Taxes on consumption help governments in developing countries redistribute thanks to the presence of large informal sectors

Consumption taxes rarely get good press. Consumers think they make products more expensive; politicians believe they will cost them votes; retailers maintain they deter clients. Moreover, in Western economies, they are often found to have no – or in fact, negative – redistribution effects (Warren 2008).

Yet most studies of consumption taxes have so far overlooked developing countries, where they are the main source of revenue. Our recent work finds that consumption taxes are, in fact, progressive in the developing world: they tax the rich more than the poor because the latter do more of their shopping in the informal sector (Bachas et al. 2020). Used wisely, they can thus be powerful tools to fight inequality in poor countries.

An evolving basket of goods

Our paper (Bachas et al. 2020) considers two channels through which consumption taxes can be redistributive. The first is the ‘de facto’ exemption from taxation of products purchased in the informal (untaxed) sector. The second is the ‘de jure’ exemption of some necessity goods, in particular food, that are often covered by government subsidies and other schemes targeted at the poor.

Why could these two channels help redistribute? Because the basket of goods households typically buy evolves as they become richer. A tax policy that exempts products on which households spend a shrinking slice of their budget as they become richer, while continuing to tax other products the same, is therefore progressive: it hits the rich proportionally more. Provided poorer households spend a bigger share of their disposable income on food, for instance, exempting food should allow governments to redistribute. Similarly, the presence of large informal sectors in developing countries should make consumption taxes progressive, provided budget shares spent in the informal sector fall with income.

Measuring informality from household expenditure surveys

The main constraint in studying informality is that, by definition, informal sector purchases are hard to observe and link to consumers’ incomes. To overcome this challenge, we used the places of purchase reported by households in expenditure surveys to proxy for the share of consumption in the informal sector. We created a micro database, which combines expenditure surveys from 31 developing countries (ranging from Burundi to Chile) and contained information on the place of purchase for each transaction (such as street stall or supermarket). Building on evidence from retail censuses and existing literature, we assigned each place of purchase to the informal or formal sector, based on the idea that large modern retailers are much more likely to remit taxes than smaller traditional ones (Lagakos 2016, Kleven et al. 2016).

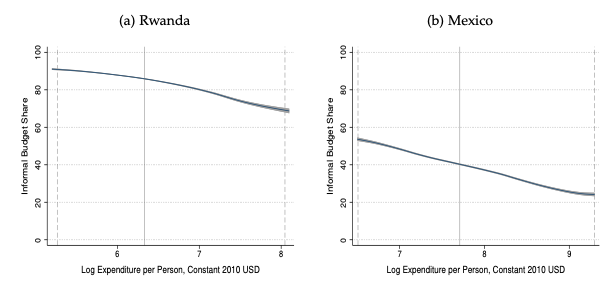

Our new data and method enabled us to produce new facts on consumption patterns across the income distribution scale. In particular, we document the existence of a downward-sloping informality Engel curve (IEC) stating that, within all countries observed, the informal budget share declines steeply with household income. Figure 1 shows this in Rwanda and Mexico as an example. In Rwanda, the informal budget share falls from 90% for the poorest decile of households to 70% for the richest decile. In Mexico, it falls from 55% to 25%.

Figure 1 Informality Engel curves in Rwanda and Mexico

Notes: These graphs plot the local polynomial fit of the Informality Engel curves in Rwanda and Mexico. Per person total expenditure on the horizontal axis is measured in log. Informal budget share is on the vertical axis. The shaded area around the polynomial fit corresponds to the 95% confidence interval. The solid grey line corresponds to the median of each country's expenditure distribution, while the dotted lines correspond to the 5th and 95th percentiles.

Subsidising food products is not optimal in the poorest countries, once informal consumption is considered

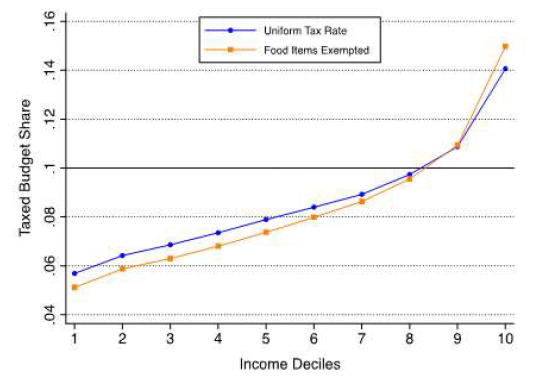

The shape of the curves implies that the de facto tax exemption of the informal sector makes consumption taxes progressive. Indeed, we find that with a simple uniform tax rate on all goods, the richest quintile pays twice as much in taxes as the poorest quintile in the average country (Figure 2, blue line). Comparing across countries in our sample, we see that this ‘progressivity dividend’ from exempting the informal sector is largest in the poorest countries. Moreover, we find that once the informal sector is taken into account, exempting food items from taxation only slightly increases redistribution (Figure 2, orange line).

