Oil multinationals in Nigeria divesting their onshore assets to local firms resulted in substantial improvements in output and declines in oil theft and violence, driven by politically connected firms

Poor countries often turn to multinational companies (MNCs) to supply the capital, technology, and expertise to develop and extract natural resources. But in weak states, extractive MNCs face serious security challenges, including social unrest (Christensen 2019), conflict with armed groups (Berman et al. 2017), and theft of natural resources through local illicit markets, common symptoms of the so-called “resource curse” (Ross 2015). In Nigeria’s petroleum sector, decades of armed conflict and a large-scale black market for crude oil have forced some supermajors to exit the market entirely. Last year, Shell announced that it would leave Nigeria after 65 years as the country’s leading producer, with plans to divest more than $2 billion in productive assets, mostly to indigenous Nigerian firms.

In Nigeria, allegations abound that state security forces protect oil theft gangs at the expense of MNCs, facilitating illicit oil theft worth 4 billion USD annually. This is puzzling, since deep-pocketed MNCs should be willing to pay for the state’s protection; in fact, they spend lavishly on private security but remain vulnerable to predation. Importantly, oil theft is not simply a transfer from the legal to illegal sector, but rather entails efficiency losses. Stolen oil is sold on the illicit market at price markdowns of nearly 80%, reducing the total surplus gained from production. Furthermore, oil theft gangs incur redundant extraction costs, and spill crude into agricultural lands and waterways, imposing large environmental and health externalities on local communities. The diversion of oil output reduces government revenue, an acute problem in a nation that depends on oil for 80% of its federal budget. Why, then, does the state protect oil theft gangs rather than firms, reducing total surplus and state revenue?

Are weak states unable, or simply unwilling, to secure extractive firms’ property rights? And what happens when the MNCs leave the sector to smaller, but potentially better-connected local firms? My research (Rexer 2023) proposes an answer: even when the state can capably protect firms, the lure of illicit rents creates strong incentives for law enforcement corruption. While firms can offer competing bribes, they cannot enforce corrupt bargains. As a result, these bargains unravel and MNCs are subject to state-sanctioned predation. Indigenous firms, however, may have a comparative advantage in corruption (Javorcik and Wei 2009). By appointing military elites as shareholders and directors, local firms make security agents residual claimants on resource income, aligning incentives. In return, local firms obtain protection from criminal predation, allowing them reduce criminality and boost output.

Can local ownership solve the resource curse in weak states? To answer this question, I use granular data on Nigeria’s oil sector over several decades to study a major indigenisation reform in Nigeria which increased the onshore market share of local firms from 6% to 40% between 2006 and 2016. Using this wave of divestment, I estimate the effect of divestment on oilfield output, resource theft, armed conflict, environmental outcomes, and law enforcement responses.

Data and methods

I use administrative records from Nigerian regulators to compile a detailed dataset of production and asset ownership from 2006-2016 for a panel of 314 active oilfields. I add to this data on several other oilfield performance outcomes – illicit oil theft, militant violence, oil spills, and gas flaring. To measure the law enforcement response of the Nigerian state, I compiled and coded thousands of local news media reports about military and police actions against the illegal oil sector. To measure political connections, I partnered with a due diligence firm to collect corporate records on all the firms in the industry and conduct in-depth biographical research on their board members and shareholders.

