A non-contributory government pension in Chile raised life expectancy of the elderly poor, increasing food consumption and visits to health centres, and also had important knock-on effects on relatives living in the same household

Life-expectancy inequalities are large and widening in developed and developing countries (Hoffman 2008, Brønnum-Hansen and Baadsgaard 2012, Tarkiainen et al. 2012). At retirement age, high-income earners live longer than low-income earners: 1.6 years longer in the US, 3.6 in Chile, 3.25 in the UK and 2.9 in South Korea (OECD 2018).

It is not clear however whether income transfers to the elderly poor can extend their life-expectancy and narrow these gaps. Unobserved characteristics might explain the correlation between higher income and better health, or better health could lead to higher income. Health status differences could also stem from cumulative conditions related to income inequalities at earlier life stages, such as exposure to pollution.

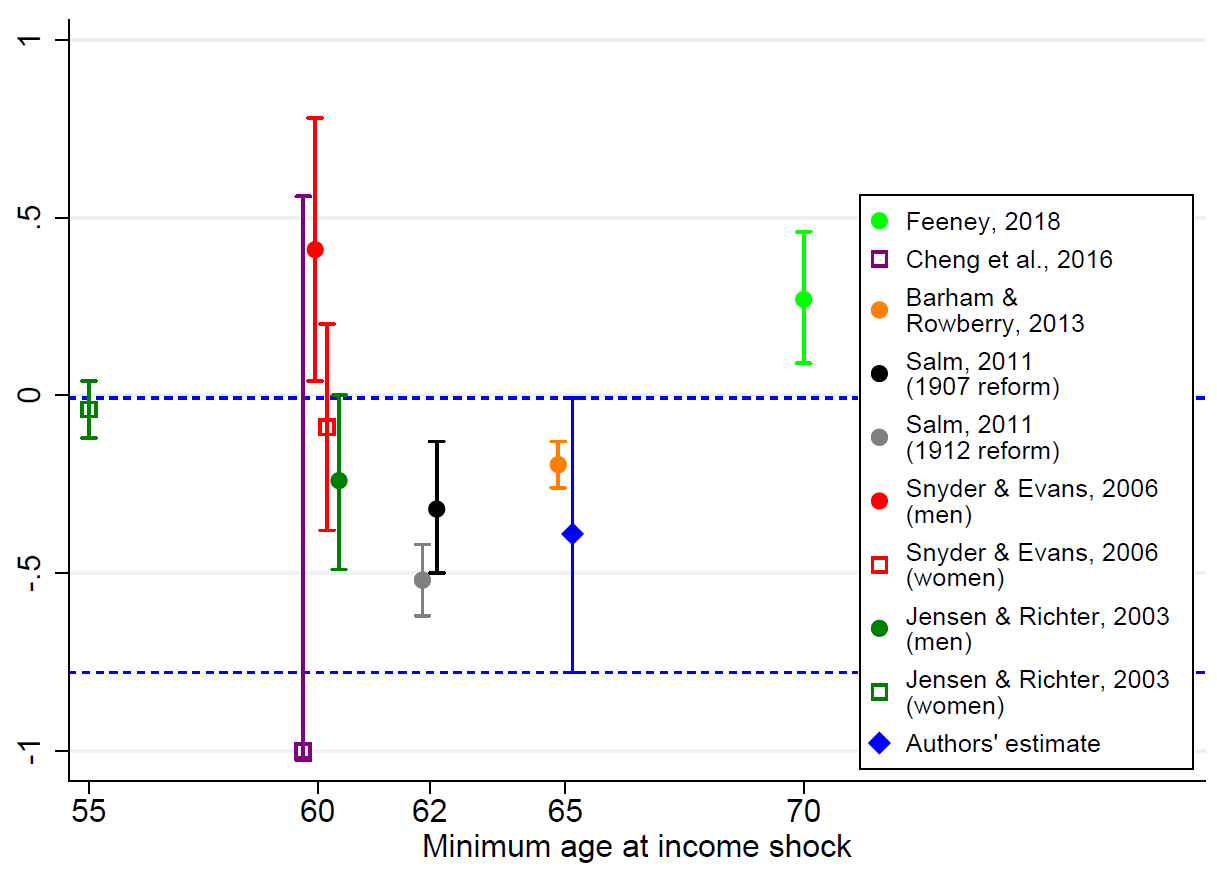

Empirical evidence from previous research remains inconclusive (Figure 1). Salm (2011) finds that two pension increases in the early 1900s reduced the mortality rates of US veterans. In modern times, studies have estimated negative (Jensen and Richter 2003, Barham and Rowberry 2013), insignificant (Cheng et al. 2016), or even positive (Snyder and Evans 2006, Feeney 2017) effects of income transfers at an old age on mortality rates.

Figure 1

To reconcile these findings, it is important to consider that higher income transfers to the elderly can induce other behaviours, such as anticipating retirement (Snyder and Evans 2006, Feeney 2017), which can themselves influence mortality. Indeed, Fitzpatrick and Moore (2018) show that transitions to retirement can cause a significant rise in mortality independently of whether income is affected. To accurately assess the health impact of increased income for the elderly poor, it is crucial to isolate the income effect from other potential mechanisms.

In recent research (Miglino, Navarrete, Navarrete, and Navarrete 2023), we shed light on this question by studying the impact of a government non-contributory basic pension introduced in Chile in 2012. The peculiarity of this programme is that it targeted individuals without a pension and already out of the labor force, mainly `stay at home mothers', meaning the transfer did not affect their retirement decisions.