Figure 2 Taxed budget shares, average across all countries

Notes: This figure plots the share of expenditures that is paid in taxes (effective tax rates), by decile, for each tax scenario. Both scenarios are simulated in all 31 countries, each point corresponds to the average effective tax rates of each decile across all countries in our sample. The blue line corresponds to a tax scenario where a uniform tax is levied on all goods, but where purchases in informal stores are de facto not taxed. The orange line corresponds to a tax scenario where both de facto informality exemption and de jure food exemption are present.

Using a simple optimal tax model, we find that allowing for the existence of informal varieties of goods (which cannot be taxed) changes both the efficiency and equity (i.e. redistribution) characteristics of consumption taxes. Notably, it increases the efficiency cost of taxing consumption because households can switch to informal varieties when taxes increase. It also makes consumption taxes progressive as long as informality Engel curves are downward sloping.

We calibrate the model for each country in our sample using our data. One of our key findings is that in some of the poorest countries, subsidising food relative to non-food items is simply not optimal: it cannot be justified on equity or on efficiency grounds. Since, in these countries, poor households consume most of their food from the informal sector, they benefit little from food being taxed at a low rate.

Consumption taxes decrease inequality more than taxes on income

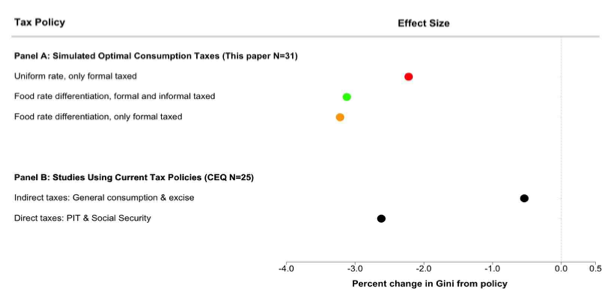

Finally, we investigate the impacts of consumption tax policies on income inequality, using tax rates and the household survey data (Figure 3). Our redistribution metric is the percentage change in the Gini coefficient from the pre-tax income distribution to the net-of-tax distribution (a decrease corresponds to a reduction in inequality).

We find that, after accounting for informal consumption, setting a uniform and optimal tax rate on all formal consumption achieves a significant reduction in inequality (first row, Panel A). This inequality reduction is substantially larger than the existing estimates of inequality reduction from consumption tax policies in developing countries (first row, Panel B), which do not systematically account for the exemption of the informal sector.

In fact, setting a uniform tax rate on formal consumption achieves as much inequality reduction as actual direct tax policies in developing countries (second row, Panel B). We further find that, after accounting for informal consumption, implementing a reduced rate on food products reduces inequality. However, the marginal reduction is small compared to the effect of the informal sector (third row, Panel A).

Figure 3 Effect of tax policy on inequality

Notes: Panel A shows the average percent-change in Gini for different scenarios. The red dot represents the scenario where a uniform rate is implemented but only the formal sector is taxed. The green dot represents the scenario where only non-food items, but both sectors are taxed. The orange dot represents the scenario where only non-food items, and only the formal sector, are taxed. The reported effects reflect the change in Gini from the pre-tax income distribution to the post-tax distribution. Panel B show the percent-change in Gini using data from the Commitment to Equity Institute (CEQ). In the first row of Panel B actual general consumption and excise taxes are applied; in the second row actual personal income taxes and compulsory social security contributions are applied. Effects calculated use country and income-decile data, publicly available, and released under Lustig (2018).

Policy recommendations: Treat formalisation efforts with caution

Overall, our paper shows that consumption taxes are a lot more progressive in developing countries than previously thought (e.g. Lustig 2018). This is due to the existence of large informal sectors, which are used more often by the poor. Policy efforts to increase the progressivity of consumption taxes, such as taxing food products at a reduced rate, are on the other hand fairly ineffective redistributive instruments.

These results do not imply that efforts to reduce the size of the informal sector, such as tax enforcement policies or tax registration drives, should be abandoned. Rather, they caution that any benefits from reducing the informal sector's size should be weighed against potential equity costs. Our findings call more generally for future research on tax enforcement policies to take into account not only their impact on efficiency, but also their distributional effects.

References

Bachas, P, L Gadenne and A Jensen (2020), “Informality, consumption taxes, and redistribution”, Institute for Fiscal Studies Working Paper W20/14.

Kleven, H, C Kreiner and E Saez (2016), “Why can modern governments tax so much? An agency model of firms as fiscal intermediaries”, Economica 83: 219-246

Lagakos, D (2016), “Explaining cross-country productivity differences in retail trade”, Journal of Political Economy 124 (2): 579–620.

Lustig, N (2018), Commitment to equity handbook: Estimating the impact of fiscal policy on inequality and poverty, Brookings Institution Press.

Warren, N (2008), “A review of studies on the distributional impact of consumption taxes in OECD countries”, OECD.