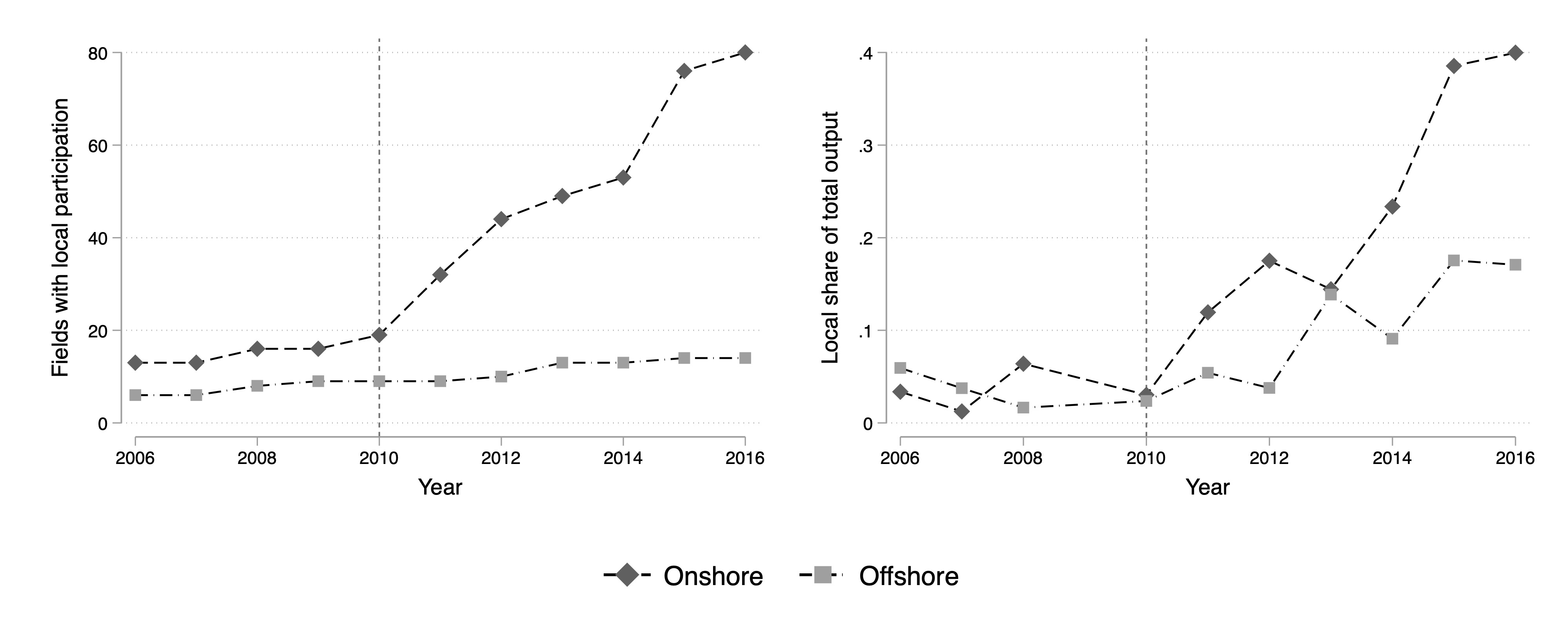

For identification, I leverage a major 2010 policy reform – the Nigerian Local Content Law – which legislated preference for indigenous firms in all oil and gas asset transactions. After the law, asset sales were unlikely to be approved unless the buyer was a Nigerian firm. The effect of the law is clear in Figure 1, which plots local participation in the sector over time, measured by either the total number of local fields (Panel A) or the local market share (Panel B). Local participation grows substantially after 2010, primarily in the onshore sector where multinationals are exposed to heightened security risks. Though the reform equally applied to the offshore sector, multinationals were initially more willing to divest from risky onshore fields, hoping to refocus on offshore assets. The local content reform generated a large-scale indigenisation policy experiment. To identify the causal effect of divestment on oilfield performance, I use this variation in a staggered adoption differences-in-differences (DD) approach that leverages the roll-out of divestment over time.