Since the basic pension programme increased recipients’ income but did not induce recipients to retire earlier, we can isolate the effect on life expectancy caused by the income increase from any potential effects due to earlier retirement.

Study design

The non-contributory basic pension programme in Chile provides an ideal regression discontinuity design (RD) to identify the causal effect of a large permanent income increase for the elderly poor on their health outcomes. Before 2008, Chile had a full-capitalisation pension system in which workers had to contribute 10% of their monthly wage into a private pension fund. Those who had never undertaken paid work received no pension. Since 2008, Chileans who are aged 65 or over and do not have a contributory pension can apply to receive a non-contributory pension, which provides lifelong monthly payments of approximately 40% of the national minimum wage. The government calculates a pension score for applicants, awarding the basic pension to those below the 60th percentile of the score distribution. Our study uses administrative data on basic pension applicants and their household members, combined with their medical history from 2011 to 2016.

We estimate the intention-to-treat effect of the pension on applicants’ mortality, hospitalisations and medical episodes (i.e. hospitalisation or death) within four years, by comparing applicants whose first application score fell just below and just above the cutoff (to adjust for later successful applications by control-group applicants, we estimate the local treatment effect on the treated using the recursive RD estimator suggested by Cellini, Ferreira and Rothstein 2010).

Key results

Receiving a basic pension significantly lowers the probability of dying by 2.7 percentage points within four years of applying from a baseline mortality rate of 7.0 percentage points. We estimate an intention-to-treat income-mortality elasticity of -0.386, which represents the percentage change in the mortality rate over four years due to a 1% increase in income at the cutoff following a successful first application for the basic pension. The confidence interval of our estimate encompasses most of the previous negative point estimates of the income-mortality elasticity (see Figure 1).

