In Ecuador, royalties from oil extraction have increased average educational attainment and generated good jobs in the formal sector, despite reducing incentives to pursue tertiary education.

The history of oil extraction in Ecuador has been marked by increasing state participation, beginning with a pivotal moment in 1971 when the government declared oil wealth as an “inalienable patrimony of the state”. This set the stage for greater state control and involvement in the sector. Significant constitutional changes in 2008 further increased government revenues from oil as global oil prices rose.

Among these changes was “Ley 010”, introduced in 1992, which aimed to provide a steady stream of oil-dependent resources to Ecuador’s Amazonian region. However, it was not until the early 2000s that these royalties became economically significant. The Amazonian region, where all of Ecuador’s oil reserves are located, has historically lagged in development and has faced severe environmental impacts from oil extraction.

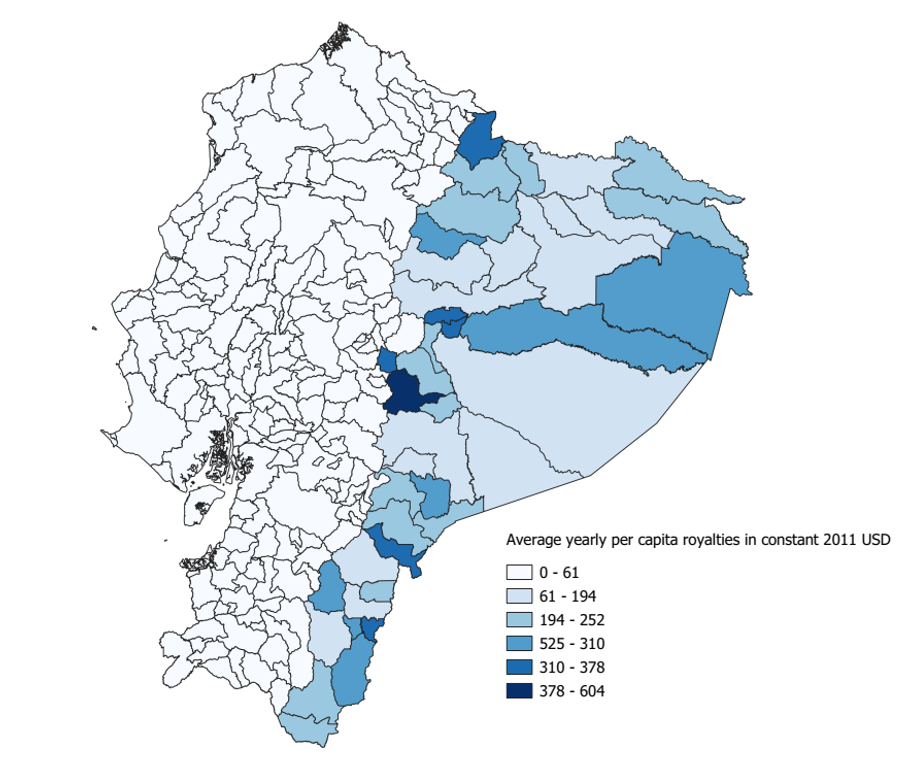

Figure 1 shows the average annual oil royalty transfer per capita in the Amazonian region from 2001 to 2017. This figure highlights the considerable spatial variation in per capita allocations, with regions outside the Amazonian area receiving zero royalties (white). Our research (Acuna, Balza, and Gomez-Parra 2024) provides an in-depth analysis of Ley 010 and its causal effects on oil royalties.

Figure 1: Distribution of oil royalties in Ecuador

Notes: This figure shows the distribution of the average yearly per capita oil royalties by municipality. The annual average is calculated for the 2001-2017 period. The figure displays a sharp discontinuity where municipalities outside the Amazonian region receive exactly zero royalties, and municipalities in the Amazonian region receive at least 61.

How could oil wealth shape education and jobs?