Figure 1

The local advantage

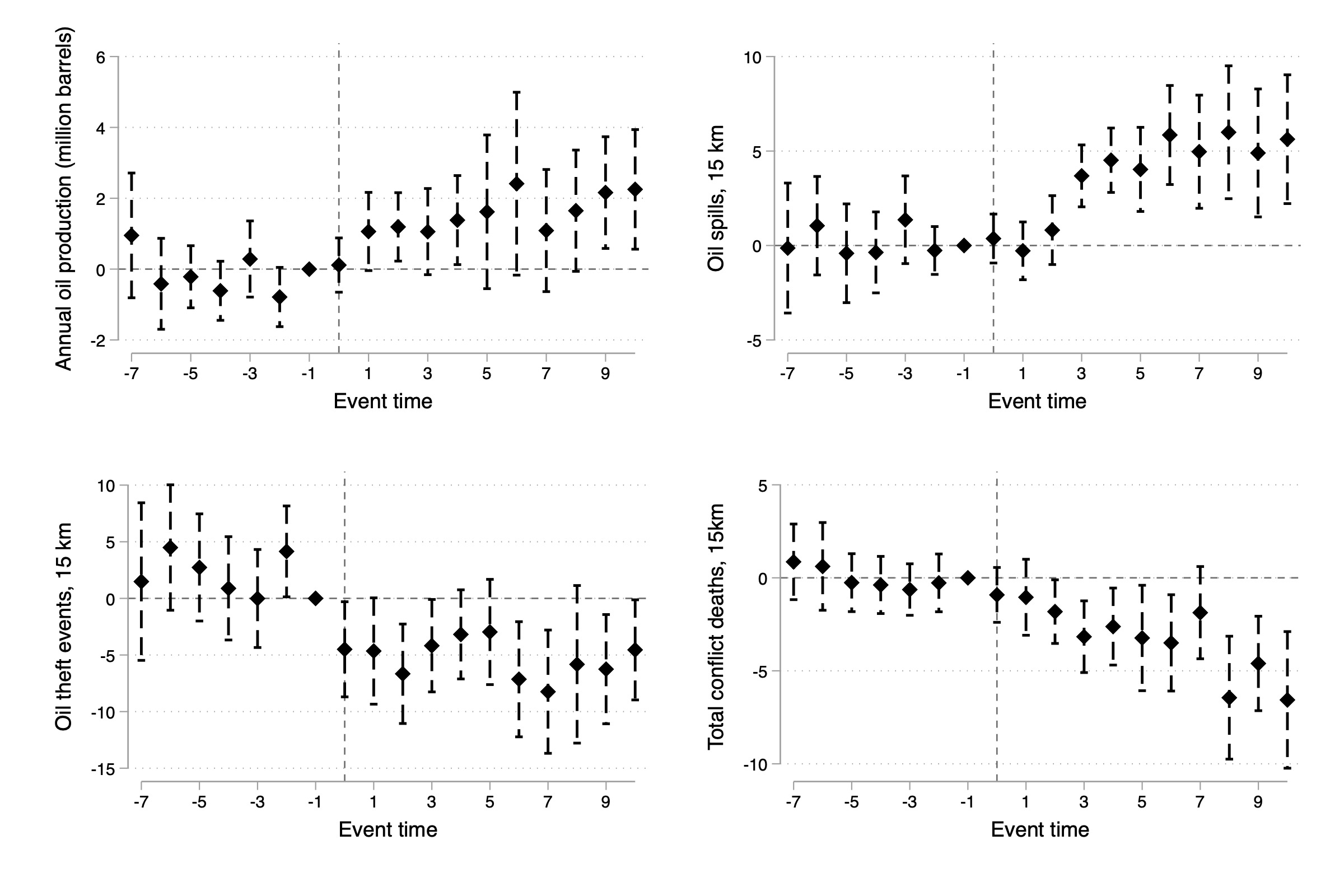

Figure 2 shows the average difference in outcomes between divested and control oilfields in years before and after divestment. Local firms revitalise newly acquired assets – divestment leads to a 33% average annual increase in oil production, sustained for up to a decade after divestment. This increase occurs despite evidence that local firms are of lower quality. Divestment leads to an 18% average annual increase in oil spills, as well as increases in gas flaring (not pictured). I interpret this effect as evidence that local firms are less likely to maintain infrastructure, leading to greater rates of operational failure.

Figure 2

How are less capable local firms able to increase output on the same assets? The bottom panel of Figure 2 shows that local advantage in output is driven by security improvements. Local participation decreases incidents of oil theft by 45% on average annually and leads to large declines in violent conflict deaths. In an additional analysis, I split the sample by onshore and offshore assets and show that the local advantage is driven by onshore fields, where security risks are concentrated. In contrast, the local disadvantage in oil spills is driven by offshore properties, which are substantially more complex and costly to operate.