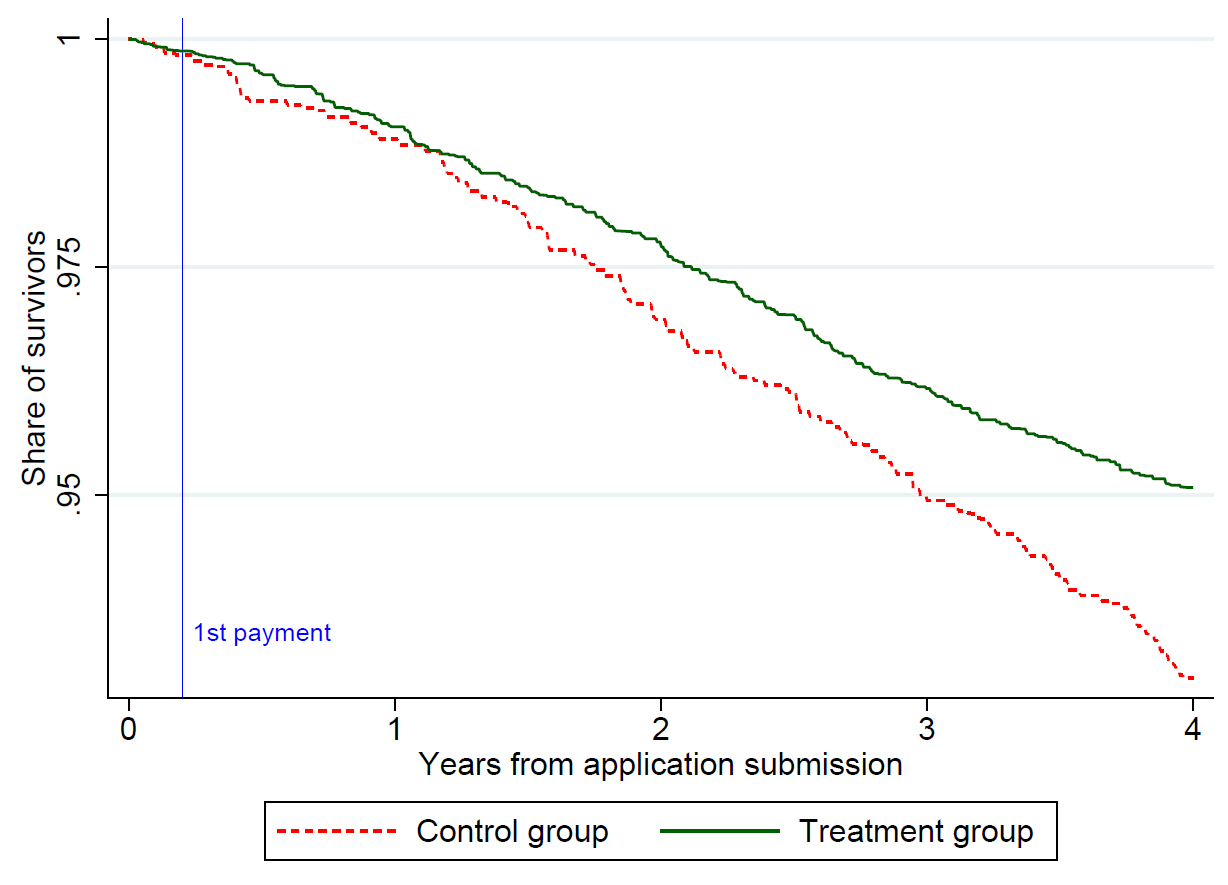

The mortality effect manifests itself approximately one year after the first payment and grows almost monotonically over time, reaching a maximum at the end of the studied period (Figure 2). We also find that pension recipients are 6.0 percentage points less likely to experience a medical episode within four years, with reductions primarily in episodes related to respiratory diseases or tumors. This has important policy implications, suggesting that increasing income can improve elderly health even at later life stages.

Figure 2

The heterogeneity analysis shows strong health improvements for applicants living without working-age household members, with a significant reduction in their mortality rate (-5.5 percentage points), in percentage of days spent in hospital (-0.157 percentage points), and in the probability of a medical episode (-12.8 percentage points). Conversely, applicants living with at least one working-age household member did not experience any significant health improvement. A plausible explanation for this last result is that younger relatives who used to provide for the applicants in the household reduced their transfers after pension payments began, lowering the net income gain for the elderly.

In line with this hypothesis, we also observe an increase in the fertility of working-age relatives of pension recipients, indicating that income transfers to the elderly might have been redirected towards child-rearing expenses. The basic pension significantly increased the probability of having a child by 2.4 percentage points for working-age household members and by 9.8 percentage points for fertility-age women living with a pension recipient.