Oil windfalls change public investment, educational attainment, and labour market prospects in Latin America (Caselli and Michaels 2013, Bonet-Morón et al. 2020, Monteiro and Ferraz 2010, Martínez 2023). However, trade-offs between employment and education emerge as wages and labour demand increase, opportunity costs change, and education becomes more costly for certain specific segments of the population (Michael 2011, Kumar 2017, Marchand and Weber 2020, Mosquera, 2022, Ebeke et al. 2015, Black et al. 2005, Ahlerup et al. 2020, Douglas and Walker 2017, Balza et al. 2021). Although previous research has not reached a consensus on the net benefits, some evidence suggests that natural resource windfalls lead to increased public spending on education, higher enrollment rates, and improved high school completion rates without hindering wage growth or human capital accumulation (Caselli and Michaels 2013, Bonilla 2020, Hajkowicz et al. 2011, Domenech 2008, Mamo et al. 2019).

Natural resources may also adversely impact development by increasing corruption, diverting public investment from education, and consequently lowering educational attainment (Gylfason, 2001, Mamo et al. 2019, Ebeke et al. 2015, Papyrakis and Gerlagh 2007, Torvik 2002, Bhattacharyya and Hodler 2010). Production delays, sudden windfalls, and political reactions after discoveries create major challenges for local governments and growth. The presence of these inefficiencies can be partially attributed to the strength of institutions (Sachs and Warner 1995, Robinson et al. 2006, Van der Ploeg 2011, Boschini et al. 2013, Mehlum et al. 2006). Good institutions play a crucial role in determining the extent to which natural resources contribute to economic and educational outcomes. For example, power-sharing institutions can mitigate violent contests for natural resource rents, or local ownership, facilitated by political connections, might be a tool to potentially mitigate some of the adverse effects of the resource curse in weak states by improving security and increasing production.