As oil theft falls, output should rise because it is being transferred back from the black market. Furthermore, production that was previously “deferred” – kept in the ground – because of insecurity may also come back online. These magnitudes may be considerable; in 2016, 20% of total output was deferred, while 15% was lost to the black market. A decomposition of the divestment output gain shows that 25% is reclaimed transfers from the black market, while 35% is deferred production. The remaining 40% is unexplained by oil theft and represents new output, perhaps due to improved incentives in a better overall security environment. Government revenue is directly linked to field-level production via both royalties and profit-sharing ventures with the state oil company, the Nigerian National Petroleum Company. As a result, government revenue increases in tandem with output, by 36% per field annually. Indigenisation generates 21.8 billion USD in additional government revenue over the sample period.

What drives local advantage?

How do local firms solve the thorny security challenges of the Niger Delta? To answer this, I build a simple bargaining model in which firms offer bribes to the Nigerian armed forces for law enforcement protection, which provides a framework to understand the mechanisms at play.

Oil theft is costly, and firms are willing to pay handsomely for state protection. However, firms face a commitment problem – large illegal sector rents create strong incentives for the military to protect oil theft gangs. Knowing that the state may renege on a deal, firms refuse to pay bribes at all. However, firms can solve this commitment problem by providing military elites with ownership stakes. Such political connections force the military to internalise oil theft losses, so that they are willing to protect assets even without bribes. The contention that local firms have better access to these corrupt networks is the foundation of the local advantage in this second-best, institutionally weak environment. I then take this model to the data to test its key predictions.

First, we should see that local firms’ assets receive preferential protection from the Nigerian state. Using data on news media reports of government law enforcement raids, I find that divestment leads to a doubling of law enforcement actions against the illegal oil sector. Local firms receive preferential sate protection.

Second, we should see that local firms indeed have superior political connections. The data reveal a high rate of connectedness: 80% of firms in the sector are connected, and local firms are not more likely to be connected than multinationals on average. However, the composition of connections differs markedly: 30% of local firms are connected to military elites, while no multinationals are.

