The extension of social pensions in Namibia in the 1990s led to a rapid, substantial decline in fertility

In Africa, current concerns about population growth on the one hand, and social protection on the other hand, are often addressed separately. Old-age pensions are not considered as a policy tool to reduce fertility, and fertility responses are not included in the cost-benefit analysis of pensions. This is surprising since the idea that people have children to, in part, secure old-age support is a longstanding hypothesis in social sciences (Leibenstein 1957, Caldwell 1978, 1982, Nugent 1985). Although the premise is widely accepted, we do not know whether this motive is an important or negligible driver of fertility. In a review article, Piggott and Woodland (2016, p.29) conclude that "The empirical evidence supporting this hypothesis is surprisingly scarce. […] More research is certainly needed to understand how much the growing availability of substitutes for old-age security affects the decline in the demand for children".

Challenges in quantifying the impact of old-age pensions on fertility

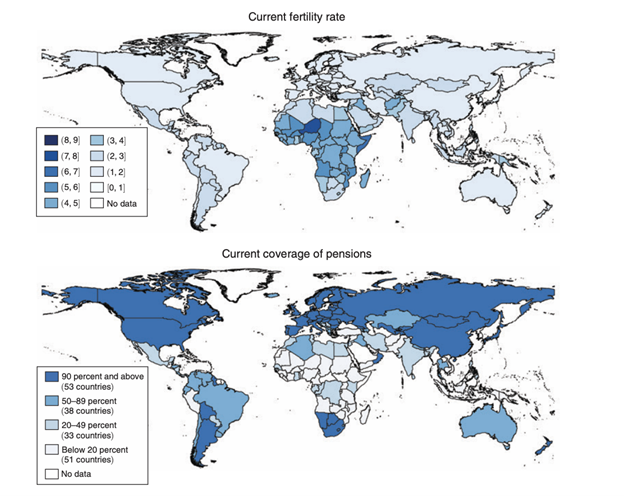

At the macroeconomic level, the correlation between pensions and fertility is striking. Figure 1 shows that countries with higher pension coverage have lower fertility. Within Africa, only a handful of countries have developed social pension systems covering the entire population, and they turn out to have much lower fertility rates than the others: three compared to five or six children per woman.

However, this is not enough to conclude that the introduction of old-age pensions leads to a dramatic reduction in birth rates. The negative correlation could be driven by a third factor, such as wealth. Alternatively, it could be the case that the fall in fertility precedes and generates the demand for social security. Therefore, the task becomes isolating the causal effect of pensions on fertility.

Implementing a field experiment is difficult due to the long lag between the time when people make their reproductive decisions and the time when they receive their pensions. A more feasible option is exploiting changes in real pension systems as a natural experiment. We would like to observe a sudden change in pensions, which is not a response to declining fertility rates, and does not affect all individuals similarly, in order to define credible comparison groups. In a recent study (Rossi and Godard, 2022), we argue that the reform of the Namibian pension system in the 1990s provides an ideal setting to answer this question.

Figure 1. Fertility and pensions in the world

Notes: The first map shows the average number of births per woman in 2017, based on estimates from United Nations (2017). The second map shows the percentage of the population above statutory pensionable age receiving any type of old-age pension in 2010-2015, based on estimates from International Labour Organization (2018)

The Namibian pension reform

Before the end of the apartheid regime in 1990, Namibia was a colony of South Africa. It was characterised by high levels of inequalities in terms of economic opportunities and social protection. The pension system was a case in point. First, there were variations in benefit amounts. The White population received much higher pensions, and within the non-White population, different ethnic groups were entitled to different sums depending on whether or not they were favoured by the regime. Second, different regions had different coverages because the administration of the system for non-Whites was decentralised. In some regions, only 30% of eligible people received their pensions due to corrupt or inefficient local authorities, whereas the share could be as high as 80% in other regions (Subbarao, 1998).

The pension system underwent substantial reform in 1992 with the Pension Act, which created the universal, non-contributory system still in place today. Pensions do not depend on the contributions of individuals during their working years: all Namibians above the age 60 are entitled to the same levels of social pension. Regional inequalities in the share of eligible people actually receiving their pensions persisted until 1996, when the government changed the delivery system with the goal of reaching universal coverage. This was achieved within a couple of years thanks to two innovations: mobile payment in cash improved access, and biometric identification reduced corruption. By 1998, benefits amounted to 3 times the poverty line and were accessible by around 88% of the population (Devereux 2001).

We cannot simply look at the evolution of fertility rates to quantify the effect of the pension reform because the 1990s were a time of intense political changes in Namibia, including many that could affect fertility (changes in poverty, urbanisation, migration, access to education and health, etc.). Instead, we exploit the variation across regions and ethnic groups prior to the reform to isolate the effect of the pensions. We compare the evolution of fertility rates in the population that already had good pensions before the reform with the population whose pensions improved substantially. The key assumption here is that both populations were affected in the same way by all other factors during the 1990s.