Royalties increase educational attainment

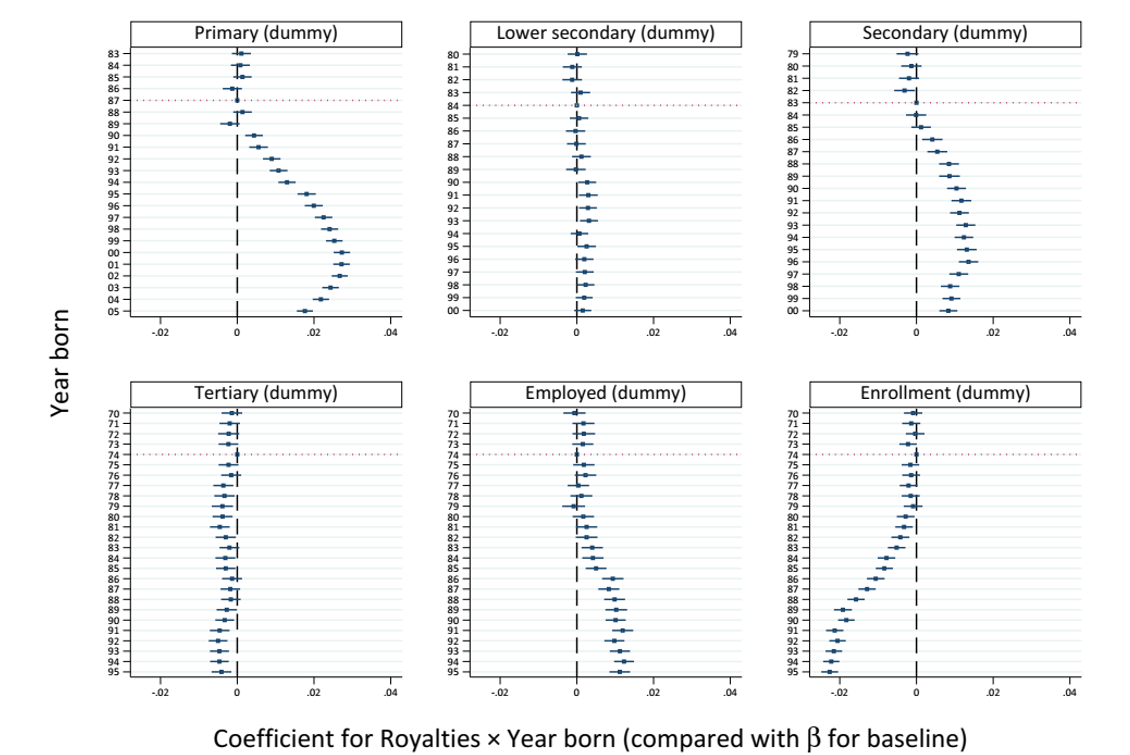

For every USD 1,000 from oil royalties, we find that the probability of completing primary education increases by 0.28 percentage points. On average, each municipality receives nearly USD 7,000 per capita between 2001 and 2017. We found a similar increase of 0.17 percentage in the probability of completing secondary education. This increase is substantial, representing a 30% rise relative to the average rate of secondary completion. However, these positive effects concentrate on younger cohorts born after 1995 who were fully exposed to royalties. For cohorts born before 1995 the effects tend to get smaller or negative. Figure 2 shows that cohorts born in the early 1980s experience zero or very small gains in education. In contrast, as we studied younger cohorts, the effects become positive and larger.

Figure 2: Impact of oil royalties on educational attainment and employment

Notes: This figure shows the effects of oil royalties on the probability of completing various educational levels and employment across different cohorts. The y-axis represents the year a cohort was born, while the x-axis shows the impact on the probability of completing a specific education level. The dashed vertical line indicates the baseline or zero effect.

The impacts of royalties go beyond educational attainment

Our analysis goes beyond educational attainment to consider the broader impacts on education quality and employment outcomes. A significant finding is the positive impact of oil royalties on standardised test scores, specifically the Ser Bachiller exam. This high-stakes exam is critical because it contributes to 30% of the final grade for high school graduation and determines eligibility for college admission. Our results show that an additional USD 1,000 per capita in oil royalties increases standardised test scores by 0.078 standard deviations. This improvement is substantial, reflecting enhanced educational quality due to better resources and infrastructure funded by the royalties.

We observed that the impact on test scores was not uniform across all subjects. They were concentrated in math and language, suggesting targeted improvements in these areas. Higher test scores imply that the quality of education increased, better preparing them for future academic and professional challenges. The increase in scores is crucial because it directly influences students' ability to graduate and pursue higher education.

Tradeoffs emerge when the time comes

However, the influence of oil royalties also introduces notable trade-offs. The bottom panels of Figure 2 show the mirror image of an increased likelihood of working with a decreased likelihood of being enrolled in school. As students in municipalities receiving oil royalties reach working age, the opportunity cost of staying in school increases. The allure of immediate employment in better-quality, higher-paying jobs created by the influx of oil money leads many students to leave school earlier than they might otherwise. Our results indicate that while primary and secondary education completion rates improve, the likelihood of pursuing tertiary education declines. This trend reflects the increased attractiveness of entering the labour market earlier rather than investing additional years in education.

The quality of jobs available in these regions has also improved significantly. The influx of oil royalties has led to the creation of more formal sector jobs, which are higher paying and offer better benefits than informal employment. These new employment opportunities are not limited to the oil industry, but span various sectors, indicating a broader economic development spurred by the royalties. Consequently, the trade-off between education and immediate employment does have a silver lining, as it leads to gainful employment in higher-quality jobs.

How did it all happen?

Better schools

Investing in infrastructure, particularly roads and connectivity, has enabled students to shift into larger and better-resourced schools. A significant aspect of this success has been a commitment to maintaining multilingual and multicultural schools, ensuring that educational improvements benefit diverse communities.

Better jobs

The tradeoff between education and work is not all in vain. We have found that the new jobs are better, higher quality, and in the formal sector. The influx of oil royalties has led to broader economic development, creating new employment opportunities across various sectors. These jobs offer higher wages and better benefits, contributing to improved living standards and economic stability for the local population.