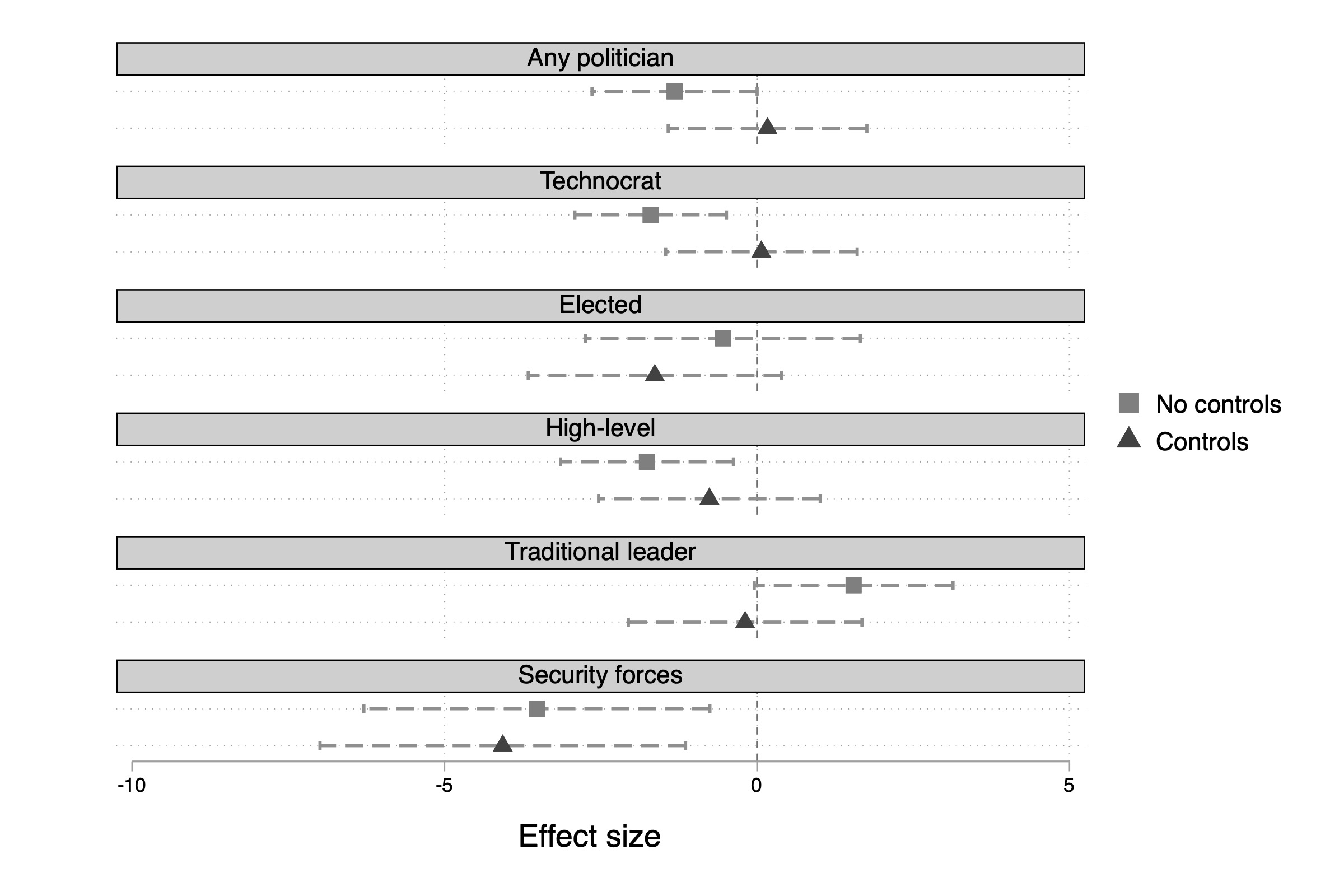

Finally, military connections are precisely the ones that matter for law enforcement protection. Figure 3 plots the correlation between field-level oil theft and various indicators of political connections. Only connections to the security forces are significantly associated with reduced theft, while all others are null. The results suggest that local firms’ superior connections to military elites drive the local advantage.

Figure 3

Welfare implications

Weighing the relative merits of foreign and local capital is a perennial issue in international economics. The empirical evidence generally favors a MNC productivity advantage (Aitken and Harrison 1999; Alfaro and Chen 2018). However, the second-best political economy of weak states may undermine this advantage. To quantify these tradeoffs, I conduct a back-of-the-envelope analysis of the net gains of indigenisation. On the benefits side, divestment increases output and reduces the efficiency losses of oil theft, including black market price discounts and extraction costs, oil spillage externalities, and violent deaths in oil-related armed conflict. On the costs side, indigenisation increases carbon emissions from oil output and gas flaring, local firms may have higher extraction costs, and state protection of assets requires law enforcement expenditures.

On net, the 2006-2016 wave of divestment increased social surplus in the oil sector by at most 23 billion USD, or 5.7% of 2016 GDP. The largest contributors to this gain are the value of new output and the recovery of price discounts on oil transferred to the black market, though environmental externalities are non-trivial as well. The results highlight important tradeoffs for industrial policy in the extractive sectors of weak states.

References

Aitken, B J, and A E Harrison (1999), “Do domestic firms benefit from direct foreign investment? evidence from Venezuela.” American Economic Review, 89(3): 605–618.

Alfaro, L, and M X Chen (2018), “Selection and market reallocation: Productivity gains from multinational production.” American Economic Journal: Economic Policy, 10(2): 1–38.

Berman, N, M Couttenier, D Rohner, and M Thoenig (2017), “This mine is mine! how minerals fuel conflicts in Africa.” American Economic Review, 107(6): 1564–1610.

Christensen, D (2018), “Concession stands: How mining investments incite protest in Africa.” International Organization, 73(1): 65–101.

Javorcik, B S, and S-J Wei (2009), “Corruption and cross-border investment in emerging markets: Firm-level evidence.” Journal of International Money and Finance, 28(4): 605–624.

Rexer, J M (2023), “The local advantage: corruption, crime, and indigenization in weak states.” Working Paper.

Ross, M L (2015), “What have we learned about the resource curse?” Annual Review of Political Science, 18(1): 239–259.