Anonymous rating of inspectors can decrease bribes and increase tax revenues as long as it takes into account market structure considerations

Firms in developing countries are routinely asked for bribes. According to the latest available World Bank Enterprise Survey data, 64.7% of operating firms in Cambodia have experienced at least one bribe payment request, as opposed to 1.9% in Sweden (World Bank 2017). The existing evidence shows that the incidence of bribes varies across industries and firms, based on industry or firm profitability (Svensson 2003, Olken and Pande 2012), and that corrupt officials charge different bribe rates to different firms (Olken and Barron 2009). These findings suggest that variation in size and profitability across firms could be a key factor in determining the extent of bribery.

Bribes are not necessarily the result of extortion. For instance, firms may find it profitable to engage in informal relationships with tax officials and inspectors to avoid paying taxes. On the flip side though, high bribes increase the cost of doing business and negatively affect firm entry, exit, and growth. If firms include the cost of the bribe in the price of their product or service, the burden falls on the consumer reducing their welfare.

When state capacity is low and the bureaucracy inefficient, an intervention that increases the bargaining power of firms in their relationship with tax officials has the potential of decreasing bribery along both the extensive (total number of bribes) and intensive (size of bribes) margins. However, designing the right intervention requires a clear understanding of the key factors that shape the willingness of both sides – firms and tax officials – to enter the bribing relationship in the first place.

Feedback incentives and shifting the cost of bribes

To investigate these issues, we ran a field experiment in the Kyrgyz Republic (Amodio et al. 2018). The smallest firms in the country are supposed to pay a monthly or quarterly fee to get a license, which gives them the right to operate their business. Tax inspectors decide whether and when to visit a business and perform ‘raid’ inspections. According to the data we collected, 74% of the micro and small enterprises in our sample have been inspected at least once over the last year.

In collaboration with the World Bank Group and the State Tax Service of the Kyrgyz Republic, we designed an incentive scheme for tax inspectors that rewards them based on the anonymous evaluation submitted by inspected firms. In theory, this should increase the bargaining power of firms in their relationship with tax officials, and decrease the bribe size. However, if firms pay bribes instead of taxes, bribes can increase on the extensive margin, and tax revenues could decrease. Indeed, Khan et al. (2016) show that doing the opposite, i.e. increasing the bargaining power of tax inspectors, reduces the total number of agents paying a bribe but it increases the size of the bribes.

Theoretical framework: A model of firm-inspector interaction

To better understand these trade-offs and design incentives correctly, we developed a simple model that describes the interaction between firms and inspectors. Our framework explicitly accounts for firm variation (heterogeneity) along a specific margin: the elasticity of the demand (i.e. the change in demand in relation to change in price) they face. Firms choose whether or not to engage in informal relationships with tax inspectors and substitute taxes with bribes. Inspectors decide which firm to inspect and the bribe size. Taxes come in the form of a fixed cost (the license fee), but inspectors can price-discriminate and charge higher bribes to bigger firms.

It turns out that, under feedback incentives, who the burden of the bribe falls on is a key element of the interaction between firms and inspectors. Bribe payments decrease firms’ profits, but relatively less so for firms facing a more inelastic demand (the demand for their products or services does not vary much as its price changes) as they can shift more of the cost of bribes to consumers. When incentivised, inspectors face a trade-off between extracting bribes and getting high evaluations. They solve it by targeting those firms for which bribing is less impactful, meaning firms facing a more inelastic demand and therefore bearing less of the cost of the bribe themselves.

The experiment

These theoretical findings guided us in the design of two feedback incentives schemes that reward inspectors for the quality of their interaction with inspected firms. We tested them in the field with an experiment that took place between March 2016 and January 2017.

1. Piece rate scheme

In the first scheme, the bonus paid to inspectors increases proportionally with the average evaluation rating submitted by inspected firms.We ask business survey respondents: “On a scale from 0 to 10 where 0 is a poor job and 10 is a goodjob, how would you rate the job of the tax inspectors during the last inspection?”. The scheme rewards inspectors for the improvement in the answer to this question relative to the pre-intervention baseline.

2. Piece rate tilted scheme

In the second scheme, the bonus paid also increases with the average evaluation rating but attaches a higher weight to the evaluations submitted by smaller firms. The objective of this tilted scheme is to discourage inspectors’ targeting and selection of bigger (low demand elasticity) firms, while still reducing the bribe size.

We randomly assigned 50 local tax offices (356 inspectors) in the Kyrgyz Republic to either one of these two treatments, or to a control group.

Results

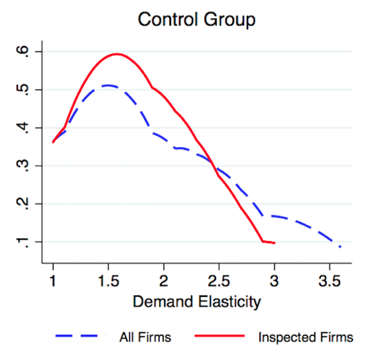

- Firms facing a more inelastic demand are relatively more likely to be inspected compared to other firms (Figure 1). This is true across all experimental arms. Our survey data show that firms facing a more inelastic demand are also significantly more likely to report that informal payments to inspectors are common compared to the other firms in our sample.