References

Acuna, J, L H Balza, and N Gomez-Parra (2024), "From wells to wealth? Government transfers and human capital", Journal of Development Economics, 169: 103206.

Ahlerup, P, T Baskaran, and A Bigsten (2020), "Gold mining and education: a long-run resource curse in Africa?", The Journal of Development Studies, 56(9): 1745-1762.

Balza, L H, C De los Rios, R Jimenez Mori, and O Manzano (2021), "The local human capital cost of oil exploitation", Inter-American Development Bank Working Paper Series, No. IDB-WP-1258.

Bhattacharyya, S and R Hodler (2010), "Natural resources, democracy and corruption", European Economic Review, 54(4): 608-621.

Black, D A, T G McKinnish, and S G Sanders (2005), "Tight labor markets and the demand for education: Evidence from the coal boom and bust", ILR Review, 59(1): 3-16.

Bonet-Morón, J, G J Pérez-Valbuena, and L Marín-Llanes (2020), "Oil shocks and subnational public investment: The role of institutions in regional resource curse", Energy Economics, 92: 105002.

Bonilla, L (2020), "Mining and human capital accumulation: Evidence from the Colombian gold rush", Journal of Development Economics, 145: 102471.

Boschini, A, J Pettersson, and J Roine (2013), "The resource curse and its potential reversal", World Development, 43: 19-41.

Caselli, F and G Michaels (2013), "Do oil windfalls improve living standards? Evidence from Brazil", American Economic Journal: Applied Economics, 5(1): 208-238.

Douglas, S and A Walker (2017), "Coal mining and the resource curse in the eastern United States", Journal of Regional Science, 57(4): 568-590.

Domenech, J (2008), "Mineral resource abundance and regional growth in Spain, 1860–2000", Journal of International Development: The Journal of the Development Studies Association, 20(8): 1122-1135.

Ebeke, C, L D Omgba, and R Laajaj (2015), "Oil, governance and the (mis) allocation of talent in developing countries", Journal of Development Economics, 114: 126-141.

Gylfason, T (2001), "Natural resources, education, and economic development", European Economic Review, 45(4-6): 847-859.

Hajkowicz, S A, S Heyenga, and K Moffat (2011), "The relationship between mining and socio-economic well being in Australia’s regions", Resources Policy, 36(1): 30-38.

Kumar, A (2017), "Impact of oil booms and busts on human capital investment in the USA", Empirical Economics, 52(3): 1089-1114.

Marchand, J and J G Weber (2020), "How local economic conditions affect school finances, teacher quality, and student achievement: evidence from the Texas shale boom", Journal of Policy Analysis and Management, 39(1): 36-63.

Mamo, N, S Bhattacharyya, and A Moradi (2019), "Intensive and extensive margins of mining and development: Evidence from Sub-Saharan Africa", Journal of Development Economics, 139: 28-49.

Mehlum, H, K Moene, and R Torvik (2006), "Institutions and the resource curse", The Economic Journal, 116(508): 1-20.

Michaels, G (2011), "The long term consequences of resource‐based specialisation", The Economic Journal, 121(551): 31-57.

Monteiro, J and C Ferraz (2010), "Does oil make leaders unaccountable? Evidence from Brazil’s offshore oil boom", Unpublished, PUC-Rio: 6.

Mosquera, R (2022), "The long-term effect of resource booms on human capital", Labour Economics, 74: 102090.

Papyrakis, E and R Gerlagh (2007), "Resource abundance and economic growth in the United States", European Economic Review, 51(4): 1011-1039.

Robinson, J A, R Torvik, and T Verdier (2006), "Political foundations of the resource curse", Journal of Development Economics, 79(2): 447-468.

Sachs, J D and A Warner (1995), "Natural resource abundance and economic growth".

Torvik, R (2002), "Natural resources, rent seeking and welfare", Journal of Development Economics, 67(2): 455-470.

Ploeg, F van der (2011), "Natural resources: curse or blessing?", Journal of Economic Literature, 49(2): 366-420.