Increasing potential tax revenues for local governments triggered a rise in violence in resource-rich areas in India

Generating tax revenue is a core state capability that is deeply intertwined with conflict processes. Wars are often fought to gain control over valuable resources, for example, Berman and co-authors (2017) show that mining booms spur local conflict in Africa. At the same time, the threat of external wars is thought to contribute to fiscal development (Besley and Persson 2009). In the asymmetric conflicts that affect many countries today, institutions and fiscal policies constrain the behaviour of state actors. These constraints are particularly relevant in decentralised countries, where successful counterinsurgency requires support from different levels of government. We focus on the link between fiscal incentives and conflict in India, a decentralised country, where the introduction of a new tax regime in 2009 greatly increased the value of controlling territory for sub-national governments (Shapiro and Vanden Eynde 2023).

Fiscal incentives and conflict in a decentralised India

In August 2009 the central government in Delhi introduced a 10% ad valorem tax on the price of iron ore mined in India, whose revenue accrued entirely to the state in which the ore was mined. Before this change states received a negligible rate per tonne of iron ore mined within their boundaries. The new royalty regime led to a 10-fold increase in the royalty collections of the affected states by 2011, with the new iron ore royalties contributing up to 5% of some states’ budgets. Among the major beneficiaries of the royalty increase were states in India's “Red Corridor'' - the region in the Centre-East of the country that is affected by a long-standing conflict between Maoist insurgents and the state. As state governments are responsible for managing counter-insurgency efforts within their territory, the royalty hike had the potential to affect the incentives they faced when allocating efforts in iron-rich districts.