Main findings

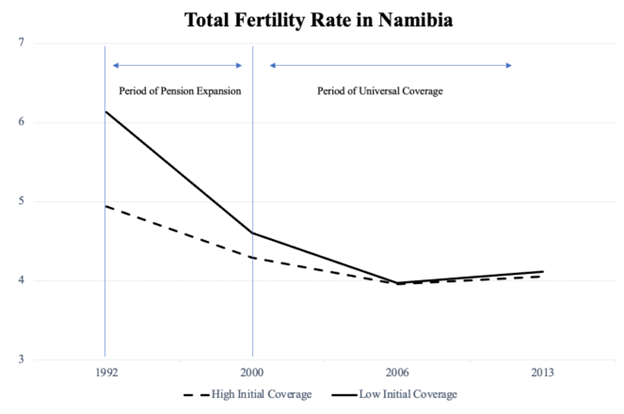

In Figure 2, we observe that, before the reform in 1992, people disadvantaged by the pension system (low initial coverage, solid line) had just above six children whereas people advantaged by the system (high initial coverage, dashed line) had just below five children. After the extension, fertility decreased everywhere, and especially for populations that used to lag behind. The convergence in fertility rates starts precisely when the reform is announced and is completed within a decade.

The reduction in birth rates is concentrated at the end of the reproductive life, confirming that the main driver of decline is stopping behaviour, as opposed to starting or spacing behaviour. This is interesting because it tells us that the old age security motive is most salient for older couples who are starting to think about who will take care of them in their old age. Another important finding is that effects are non-linear. Fertility drops by roughly one child when the level of social protection changes from low to medium (at least half of the elderly are covered and the pensions are at least as high as the poverty line), while further raising the coverage and the benefits makes no detectable difference.

Figure 2. Evolution of fertility, by initial pension coverage

Notes: The graph plots the evolution of the total fertility rate (a synthetic rate measuring how many births a woman would have if she was subject to current age-specific fertility rates at all ages throughout her reproductive life) in regions with low (solid line) and high (dashed line) initial pension coverage. The sample is restricted to non-White Namibian residents.

Implications for policy

Two main lessons can be learnt from the Namibian experience.

First, African governments currently tackle fertility reduction goals by focusing on birth control access and female empowerment (United Nations 2013). The assumption is that women have more children than what they actually want. The Namibian case, however, suggests that exploring why people want many children and what can be done to reduce their dependence on offspring could go a long way in renewing population policies.

Second, social protection for the elderly figures prominently in the fight against poverty in Africa, and decision-makers weigh the gains in terms of protection against the fiscal costs (World Bank 2018). Our findings show that pensions do not only influence the well-being of the elderly today, but also the reproductive behaviour of the next generation. Both the contribution to reaching population targets and the potential disruption to the intergenerational transmission of poverty are strong arguments in favour of social pensions. On the costs side, curbing population growth affects the size of the next generation and therefore the financial sustainability of the system. Therefore, taking fertility responses into account may change the conclusions of cost-benefit analyses of pension reforms.

References

Caldwell, J C (1978), “A Theory of Fertility: From High Plateau to Destabilization”, Population and Development Review 4(4): 553–77.

Caldwell, J C (1982), Theory of Fertility Decline, London: Blackwell Science.

Devereux, S (2001), “Social Pensions in Namibia and South Africa”, IDS Discussion Paper 379, Brighton: IDS.

International Labour Organization (2018), “Social Protection for Older Persons: Policy Trends and Statistics 2017-19”, Social Protection Policy Paper 17.

Leibenstein, H (1957), Economic Backwardness and Economic Growth: Studies in the Theory of Economic Development, New York: Wiley.

Nugent, J B (1985), “The Old-Age Security Motive for Fertility”, Population and Development Review 11(1): 75–97.

Piggott, J and A Woodland, eds (2016), Handbook of the Economics of Population Aging, Vol.1B Amsterdam: Elsevier.

Rossi, P and M Godard (2022), “The Old-Age Security Motive for Fertility: Evidence from the Extension of Social Pensions in Namibia”, American Economic Journal: Economic Policy 14(4): 488–518

Subbarao, K. (1998), “Namibia's social safety net: Issues and options for reform”, Policy Research Working Paper 1996, Washington DC: World Bank.

United Nations (2013), World Population Policies, New York: United Nations.

United Nations (2017), World Population Prospects: The 2017 Revision, New York: United Nations.

World Bank (2018), The State of Social Safety Nets 2018, Washington DC: World Bank.