To shed light on the mechanisms behind the health effects of the pension, we analysed a longitudinal survey conducted by the Chilean Ministry of Labor. Controlling for individual, survey-year and age fixed effects, we find that receiving a basic pension is associated with more frequent visits to health centres and higher food consumption, whereas we do not find significant changes in health insurance coverage, labour supply, drinking or smoking habits. Medical literature has shown that higher nutrient intake can enhance immune and respiratory system functioning, prevent tumor development, and support invasive treatment tolerance. Outpatient care plays a critical role in disease prevention and treatment, leading to improved health status and reduced mortality (Rennard 2004, Starfield et al. 2005).

Takeaways

The main policy implication of our results is that non-contributory basic pensions, intended to improve the living standards of the elderly poor, can also improve their health. We also find that they are a cost-effective measure to increase life expectancy, as the costs to government are lower than the gains in terms of value of statistical life estimated for Chile.

Our results are informative for policymakers who aim to introduce income transfers that target subpopulations similar to our treatment group, which is composed primarily of elderly, low-income women in a middle-income country. The beneficial effects of the pension are concentrated on pensioners living alone or with their spouse. Income transfers directed to recipients with different characteristics may have different policy implications, as suggested by the large variance of mortality-income elasticities estimated in the literature.

Previous studies have shown that transition to retirement can cause a significant rise in mortality. Therefore, governments should be careful when designing pension policies that incentivise retirement. Basic non-contributory pensions appear particularly beneficial in terms of health when they have limited impact on retirement transitions and when they help elderly people living without younger relatives.

References

Barham, T and R Rowberry (2013), "Living longer: The effect of the Mexican conditional cash transfer program on elderly mortality", Journal of Development Economics, 105(C): 226-236.

Brønnum-Hansen, H and M Baadsgaard (2012), "Widening social inequality in life expectancy in Denmark. A register-based study on social composition and mortality trends for the Danish population", BMC Public Health, 12(1): 994.

Cellini, S R, F Ferreira, and J Rothstein (2010), "The Value of School Facility Investments: Evidence from a Dynamic Regression Discontinuity Design", The Quarterly Journal of Economics, 125(1): 215-261.

Cheng, L, H Liu, Y Zhang, and Z Zhao (2016), "The health implications of social pensions: Evidence from China's new rural pension scheme", Journal of Comparative Economics, 46(1): 1-25.

Feeney, K (2017), "Cash Transfers and Adult Mortality: Evidence from Pension Policies", UC Berkeley PhD Thesis.

Fitzpatrick, M D and T J Moore (2018), "The mortality effects of retirement: Evidence from Social Security eligibility at age 62", Journal of Public Economics, 157: 121-137.

Hoffman, R (2008), "Socioeconomic Differences in Old Age Mortality", Springer Science & Business Media, Vol. 25.

Jensen, R T and K Richter (2003), "The health implications of social security failure: evidence from the Russian pension crisis", Journal of Public Economics, 88: 209-236.

Miglino, E, N Navarrete H., G Navarrete H., and P Navarrete H. (2023), "Health Effects of Increasing Income for the Elderly: Evidence from a Chilean Pension Program", American Economic Journal: Economic Policy, 15(1): 370–93. Available at https://www.aeaweb.org/articles?id=10.1257/pol.20200076

OECD (2018), "OECD Pensions Outlook 2018", OECD Publishing.

Rennard, S (2004), "Treatment of stable chronic obstructive pulmonary disease", The Lancet (British edition), 364(9436): 791-802.

Salm, M (2011), "The effect of pensions on longevity: Evidence from union army veterans", The Economic Journal, 121(552): 595-619.

Snyder, S E and W N Evans (2006), "The effect of income on mortality: evidence from the social security notch", The Review of Economics and Statistics, 88(3): 482-495.

Starfield, B, L Shi, and J Macinko (2005), "Contribution of Primary Care to Health Systems and Health", The Milbank Quarterly, 83(3): 457-502.

Tarkiainen, L, P Martikainen, M Laaksonen, and T Valkonen (2012), "Trends in life expectancy by income from 1988 to 2007: decomposition by age and cause of death", Journal of Epidemiology and Community Health, 66(7): 573-578.