Increased violence following the tax change

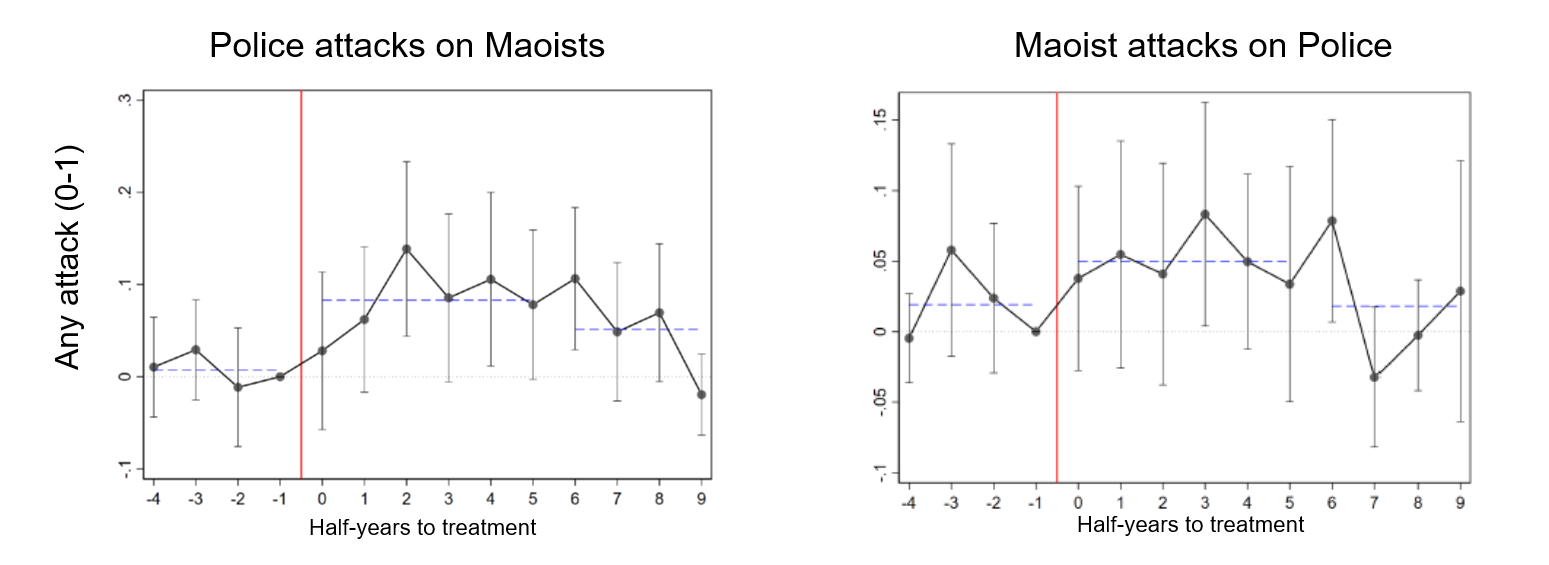

We find this royalty change for iron ore was followed by an increase in the extent and intensity of the insurgent conflict in districts with substantial iron ore deposits compared to other districts for at least three years. The intensification in violence was two-sided, both fatal police attacks on Maoists and fatal Maoist attacks on police forces increased substantially. Figure 1 shows this intensification for the probability of an attack at the semester-district level, comparing iron ore to non-iron ore districts. Our estimates suggest the number of fatal attacks by police on Maoists per year goes up by about 12% in districts with the mean level of iron deposits compared to those without iron deposits, while fatal attacks by Maoists on police increase by approximately 9.5%.

Figure 1: Event Study around the 2009 royalty hike on iron ore

What can explain the violence?

We argue that the observed intensification of violence in iron ore districts is likely to reflect stronger incentives to control these mining zones. Importantly, we can rule out some alternative explanations. First of all, the intensification of violence in iron ore districts was not a coincidence of timing. Districts with coal and bauxite deposits did not see similar changes in violence. Like iron ore, these two minerals occur in many districts and are economically important, but they did not experience a comparable royalty hike. Second, the intensification of violence cannot be explained by price movements in iron ore. Iron ore prices followed trends that were similar to those of other minerals, and throughout our analysis, we control for the effect of price movements so that we can estimate the separate effect of the royalty change. Another explanation for the intensification of violence in iron ore districts could be that increased royalty revenue funds police operations. However, the royalty revenues are collected at the state-level and are not mechanically linked to the funding of local security operations.

The increased conflict in mining zones when the tax value of extraction increases can be explained in part by the prevalence of illegal mining in India's Maoist belt. It is well documented that state-level officials benefit from the rents created by this illegal sector. For example, Asher and Novosad (2023) show that mineral price shocks lead to the election of more politicians who are charged with serious crimes. In the Maoist belt, illegal mining can take various forms, including mines that are larger than permitted or mines that are still in operation after their lease has expired, both of which could be observable from satellite imagery. We find that the royalty hike was associated with an increase in potential illegal mining activity – vehicle activity after a lease had expired or a measured mining area exceeding permitted boundaries – when we compare iron mines to other mines. The royalty hike could affect the incentives of actors to engage in conflict and illegal mining through two main channels. One possibility is that state governments engage in conflict to secure mining sites. Thus, they benefit more from permitting illegal mining thanks to their improved bargaining positions. A second possibility is that mining firms increase the funding of Maoist rebels to shield their illegal activities, as these became more valuable after the royalty hike. We cannot fully distinguish between these explanations, but either mechanism is consistent with the idea that illegal mining plays a role in the intensification in violence we observe in iron ore districts after the royalty hike.

Broader implications and future research directions

The finding that fiscal regimes matter for the behaviour of state actors in conflicts opens up a much larger research agenda on the interaction between different branches of government whose interests in conflict settings are not necessarily aligned. In addition to fiscal policies, institutional design could also play an important role in shaping this interaction. Fetzer and Kyburz (2022), for example, shows how power-sharing agreements at the state-level mitigate the increases conflict from oil price shocks in Nigeria. Many developing countries are decentralising political power while also managing important natural resource deposits. Understanding how the fiscal regimes that govern resource extraction shape violent conflict has clear relevance beyond India.

References

Asher, S and P Novosad (2023), "Rent-seeking and criminal politicians: Evidence from mining booms", Review of Economics and Statistics, 105(1): 20-39.

Berman, N, M Couttenier, D Rohner and M Thoenig (2017), “This mine is mine! How minerals fuel conflicts in Africa.” American Economic Review, 107(6): 1564-1610.

Besley, T, and T Persson (2009), "The Origins of State Capacity: Property Rights, Taxation, and Politics." American Economic Review, 99(4): 1218-44.

Fetzer, T and S Kyburz (2022), “Cohesive Institutions and Political Violence”, Review of Economics and Statics: 1-46.

Shapiro, J N, O Vanden Eynde (2023), " Fiscal Incentives for Conflict: Evidence from India's Red Corridor", Review of Economics and Statistics, 105(1): 217-225.