and the efficiency cost of social programs: evidence from the brazilian unemployment insurance program”, American Economic Journal: Economic Policy, forthcoming.

Hendren, N (2016), “The policy elasticity”, Tax Policy and the Economy 30(1): 51–89.

Hendren, N and B Sprung-Keyser (2020), “A Unified Welfare Analysis of Government Policies”, The Quarterly Journal of Economics 135(3): 1209-1318.

La Porta, R and A Shleifer (2014), “Informality and development”, Journal of Economic Perspectives 28(3): 109–126.

Levy, S and N Schady (2013), “Latin America’s social policy challenge: education, social insurance, redistribution”, Journal of Economic Perspectives 27(2): 193–218.

Endnotes

1 The rest of disqualifications corresponds to failures in mandatory health check and school attendance requirements for children, and household’s children reached 18 years of age.

2 Our analysis bases on a comparison of households that passed the income test at the time of application but were deemed either eligible or ineligible by the proxy means test (i.e. their eligibility poverty score).

3 Although the available evidence rules out manipulation of the assignment rule by applicants, we find some degree of imbalance in registered employment at baseline, which motivates our difference-in-discontinuity strategy (e.g. Bertrand et al. 2020).

4 The elasticity measures the percentage change in formal employment for each percentage change in the net average tax rate.

5 The MVPF is given by the ratio of marginal benefits to marginal costs of the extra funds spent on the policy.