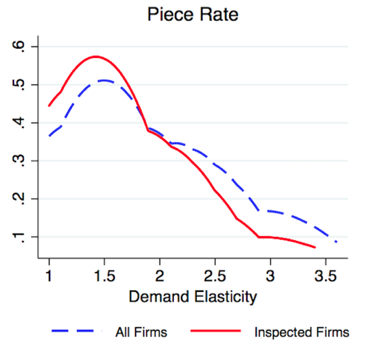

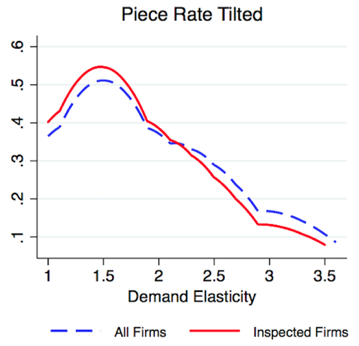

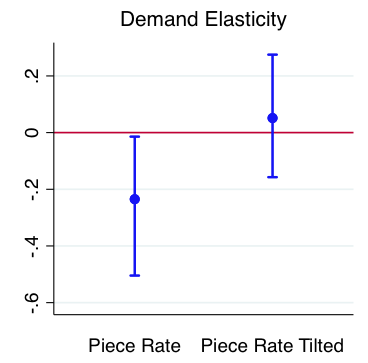

- Providing feedback incentives decreases the frequency of inspection and increases the firms’ rating of inspectors, which is what our model predicts. More importantly, Figure 1 (middle panel) and Figure 2 (top panel) show that, when the unweighted version of feedback incentives is implemented (the piece rate scheme), firms facing a more inelastic demand are even more likely to be inspected. This means that, as predicted, feedback incentives make firms with inelastic demand more attractive for inspectors. This pattern is reversed under the weighted scheme, where the distribution of demand elasticity among inspected firms appears to track the overall sample distribution more closely (bottom panel of Figure 1 and top panel of Figure 2).

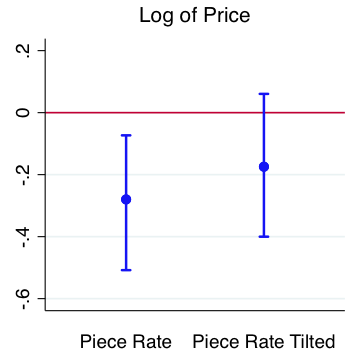

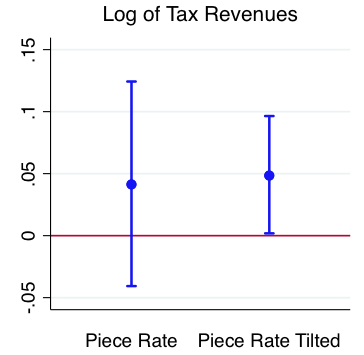

- We also find that inspected firms in treatment arms, on average, have lower costs and charge lower prices (Figure 2, middle panel). We interpret this as evidence that firms pass on the cost of bribes to consumers, lower elasticity firms are disproportionately inspected, but the feedback incentives reduce the bribe size (lower bribes sizes ‘pass-through’ lower prices). Finally, since fewer firms are given the opportunity to substitute taxes with bribes, tax revenues increase when feedback incentives are in place, and significantly so for those offices assigned to the weighted scheme, i.e. the piece rate tilted scheme (Figure 2 bottom panel).

Figure 1 Distribution of the elasticity of demand faced by firms in the three experimental arms

Note: The figure plots the distribution of demand elasticity among all firms and inspected firms only, separately for each experimental group. The blue dashed line is the same across all three figures as it plots the distribution among all firms in the sample.

Figure 2 Estimated average differences between treatment and control groups with 95% confidence intervals

Concluding remarks

Our study delivers two main findings:

- The demand elasticity of a firms’ output and its ability to shift the burden of the bribe to consumers matter in shaping incentives for firms and business tax inspectors to engage in informal relationships.

- Firms use prices to pass on the cost of bribes to consumers, and corruption that affects firms decreases consumer welfare.

These findings set the ground for future explorations of the relationship between market structure and bribery. Our research does not necessarily imply that a bonus scheme is the only way to incentivise sound behaviour; future research could contemplate alternative approaches. Yet, consistent with World Bank (2004), our study highlights how careful design and implementation of an incentive scheme are key to improving the effectiveness of monetary incentives in tax administration, as bonuses would not automatically increase the effectiveness of revenue departments.

Author’s Note: We gratefully acknowledge the CEPR/DFID PEDL initiative for financial support, and the State Tax Service of the Kyrgyz Republic for data sharing and collaboration. The findings, interpretations, and conclusions expressed in this paper are entirely of the authors. They do not necessarily represent the views of the International Bank for Reconstruction and Development/World Bank and its affiliated organisations, or those of the Executive Directors of the World Bank or the governments they represent.

Editor's note: Baed on work from this PEDL project.

References

Amodio, F, J Choi, G De Giorgi and A Rahman (2018). “Bribes vs. taxes: Market structure and incentives”, Mimeo.

Khan, A Q, A I Khwaja and B A Olken (2016), “Tax farming redux: Experimental evidence on performance pay for tax collectors”, The Quarterly Journal of Economics 131(1), 219– 271.

Olken, B A and P Barron (2009), “The simple economics of extortion: Evidence from truck-ing in Aceh”, Journal of Political Economy 117(3), 417–452.

Olken, B A and R Pande (2012), “Corruption in developing countries”, Annual Review of Economics 4(1), 479–509.

Svensson, J (2003), “Who must pay bribes and how much? Evidence from a cross section of firms”, The Quarterly Journal of Economics 118(1), 207–230.

World Bank (2004), "Salary bonuses in revenue departments: Do they work?", PREM Note 83.

World Bank (2017), Enterprise Survey, World Bank.